Minnesota Contract For Deed Interest Rate

Description

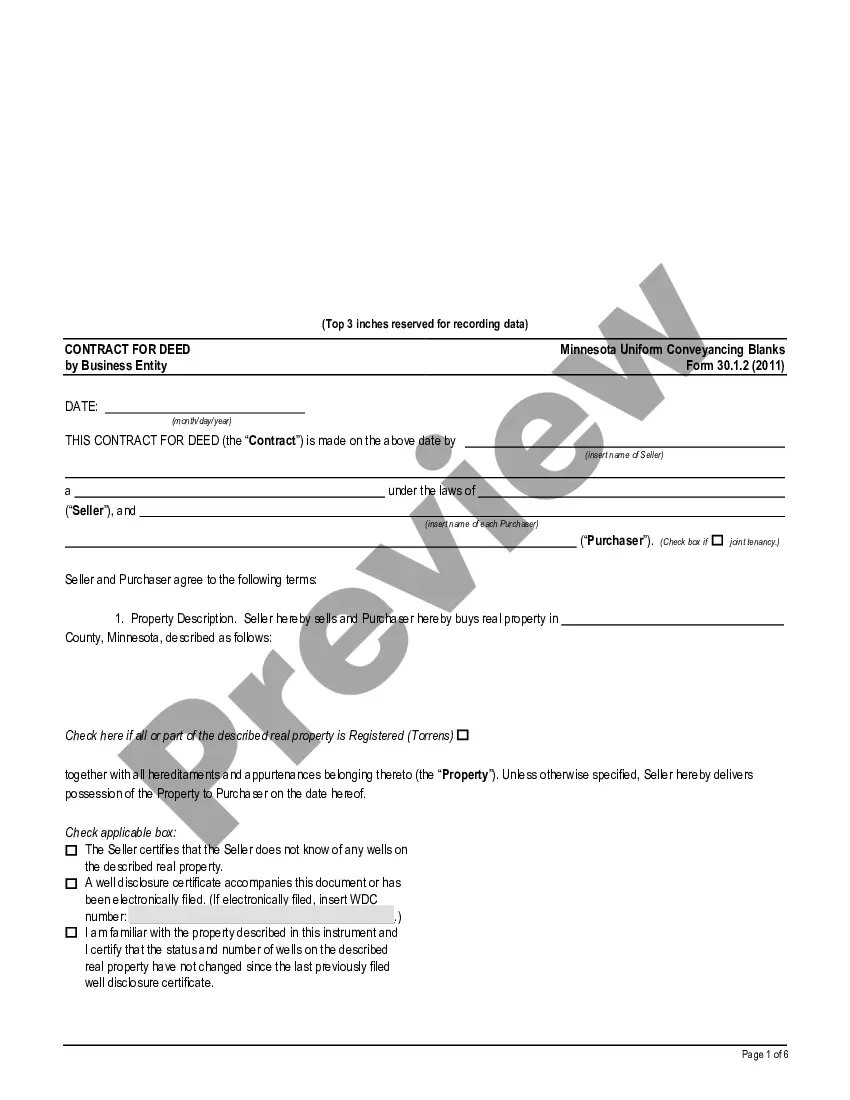

How to fill out Minnesota Contract For Deed - Individual Seller - UCBC Form 30.1.1?

Creating legal documents from the ground up can frequently be overwhelming.

Some situations may require extensive research and significant expenses.

If you’re looking for a more simple and economical method of preparing the Minnesota Contract For Deed Interest Rate or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously arranged for you by our legal experts.

Review the document preview and descriptions to confirm that you have the form you need. Ensure the document you select adheres to your state and county regulations. Pick the appropriate subscription option to acquire the Minnesota Contract For Deed Interest Rate. Download the file. Then complete it, validate it, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make completing forms a straightforward and efficient process!

- Utilize our platform whenever you require a dependable and trustworthy service to swiftly find and download the Minnesota Contract For Deed Interest Rate.

- If you’re a returning user and have already created an account with us, simply Log In to your account, choose the template and download it, or re-download it later in the My documents section.

- Not registered yet? No worries. Setting up takes just a few minutes, allowing you to browse the library.

- Before diving into downloading the Minnesota Contract For Deed Interest Rate, follow these recommendations.

Form popularity

FAQ

Filing required. All contracts for deed executed on or after January 1, 1984, shall be recorded by the vendee within four months in the office of the county recorder or registrar of titles in the county in which the land is located. Any other person may record the contract.

Under a contract for deed, the grantor retains the legal title to the real property until the purchase price is paid in full and the other terms of the contract are completed. Before a contract is paid off, the grantor (vendor) may choose to assign its contract rights to a third party.

Deed following Contract for Deed Deed Tax is due on the conveyance of legal ownership of real property with a deed following the satisfactory completion of the terms of a contract for deed. The deed that conveys legal ownership of the property from the grantor to the grantee is taxable.

Instead of purchasing a home with a mortgage, the buyer agrees to directly pay the seller in monthly installments. The buyer is able to occupy the home after the closing of the sale, but the seller still retains legal title to the property. Actual ownership passes to the buyer only after the final payment is made.

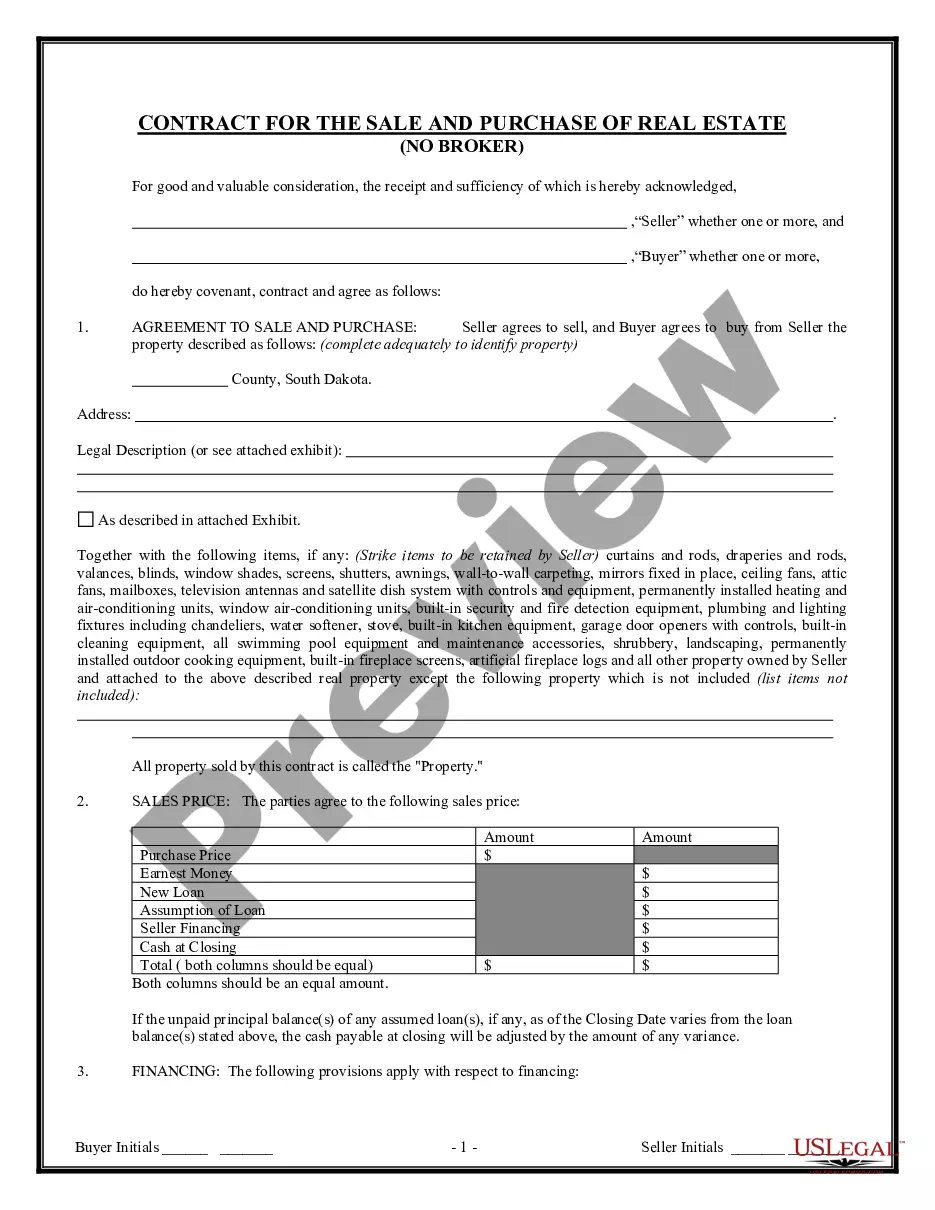

For an interest-only payment, simply multiply the amount financed by the interest rate, and divide the result by the number of installments in a year. For example, the monthly interest payment on a $200,000 land contract home with an 8% interest rate after a 10% down payment would be $1,200.