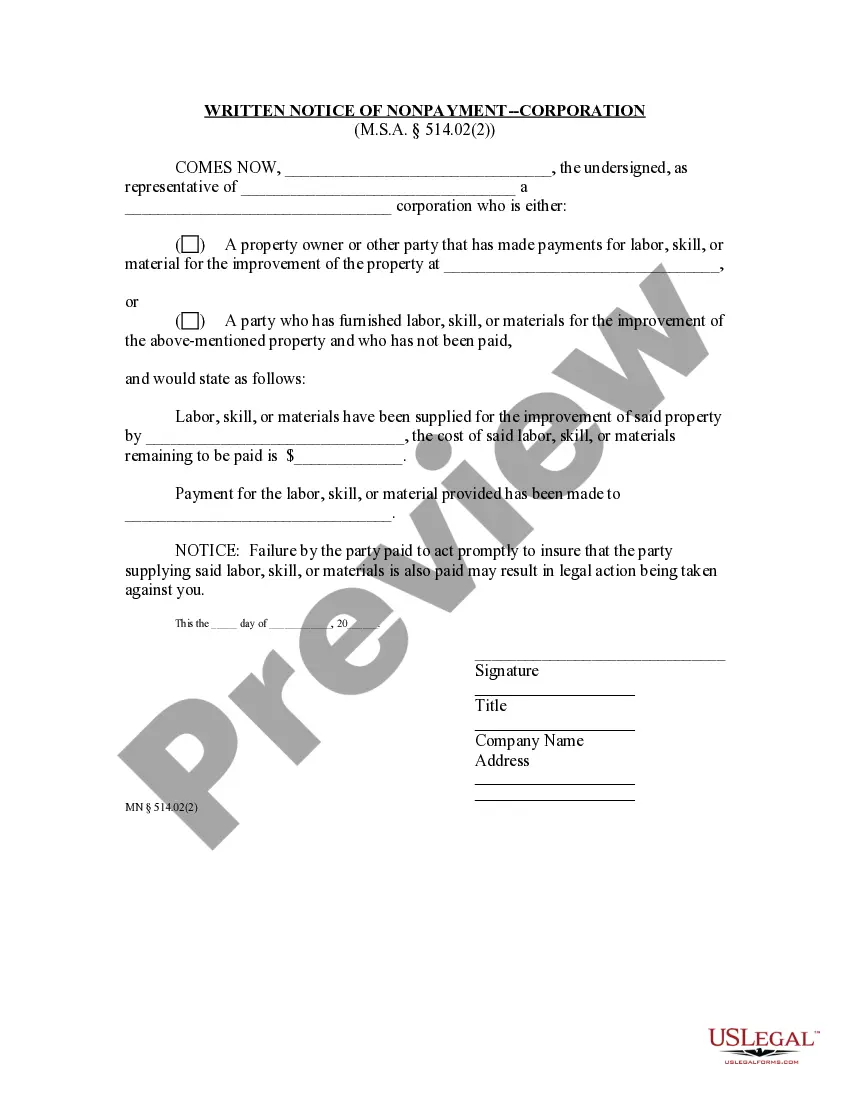

Minnesota law has many provisions which require mandatory communication between the different parties involved in a construction project. In this form, the party that has been paying the contractor, or the subcontractor that has not been paid, provides notice to the contractor that a subcontractor has not yet been paid for services provided.

Minnesota Corporation Company Foreign

Description

How to fill out Minnesota Corporation Company Foreign?

When you are required to finalize Minnesota Corporation Company Foreign in line with your local state's laws, there can be several alternatives to choose from.

There's no necessity to scrutinize each form to ensure it meets all the legal specifications if you are a US Legal Forms member.

It is a dependable source that can assist you in obtaining a reusable and current template on any subject.

Acquiring properly constructed official documentation becomes effortless with US Legal Forms. Additionally, Premium users can also take advantage of the powerful integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the largest digital library with a collection of over 85k ready-to-use documents for commercial and personal legal matters.

- All templates are confirmed to comply with each state's regulations.

- Thus, when downloading Minnesota Corporation Company Foreign from our platform, you can be assured that you maintain a valid and current document.

- Acquiring the necessary template from our platform is exceptionally easy.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and retain access to the Minnesota Corporation Company Foreign at any hour.

- If this is your first encounter with our library, please adhere to the guide below.

- Review the suggested page and verify it for alignment with your needs.

Form popularity

FAQ

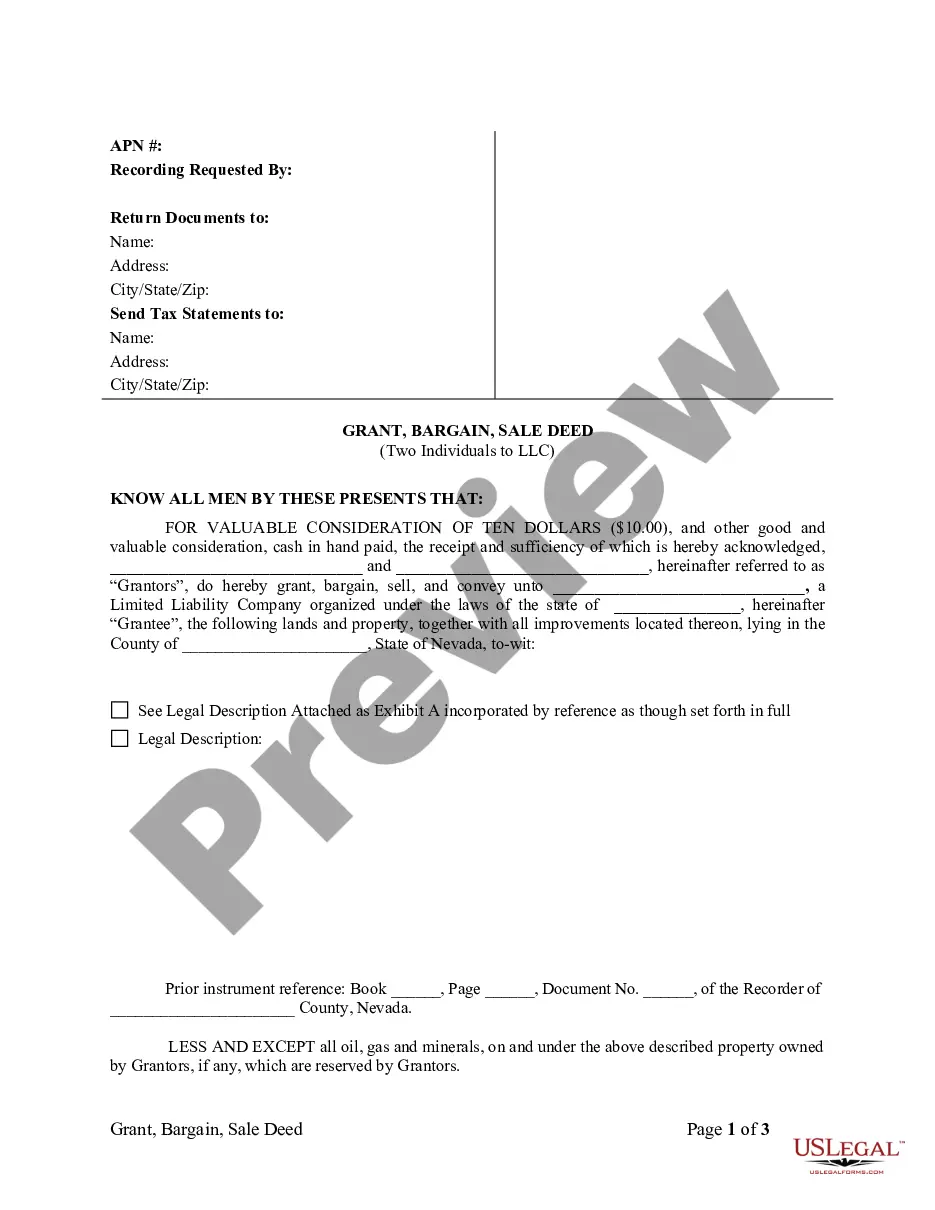

A corporation is a legal entity separate from its owners, providing limited liability protection to its shareholders. In contrast, an LLC, or Limited Liability Company, offers flexibility in management and pass-through taxation to its members. For anyone contemplating which structure to choose, understanding these distinctions is vital; particularly if considering registering as a Minnesota corporation company foreign.

Conducting business refers to actions taken to offer services or sell goods to consumers or other businesses. This can be done through physical locations, online platforms, or sales agents operating in Minnesota. Corporations, including a Minnesota corporation company foreign, must secure the necessary permits and registrations to operate legally within the state.

Doing business in Minnesota means actively engaging in trade or commerce within the state. This includes having employees, maintaining an office, or regularly selling products or services. For foreign corporations looking to expand, registering as a Minnesota corporation company foreign can help ensure compliance with state laws while allowing you to benefit from the local market.

Yes, you can run a business from your home in Minnesota, provided you adhere to local zoning regulations. Home-based businesses must also comply with any licensing requirements pertinent to your type of operation. Whether you operate as a sole proprietorship or as a Minnesota corporation company foreign, it’s essential to understand the legal obligations of running a home business.

Doing business in Minnesota includes engaging in transactions, providing services, or generating revenue within the state. If your Minnesota corporation company foreign has a physical presence, employees, or regularly solicits sales in Minnesota, you may be considered doing business. It is crucial to understand these criteria to ensure compliance with local regulations.

In Minnesota, a small business typically has fewer than 100 employees and generates less than $5 million in annual revenue. These businesses can operate as sole proprietorships, partnerships, or corporations, including a Minnesota corporation company foreign. The state provides resources and support for small businesses, making it easier to establish and grow your venture.

A foreigner can engage in a variety of business activities within the USA. From establishing a corporation to investing in existing businesses, the possibilities are vast. It's essential to understand the specific legal and tax implications applicable to your chosen business type. For detailed assistance on starting a business as a foreigner in Minnesota, explore the options provided by USLegalForms, which can guide you through managing your Minnesota corporation company foreign.

Working in the US for a foreign company is possible, but it requires proper visa status. Typically, you will need a work visa that allows you to perform job duties for an overseas employer on US soil. Additionally, it’s important to ensure that the foreign company complies with US labor laws. If you are unsure about visa regulations, USLegalForms offers valuable resources to help you understand your options regarding your Minnesota corporation company foreign.

Foreign companies can indeed conduct business in the US, provided they adhere to the necessary legal requirements. This includes obtaining the appropriate licenses, permits, and registering with state authorities. In Minnesota, a foreign corporation can be recognized and operate under its home state statutes. To navigate this process smoothly, consider using resources from USLegalForms for guidance tailored to your Minnesota corporation company foreign needs.

Yes, a foreign corporation can own a US LLC. When a foreign company registers a Limited Liability Company in the United States, it must comply with both federal and state regulations. In Minnesota, foreign corporations enjoy the benefits of limited liability, protecting their assets from business liabilities. Utilizing platforms like USLegalForms can simplify the process of establishing your Minnesota corporation company foreign.