Transfer on Death Deed - One Individual to Three Individuals

Minnesota Statutes

Property Interests and Liens

Chapter 507 Recording and Filing Conveyances

507.071 Transfer on Death Deeds.

Subdivision 1. Definitions. For the purposes of this section the following terms have the meanings given:

(a) "Beneficiary" or "grantee beneficiary" means a person or entity named as a grantee beneficiary in a transfer on death deed, including a successor grantee beneficiary.

(b) "County agency" means the county department or office designated to recover medical assistance benefits from the estates of decedents.

(c) "Grantor owner" means an owner named as a grantor in a transfer on death deed upon whose death the conveyance or transfer of the described real property is conditioned. Grantor owner does not include a spouse who joins in a transfer on death deed solely for the purpose of conveying or releasing statutory or other marital interests in the real property to be conveyed or transferred by the transfer on death deed.

(d) "Owner" means a person having an ownership or other interest in all or part of the real property to be conveyed or transferred by a transfer on death deed. Owner does not include a spouse who joins in a transfer on death deed solely for the purpose of conveying or releasing statutory or other marital interests in the real property to be conveyed or transferred by the transfer on death deed.

(e) "Recorded" means recorded in the office of the county recorder or registrar of titles, as appropriate for the real property described in the instrument to be recorded.

(f) "State agency" means the Department of Human Services or any successor agency.

(g) "Transfer on death deed" means a deed authorized under this section.

Subd. 2. Effect of transfer on death deed. A deed that conveys or assigns an interest in real property, including a mortgage, judgment, or any other lien on real property, to a grantee beneficiary and that expressly states that the deed is only effective on the death of one or more of the grantor owners, transfers the interest to the grantee beneficiary upon the death of the grantor owner upon whose death the conveyance or transfer is stated to be effective, but subject to the survivorship provisions and requirements of section 524.2-702. A transfer on death deed must comply with all provisions of Minnesota law applicable to deeds of real property including, but not limited to, the provisions of sections 507.02, 507.24, 507.34, 508.48, and 508A.48.

Subd. 3. Rights of creditors and rights of state and county under sections 246.53, 256B.15, 256D.16, 261.04, and 514.981. The interest transferred to a beneficiary under a transfer on death deed after the death of a grantor owner is transferred subject to all effective conveyances, assignments, contracts, mortgages, deeds of trust, liens, security pledges, judgments, tax liens, and other encumbrances made by the grantor owner or to which the property was subject during the grantor owner's lifetime, including but not limited to, any claim by a surviving spouse or any claim or lien by the state or county agency authorized by section 246.53, 256B.15, 256D.16, 261.04, or 514.981, if other assets of the deceased owner's estate are insufficient to pay the amount of any such claim. A beneficiary to whom the interest is transferred after the death of a grantor owner shall be liable to account to the state or county agency with a claim or lien authorized by section 246.53, 256B.15, 256D. 16, 261.04, or 514.981, to the extent necessary to discharge any such claim remaining unpaid after application of the assets of the deceased grantor owner's estate, but such liability shall be limited to the value of the interest transferred to the beneficiary. To establish compliance with this subdivision and subdivision 23, the beneficiary must record a clearance certificate issued in accordance with subdivision 23 in each county in which the real property described in the transfer on death deed is located.

Subd. 4. Multiple grantee beneficiaries. A transfer on death deed may designate multiple grantee beneficiaries to take title as joint tenants, as tenants in common or in any other form of ownership or tenancy that is valid under the laws of this state.

Subd. 5. Successor grantee beneficiaries. A transfer on death deed may designate one or more successor grantee beneficiaries or a class of successor grantee beneficiaries, or both. If the transfer on death deed designates successor grantee beneficiaries or a class of successor grantee beneficiaries, the deed shall state the condition under which the interest of the successor grantee beneficiaries would vest.

Subd. 6. Multiple joint tenant grantors. If an interest in real property is owned as joint tenants, a transfer on death deed executed by all of the owners that conveys an interest in real property to one or more grantee beneficiaries transfers the interest to the grantee beneficiary or beneficiaries effective only after the death of the last surviving grantor owner. If the last surviving joint tenant owner did not execute the transfer on death deed, the deed is ineffective to transfer any interest and the deed is void. An estate in joint tenancy is not severed or affected by the subsequent execution of a transfer on death deed and the right of a surviving joint tenant owner who did not execute the transfer on death deed shall prevail over a grantee beneficiary named in a transfer on death deed unless the deed specifically states that it severs the joint tenancy ownership.

Subd. 7. Execution by attorney-in-fact. A transfer on death deed may be executed by a duly appointed attorney-in-fact pursuant to a power of attorney which grants the attorney-in-fact the authority to execute deeds.

Subd. 8. Recording requirements and authorization. A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective. A transfer on death deed is not effective for purposes of section 507.34, 508.47, or 508A.47 until the deed is recorded in the county in which the real property is located. When a transfer on death deed is presented for recording, no certification by the county auditor as to transfer of ownership and current and delinquent taxes shall be required or made and the transfer on death deed shall not be required to be accompanied by a certificate of real estate value. A transfer on death deed that otherwise satisfies all statutory requirements for recording may be recorded and shall be accepted for recording in the county in which the property described in the deed is located. If any part of the property described in the transfer on death deed is registered property, the registrar of titles shall accept the transfer on death deed for recording only if at least one of the grantors who executes the transfer on death deed appears of record to have an ownership interest in the property described in the deed. No certification or approval of a transfer on death deed shall be required of the examiner of titles prior to recording of the deed in the office of the registrar of titles.

Subd. 9. Deed to trustee or other entity. A transfer on death deed may transfer an interest in real property to the trustee of an inter vivos trust even if the trust is revocable, to the trustee of a testamentary trust or to any other entity legally qualified to hold title to real property under the laws of this state.

Subd. 10. Revocation or modification of transfer on death deed. (a) A transfer on death deed may be revoked at any time by the grantor owner or, if there is more than one grantor owner, by any of the grantor owners. To be effective, the revocation must be recorded in the county in which at least a part of the real property is located before the death of the grantor owner or owners who execute the revocation. The revocation is not effective for purposes of section 507.34, 508.47, or 508A.47 until the revocation is recorded in the county in which the real property is located. Subject to subdivision 6, if the real property is owned as joint tenants and if the revocation is not executed by all of the grantor owners, the revocation is not effective unless executed by the last surviving grantor owner.

(b) If a grantor owner conveys to a third party, subsequent to the recording of the transfer on death deed, by means other than a transfer on death deed, all or a part of such grantor owner's interest in the property described in the transfer on death deed, no transfer of the conveyed interest shall occur on such grantor owner's death and the transfer on death deed shall be ineffective as to the conveyed or transferred interests, but the transfer on death deed remains effective with respect to the conveyance or transfer on death of any other interests described in the transfer on death deed owned by the grantor owner at the time of the grantor owner's death.

(c) A transfer on death deed is a "governing instrument" within the meaning of section 524.2-804 and, except as may otherwise be specifically provided for in the transfer on death deed, is subject to the same provisions as to revocation, revival, and nonrevocation set forth in section 524.2-804.

Subd. 11. Antilapse; deceased beneficiary; words of survivorship. (a) If a grantee beneficiary who is a grandparent or lineal descendant of a grandparent of the grantor owner fails to survive the grantor owner, the issue of the deceased grantee beneficiary who survive the grantor owner take in place of the deceased grantee beneficiary. If they are all of the same degree of kinship to the deceased grantee beneficiary, they take equally. If they are of unequal degree, those of more remote degree take by right of representation.

(b) For the purposes of this subdivision, words of survivorship such as, in a conveyance to an individual, "if he or she survives me," or, in a class gift, to "my surviving children," are a sufficient indication of intent to condition the conveyance or transfer upon the beneficiary surviving the grantor owner.

Subd. 12. Lapse. If all beneficiaries and all successor beneficiaries, if any, designated in a transfer on death deed, and also all successor beneficiaries who would take under the antilapse provisions of subdivision 11, fail to survive the grantor owner or the last survivor of the grantor owners if there are multiple grantor owners, if the beneficiary is a trust which has been revoked prior to the grantor owner's death, or if the beneficiary is an entity no longer in existence at the grantor owner's death, no transfer shall occur and the transfer on death deed is void.

Subd. 13. Multiple transfer on death deeds. If a grantor owner executes and records more than one transfer on death deed conveying the same interest in real property or a greater interest in the real property, the transfer on death deed that has the latest acknowledgment date and that is recorded before the death of the grantor owner upon whose death the conveyance or transfer is conditioned is the effective transfer on death deed and all other transfer on death deeds, if any, executed by the grantor owner or the grantor owners are ineffective to transfer any interest and are void.

Subd. 14. Nonademption; unpaid proceeds of sale, condemnation, or insurance; sale by conservator or guardian. If at the time of the death of the grantor owner upon whose death the conveyance or transfer is stated to be effective, the grantor owner did not own a part or all of the real property described in the transfer on death deed, no conveyance or transfer to the beneficiary of the nonowned part of the real property shall occur upon the death of the grantor owner and the transfer on death deed is void as to the nonowned part of the real property, but the beneficiary shall have the same rights to unpaid proceeds of sale, condemnation or insurance, and, if sold by a conservator or guardian of the grantor owner during the grantor owner's lifetime, the same rights to a general pecuniary devise, as that of a specific devisee as set forth in section 524.2-606.

Subd. 15. Nonexoneration. Except as otherwise provided in subdivision 3, a conveyance or transfer under a transfer on death deed passes the described property subject to any mortgage or security interest existing at the date of death of the grantor owner, without right of exoneration, regardless of any statutory obligations to pay the grantor owner's debts upon death and regardless of a general directive in the grantor owner's will to pay debts.

Subd. 16. Disclaimer by beneficiary. A grantee beneficiary's interest under a transfer on death deed may be disclaimed as provided in sections 524.2-1101 to 524.2-1116, or as otherwise provided by law.

Subd. 17. Effect on other conveyances. This section does not prohibit other methods of conveying property that are permitted by law and that have the effect of postponing ownership or enjoyment of an interest in real property until the death of the owner. This section does not invalidate any deed that is not a transfer on death deed and that is otherwise effective to convey title to the interests and estates described in the deed that is not recorded until after the death of the owner.

Subd. 18. Notice, consent, and delivery not required. The signature, consent or agreement of, or notice to, a grantee beneficiary under a transfer on death deed, or delivery of the transfer on death deed to the grantee beneficiary, is not required for any purpose during the lifetime of the grantor owner.

Subd. 19. Nonrevocation by will. A transfer on death deed that is executed, acknowledged, and recorded in accordance with this section is not revoked by the provisions of a will.

Subd. 20. Proof of survivorship and clearance from public assistance claims and liens; recording. An affidavit of identity and survivorship with a certified copy of a record of death as an attachment may be combined with a clearance certificate under this section and the combined documents may be recorded separately or as one document in each county in which the real estate described in the clearance certificate is located. The affidavit must include the name and mailing address of the person to whom future property tax statements should be sent. The affidavit, record of death, and clearance certificate, whether combined or separate, shall be prima facie evidence of the facts stated in each, and the registrar of titles may rely on the statements to transfer title to the property described in the clearance certificate.

Subd. 21. After-acquired property. Except as provided in this subdivision, a transfer on death deed is not effective to transfer any interest in real property acquired by a grantor owner subsequent to the date of signing of a transfer on death deed. A grantor owner may provide by specific language in a transfer on death deed that the transfer on death deed will apply to any interest in the described property acquired by the grantor owner after the signing or recording of the deed.

Subd. 22. Anticipatory alienation prohibited. The interest of a grantee beneficiary under a transfer on death deed which has not yet become effective is not subject to alienation; assignment; encumbrance; appointment or anticipation by the beneficiary; garnishment; attachment; execution or bankruptcy proceedings; claims for alimony, support, or maintenance; payment of other obligations by any person against the beneficiary; or any other transfer, voluntary or involuntary, by or from any beneficiary.

Subd. 23. Clearance for public assistance claims and liens. Any person claiming an interest in real property conveyed or transferred by a transfer on death deed, or the person's attorney or other agent, may apply to the county agency in the county in which the real property is located for a clearance certificate for the real property described in the transfer on death deed. The application for a clearance certificate and the clearance certificate must contain the legal description of each parcel of property covered by the clearance certificate. The county agency shall provide a sufficient number of clearance certificates to allow a clearance certificate to be recorded in each county in which the real property described in the transfer on death deed is located. The real property described in the clearance certificate is bound by any conditions or other requirements imposed by the county agency as specified in the clearance certificate. If the real property is registered property, a new certificate of title must not be issued until the clearance certificate is recorded. If the clearance certificate shows the continuation of a medical assistance claim or lien after issuance of the clearance certificate, the real property remains subject to the claim or lien. If the real property is registered property, the clearance certificate must be carried forward as a memorial in any new certificate of title. The application shall contain the same information and shall be submitted, processed, and resolved in the same manner and on the same terms and conditions as provided in section 525.313 for a clearance certificate in a decree of descent proceeding, except that a copy of a notice of hearing does not have to accompany the application. The application may contain a statement that the applicant, after reasonably diligent inquiry, is not aware of the existence of a predeceased spouse or the existence of a claim which could be recovered under section 246.53, 256B.15, 256D.16, 261.04, or 514.981. If the county agency determines that a claim or lien exists under section 246.53, 256B.15, 256D.16, 261.04, or 514.981, the provisions of section 525.313 shall apply to collection, compromise, and settlement of the claim or lien. A person claiming an interest in real property transferred or conveyed by a transfer on death deed may petition or move the district court, as appropriate, in the county in which the real property is located or in the county in which a probate proceeding affecting the estate of the grantor of the transfer on death deed is pending, for an order allowing sale of the real property free and clear of any public assistance claim or lien but subject to disposition of the sale proceeds as provided in section 525.313. On a showing of good cause and subject to such notice as the court may require, the court without hearing may issue an order allowing the sale free and clear of any public assistance claim or lien on such terms and conditions as the court deems advisable to protect the interests of the state or county agency.

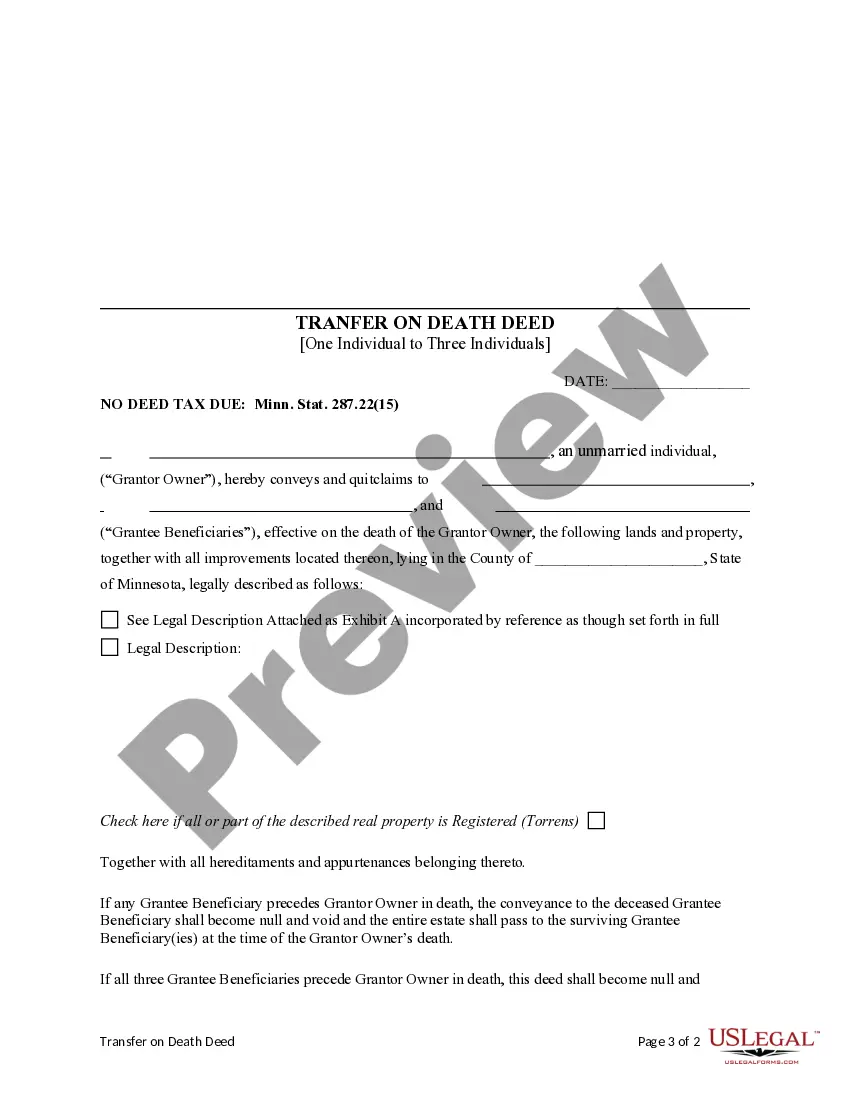

Subd. 24. Form of transfer on death deed. A transfer on death deed may be substantially in the following form:

Transfer on Death Deed

I (we) ______________________ (grantor owner or owners and

spouses, if any, with marital status designated), grantor(s),

hereby convey(s) and quitclaim(s) to ____________ (grantee

beneficiary, whether one or more) effective (check only one of the following)

_______ on the death of the grantor owner, if only one

grantor is named above, or on the death of the last of the

grantor owners to die, if more than one grantor owner is named

above, or

_______ on the death of (name of grantor owner)

______________________________________ (must be one of the

grantor owners named above), the following described real

property:

(Legal description)

If checked, the following optional statement applies:

_______ When effective, this instrument conveys any and all

interests in the described real property acquired by the

grantor owner(s) before, on, or after the date of this

instrument.

__________________________

(Signature of grantor(s))

(acknowledgment)

Subd. 25. Form of instrument of revocation. An instrument of revocation may be substantially in the following form:

Revocation of Transfer on Death Deed

The undersigned hereby revokes the transfer on death deed

recorded on _____________, ____________, as Document No

___________ (or in Book __________ of ________, Page _______)

in the office of the (County Recorder) (Registrar of Titles)

of ___________ County, Minnesota, affecting real property

legally described as follows:

(legal description)

Dated:

__________________________

Signature

(acknowledgment)

Subd. 26. Jurisdiction. In counties where the district court has a probate division, actions to enforce a medical assistance lien or claim against real property described in a transfer on death deed and any matter raised in connection with enforcement shall be determined in the probate division. Notwithstanding any other law to the contrary, the provisions of section 256B. 15 shall apply to any proceeding to enforce a medical assistance lien or claim under chapter 524 or 525. In other counties, the district court shall have jurisdiction to determine any matter affecting real property purporting to be transferred by a transfer on death deed.

HIST: 2008 c 341 art 2 s 5; 2009 c 30 art 1 s 1, 2; 2010 c 382 s 77