Affidavit Of Heirship Minnesota Without A Lawyer

Description

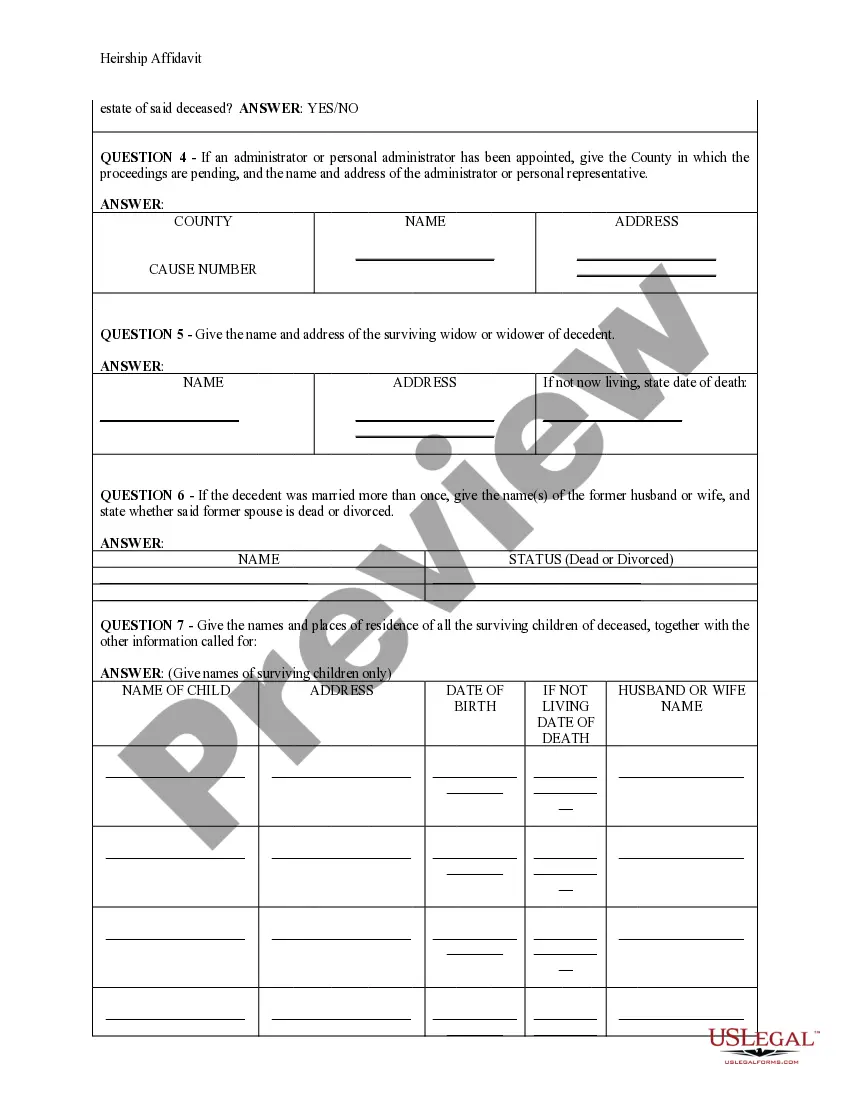

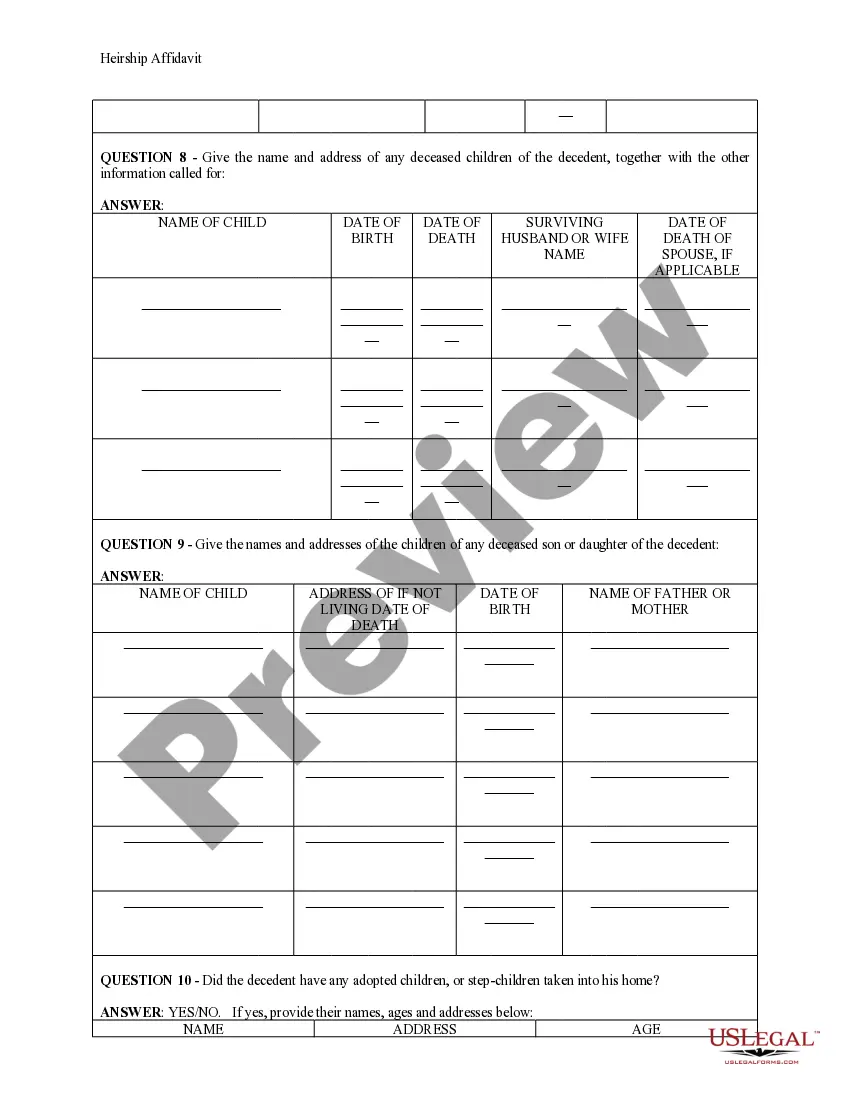

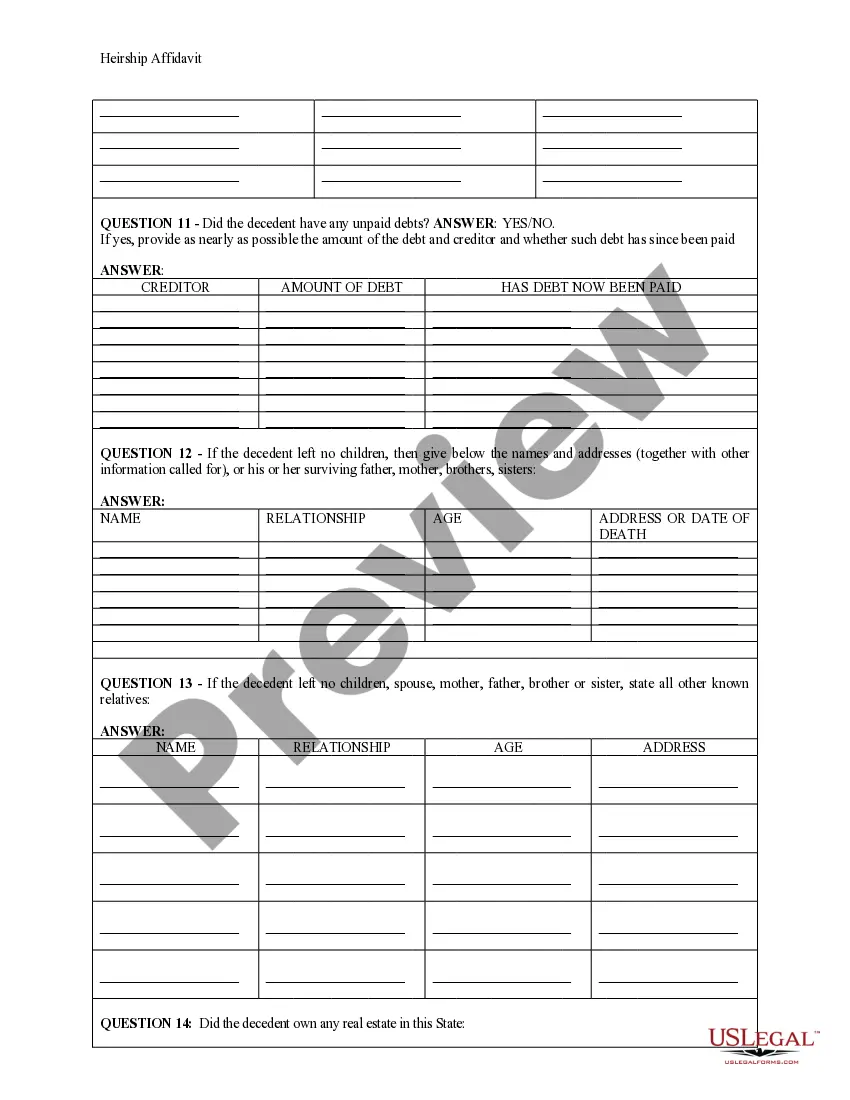

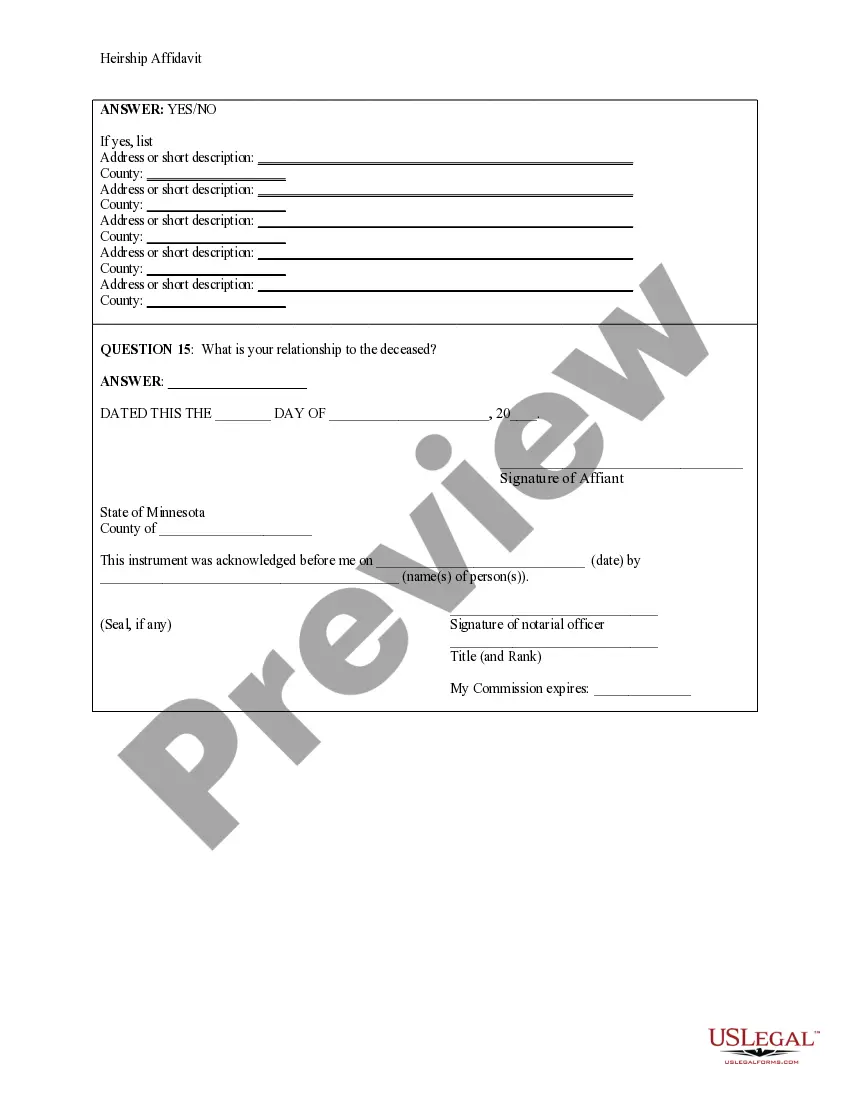

How to fill out Minnesota Heirship Affidavit - Descent?

Obtaining legal templates that comply with federal and regional laws is a matter of necessity, and the internet offers many options to pick from. But what’s the point in wasting time looking for the correctly drafted Affidavit Of Heirship Minnesota Without A Lawyer sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are easy to browse with all papers collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Affidavit Of Heirship Minnesota Without A Lawyer from our website.

Getting a Affidavit Of Heirship Minnesota Without A Lawyer is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

- Analyze the template utilizing the Preview option or through the text outline to ensure it fits your needs.

- Locate a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Affidavit Of Heirship Minnesota Without A Lawyer and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Your property will go to your spouse or closest relatives. If you have a spouse and children, the property will go to them by a set formula. If not, the property will descend in the following order: grandchildren, parents, brothers and sisters, or more distant relatives if there are no closer ones.

The timeframe for this process in Minnesota can vary widely, typically ranging from several months to over a year, depending on factors such as the size and complexity of the estate, the clarity of the will, and whether or not the probate process is contested.

Trusts. One of the most popular ways to avoid probate is by having a revocable living trust as part of your estate plan.

You may not need probate if there are no assets, or you are a joint owner of the assets. The non-probate assets that do not apply to the deceased person's debts are: Property with the right of survivorship. Insurance proceeds, such as life insurance.

Who Gets What in Minnesota? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendantsspouse inherits everythingspouse and descendants from you and that spouse, and the spouse has no other descendantsspouse inherits everything4 more rows