Affidavit Of Heirship Minnesota Withholding

Description

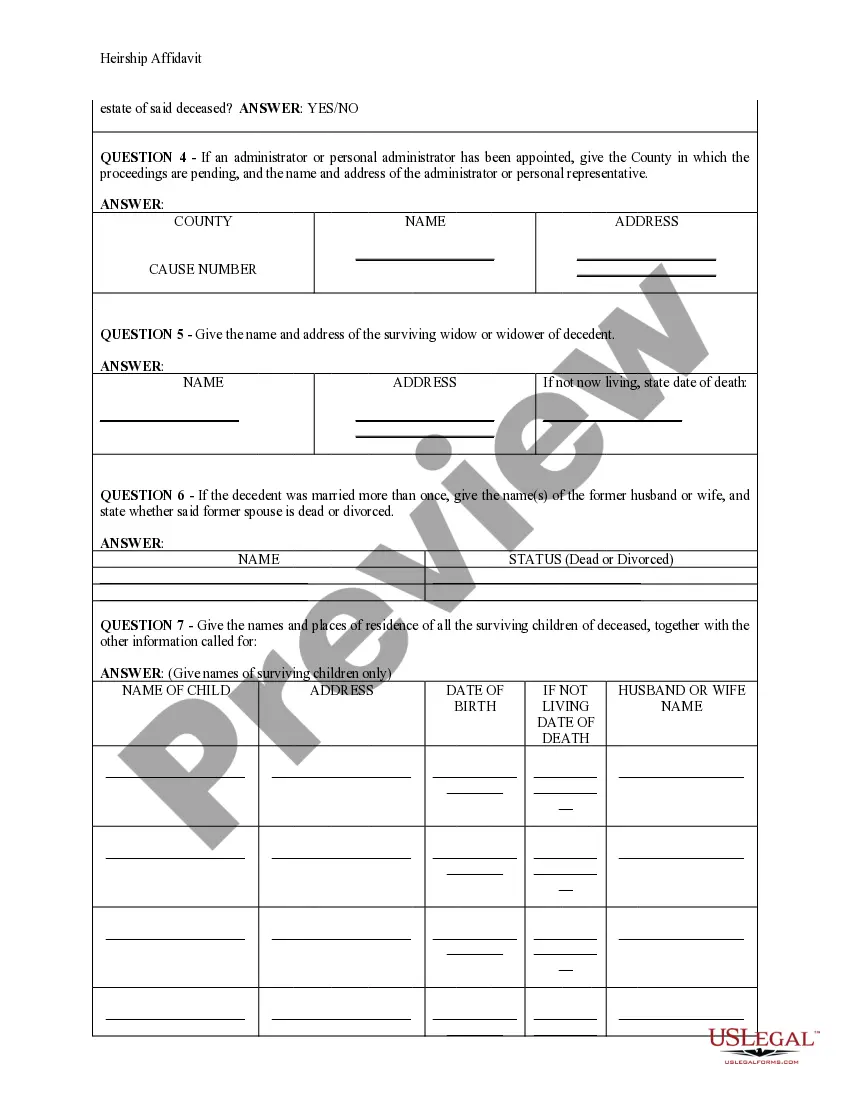

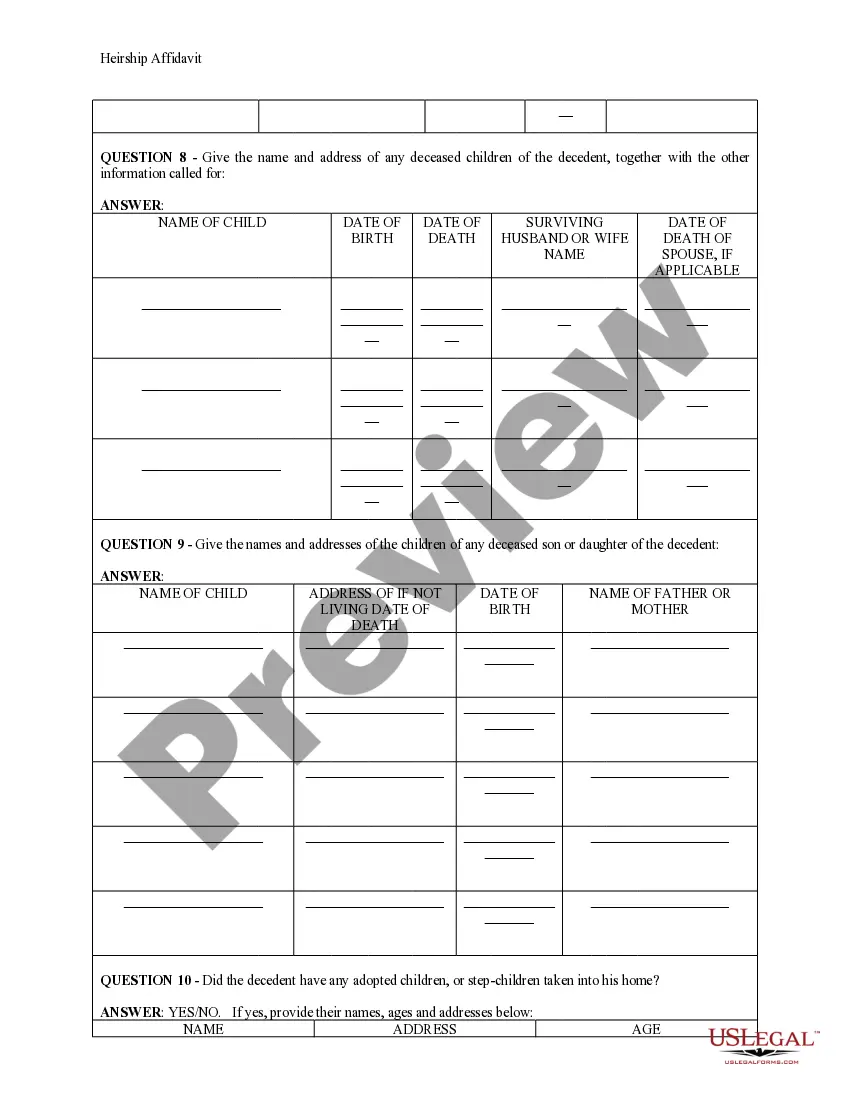

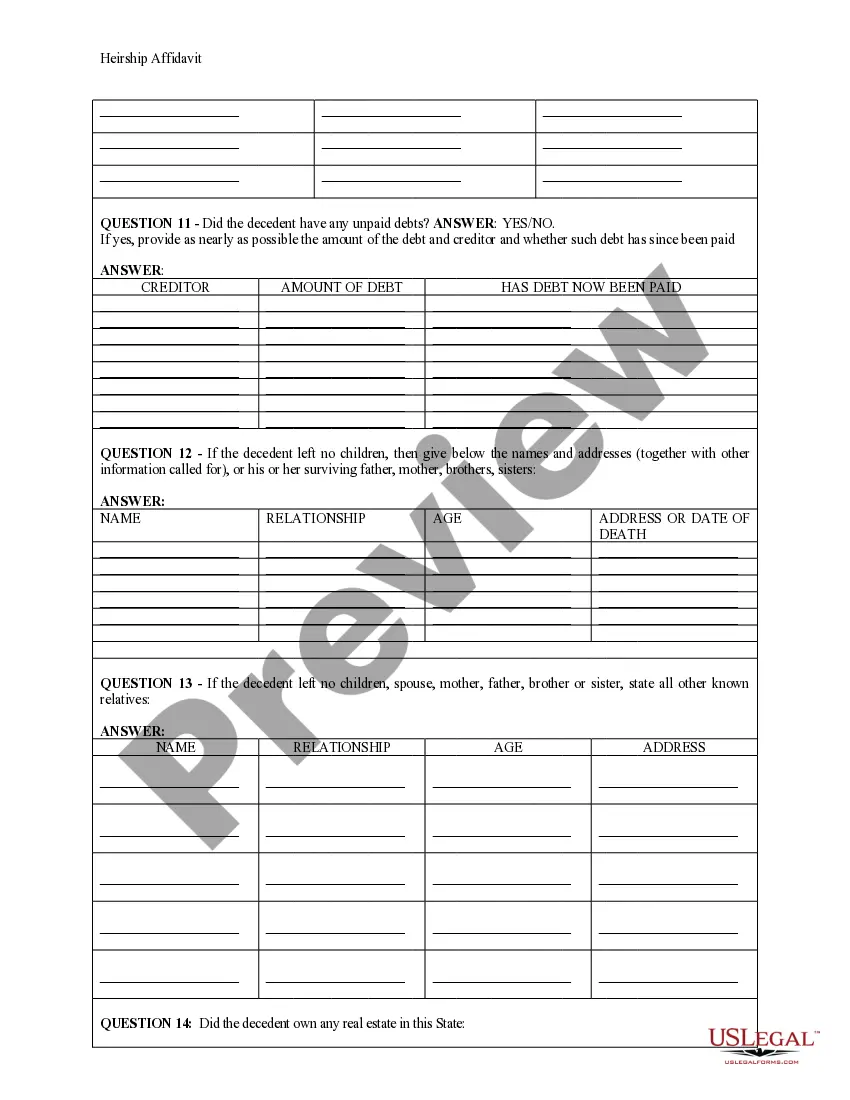

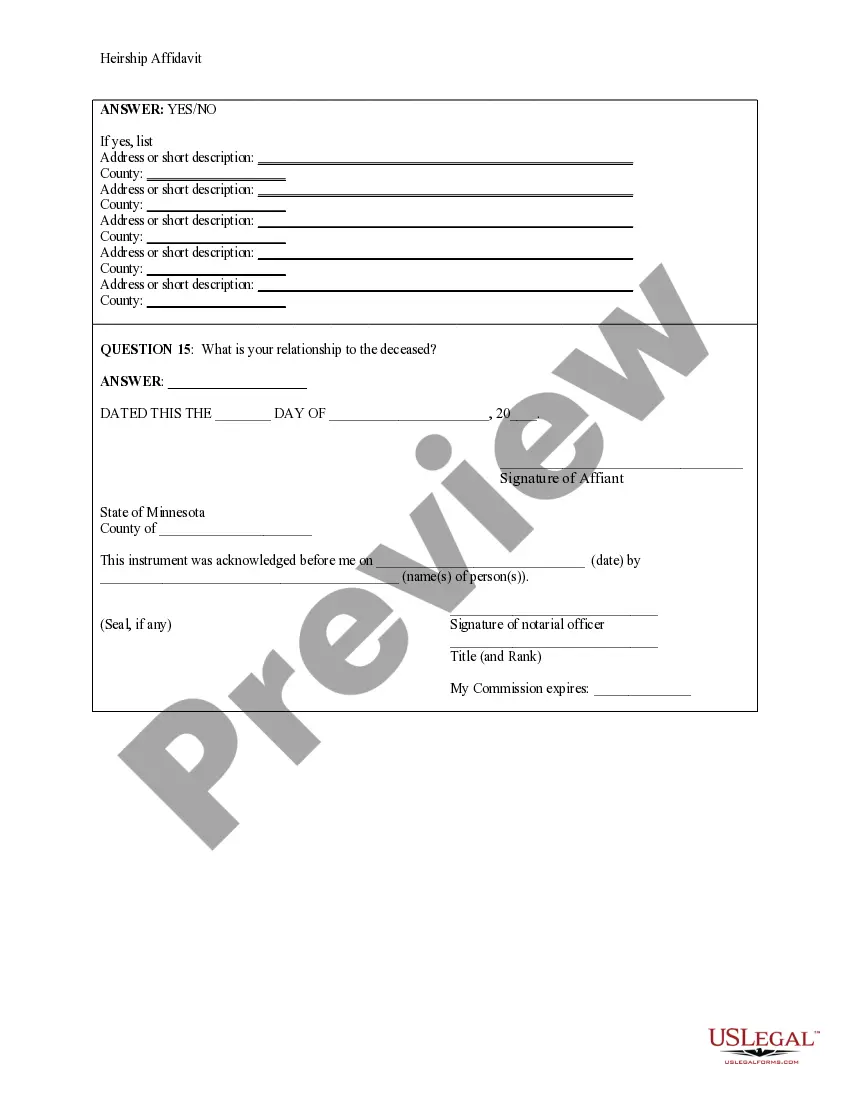

How to fill out Minnesota Heirship Affidavit - Descent?

The Affidavit Of Heirship Minnesota Withholding you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and regional laws. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Affidavit Of Heirship Minnesota Withholding will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to confirm it fits your needs. If it does not, utilize the search bar to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Affidavit Of Heirship Minnesota Withholding (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Your property will go to your spouse or closest relatives. If you have a spouse and children, the property will go to them by a set formula. If not, the property will descend in the following order: grandchildren, parents, brothers and sisters, or more distant relatives if there are no closer ones.

After the informal probate has been fully administered, the personal representative should file an "Unsupervised Personal Representative's Statement to Close Estate" with the Probate Court. No other forms need to be filed with the Probate Court to informally close administration.

Who Gets What in Minnesota? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendantsspouse inherits everythingspouse and descendants from you and that spouse, and the spouse has no other descendantsspouse inherits everything4 more rows

Trusts. One of the most popular ways to avoid probate is by having a revocable living trust as part of your estate plan.

Probate ends when the personal representative or court issues a final account detailing the assets and how they were distributed. A copy is filed with the probate court. The personal representative must provide a copy of the account on request.