Affidavit Of Heirship Minnesota For A House

Description

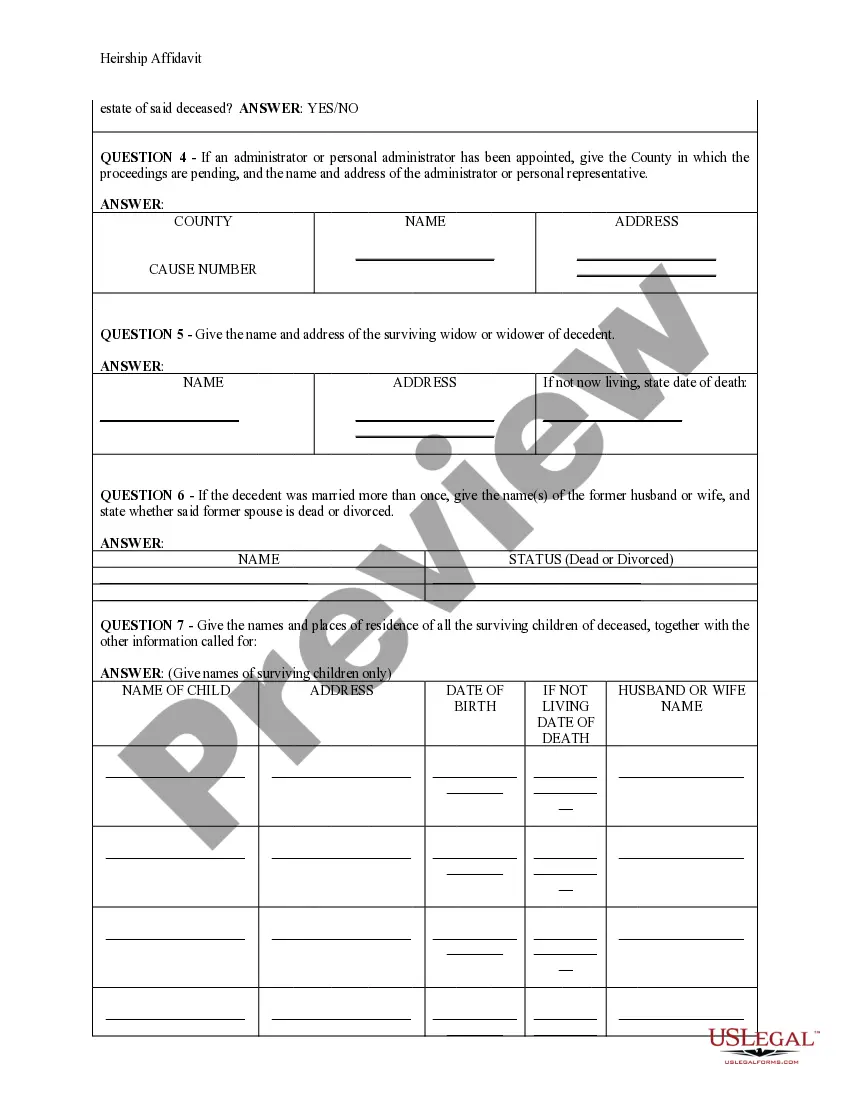

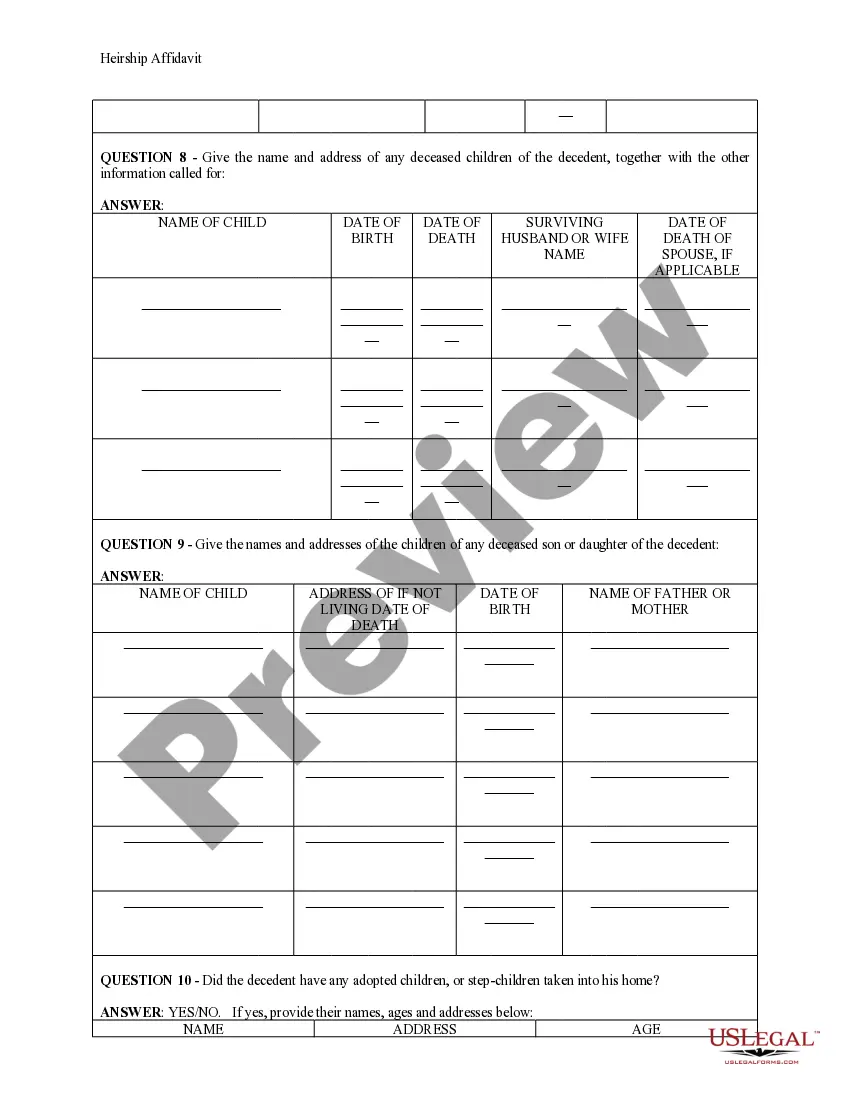

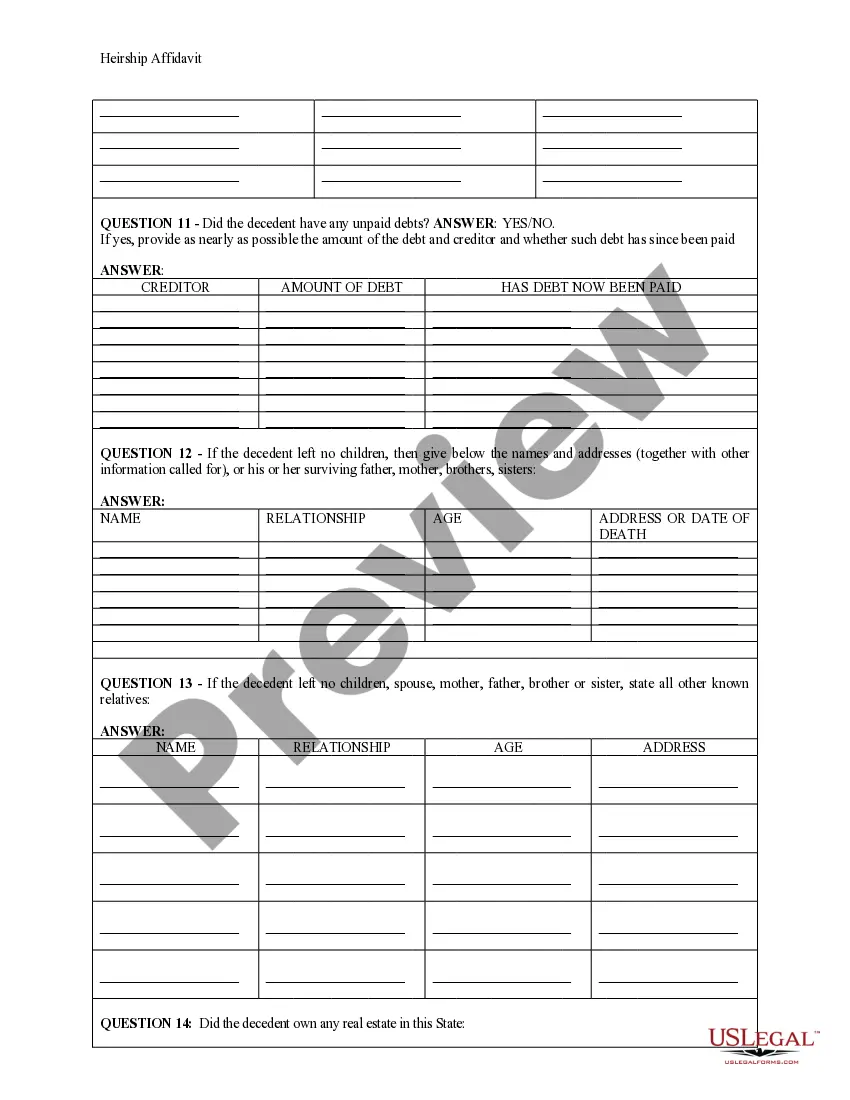

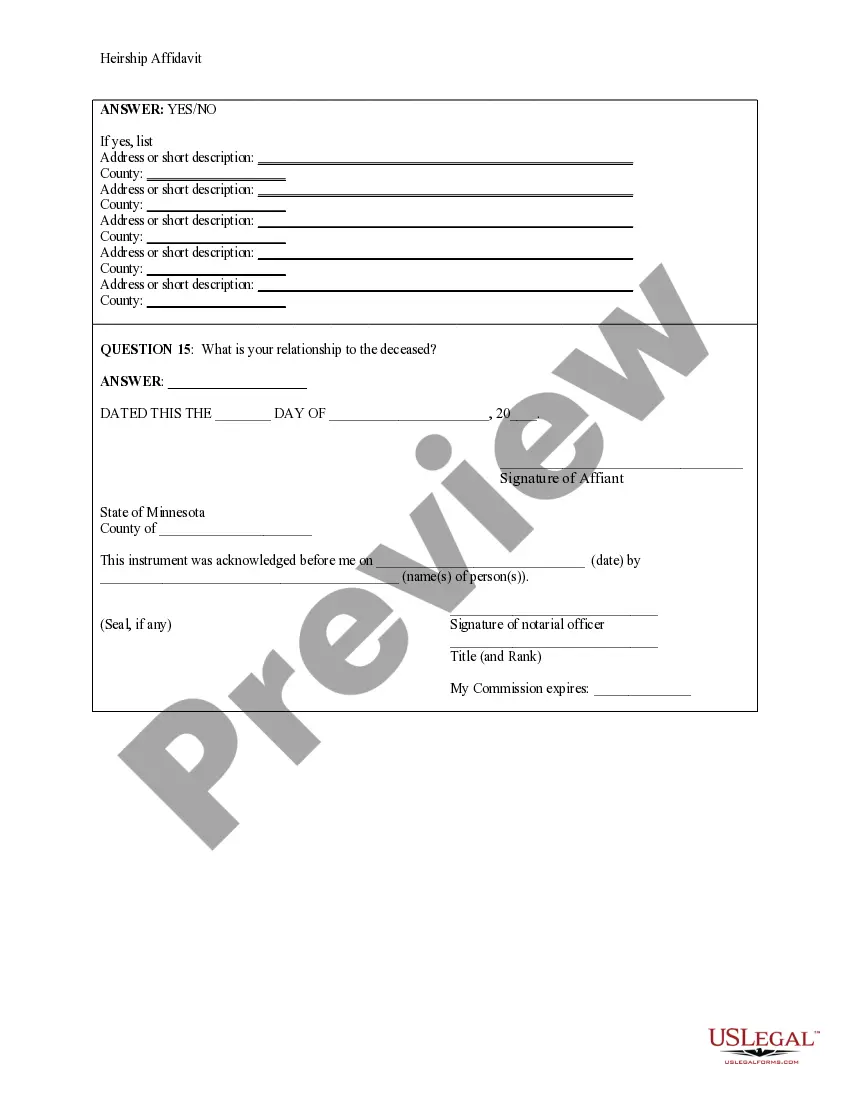

How to fill out Minnesota Heirship Affidavit - Descent?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal files requirements accuracy and attention to detail, which is why it is important to take samples of Affidavit Of Heirship Minnesota For A House only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and view all the details regarding the document’s use and relevance for the situation and in your state or region.

Consider the following steps to finish your Affidavit Of Heirship Minnesota For A House:

- Utilize the catalog navigation or search field to find your template.

- Open the form’s information to check if it suits the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is definitely the one you are looking for.

- Return to the search and look for the correct template if the Affidavit Of Heirship Minnesota For A House does not suit your needs.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Select the pricing plan that fits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Select the file format for downloading Affidavit Of Heirship Minnesota For A House.

- When you have the form on your device, you can modify it with the editor or print it and finish it manually.

Get rid of the headache that comes with your legal documentation. Explore the comprehensive US Legal Forms library where you can find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

An affidavit of heirship must be signed and sworn to before a notary public by a person who knew the decedent and the decedent's family history. This person can be a friend of the decedent, an old friend of the family, or a neighbor, for example.

What Is An Affidavit Of Heirship in Oklahoma. Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

What is an Affidavit of Heirship in Illinois? An affidavit of heirship is a written statement establishing the right of inheritance. To be valid, it must be signed under oath and witnessed by a third party.

When using an affidavit of heirship in Texas, the witnesses must swear to the following conditions: They knew the decedent. The decedent did not owe any debts. The true identity of the family members and heirs. The person died on a certain date in a certain place. The witness will not gain financially from the estate.