Owner Corporation Paper For The Future

Description

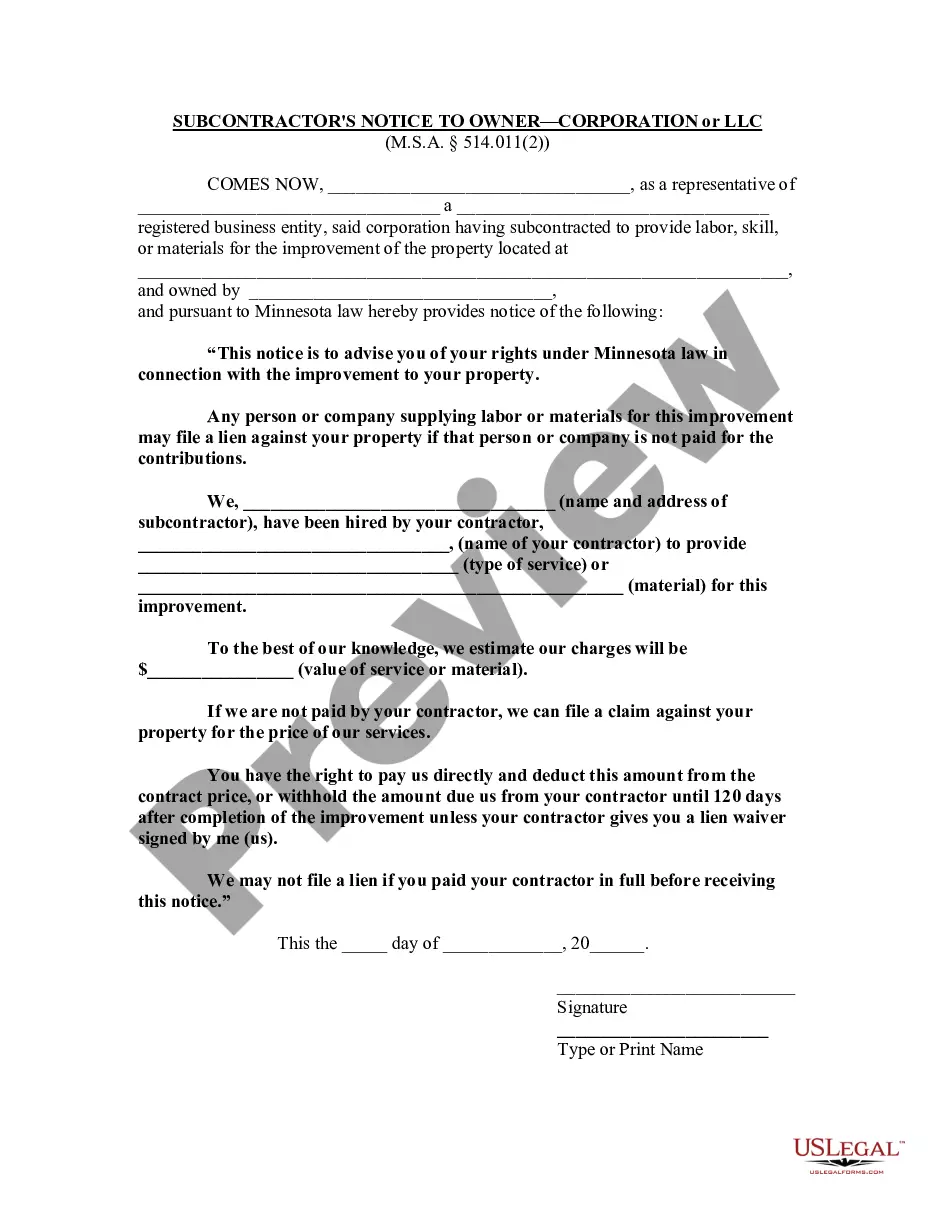

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- If you're a returning user, simply log in to your account and locate the owner corporation paper for the future. Ensure your subscription is up to date to access the template without interruption.

- For first-time users, start by browsing the preview mode and form descriptions. This helps confirm that the form meets your needs and complies with local jurisdiction standards.

- If the template doesn't fit your criteria, utilize the Search tab to find a more suitable version of the owner corporation paper for the future.

- Once you identify the correct form, click on the Buy Now button and select a subscription plan that best suits your needs. You'll need to create an account for access to all resources.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Finally, download the form to your device. You can access it anytime through the My Forms section of your profile.

By following these simple steps, you can ensure you have the proper documentation for your needs. US Legal Forms not only provides a vast collection of forms but also offers expert assistance, making your legal paperwork process more manageable.

Don’t wait any longer—visit US Legal Forms today and get started on securing your owner corporation paper for the future!

Form popularity

FAQ

To create your own corporation, start by selecting a business name that complies with state laws. Next, file the articles of incorporation with your state, and gather the necessary documentation, including bylaws and an operating agreement. Consider using platforms like US Legal Forms to guide you through the process of developing your owner corporation paper for the future.

Not all LLCs are required to file a beneficial ownership report, but many states have business regulations that mandate it. Assessing your state’s specific requirements can determine whether you need to file. Understanding these regulations is vital for maintaining your owner corporation paper for the future.

The beneficial ownership form is typically filled out by the corporation's owners or a designated representative. It is crucial that the information is accurate and reflects the true ownership structure. This ensures your compliance and strengthens your owner corporation paper for the future.

You can fill out a beneficial ownership form online or request a paper version from your state’s regulatory agency. Many organizations, including US Legal Forms, provide templates that simplify this process. Having the right tools can help you accurately complete your owner corporation paper for the future.

You can file your beneficial ownership report with the appropriate state regulatory agency in your area. Each state has different requirements and potential online portals for submission. Ensuring your compliance will help secure your owner corporation paper for the future.

Filling out the beneficial ownership report typically takes about 30 to 60 minutes, depending on the complexity of your corporation. You will need to gather the necessary information about each owner, which can streamline the process. By preparing in advance, you can efficiently complete the report and move forward with your owner corporation paper for the future.

The certificates that evidence ownership in a company primarily include stock certificates and sometimes membership certificates for limited liability companies. These documents detail your ownership share and the associated rights. Safeguarding these certificates is paramount, as they serve as crucial proof in legal and financial matters. Thus, obtaining your owner corporation paper for the future becomes an essential task for all business owners.

You prove ownership in a corporation by providing stock certificates or similar documents that detail your shareholdings. In cases where the corporation maintains electronic records, an official statement may suffice. Keeping your paperwork organized is essential for demonstrating your ownership, and the necessary owner corporation paper for the future helps ensure that you can easily verify your stake.

To obtain ownership proof, you typically need to receive stock certificates from the corporation or document the acquisition through an ownership agreement. For many, securing these documents is simple, especially when the company provides organized systems. If you are unsure about how to acquire this proof, consider using platforms like USLegalForms to streamline the process of obtaining your owner corporation paper for the future.

When you become an owner in a corporation, you are buying a stake in the business, which includes assets, profits, and a say in certain decisions. This ownership not only gives you potential financial returns but also the right to participate in corporate governance. Therefore, understanding what your ownership entails can help you make informed decisions. The owner corporation paper for the future plays a crucial role in clarifying these rights and responsibilities.