Limited Liability Company With One Member

Description

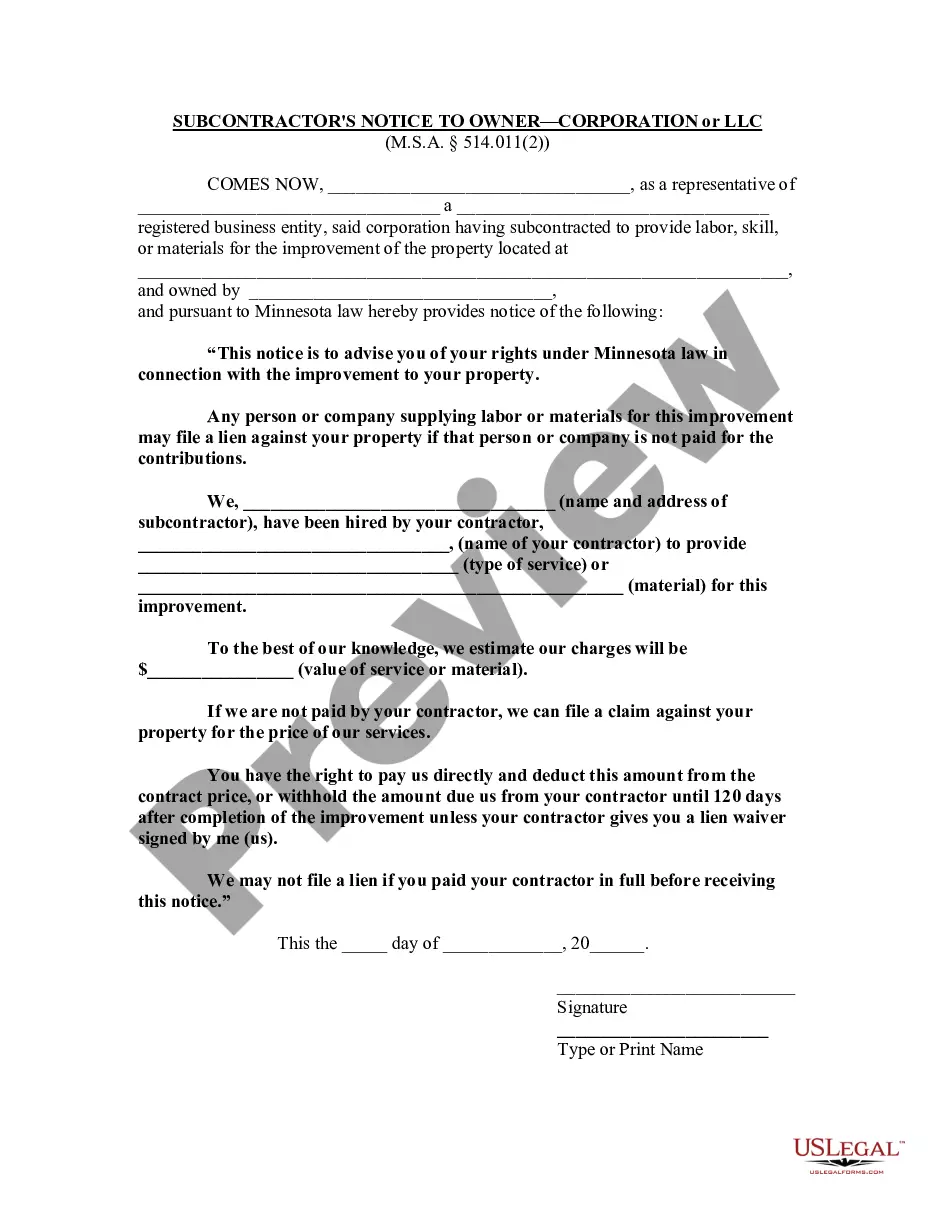

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- Log in to your US Legal Forms account if you're a returning user and ensure your subscription is active. Click on the Download button to save the necessary template to your device.

- For first-time users, begin by browsing the available form descriptions to ensure you've selected the correct one that aligns with your needs and complies with local regulations.

- If the desired template isn't suitable, utilize the Search tab to explore additional options until you find one that meets your requirements.

- Once you identify the correct document, click on the Buy Now button, select your preferred subscription plan, and create an account to access the library’s resources.

- Complete the payment process by providing your credit card information or using your PayPal account for purchase.

- After purchasing, download your form and save it on your device for easy access later through the My Forms section of your profile.

Upon following these steps, you'll gain access to a user-friendly and legally sound document tailored for your LLC needs.

With US Legal Forms, you benefit from a robust collection of forms and access to premium experts for precise completion. Start your journey today and simplify your legal document management!

Form popularity

FAQ

An LLC with one person is commonly known as a single member LLC or a limited liability company with one member. This form of business organization offers the same liability protections and tax benefits as multi-member LLCs but is designed specifically for individual ownership. When you choose this structure, you can operate your business independently while enjoying the advantage of limited liability.

In a limited liability company with one member, you can choose a title that best describes your role, such as 'Owner,' 'Member,' or 'Managing Member.' These titles reflect your position as the single decision-maker responsible for the company's operations. Ultimately, the title is flexible and can be tailored to fit your preferences and the nature of your business.

As the owner of a limited liability company with one member, your personal liability is generally protected from business debts and obligations. This protection means that if your LLC faces legal actions or debts, your personal assets are typically safe. However, it's important to maintain compliance with legal requirements and separate your personal and business finances to maintain that liability protection.

If you own a limited liability company with one member, you are generally referred to as the member or owner of the LLC. In this structure, you hold both ownership and operational control, meaning that you make all the key decisions for your business. While you have many titles available, simply using 'member' clearly conveys your role in the LLC.

To fill out a W-9 for a limited liability company with one member, first indicate your LLC status in the appropriate box. Use your name as the sole member, and provide the LLC's Employer Identification Number (EIN) or your Social Security Number (SSN) if you do not have an EIN. Remember, as the sole owner, you are the responsible party for reporting income, so make sure the information is accurate and up to date.

A single member LLC is commonly referred to as a limited liability company with one member. This structure allows an individual to establish a business entity that protects personal assets while providing flexibility in management. By forming a limited liability company with one member, you can enjoy the benefits of limited liability while maintaining complete control over your business decisions.

Filling out a W-9 for a single-member LLC is straightforward. Start by entering your name and your LLC's business name, if applicable. Check the box indicating your LLC tax classification and provide your SSN or EIN. After ensuring all entries are correct, sign and date the form. Using services like uslegalforms can help you accurately complete this form with additional resources and templates available for your convenience.

member LLC should use either a social security number (SSN) or an employer identification number (EIN) on the W9 form. If you have obtained an EIN for your LLC, it is advisable to use this number as it separates your personal and business finances. However, if you have not acquired an EIN, you can use your SSN. Clearly state which identification number you are using to avoid any potential confusion.

To fill out a W9 as a single-member LLC, enter your name on the first line and your business name under 'Business Name.' In the tax classification section, check the box for 'Limited Liability Company' and include 'S' if your LLC is taxed as an S-Corporation or leave it blank if taxed as a sole proprietorship. It is important to ensure the accuracy of the entered information, as it will be used for tax reporting purposes.

When a single person fills out a W9 form, they should include their name, business name (if applicable), and social security number. If they are operating as a limited liability company with one member, they should write their name in the 'Name' field and their LLC name in the 'Business Name' field. Ensure that all information is accurate and clearly printed to avoid processing delays. After completing the form, the individual should sign and date it at the bottom.