Limited Liability Company For Dummies

Description

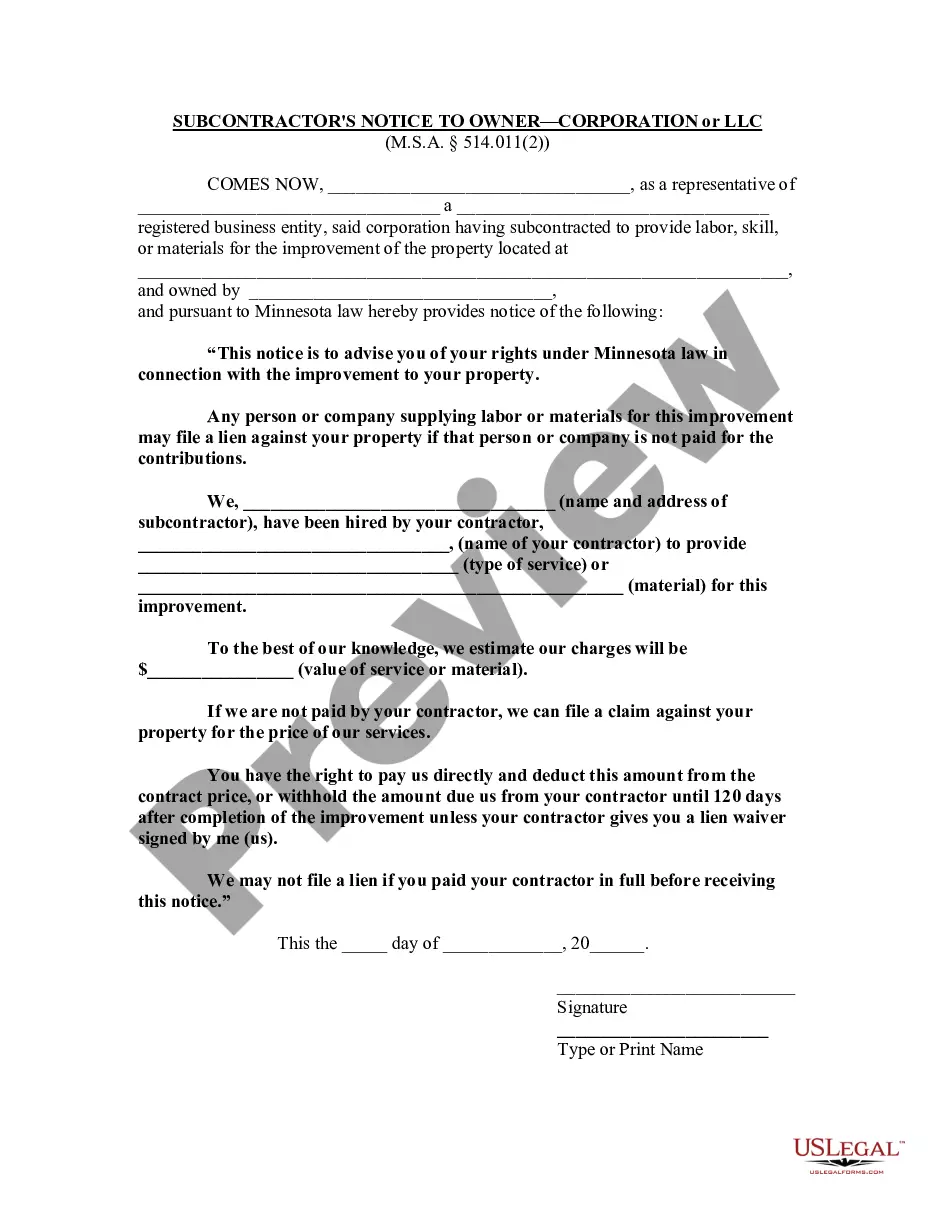

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- If you have an existing US Legal Forms account, simply log in and download the necessary template by clicking the Download button. Ensure your subscription is current or renew it if needed.

- For first-time users, begin by checking the preview mode and detailed descriptions of the forms to find the one that meets your specific requirements based on your jurisdiction.

- Need another template? Use the Search tab above to locate the appropriate document if your initial choice is unsuitable.

- After selecting a form, click on the Buy Now button. Choose your desired subscription plan and create an account to gain access to the full library.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Finally, download the form to your device and access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms simplifies the process of creating your LLC with its user-friendly services. Whether you're a first-timer or an experienced user, their vast collection of forms and access to legal experts guarantee your documents are precise and compliant.

Don't wait! Start your LLC journey today with US Legal Forms and ensure a smooth formation process.

Form popularity

FAQ

The easiest LLC to create often involves minimal members and a straightforward business model. Starting as a single-member LLC is usually recommended for simplicity in management and compliance. US Legal Forms simplifies the creation process, guiding you in forming a limited liability company for dummies without unnecessary confusion.

A limited liability company for dummies refers to a straightforward way of understanding LLCs, which offer business owners personal liability protection while allowing flexible management and tax benefits. It’s an excellent choice for new entrepreneurs looking to simplify their business structure. Using user-friendly platforms like US Legal Forms can help you grasp the essentials quickly.

Limited liability, in simple terms, means that if your LLC faces financial trouble, your personal assets are protected. It allows you to separate personal finances from business finances, minimizing your risk. This concept is especially important for anyone interested in forming a limited liability company for dummies.

Limited liability means that business owners are not personally responsible for business debts; their financial risk is limited to their investment in the company. In contrast, unlimited liability means that owners can lose personal assets if the business incurs debt. Understanding these concepts is vital for anyone looking into forming a limited liability company for dummies.

One downside to an LLC is that it may involve more paperwork and ongoing fees compared to a sole proprietorship. While it offers limited liability protection, some state regulations can be complex. For a simplified understanding of these aspects, exploring resources on a limited liability company for dummies can be quite beneficial.

The abbreviation for limited liability is 'LL.' It is commonly used in various business contexts, particularly when referring to limited liability companies, which protect owners from personal liability for business debts. Understanding this term is essential for anyone exploring a limited liability company for dummies.

The easiest LLC to start is typically one where you have a clear understanding of your business goals. Generally, many choose a single-member LLC, as it requires less paperwork and fewer complexities. A platform like US Legal Forms can streamline the process, helping you focus on launching your business with a limited liability company for dummies approach.

owner Limited Liability Company typically files taxes as a sole proprietorship, meaning you report your business income and expenses on Schedule C attached to your individual tax return. This makes the process straightforward, but you should still keep meticulous records. Understanding these basics ensures you remain compliant and can maximize your tax potential.

Yes, you can file your Limited Liability Company separately from your personal taxes, especially if your LLC is treated as a corporation for tax purposes. However, single-member LLCs often file in conjunction with personal taxes. Evaluating your options with a tax professional can clarify the best strategy for your situation.

The best way to file for a Limited Liability Company includes researching your state's requirements and filling out the appropriate formation documents. You can complete this process online or through mail, where platforms like USLegalForms can simplify the task for you. Ensuring that all documents are correctly filed can save you time and potential issues later.