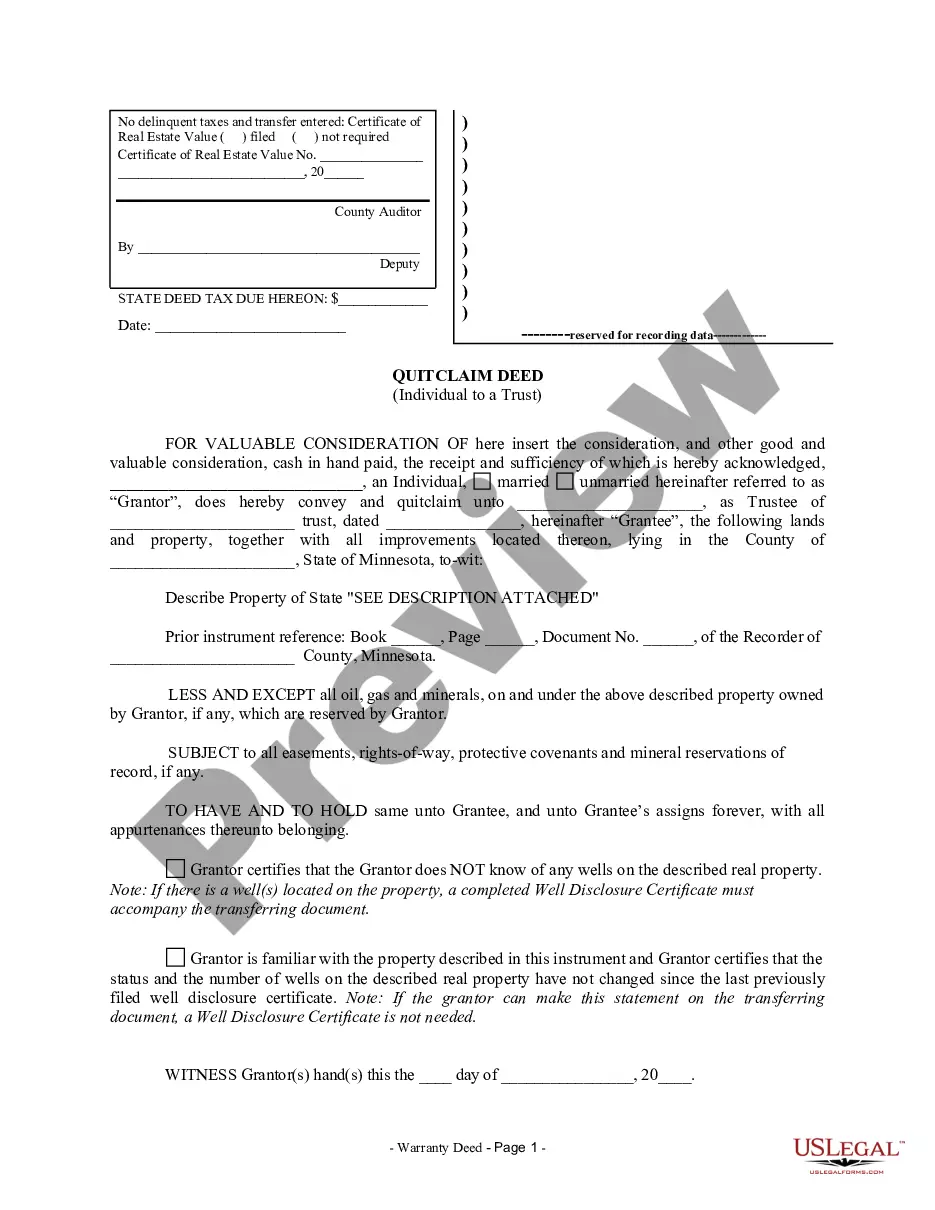

Quitclaim Deed Grantee

Description

How to fill out Minnesota Quitclaim Deed From Individual To A Trust?

- If you're a returning user, log into your account to access the required form templates. Ensure your subscription is current; if not, renew it accordingly.

- Check the Preview mode and description of the selected form to confirm it aligns with your legal requirements.

- Use the Search tab to find an alternative template if the current one seems unsuitable. Ensure it's compatible with your local jurisdiction.

- Proceed to purchase the document by clicking the Buy Now button. Select a subscription plan that works for you, and register an account to access the full library.

- Enter your payment details, either using a credit card or PayPal, and finalize your subscription.

- Download your completed form and save it to your device. You can always retrieve it later from the My Forms section of your profile.

In summary, US Legal Forms offers a user-friendly platform that empowers you to quickly and efficiently acquire the legal documents you need, such as a quitclaim deed grantee. With access to a vast library and expert assistance, you're well-equipped to handle your legal affairs with confidence.

Start your hassle-free experience today by visiting US Legal Forms and unlocking the benefits of having your legal documentation at your fingertips.

Form popularity

FAQ

The grantee on a deed is the individual or entity receiving ownership rights to a property. In the context of a quitclaim deed, once the grantor signs the document, the grantee takes on the rights specified within it. Understanding the role of the quitclaim deed grantee is essential, as it determines who gains property rights after the transfer. At US Legal Forms, you can find templates and guidance to help you navigate this process smoothly.

A quitclaim deed is a legal document that transfers interest in a property from one party to another. For example, if John wants to give his rights to a piece of land to Mary, he can execute a quitclaim deed. In this scenario, John is the grantor, and Mary becomes the quitclaim deed grantee. This deed does not guarantee that John holds clear title, but it allows Mary to claim whatever interest John has in the property.

Yes, you can file a quitclaim deed yourself, but it is essential to understand the process involved. As the quitclaim deed grantee, you must ensure that all necessary documents are completed accurately and submitted to the appropriate local authority. Taking the time to research your state's requirements can help prevent mistakes during the filing. For a streamlined experience, consider using US Legal Forms, which offers user-friendly templates and guidance to assist you in filing the quitclaim deed correctly.

The primary disadvantage of a quitclaim deed is that it offers no protection to the quitclaim deed grantee against existing claims on the property. If there are title issues, such as liens or disputes, the grantee may face complications after the transfer. Additionally, the lack of a warranty means that the grantee cannot claim compensation if problems arise with the property. It's essential to fully understand these risks, and using services like US Legal Forms can help you navigate the process.

A quitclaim deed is most commonly used to transfer property between family members or in divorce settlements. It allows for a straightforward transfer of ownership without the need for title searches or legal guarantees, making it an effective tool for quitclaim deed grantees. Additionally, real estate transactions involving trusts or estates often utilize quitclaim deeds to simplify the process. Overall, this deed serves as a practical solution when strong trust exists between the parties involved.

The purpose of a quitclaim deed is to transfer ownership of real property from one person to another without making any guarantees about the title. This means that the quitclaim deed grantee receives whatever interest the grantor has in the property, if any at all. Unlike warranty deeds, quitclaim deeds do not provide protection against claims or liens against the property. This type of deed is often used in situations where the parties trust each other.

Those who benefit most from a quitclaim deed include family members, friends, or trust-based relationships where property transfer happens without monetary exchange. The quitclaim deed grantee often receives property quickly and with minimal costs involved. This legal tool enables efficient transfers among trusted parties, streamlining ownership changes.

Yes, you can prepare a quitclaim deed yourself by following the required legal guidelines. However, it is advisable to seek assistance from legal experts or platforms like UsLegalForms to ensure the deed is accurately completed and recorded. This can save the quitclaim deed grantee time and avoid potential mistakes that could complicate the property transfer.

One significant disadvantage for a buyer receiving a quitclaim deed is the risk of inheriting unresolved title issues. The quitclaim deed grantee takes on property liabilities without any assurance of a clear title. This means potential challenges could arise, leading to unforeseen expenses or legal disputes in the future.

Quitclaim deeds are often used to transfer property between family members or close friends where trust is established. This makes the quitclaim deed grantee's acceptance simpler and more straightforward. Their lack of formalities and lower costs attract those looking for quick and uncomplicated transfers.