Transfer Deed On Death Form With Decimals

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Managing legal documents and procedures can be a lengthy addition to your entire day.

Transfer Deed On Death Form With Decimals and similar forms typically necessitate searching for them and figuring out the best method to fill them out accurately.

Consequently, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online resource of forms readily available will be beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms and various tools to help you complete your documents swiftly.

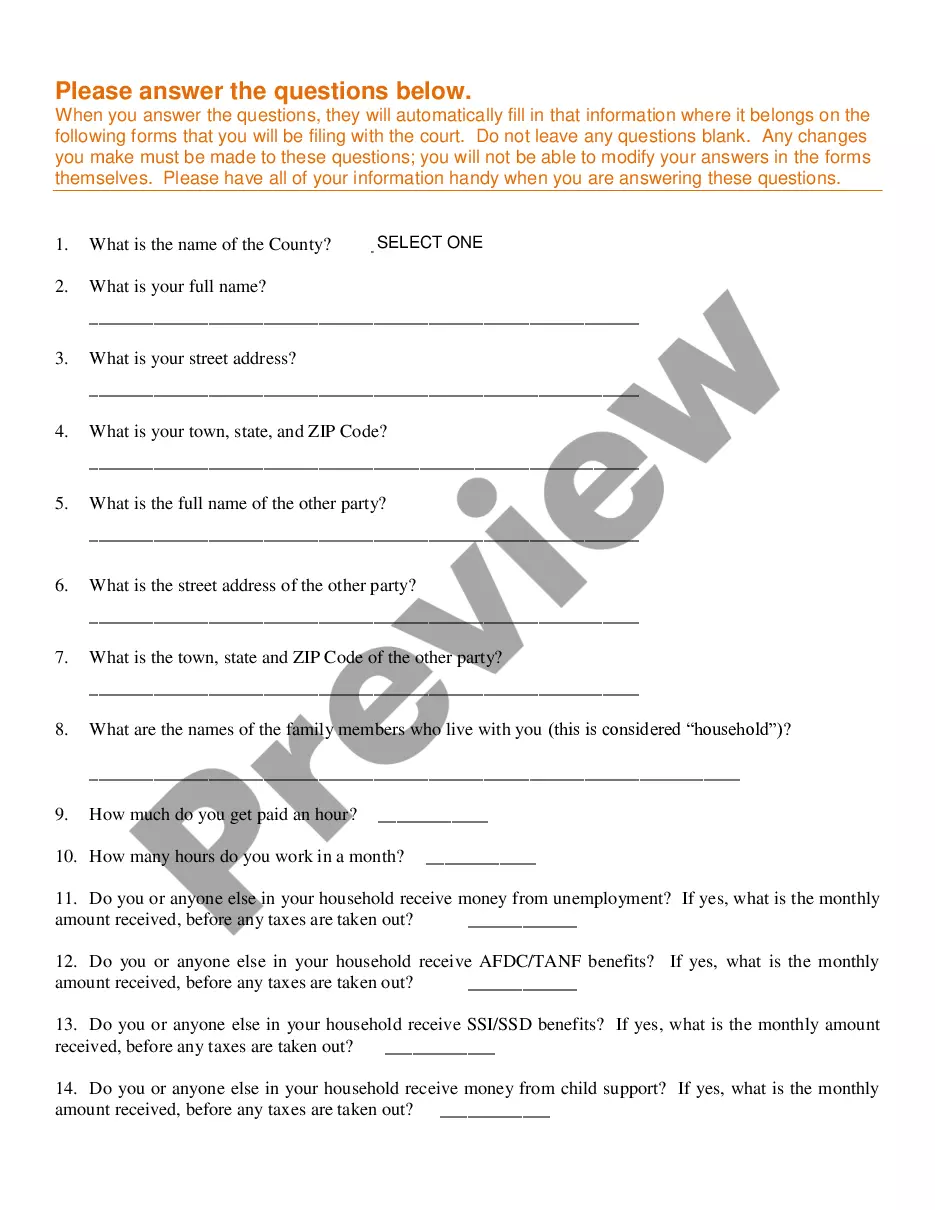

Is this your first time using US Legal Forms? Sign up and create a free account in just a few minutes to gain access to the form library and Transfer Deed On Death Form With Decimals. Then, follow the steps below to complete your form: Ensure you have located the correct form using the Review feature and reading the form details. Click Buy Now when ready, and select the subscription option that fits your needs. Click Download, then fill out, sign, and print the form. US Legal Forms has twenty-five years of expertise assisting clients in managing their legal documents. Discover the form you need today and streamline any process effortlessly.

- Explore the library of pertinent documents accessible to you with a single click.

- US Legal Forms provides you with state- and county-specific forms available at any time for download.

- Protect your document management processes with a premium service that enables you to prepare any form in minutes without additional or concealed fees.

- Simply Log In to your account, locate Transfer Deed On Death Form With Decimals and obtain it immediately from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Some potential problems include: Paying estate debt. ... Accidentally disinheriting someone. ... Jeopardizing your beneficiary's government benefits. ... Conflict with your will. ... No plan for incapacity.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.

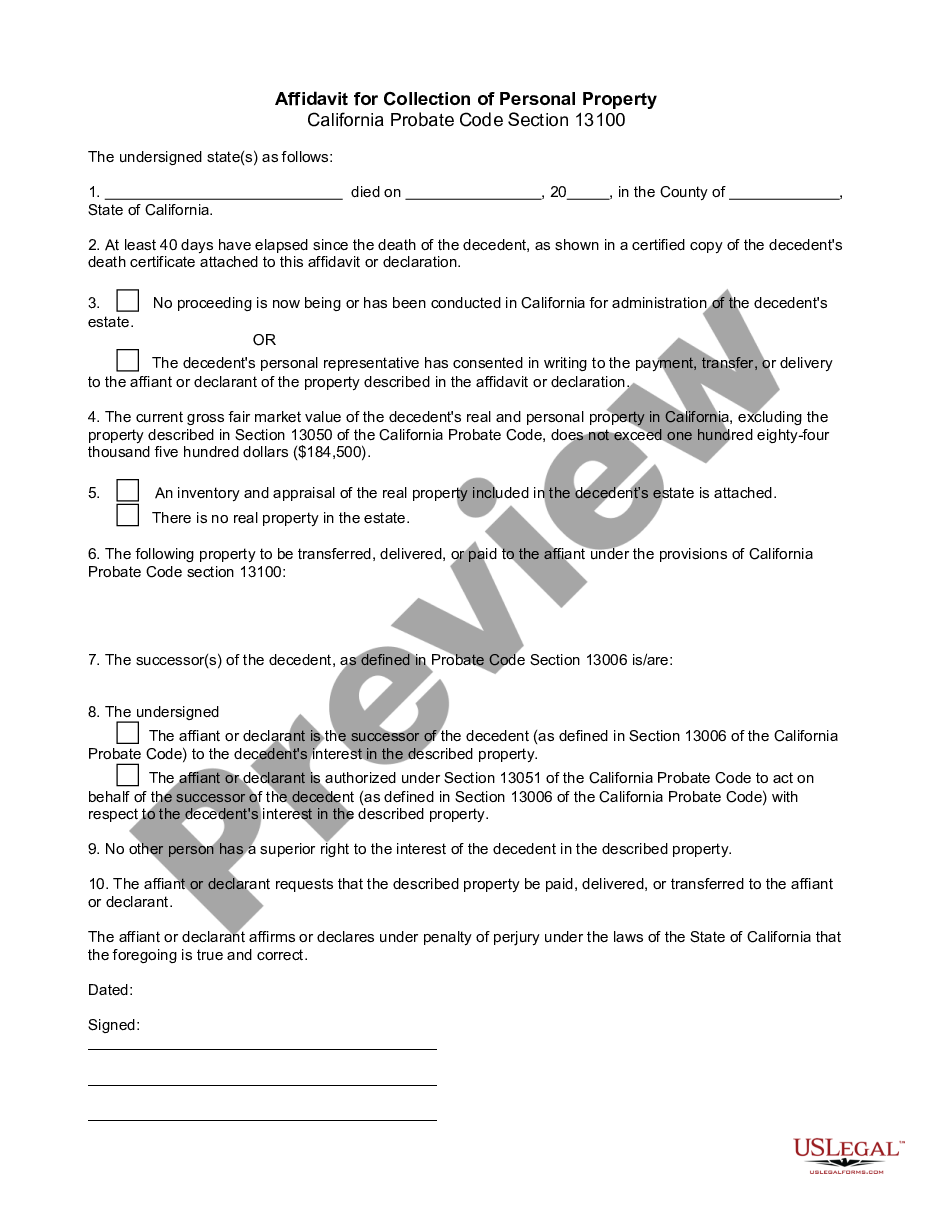

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records. ... Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,