Transfer Deed On Death Form With 2 Points

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Creating legal documents from the ground up can frequently be daunting. Some situations may require extensive research and significant financial investment.

If you’re seeking a more straightforward and cost-effective method of generating Transfer Deed On Death Form With 2 Points or any other documents without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can promptly acquire state- and county-compliant templates meticulously crafted for you by our legal professionals.

Utilize our platform whenever you require trusted and dependable services through which you can swiftly find and download the Transfer Deed On Death Form With 2 Points. If you’re already familiar with our site and have set up an account with us before, simply Log In to your account, select the template, and download it or re-download it anytime later in the My documents section.

Confirm that the template you select adheres to the rules and regulations of your state and county. Choose the appropriate subscription option to purchase the Transfer Deed On Death Form With 2 Points. Download the form, then complete, certify, and print it out. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us now and make form completion a straightforward and efficient process!

- Not registered yet? No problem.

- It takes just a few minutes to register and browse the catalog.

- Before proceeding to download the Transfer Deed On Death Form With 2 Points, consider these recommendations.

- Examine the form preview and descriptions to verify that you have located the document you need.

Form popularity

FAQ

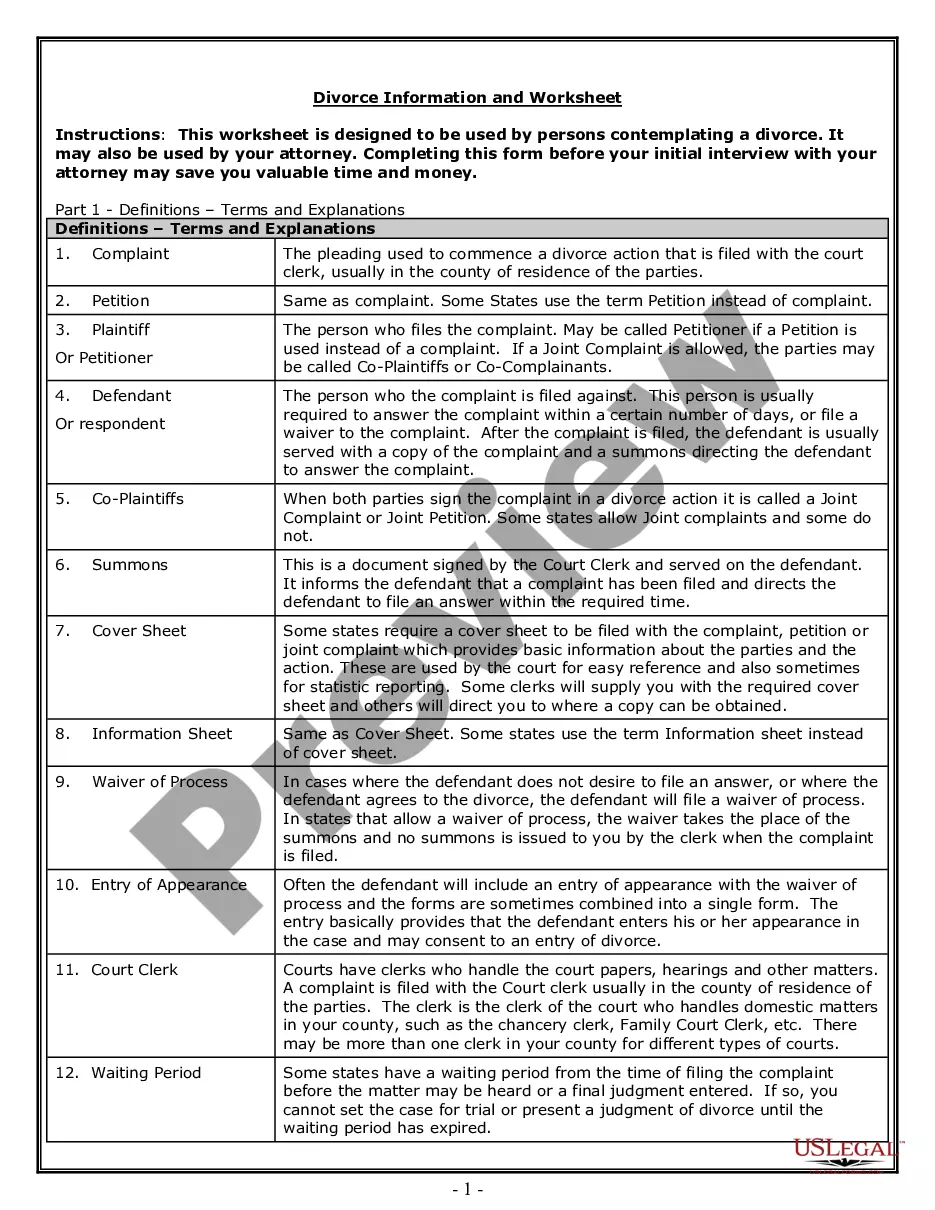

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records. ... Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk's office before your death. Otherwise, it won't be valid. You can make a Texas transfer on death deed with WillMaker.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...