Transfer Death Individual With Ohio

Description

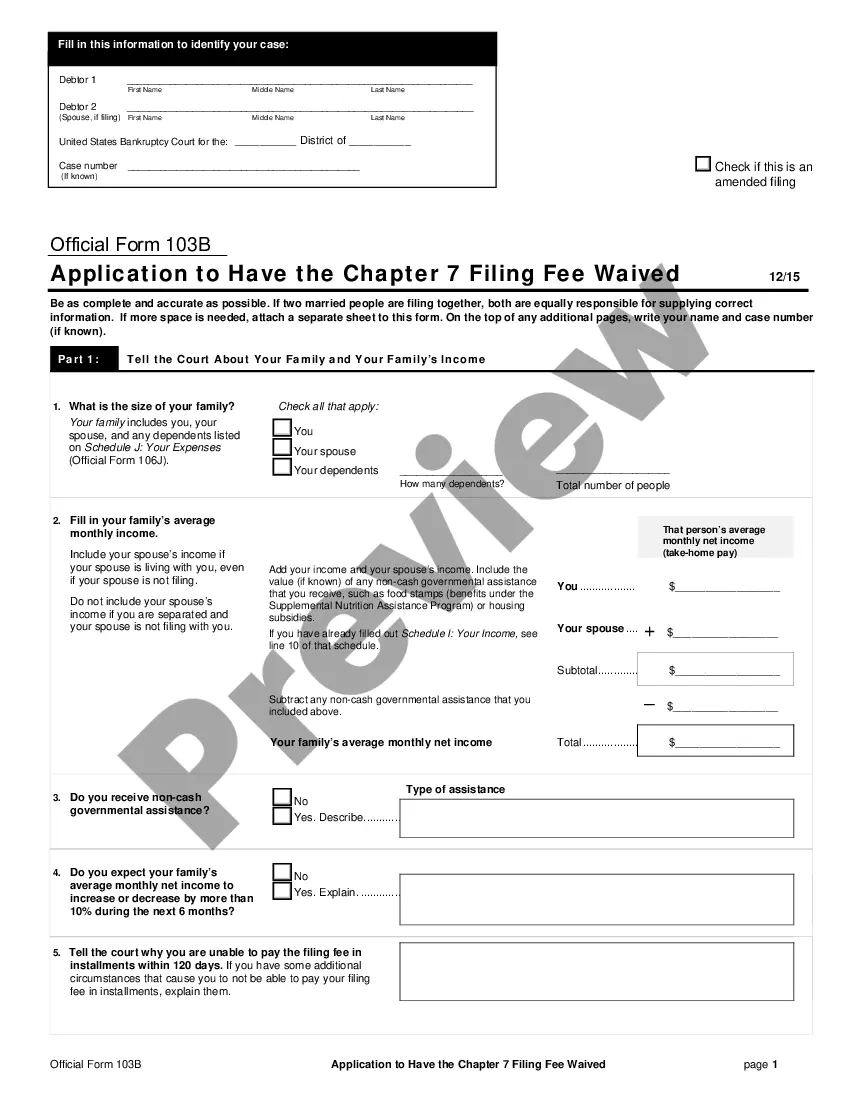

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

- Log in to your US Legal Forms account. Make sure your subscription is active for uninterrupted access.

- Review the form preview and description carefully to confirm it meets your needs and complies with Ohio regulations.

- If you don't find the right form, utilize the Search feature to explore other templates available.

- Select the desired document and click the 'Buy Now' button. Opt for the subscription plan that suits you best.

- Complete your purchase by entering your payment information, whether through credit card or PayPal.

- Download the form onto your device. You can access it later in the 'My Forms' section of your profile.

In conclusion, US Legal Forms provides an efficient solution for individuals navigating post-death asset transfers in Ohio. Their extensive library ensures you have the necessary tools to complete your forms accurately.

Ready to streamline your legal document process? Start using US Legal Forms today!

Form popularity

FAQ

To obtain a Transfer on Death (TOD) deed in Ohio, start by filling out the appropriate form with the required information. You can find this form through local county offices or trusted legal websites. Once completed, you will need to sign and notarize the deed before filing it with the county recorder’s office. For convenience, consider using platforms like US Legal Forms, where you can access templates that simplify this process and help you meet all legal requirements.

Yes, the transfer on death option is available in Ohio. This provision allows you to name a beneficiary who will receive the property at your passing without undergoing the lengthy probate process. It is a practical solution for those looking to streamline property transfers to heirs. Always ensure your TOD deed complies with Ohio state laws by consulting the appropriate resources.

Yes, Ohio does allow transfers on death deeds, commonly referred to as TOD deeds. This legal process enables individuals to transfer real property directly to a beneficiary after their death, bypassing probate. Using a TOD deed provides a straightforward way to ensure your property passes to your loved ones without the complications of probate court. You can easily create and file a TOD deed in Ohio with the right resources.

In Ohio, there is no specific deadline to transfer property after death, but it is recommended to act in a timely manner. Delaying the transfer can create complications related to taxes, bills, and maintenance responsibilities. Utilizing a Transfer on Death designation can significantly ease this process, allowing the property to move to beneficiaries swiftly and efficiently.

To transfer property after your parent dies in Ohio, you will need to gather necessary documents, like the death certificate and any existing transfer on death titles. You may need to file a probate case if there are no TOD designations in place. Using USLegalForms can simplify this process and help ensure all steps are followed correctly to avoid delays.

Property can remain in a deceased person's name indefinitely, but it is not practical to delay the transfer. Families may face challenges when dealing with taxes, maintenance, or selling the property if it remains in the deceased's name too long. To prevent such issues, consider using a Transfer on Death designation, making the transition straightforward and efficient.

In Ohio, a house can remain in a deceased person's name until it is legally transferred to the beneficiary or sold. However, it is advisable to initiate the transfer as soon as possible to avoid complications. Utilizing options like Transfer on Death titles can expedite this process, allowing for a smooth transition of ownership.

While you do not necessarily need a lawyer to create a Transfer on Death designation in Ohio, having one can provide valuable guidance. A legal professional can ensure that the form is filled out correctly and that you understand all implications of the TOD. This expertise may help prevent future disputes or issues regarding your assets after your passing.

To file a transfer on death title in Ohio, you need to complete a specific form that indicates your intention to transfer the property after your death. This form must be signed and filed with your county recorder's office. Using a reliable resource like USLegalForms can help guide you through the process to ensure everything is done correctly and efficiently.

Yes, property can be transferred without probate in Ohio using a Transfer on Death (TOD) designation. This legal mechanism allows individuals to name a beneficiary who receives the property upon the death of the owner. Utilizing a TOD can simplify the process and bypass the complications of probate, making it easier for families during difficult times.