Transfer Death Deed Document For Sale Of Property

Description

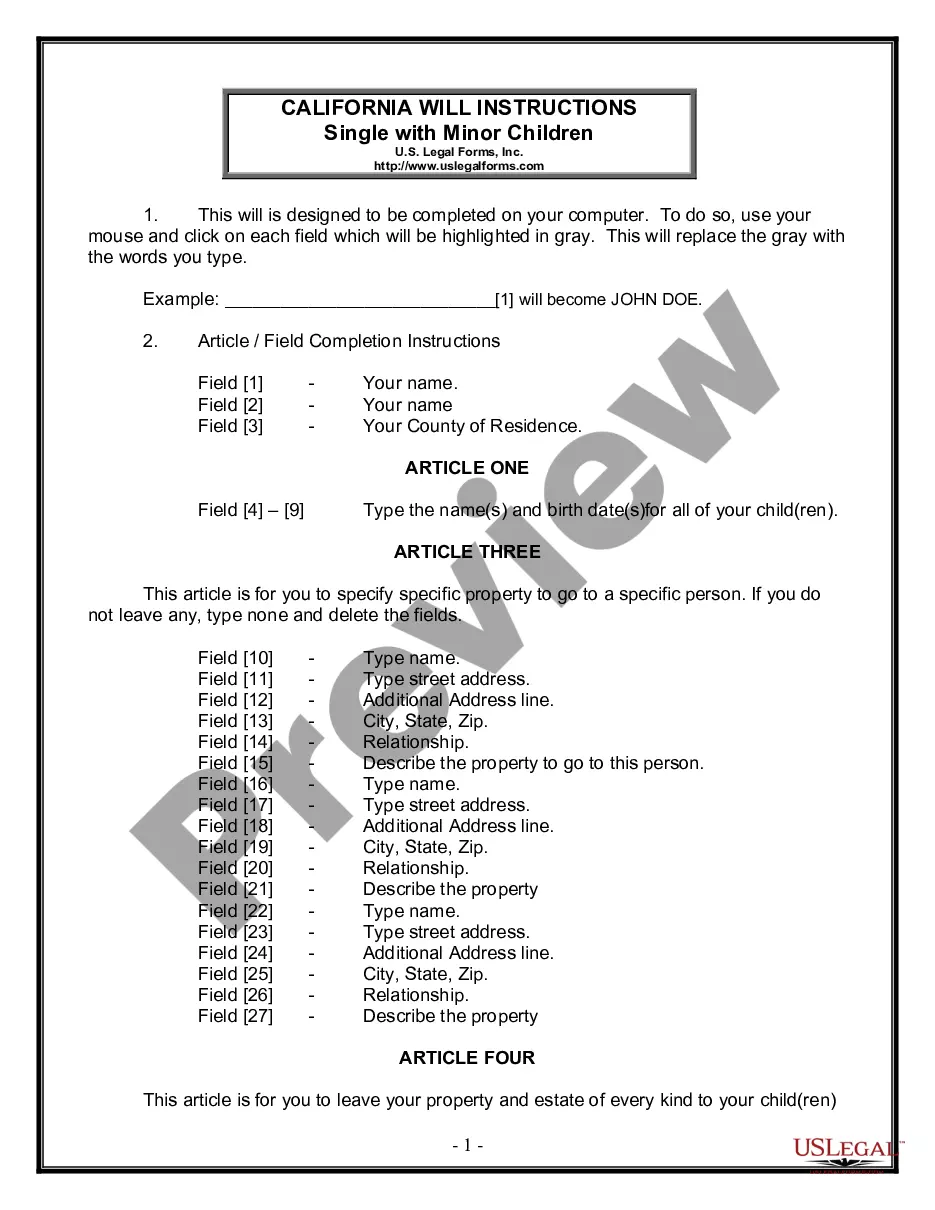

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

- If you are a returning user, log in to your account and download the required form template by clicking the Download button. Ensure your subscription is active; if not, renew it.

- For first-time users, start by checking the Preview mode and form description to ensure you select the right document that aligns with your local jurisdiction.

- If the document doesn’t meet your needs, use the Search tab to look for a more suitable template.

- Once you have found the correct form, click on the Buy Now button and choose your preferred subscription plan, registering an account to access the library.

- Proceed to make your payment using either a credit card or your PayPal account.

- Finally, download your form and save it on your device. You can also access it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms provides a robust collection of legal forms that simplify the process of document preparation. Their extensive library and expert assistance ensure that your legal needs are met efficiently.

Don't hesitate to start your journey with US Legal Forms today for seamless legal documentation.

Form popularity

FAQ

A downside of a transfer on death deed (TOD) is that it may not be suitable for all individuals, particularly those with complex estates. Additionally, a TOD does not avoid the probate process if the property is not transferred properly, which could lead to delays. Using a transfer death deed document for sale of property can simplify the process, but be aware that it may not address all concerns related to estate planning.

You can obtain a transfer of death deed through various online legal services or by visiting your local county recorder's office. Many legal platforms, such as USLegalForms, offer templates and guides to help you create a transfer death deed document for sale of property. This makes it easy to ensure your document meets all legal requirements.

To create a transfer on death deed in Illinois, the property owner must fill out the required document with accurate information about the property and the beneficiaries. This document must be signed in front of a notary public before being recorded with the appropriate county office. A properly executed transfer death deed document for sale of property ensures that the transfer occurs seamlessly upon the owner's death.

One disadvantage of a transfer on death deed in Illinois is that it does not provide protection from creditors. If the property owner has outstanding debts, creditors may still attempt to claim the property after death. Additionally, a transfer death deed document for sale of property may create complications if multiple heirs are involved or if the property owner changes their mind about the transfer.

While a transfer on death deed provides an efficient way to transfer property, it does come with disadvantages. One potential drawback is that it does not protect the property from creditors' claims after death. Additionally, if you decide to sell the property before death, you need to revoke the transfer death deed document for sale of property, which requires legal steps. Always weigh the pros and cons before proceeding.

To transfer property while avoiding capital gains tax, consider using a transfer death deed document for sale of property. This option allows you to designate beneficiaries without incurring immediate tax liabilities. However, it's essential to consult a tax professional to discuss your specific situation and ensure compliance with tax laws. Proper planning can greatly help in minimizing tax implications during the transfer.

Transferring a deed after death typically depends on state laws and the complexity of the estate. Generally, the process can take anywhere from a few weeks to several months. To expedite the transfer, it’s advisable to prepare a transfer death deed document for sale of property beforehand. This document helps simplify the process and ensures a smoother transition of ownership.

The primary advantage of a transfer on death deed is its ability to bypass probate, offering a straightforward transition of property to your beneficiaries. This estate planning tool allows you to maintain ownership during your lifetime, ensuring you have full control. By considering a transfer death deed document for the sale of property, you can provide your heirs with a seamless inheritance experience while reducing estate administration costs.

The transfer on death form is a legal document that specifies who will inherit your property upon your death. This form transfers the title without the need for probate, simplifying the process for your heirs. Utilizing a transfer death deed document for the sale of property can help streamline your estate planning.

A transfer on death deed, or tod deed, can have disadvantages, such as lack of flexibility after it is executed. If you decide to change your beneficiaries or property ownership, you will need to revoke and create a new deed. Additionally, it may not solve all estate planning issues, so it is wise to seek professional guidance when using a transfer death deed document for the sale of property.