Minnesota Transfer On Death Form With Notary Signature

Description

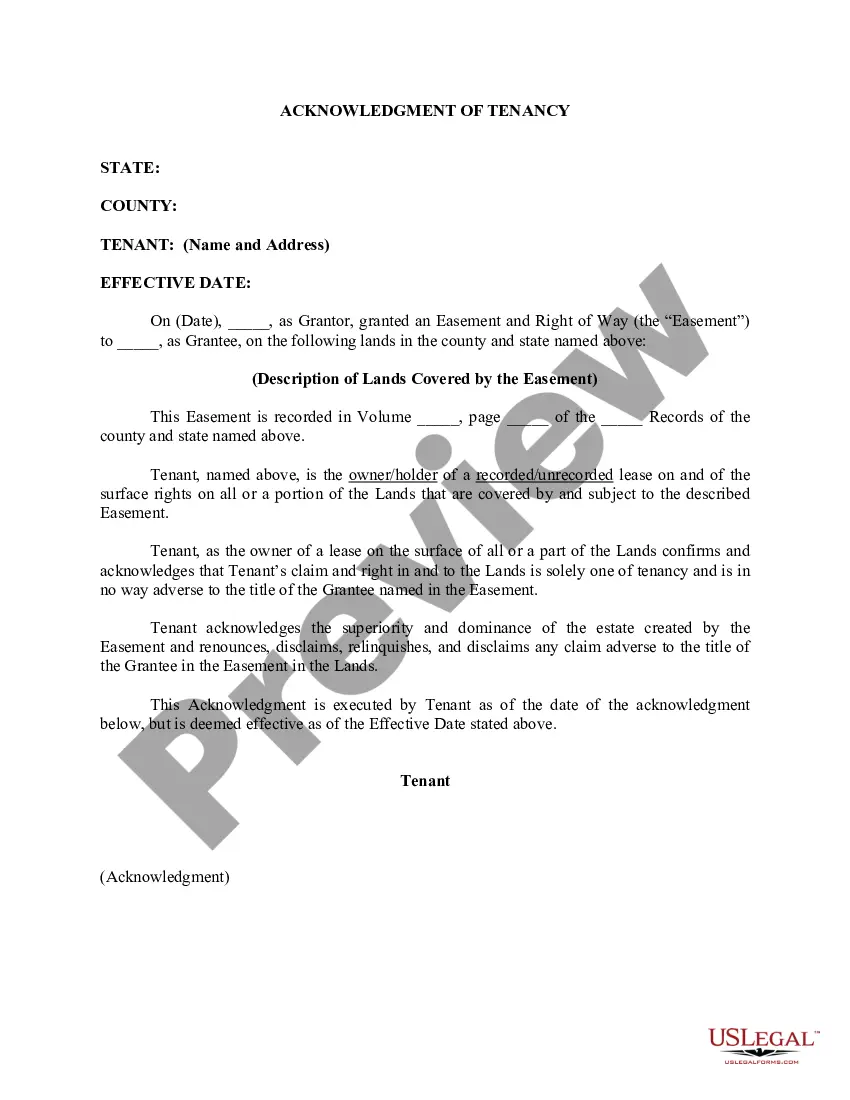

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Legal administration can be challenging, even for proficient professionals.

When you are looking for a Minnesota Transfer On Death Form With Notary Signature and lack the time to search for the correct and current version, the process may be stressful.

US Legal Forms caters to any needs you may have, from personal to business paperwork, all in a single place.

Utilize sophisticated tools to complete and manage your Minnesota Transfer On Death Form With Notary Signature.

Here are the steps to follow after accessing the form you need: Validate that it is the correct form by previewing it and reviewing its details.

- Access a valuable resource pool of articles, guides, and materials pertinent to your situation and requirements.

- Save time and effort in locating the necessary documents, and use US Legal Forms' advanced search and Preview tool to find the Minnesota Transfer On Death Form With Notary Signature and download it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you’ve saved previously and to manage your folders as you like.

- If this is your initial experience with US Legal Forms, create a complimentary account and gain unlimited access to all the benefits of the library.

- A comprehensive online form directory can be revolutionary for anyone who wishes to manage these circumstances efficiently.

- US Legal Forms stands out as a frontrunner in online legal documents, provisioned with over 85,000 state-specific legal forms accessible at any time.

- Through US Legal Forms, users can access state- or county-specific legal and business documents.

Form popularity

FAQ

A resident in Mississippi has the legal right to stop a wage garnishment by filing personal bankruptcy. Personal bankruptcy has two options. Chapter 7 is for anyone in Mississippi with very little income, but a lot of unsecured debts.

Limitations on garnishment You may be relieved to know that Mississippi law limits the amount that may be taken from your paycheck. Under the law, your creditors may only take the lesser of: 25 percent of your disposable earnings or 30 times the federal minimum wage.

Under most circumstances in Mississippi, creditors can only garnish your wages or bank accounts after they have a judgment or other court decree against you. A judgment is the final decision of a court entered by a court at the end of a lawsuit.

In Mississippi, your wages cannot be garnished without your knowledge in most cases. In the majority of instances, your creditor must first file and win a lawsuit against you before garnishment is even a question. If the court rules in the creditor's favor, it can then award a judgment against you.

If you have more than one wage garnishment issued against you, creditors can still only take a total of 25% of your weekly disposable income. So, for example, if one creditor is garnishing 15% of your weekly disposable income, then the other creditor can only garnish the remaining 10%.

Private student loans and their debt collectors must first go to court and obtain a judgment and wait the 30 days before they can garnish your paycheck. The IRS and the Mississippi Department of Revenue can garnish your wages if you owe back taxes, without a court judgment.

The IRS and the Mississippi Department of Revenue can garnish your wages if you owe back taxes, without a court judgment. The amount they can garnish depends on how many dependents you have and your tax deduction rate. The IRS and the Mississippi Department of Revenue do not have to wait 30 days to garnish your wages.

Levy Bank Accounts in Mississippi Mississippi law calls account levy "bank garnishment." A bank garnishment seizes all funds available to the bank as long as it is clear that the funds belong to the consumer and are not Social Security or a similar federal benefit.

A resident in Mississippi has the legal right to stop a wage garnishment by filing personal bankruptcy. Personal bankruptcy has two options. Chapter 7 is for anyone in Mississippi with very little income, but a lot of unsecured debts.

In Mississippi wages that are earned within the first 30 days after the writ of garnishment is served on the employer are protected and must be paid over to the employee. Once the thirty days are up, wage garnishments are then limited only by the Federal Wage Garnishment Law.