Minnesota Transfer On Death Deed Form With Signature Required

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Whether for corporate reasons or for individual issues, everyone eventually has to confront legal matters at some point in their lifetime.

Completing legal documents requires meticulous attention, starting with selecting the correct form template.

Select your payment method: use a credit card or PayPal account. Choose the desired file format and download the Minnesota Transfer On Death Deed Form With Signature Required. Once it is downloaded, you have the option to fill out the form using editing software or print it and complete it manually. With a vast US Legal Forms catalog available, you don’t have to waste time hunting for the right template across the web. Take advantage of the library’s easy navigation to find the proper template for any circumstance.

- For instance, if you choose an incorrect version of a Minnesota Transfer On Death Deed Form With Signature Required, it will be declined once you submit it.

- Thus, it is essential to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a Minnesota Transfer On Death Deed Form With Signature Required template, follow these straightforward instructions.

- Acquire the template you require by utilizing the search field or catalog navigation.

- Review the form’s description to ensure it aligns with your case, state, and area.

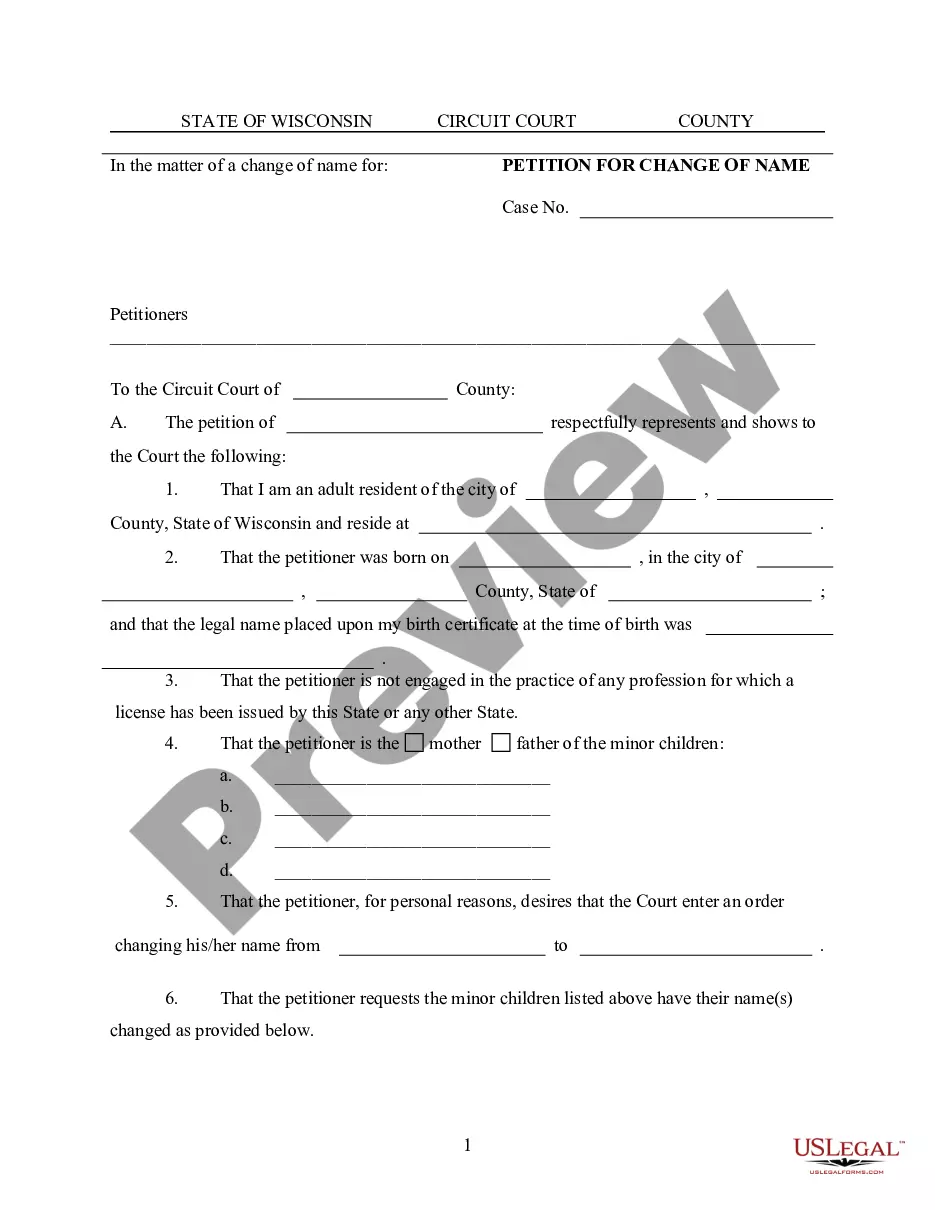

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search function to locate the Minnesota Transfer On Death Deed Form With Signature Required sample you need.

- Download the file when it satisfies your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- In case you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option and complete the profile registration form.

Form popularity

FAQ

To fill out a Minnesota transfer on death deed form with signature required, start by clearly writing the name of the property owner. Next, include the legal description of the property, ensuring all details are accurate. Then, specify the names of the beneficiaries who will receive the property upon the owner’s death. Finally, sign the document in front of a notary public to complete the process, ensuring compliance with Minnesota state laws.

While it is not mandatory for an attorney to prepare a Minnesota transfer on death deed form with signature required, it is often beneficial. An attorney can ensure that the document meets all legal requirements and properly reflects your intentions. This guidance can prevent future disputes. Using a platform like US Legal Forms can also provide helpful resources for creating your TOD deed.

Yes, Minnesota fully recognizes transfers on death deeds, making them a viable option for estate planning. With a correctly executed Minnesota transfer on death deed form with signature required, property can easily transfer to beneficiaries upon the owner's death. This method allows owners to retain full control of their property while alive. It simplifies the inheritance process for loved ones.

Using a Minnesota transfer on death deed form with signature required can lead to potential challenges. One major concern is the lack of oversight, which might allow for disputes among heirs. Additionally, if the owner of the property has debts, creditors may claim the property before heirs can inherit it. Consulting with a legal professional can help clarify these risks.

Technically, you do not need a lawyer to file a Minnesota transfer on death deed form with signature required. However, having legal assistance can simplify the process and help you navigate any complexities involved. If you're unsure about the procedure, a legal professional can help clarify your options and ensure that your form is completed correctly.

Using a transfer on death deed does come with some risks, including potential challenges from relatives or issues with creditors. If the deed is not executed properly, it may lead to disputes after your death. It's crucial to understand these risks and consider consulting with a legal expert for guidance while using the Minnesota transfer on death deed form with signature required.

While it is not mandatory to have a lawyer when filing a Minnesota transfer on death deed form with signature required, consulting one can be beneficial. A lawyer can help ensure that all legal requirements are met and that your document is properly executed. If you feel uncertain about any part of the process, seeking legal advice might give you peace of mind.

To fill out the Minnesota transfer on death deed form with signature required, start by entering your name and the property details. Next, specify the beneficiaries who will inherit the property after your passing. Ensure you provide accurate information to avoid delays or issues in the future. After completing the form, remember to sign it in front of a notary.

Filling out a transfer on death deed involves completing the Minnesota transfer on death deed form with signature required correctly. Start by entering the property description, including the address and legal description. Next, designate the beneficiary by providing their name and contact details, and include your signature along with a notary acknowledgment. If you need assistance, platforms like US Legal Forms offer clear templates and guidance to simplify the process.

To transfer a deed after a death in Minnesota, you should use a Minnesota transfer on death deed form with signature required. This form allows you to designate a beneficiary to receive the property without going through probate. Ensure that the form includes the deceased's details and the beneficiary’s information, and sign it in front of a notary. Lastly, file the completed form with your local county recorder's office to finalize the transfer.