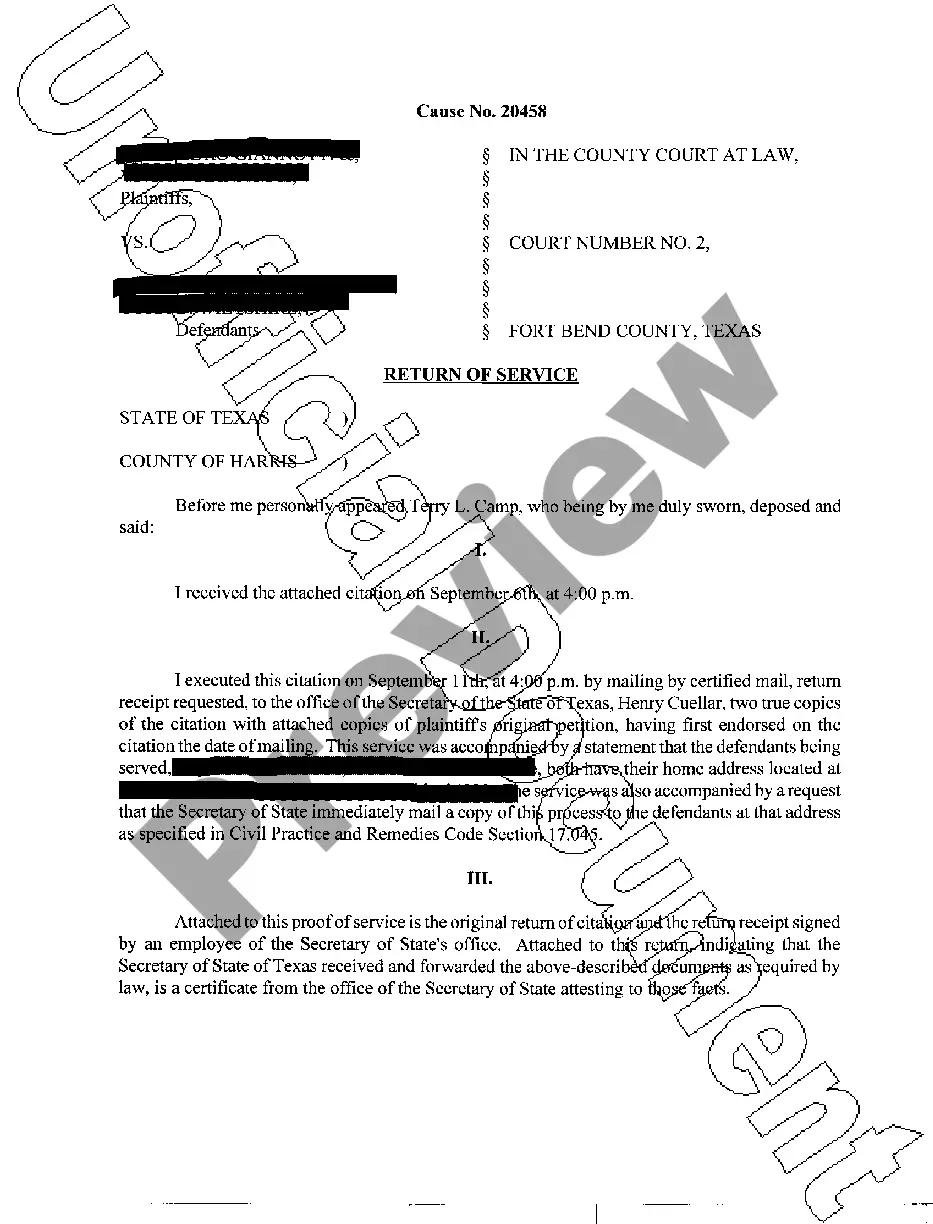

Minnesota Transfer On Death Deed Form With Signature

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

The Minnesota Transfer Upon Death Deed Form With Signature displayed on this page is a repeatable official template prepared by experienced attorneys in compliance with national and local laws.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal professionals with more than 85,000 authenticated, state-specific forms for any professional and personal event. It represents the quickest, simplest, and most reliable method to acquire the documents you require, as the service ensures the utmost level of data privacy and anti-malware safeguards.

Download the paperwork again. Use the same document repeatedly whenever necessary. Access the My documents tab in your profile to re-download any previously bought forms.

- Explore the document you require and examine it.

- Browse the sample you sought and preview it or review the form description to verify it meets your requirements. If it doesn’t, utilize the search function to find the correct one. Click Buy Now once you have discovered the template you need.

- Register and Log Into your account.

- Select the pricing option that best fits you and create an account. Use PayPal or a credit card for a speedy transaction. If you already possess an account, Log In and check your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

Filling out a transfer on death deed requires attention to detail. Start with the Minnesota transfer on death deed form with signature, and include the owner's name, property description, and the beneficiary's information. It's crucial to ensure all required fields are completed without any errors. If you need guidance, consider using platforms like US Legal Forms, which can provide templates and additional assistance.

Filing a transfer on death deed in Minnesota involves a few important steps. Begin by completing the Minnesota transfer on death deed form with signature accurately. After that, make sure to sign the document in front of a notary public. Lastly, file the notarized form with your county recorder to ensure the transfer is properly recorded.

To transfer a deed after a death in Minnesota, you need to utilize the Minnesota transfer on death deed form with signature. First, gather essential documents like the original deed and death certificate. Then, complete the transfer on death deed form, ensuring correct details are filled out. Finally, file the completed form with your county's office to officially complete the transfer.

One of the key disadvantages of a transfer on death deed is that it does not provide asset protection during the grantor's lifetime. Additionally, the Minnesota transfer on death deed form with signature can lead to disputes among heirs if not properly executed. It's also important to remember that this form cannot cover all types of assets, and certain property must still go through probate. Evaluating your situation carefully helps in addressing these potential issues.

A transfer on death deed does not directly avoid inheritance tax. However, using the Minnesota transfer on death deed form with signature can simplify the process of transferring property without going through probate, which may help in reducing certain tax liabilities. It's essential to consult with a tax professional for personalized advice, as state laws may vary. Understanding your options ensures you make informed decisions about your estate.

To properly fill out a Minnesota transfer on death deed form with signature, begin by entering accurate property information. Clearly list your beneficiaries and ensure their names are correctly spelled. Next, follow the signing and witnessing requirements specific to Minnesota laws. For a seamless experience, consider using uslegalforms, which provides you with all the necessary resources and assistance for accurate completion.

Filling out a Minnesota transfer on death deed form with signature involves several straightforward steps. Start by providing details about the property and the designated beneficiaries. Include your information as the grantor and ensure that you sign the form as required. To simplify this process, you can find user-friendly templates and instructions on platforms like uslegalforms.

You do not need a lawyer to file a Minnesota transfer on death deed form with signature. Many individuals choose to complete this process on their own. However, consulting a lawyer can provide clarity on legal nuances and ensure all requirements are met. If you prefer a do-it-yourself approach, uslegalforms can guide you with the necessary documents and support.