Minnesota Transfer Deed Form With Trustee

Description

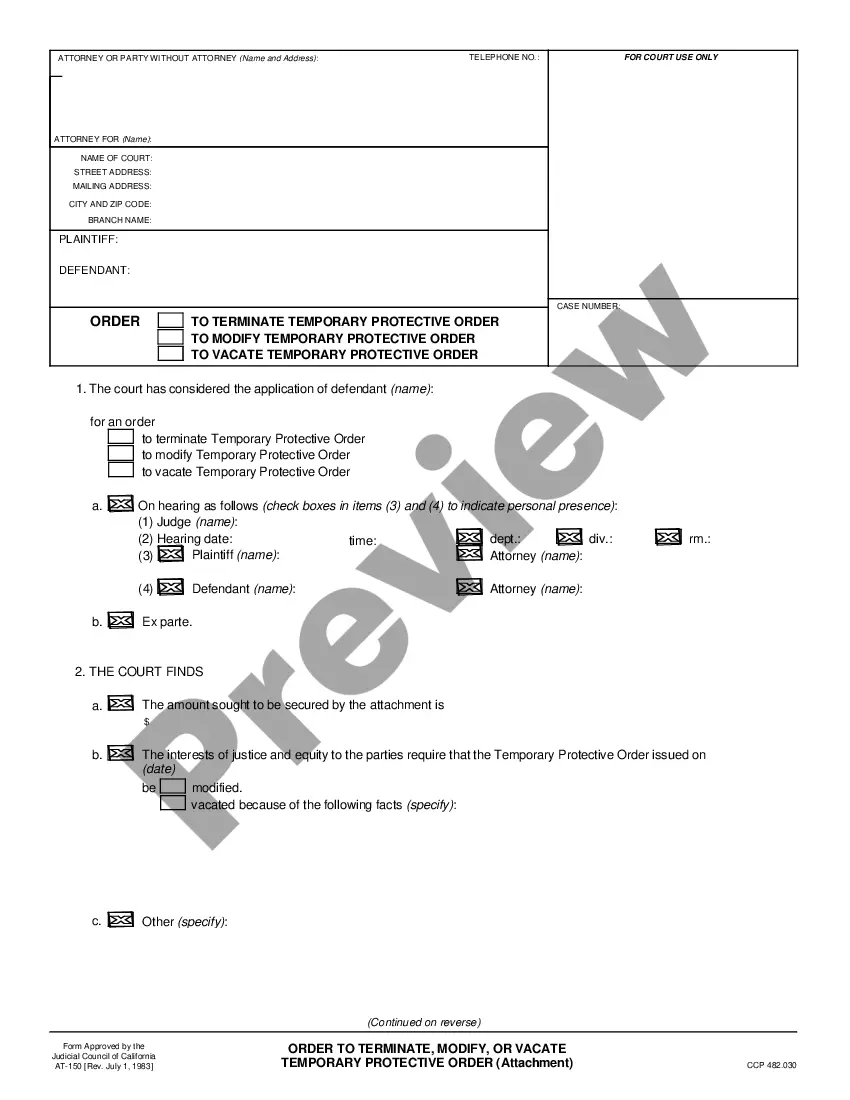

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Locating a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy. Acquiring the correct legal documents requires accuracy and meticulousness, which is why it is essential to obtain samples of the Minnesota Transfer Deed Form With Trustee solely from trustworthy sources, such as US Legal Forms. An inaccurate template can lead to wasted time and hinder your current situation. With US Legal Forms, you have minimal concerns. You can access and review all the specifics regarding the document’s usage and suitability for your circumstances and in your area.

Follow these steps to finalize your Minnesota Transfer Deed Form With Trustee.

Eliminate the complications associated with your legal documentation. Browse the comprehensive US Legal Forms catalog where you can discover legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the library navigation or search bar to locate your template.

- Review the form’s details to confirm it aligns with the requirements of your area.

- Preview the form, if possible, to ensure the template is indeed the one you need.

- Return to the search to find the suitable template if the Minnesota Transfer Deed Form With Trustee does not meet your needs.

- Once you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you have not created an account yet, click Buy now to acquire the template.

- Choose the pricing option that best fits your requirements.

- Proceed to register to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Minnesota Transfer Deed Form With Trustee.

- Once the form is on your device, you can modify it using the editor or print it out and complete it manually.

Form popularity

FAQ

Minnesota's deed tax is calculated based on the consideration for the transfer. The rate for most transfers is 0.33 percent of the purchase price. Minnesota law authorizes Hennepin and Ramsey Counties to charge an additional . 01 percent of consideration.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

Yes, Minnesota has a law that lets you transfer the title to real estate when you die to avoid probate. It is an estate planning tool called a Transfer on Death Deed (TODD). It is like the "payable on death" (POD) designation on a bank account.

Primary beneficiaries have the first right to inherit assets or benefits as specified in the will, trust, or insurance policy. They also have the right to be informed about any changes to the estate plan, and in the case of trusts, they have the right to receive regular financial statements.

In Minnesota, the trustee's deed is a modified quitclaim deed, containing the granting language "convey and quitclaim." A quitclaim deed merely grants "all right, title, and interest of the grantor in the premises described" to the grantee, and contains no warranty of title (Minn. Stat. 707.07).