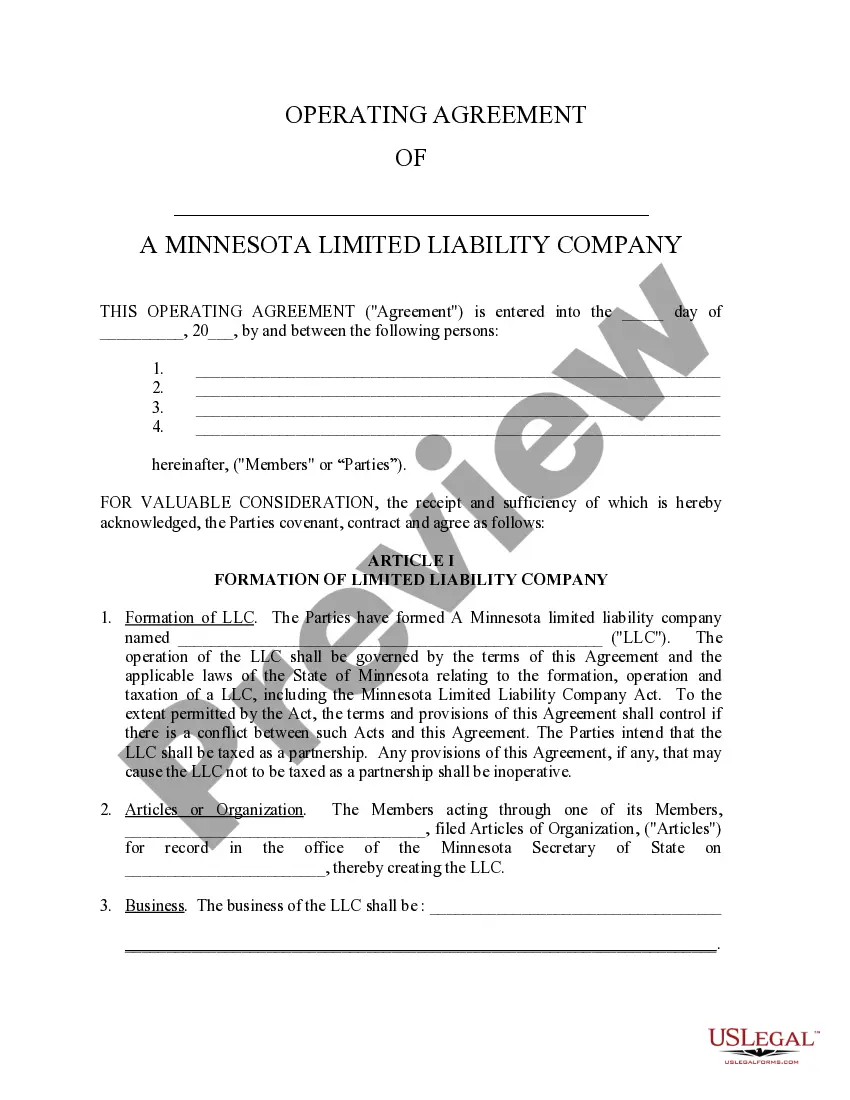

Minnesota Llc Operating Agreement For Married Couple

Description

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

What is the most trustworthy service to obtain the Minnesota Llc Operating Agreement For Married Couple and other recent editions of legal documentation? US Legal Forms is the answer!

It's the largest collection of legal forms for any situation. Each sample is professionally crafted and verified for adherence to federal and local statutes and regulations.

Regulatory compliance review. Before acquiring any template, you must verify if it meets your use case requirements and the laws of your state or county. Read the template description and utilize the Preview if available.

- They are categorized by area and state of application, making it simple to locate the one you require.

- Seasoned users of the platform just need to Log In to the system, verify if their subscription is active, and press the Download button next to the Minnesota Llc Operating Agreement For Married Couple to obtain it.

- Once saved, the template remains accessible for future use within the My documents section of your profile.

- If you do not yet have an account with us, here are the steps you need to follow to create one.

Form popularity

FAQ

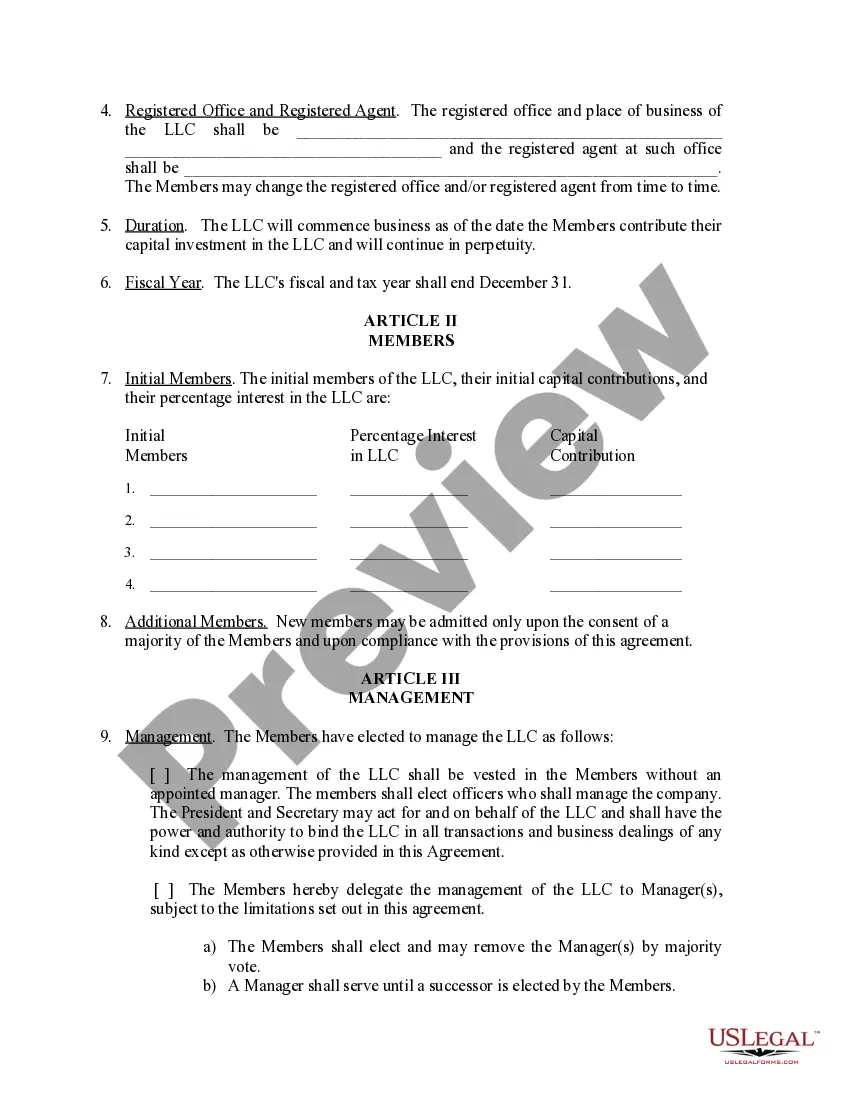

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

The business must be owned by a husband and wife as community property under the laws of a state, foreign country or possession of the United States. Nobody other than both spouses would be considered owners for federal tax purposes and, The business is not treated as a corporation under federal law.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

A business jointly owned and operated by a married couple is a partnership (and should file Form 1065, U.S. Return of Partnership Income) unless the spouses qualify and elect to have the business be treated as a qualified joint venture, or they operate their business in one of the nine community property states.

If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship or a corporation. If your LLC has more than one member, you can classify it as a partnership or corporation.