Michigan Estate Laws For Minors

Description

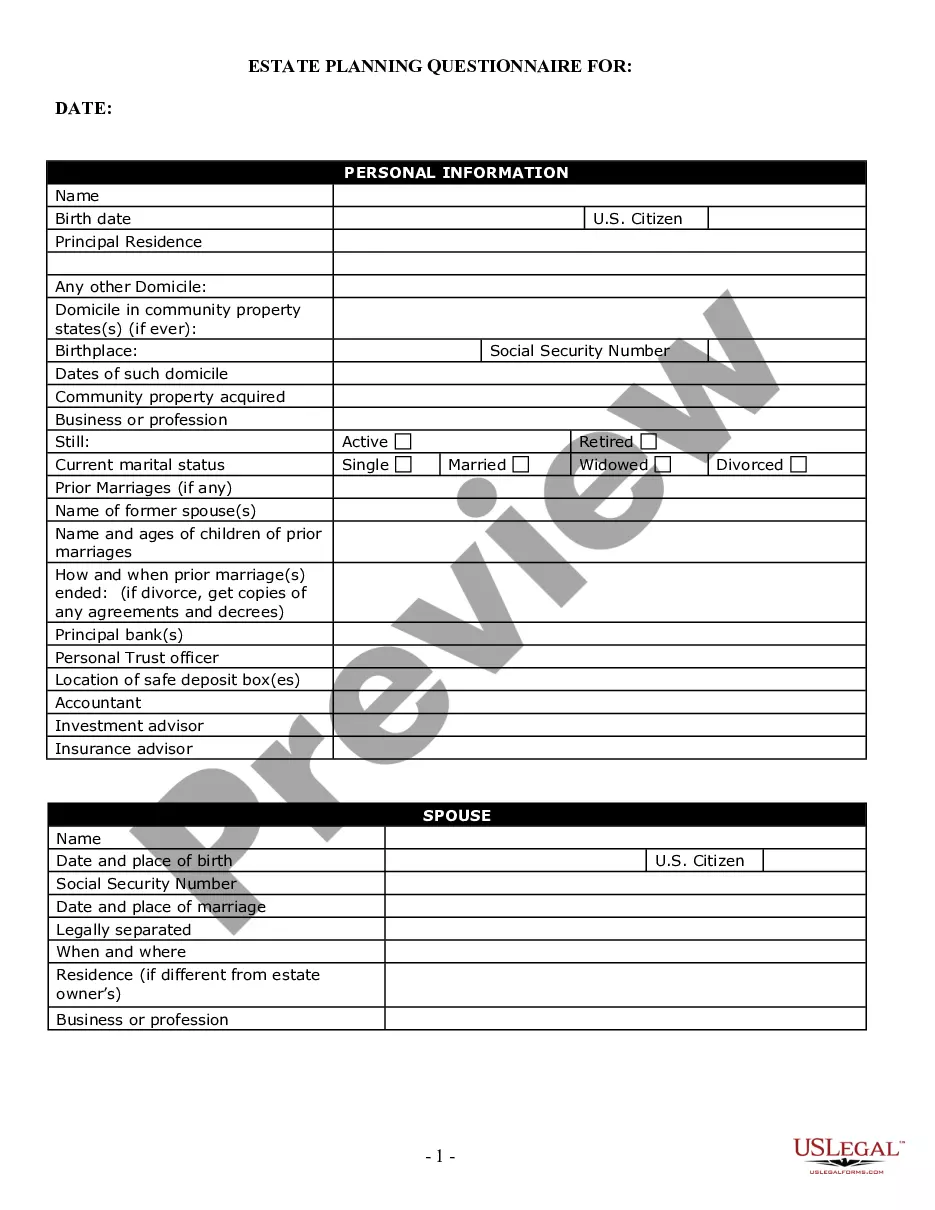

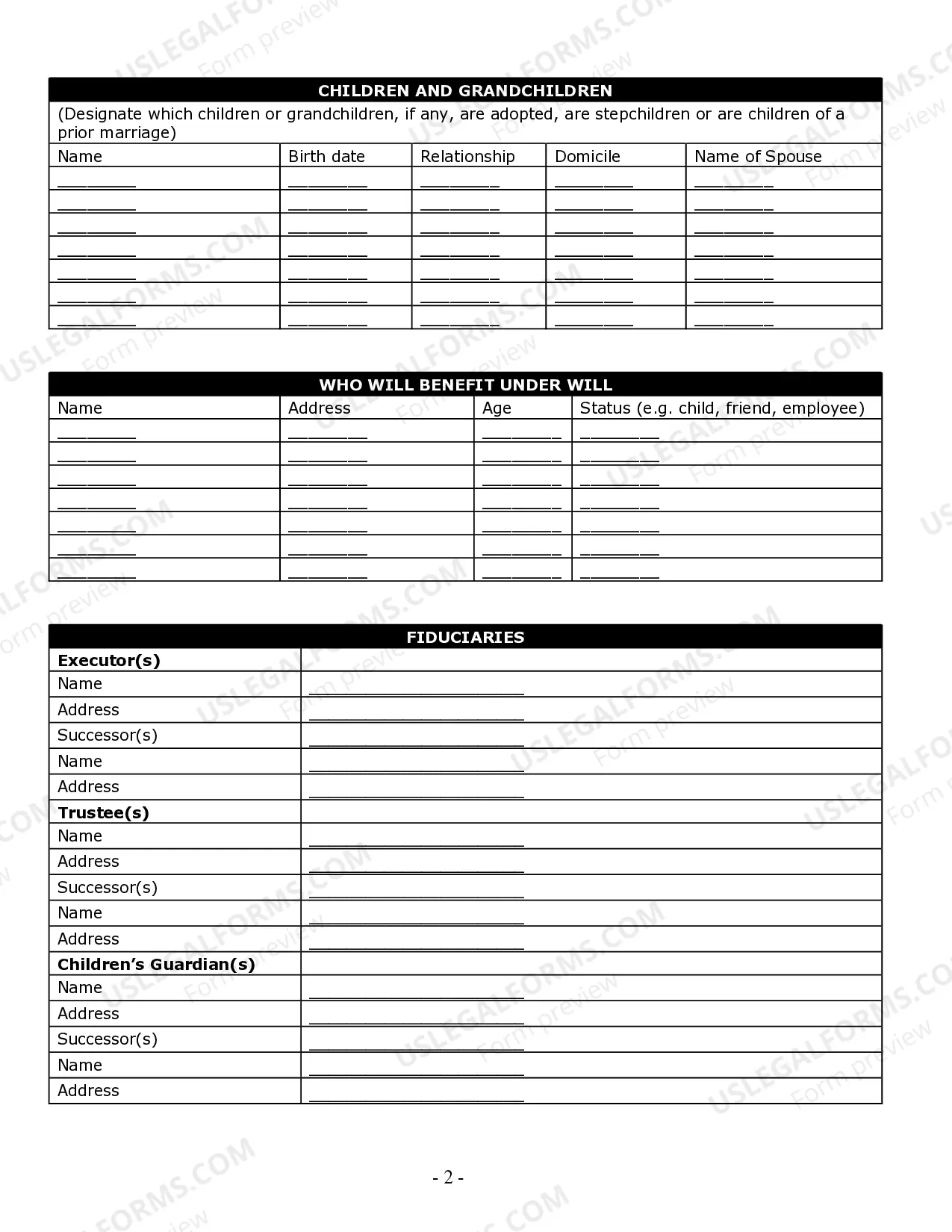

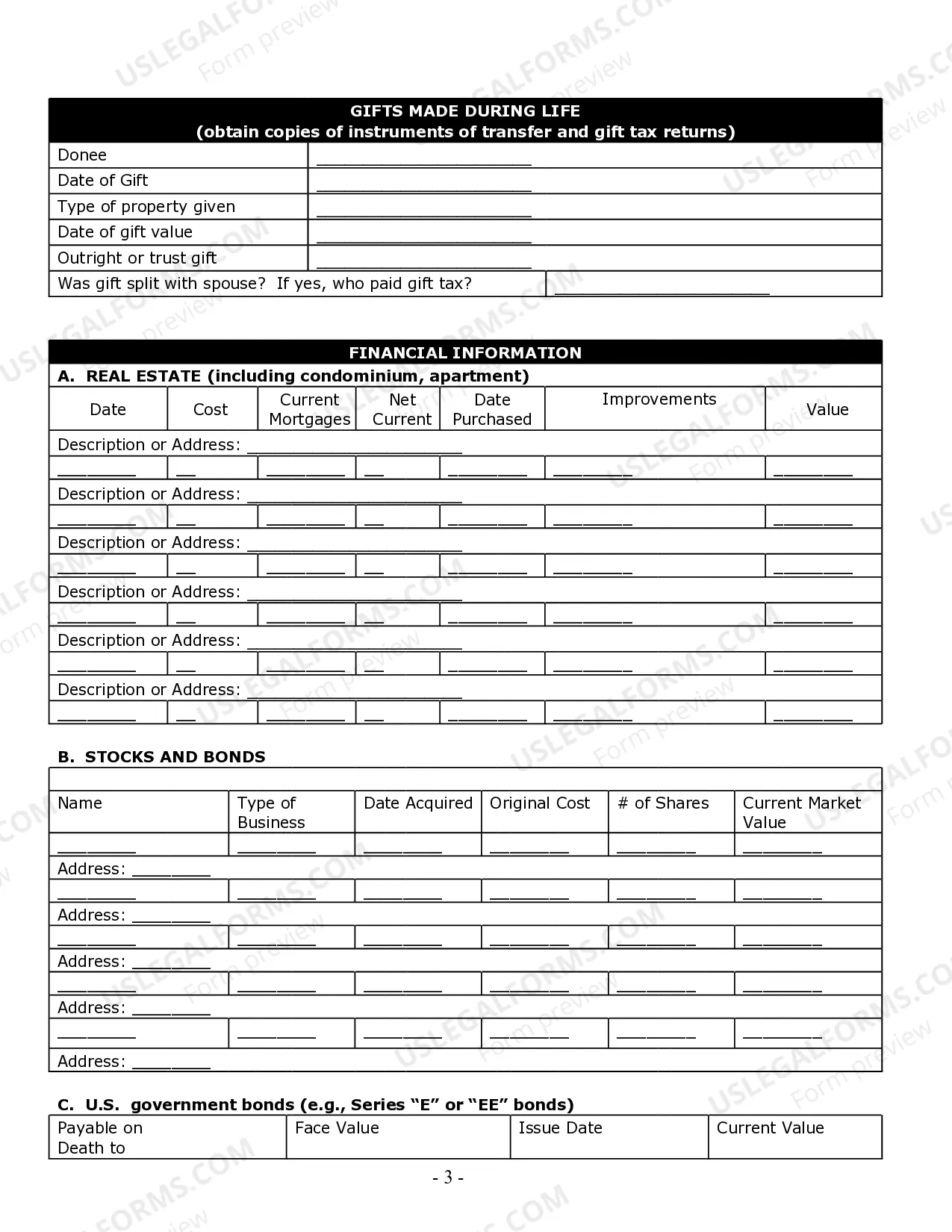

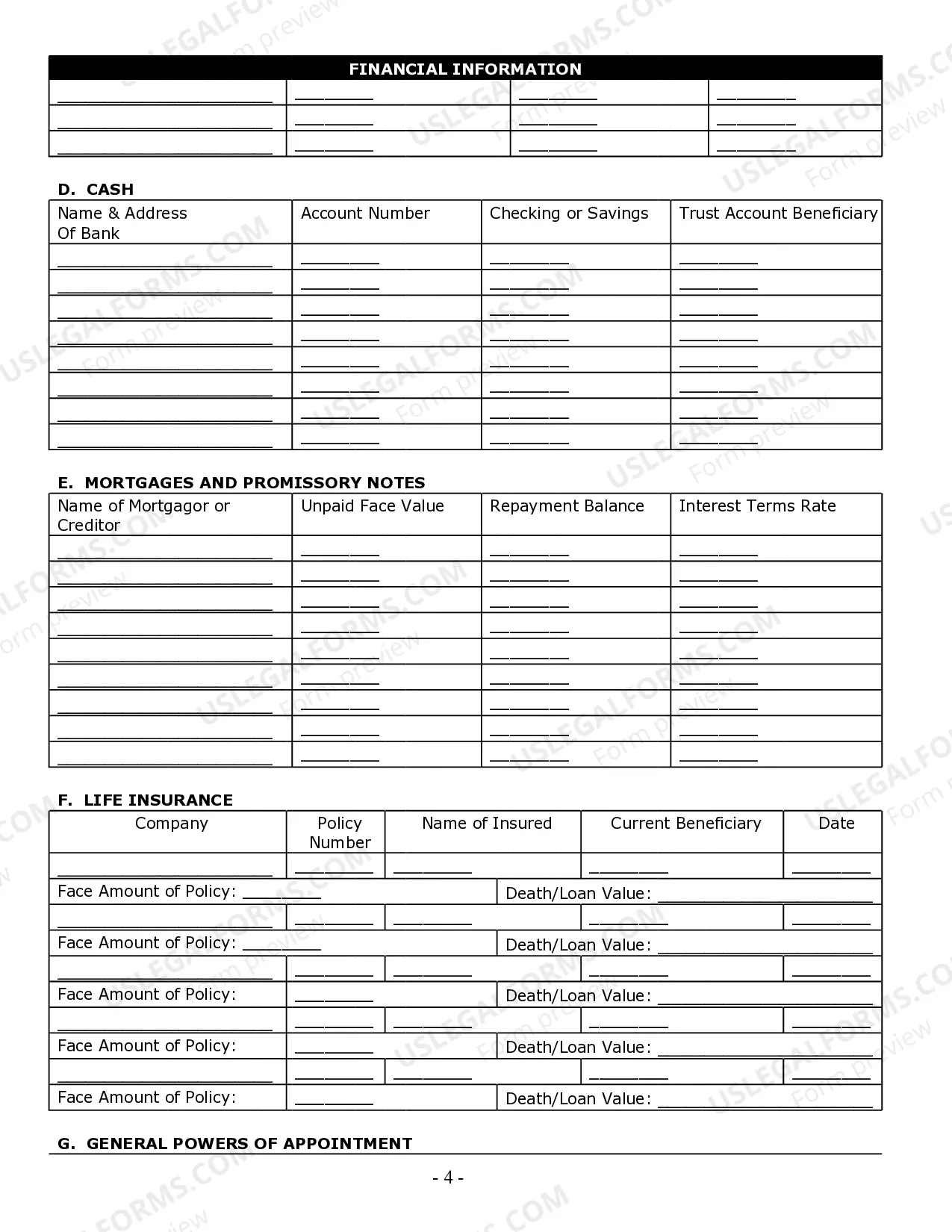

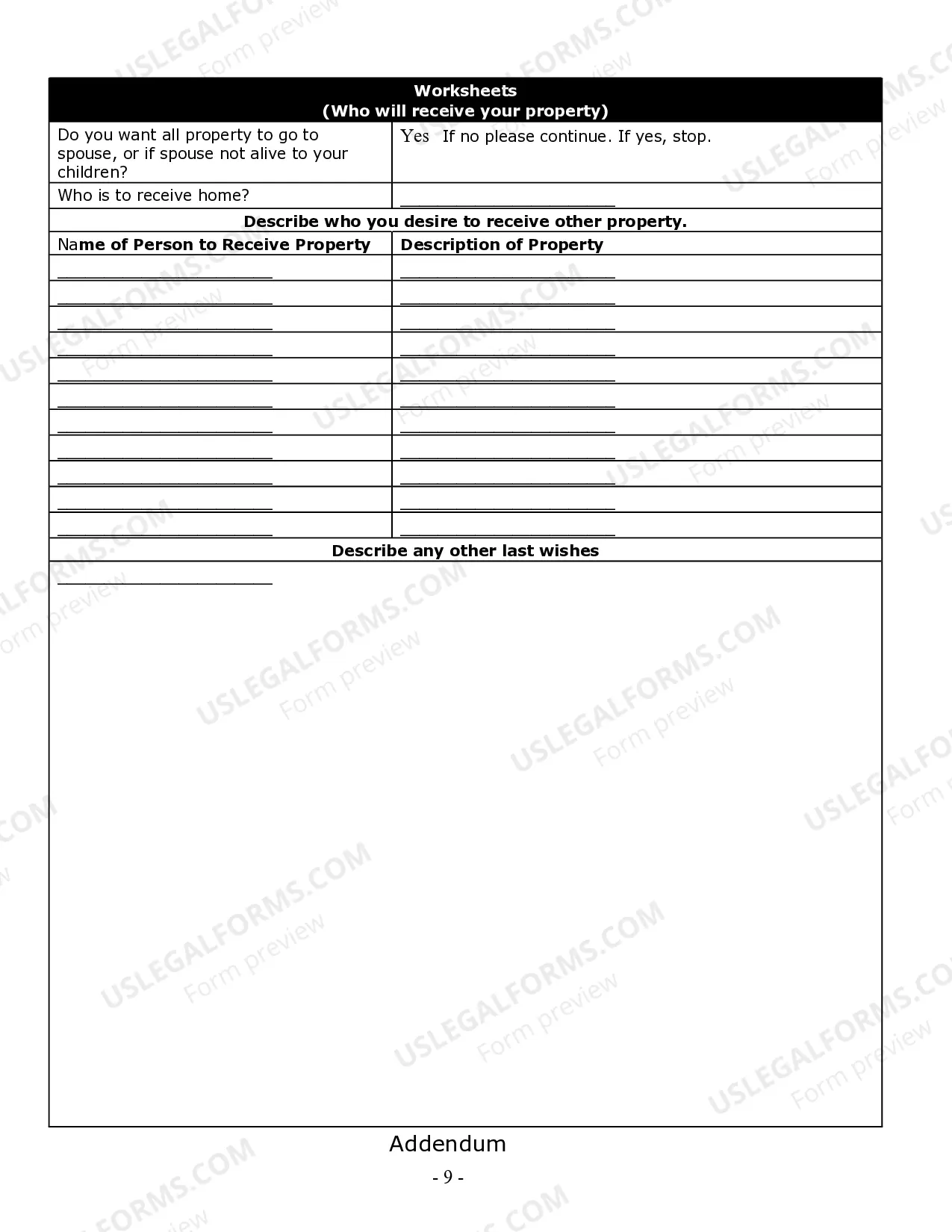

How to fill out Michigan Estate Planning Questionnaire And Worksheets?

It’s no secret that you can’t become a law professional overnight, nor can you figure out how to quickly prepare Michigan Estate Laws For Minors without having a specialized set of skills. Creating legal forms is a long process requiring a certain training and skills. So why not leave the preparation of the Michigan Estate Laws For Minors to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Michigan Estate Laws For Minors is what you’re searching for.

- Start your search again if you need a different form.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. As soon as the transaction is through, you can download the Michigan Estate Laws For Minors, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The main advantage of using a UTMA account is that the money contributed to the account is exempted from paying a gift tax of up to a maximum of $16,000 per year for 2022 ($17,000 for 2023). 2 Any income earned on the contributed funds is taxed at the tax rate of the minor who is being gifted the funds.

If you do not have a surviving spouse, your children inherit your estate in equal portions. If there are no surviving children, your surviving grandchildren, siblings, or parents will be entitled to the estate, ing to specific provisions in the Michigan statute.

Minors, because they are not legally adults, are not allowed to handle their own legal or financial affairs, including receiving inheritances. Therefore, if a minor is a beneficiary, their inheritance must be placed in a trust or custodial account.

Most life insurance policies will not allow you to directly leave money to beneficiaries who are minors. If you name a minor as a beneficiary, they will have to settle the matter in probate court. In which an adult will be delegated to manage the money until the minor is old enough to be responsible for it themselves.

Age of Majority and Trust Termination StateUGMAUTMAMichigan1818Minnesota1821Mississippi2121Missouri212149 more rows