Notice Beneficiaries Being With You

Description

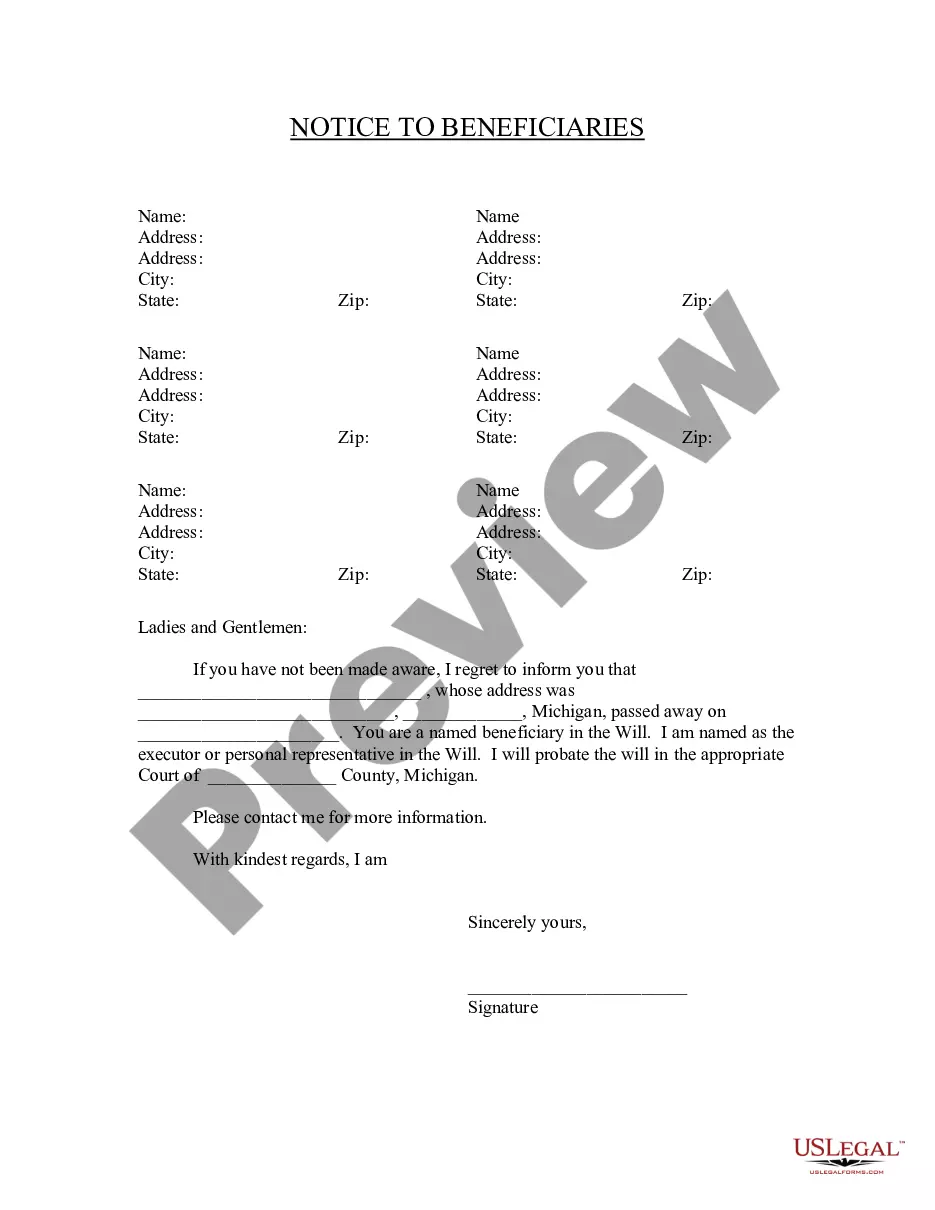

How to fill out Michigan Notice To Beneficiaries Of Being Named In Will?

- For returning users, log in to your account and click on the Download button to save your desired form template. Ensure your subscription remains active; renew it if necessary.

- If you're new to US Legal Forms, start by checking the Preview mode and form description. Confirm it meets your jurisdiction requirements.

- Should you need a different template, use the Search tab above to find what suits you best.

- Once you've selected the correct document, click the Buy Now button and choose a subscription plan.

- Complete your purchase by entering your credit card information or using PayPal.

- After your payment processes, download your form to your device for completion, and access it anytime via the My Forms menu.

By using US Legal Forms, you can avoid the hassle of searching for appropriate documents everywhere. With over 85,000 editable legal forms available, you’re guaranteed to find what you need.

Ready to streamline your legal documentation process? Sign up with US Legal Forms today!

Form popularity

FAQ

If a beneficiary is not notified, they may miss important deadlines or opportunities to claim their inheritance. Not knowing their status can lead to disputes or even legal challenges, ultimately complicating the estate process. By ensuring you notice beneficiaries being with you, you create an environment of clarity and cooperation. An informed beneficiary is more likely to work amicably with the executor, which can ease any potential tensions.

Yes, it is possible for someone to designate you as a beneficiary without your knowledge. Unfortunately, this means you may not be aware of any rights or claims you need to assert. Therefore, it’s essential to proactively seek information on your potential beneficiary status, as knowing can empower you to take necessary actions. The more you engage in these discussions, the better you can understand your estate planning landscape.

Yes, it is crucial to notice beneficiaries being with you in any estate planning or insurance process. Clear communication ensures they are aware of their role and rights, which can prevent confusion later. Informing them promotes transparency, allowing for effective planning and better relationships. Additionally, it respects their entitlement and gives them the opportunity to ask questions or express concerns.

Generally, you will be informed by the executor or the estate’s attorney if you are a beneficiary. They will provide you with necessary documentation, including the will or a formal notice. This practice underscores the importance of notice beneficiaries being with you and ensuring clarity about your rights.

Yes, a life insurance company typically reaches out to beneficiaries directly once a claim is filed. They inform beneficiaries about the policy and assist them through the claims process. This proactive communication aligns with the principle of notice beneficiaries being with you.

Yes, beneficiaries can request to see bank statements and other financial documents. This right helps ensure transparency regarding the estate’s financial status. Ultimately, this reflects the intention of notice beneficiaries being with you during the estate administration process.

Beneficiaries have the right to receive information about the estate, including financial statements and updates on the probate process. They can also ask for transparency and seek clarification on any decisions made by the executor. This openness is a crucial part of ensuring notice beneficiaries being with you.

It is advisable to inform individuals if they are designated as beneficiaries. Open communication helps prevent confusion and prepares them for future actions related to the estate. This practice is a vital part of adhering to the notice beneficiaries being with you concept.

Yes, beneficiaries should be formally notified by the executor once the estate is opened. This notification will confirm their status and detail what assets they are entitled to access. Remember, this aligns with the principle of notice beneficiaries being with you.

As an executor, avoid conflicts of interest and ensure you act impartially. Do not withhold information from the beneficiaries or engage in any behavior that may seem like favoritism. Adhering to ethical standards aligns with the concept of notice beneficiaries being with you.