Notice Beneficiaries Being For The Rights Of The Child

Description

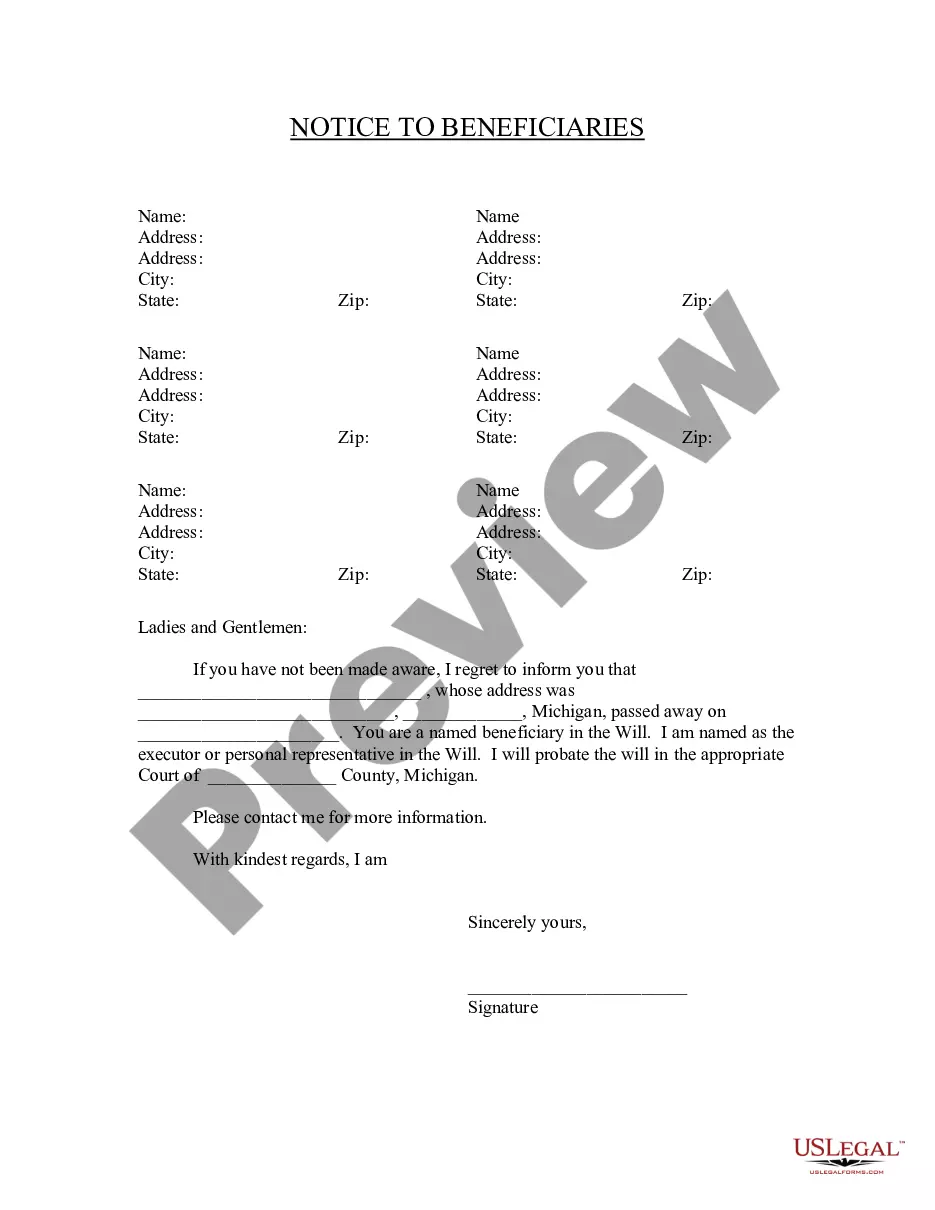

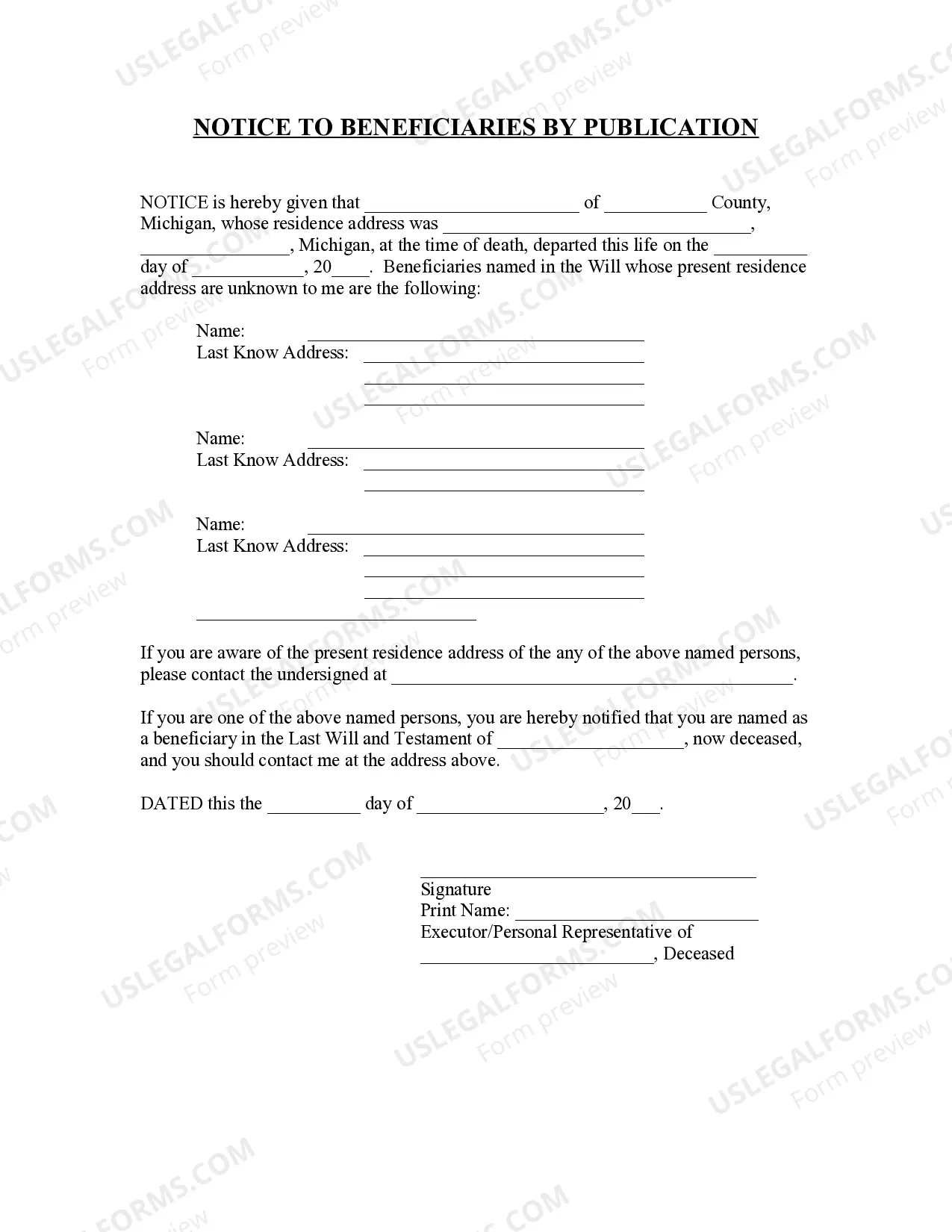

How to fill out Michigan Notice To Beneficiaries Of Being Named In Will?

- If you are a returning user, log in to your account and download the desired form template directly by clicking the Download button. Ensure your subscription is current; if not, please renew it as per your payment plan.

- For first-time users, start by previewing the form description to ensure you select the correct document that matches your local jurisdiction requirements.

- If you encounter any discrepancies, utilize the Search tab to find the right template that meets your needs before proceeding.

- Purchase the required document by clicking the Buy Now button. You will need to select your preferred subscription plan and create an account to access all available resources.

- Complete your transaction by submitting your credit card details or using a PayPal account to finalize your subscription.

- Finally, download the form and save it to your device. You can access it anytime through the My Forms section of your profile.

By leveraging US Legal Forms, you gain access to an extensive library of over 85,000 legal forms, tailored for simplicity and efficiency.

Don't miss out on the chance to streamline your legal documentation process – visit US Legal Forms today to get started!

Form popularity

FAQ

Informing someone that they are your beneficiary is not legally required, but it is a prudent step. By providing a clear Notice to beneficiaries being for the rights of the child, you help ensure your wishes are understood. Open communication can prevent confusion and disputes regarding your intentions. Using platforms like USLegalForms can assist you in creating proper documentation that outlines your beneficiary designations clearly.

Writing a beneficiary statement involves clearly identifying yourself and stating your intentions regarding the distribution of your assets. List the beneficiaries along with their respective details and provide instructions on how to access these assets. This statement will help clarify your wishes, reinforcing the importance of notice beneficiaries being for the rights of the child.

To write a letter of instruction, begin with an introductory paragraph explaining your intentions. Include detailed instructions for your heirs, covering important tasks such as accessing accounts or distributing assets. This letter supports clarity, especially in relation to notice beneficiaries being for the rights of the child, which can ease the process during a difficult time.

A common example of a beneficiary is a family member, such as a spouse or child, designated to receive life insurance benefits. You could also name a charity as a beneficiary for part of your estate. Clear examples like these illustrate the impact of notice beneficiaries being for the rights of the child effectively.

A beneficiary statement is a formal document that outlines who will receive your assets after your passing. It typically includes the names, contact information, and the relationship of the beneficiaries to you. This statement serves as a crucial tool in achieving clarity regarding notice beneficiaries being for the rights of the child.

In the beneficiary account description, include the specific assets or accounts that will pass to the beneficiaries. Be clear about the amount or percentage designated to each beneficiary. This thorough explanation helps prevent misunderstandings and legal issues related to notice beneficiaries being for the rights of the child.

To fill out a beneficiary statement, start with your identification details. Clearly state the purpose of the statement, and precisely list the beneficiaries along with their relevant information. This document should provide a clear understanding of how you intend to allocate your assets, ensuring compliance with notice beneficiaries being for the rights of the child.

Filling a beneficiary form is straightforward. Begin by entering your personal information, such as your name and address. Next, designate the beneficiary’s details, ensuring you clearly specify their relationship to you. It’s crucial to double-check all entries for accuracy to prevent any legal complications regarding notice beneficiaries being for the rights of the child.

If you are a beneficiary, you will usually receive a formal notification from the executor or estate representative. This notification may arrive via a letter or an official document outlining your rights and next steps. Being informed is essential for understanding your obligations and entitlements regarding the estate. To ease this process, platforms like USLegalForms offer resources to clarify these notifications.

Beneficiaries of life insurance policies typically receive notification directly from the insurance company once a claim is filed. The process may involve sending paperwork and providing verification of identity. This quick communication helps beneficiaries understand their rights, especially in cases involving the rights of the child. Staying informed ensures that the benefits are distributed promptly.