Notice Beneficiaries Being For The Future

Description

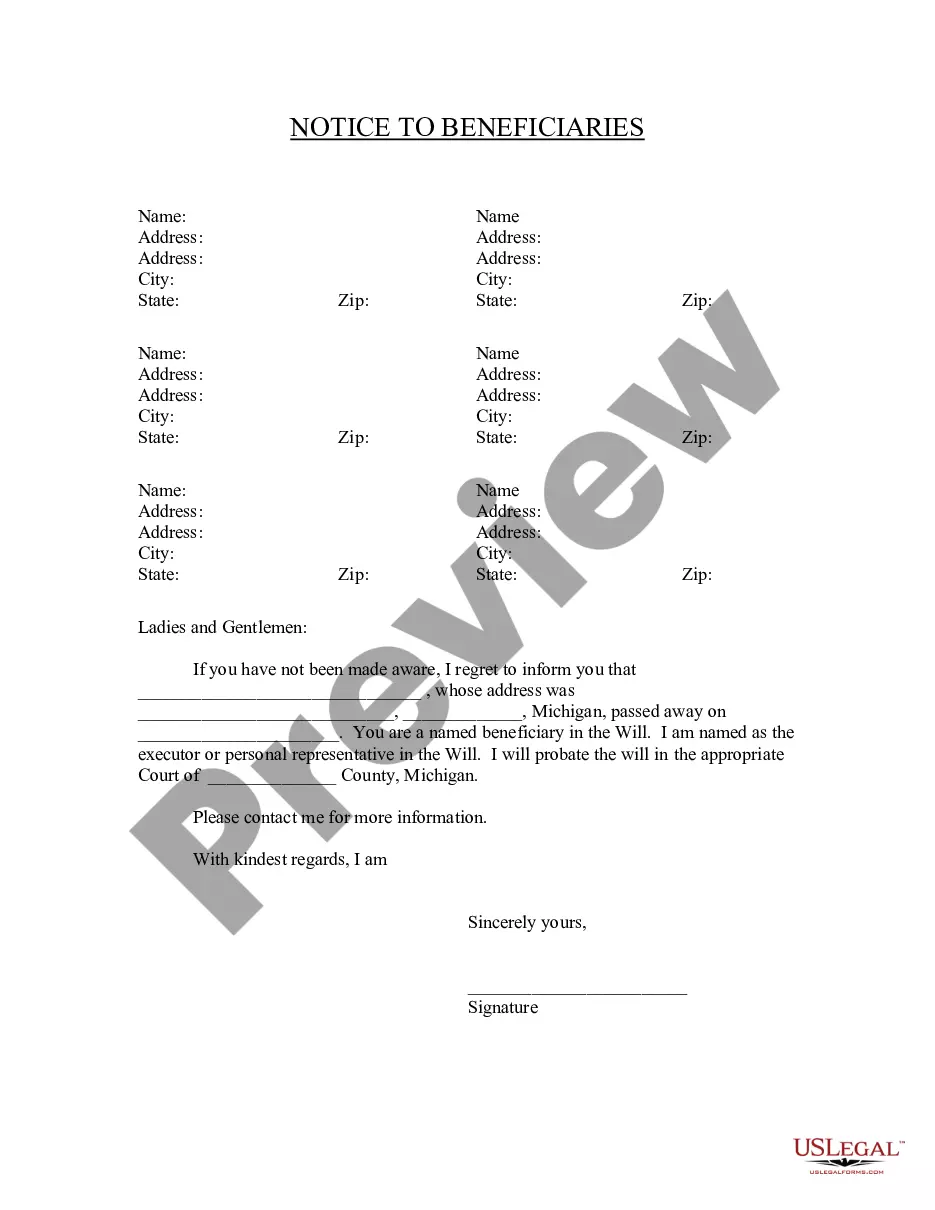

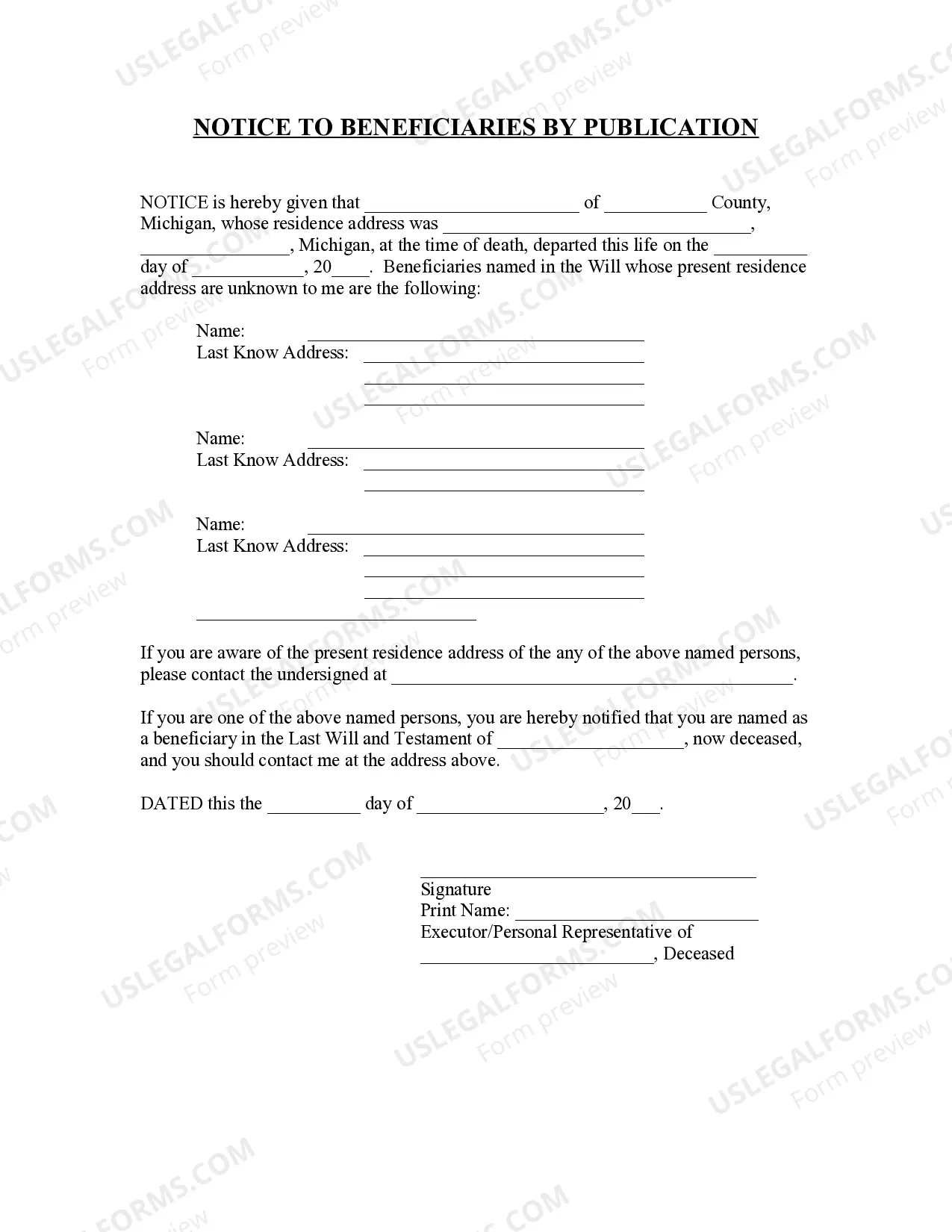

How to fill out Michigan Notice To Beneficiaries Of Being Named In Will?

- If you’re a returning user, simply log in to your account and ensure your subscription is active. Click the Download button to save your required form template.

- For first-time users, start by checking the Preview mode and the detailed description of the form. Confirm it meets your individual requirements and adheres to local jurisdiction.

- If the selected form doesn't fit your needs, utilize the Search tab above to find the appropriate template.

- Once you've located the correct document, click on the Buy Now button. Choose a subscription plan that suits you, and you’ll need to create an account to gain access.

- Proceed to make your payment using a credit card or PayPal for the selected subscription.

- Finally, download your form and save it to your device. You can access this document anytime from the My Forms section of your profile.

US Legal Forms is the go-to resource for individuals and attorneys looking to efficiently manage their legal documents.

Begin your journey toward streamlined legal documentation today with US Legal Forms and ensure your plans are in place for the future.

Form popularity

FAQ

Form 56 should be filed promptly after the appointment of a fiduciary, such as a trustee or executor. This form helps notify the IRS that a specific entity may need to fulfill tax obligations. To ensure that you meet all requirements, including notice beneficiaries being for the future, consider using our platform for guidance and proper documentation.

Yes, informing beneficiaries is a crucial responsibility of the trustee. Beneficiaries must be made aware of their interests and any developments that could impact them. Therefore, it is essential to maintain communication to meet the requirements of notice beneficiaries being for the future.

The trustee's duty to notify beneficiaries encompasses informing them about trust activities, upcoming distributions, and their rights under the trust. This obligation ensures that beneficiaries remain aware of their benefits and any changes in management. Such transparency supports the important goal of notice beneficiaries being for the future.

Yes, a trustee is required to communicate with beneficiaries regarding the trust's affairs. This communication includes updates on assets, distributions, and any decisions made that could affect them. Keeping beneficiaries informed is vital for notice beneficiaries being for the future and maintaining a smooth relationship.

To notify beneficiaries of a will, you should send a formal notification that includes a copy of the will itself. It's important to provide clear information about the estate's distribution and any relevant timelines. Utilizing our platform, uslegalforms, can aid in creating the necessary documents to ensure you notice beneficiaries being for the future effectively.

The trustee has a legal and ethical obligation to keep beneficiaries informed about the trust's status and activities. This includes sharing relevant updates, financial statements, and any changes that may impact the beneficiaries. By ensuring clear communication, the trustee helps foster trust and transparency, which is essential for notice beneficiaries being for the future.

It's important to inform beneficiaries about their future status to avoid confusion and ensure they understand your intentions. Notifying beneficiaries about their potential role can facilitate better communication and planning for everyone involved. Additionally, this knowledge can often lead to smoother transitions upon the distribution of assets. Utilizing US Legal Forms can aid in creating clear documentation that outlines your wishes and communicates them effectively.

A future beneficiary is an individual or entity designated to receive assets or benefits from a trust or estate at a specific future date or upon a certain event. This designation allows the current owner to plan for potential future distributions. Clearly indicating future beneficiaries helps ensure your wishes are honored when the time comes. Using services like US Legal Forms can make documenting these beneficiaries straightforward and reliable.

Beneficiaries are usually contacted via direct mail, phone calls, or emails by the executor or the institution managing the estate. This communication includes key information about their inheritance and any required actions. Ensuring timely communication is essential for all parties involved, making it easier to notice beneficiaries being for the future. Using resources like US Legal Forms can help organize these communications efficiently.

Yes, if you are a named beneficiary on a life insurance policy, the company will typically reach out to you after the policyholder's passing. They will ask for necessary documents to process your claim. Being listed ensures that the insurance company knows to notice beneficiaries being for the future. Keeping your contact information updated can help expedite this process.