Satisfaction, Release or Cancellation of Mortgage by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

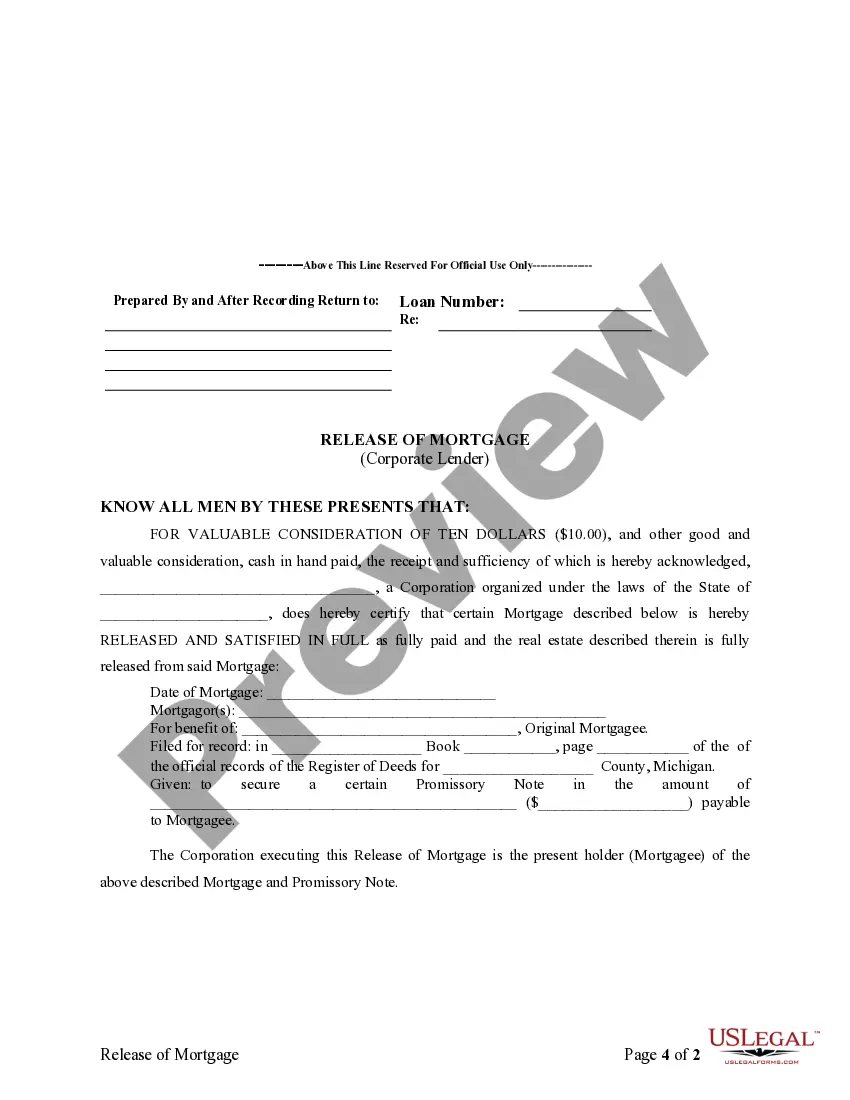

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Michigan Law

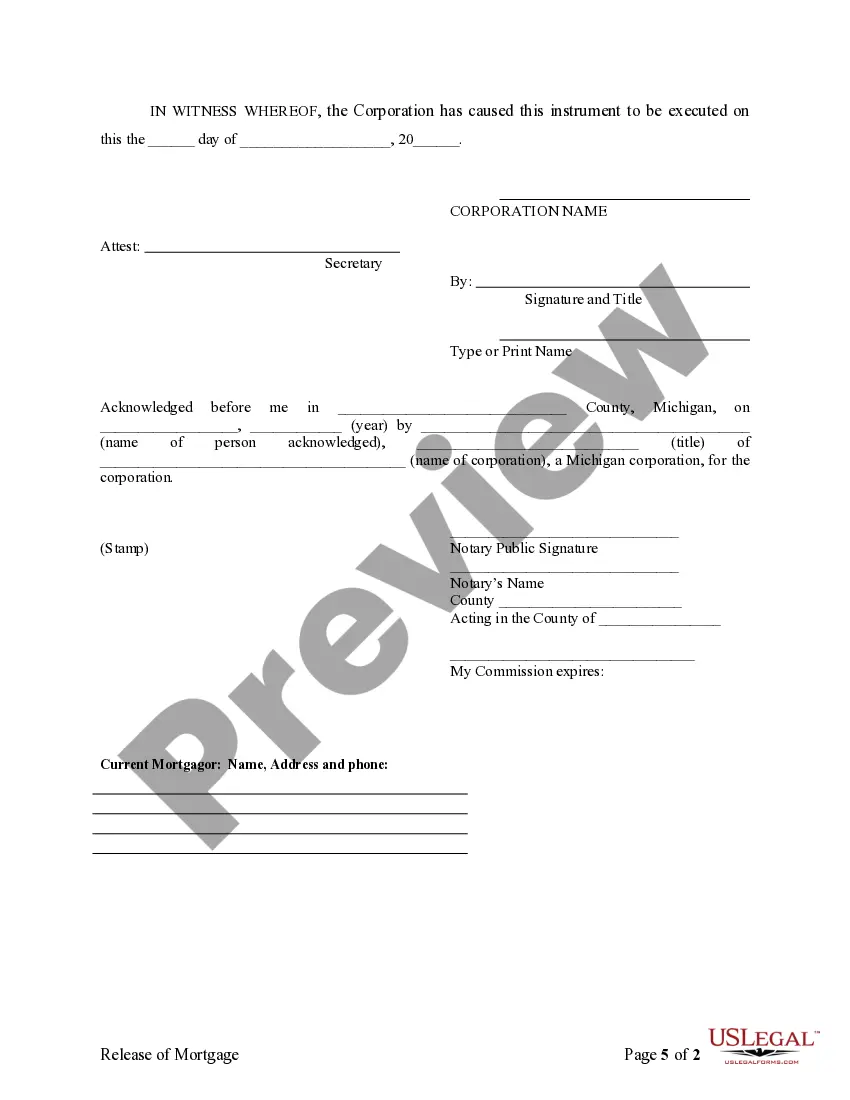

Execution of Assignment or Satisfaction: Must be signed by mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Upon full payoff, mortgagee has 90 days to record satisfaction. However, if, following full payoff, mortgagor requests that mortgagee record satisfaction, then mortgagee must do so within 7 days, or suffer liability.

Recording Satisfaction: Any mortgage shall also be discharged upon the record thereof by the register of deeds, in whose custody it shall be, whenever there shall be presented to him a certificate executed by the mortgagee, acknowledged, approved and certified as in this chapter provided, specifying that such mortgage has been paid, or otherwise satisfied or discharged.

Penalty: If mortgagee fails (within 7 days following request) to discharge the mortgage of record after full payoff, he is liable for a penalty of $100 plus actual damages.

Acknowledgment: An assignment or satisfaction must contain a proper Michigan acknowledgment, or other acknowledgment approved by Statute.

Michigan Statutes

CHAPTER 65 - CHAPTER 65. OF ALIENATION BY DEED, AND THE PROOF AND RECORDING OF CONVEYANCES, AND THE CANCELING OF MORTGAGES. (EXCERPT) 565.41 Discharge of mortgage; payment of filing fee by mortgagee. [M.S.A. 26.558(1)]

Sec. 41.(1) Within the applicable time period in section 44(2) after a mortgage has been paid or otherwise satisfied, the mortgagee or the personal representative, successor, or assign of the mortgagee shall prepare a discharge of the mortgage, file the discharge with the register of deeds for the county where the mortgaged property is located, and pay the fee for recording the discharge.

(2) If a discharge of mortgage received by a register of deeds under subsection (1) is not recorded on the day it is received, the register of deeds shall place on or attach to the discharge, by means of a stamp, electronically, or otherwise, the date the discharge is received. The date placed on or attached to the discharge under this subsection is prima facie evidence of the date the discharge was filed with the register of deeds.

CHAPTER 65 CHAPTER 65. OF ALIENATION BY DEED, AND THE PROOF AND RECORDING OF CONVEYANCES, AND THE CANCELING OF MORTGAGES. (EXCERPT) 565.42 Discharge of mortgage; certificate of mortgagee; circuit court, or register in chancery. [M.S.A. 26.559]

Sec. 42. Any mortgage shall also be discharged upon the record thereof by the register of deeds, in whose custody it shall be, whenever there shall be presented to him a certificate executed by the mortgagee, his personal representative or assigns, acknowledged, approved and certified as in this chapter provided, to entitle conveyances or instruments in writing in any wise affecting the title to lands to be recorded, specifying that such mortgage has been paid, or otherwise satisfied or discharged; or upon the presentation to such register of deeds of the certificate of the circuit court, signed by the judge of said court, and under the seal thereof, certifying that it has been made to appear to said court that said mortgage has been duly paid, or upon the presentation to such register of deeds of a certificate of the register in chancery of the county and under the seal thereof certifying that a decree of foreclosure of any such mortgage has been duly entered in his office, and that the records in his office shows that such decree has been fully paid and satisfied.

CHAPTER 65 CHAPTER 65. OF ALIENATION BY DEED, AND THE PROOF AND RECORDING OF CONVEYANCES, AND THE CANCELING OF MORTGAGES. (EXCERPT) 565.43 Discharge of mortgage; recording of certificate; reproduced documents; reference to book and page containing certificate. [M.S.A. 26.560]

Sec. 43. Every certificate described in section 42 of this chapter, and the proof or acknowledgment of the certificate, shall be recorded at full length, and a reference shall be made to the liber and page, or other unique identifying number, containing the certificate, in the minutes of the discharge of the mortgage made by the register upon the mortgage. If the register of deeds is authorized by the board of commissioners to reproduce deeds, mortgages, maps, instruments, or writings, as provided in section 2 of 1964 PA 105, MCL 691.1102, and the mortgage does not exist in a hard copy medium, it is not necessary for him or her to make reference to the liber and page containing the certificate on the liber and page containing the mortgage. Instead, reference to the liber and page containing the certificate shall be made in the index to the permanent index of mortgages.

CHAPTER 65 CHAPTER 65. OF ALIENATION BY DEED, AND THE PROOF AND RECORDING OF CONVEYANCES, AND THE CANCELING OF MORTGAGES. (EXCERPT) 565.44 Discharge of mortgage; refusal; civil liability, penalty. [M.S.A. 26.561]

Sec. 44. (1) If a mortgagee or the personal representative or assignee of the mortgagee, after full performance of the condition of the mortgage, whether before or after a breach of the mortgage, or, if the mortgage is entirely due, after a tender of the whole amount due, within the applicable time period in subsection (2) after being requested and after tender of the mortgagee’s reasonable charges, refuses or neglects to discharge the mortgage as provided in this chapter or to execute and acknowledge a certificate of discharge or release of the mortgage, the mortgagee is liable to the mortgagor or the mortgagor’s heirs or assigns for $1,000.00 damages. The mortgagee is also liable for all actual damages caused by the neglect or refusal to the person who performs the condition of the mortgage or makes the tender to the mortgagee or the mortgagee’s heirs or assigns, or to anyone who has an interest in the mortgaged premises. Damages under this section may be recovered in an action for money damages or to procure a discharge or release of the mortgage. The court may, in its discretion, award double costs in an action under this section.

(2) The discharge of mortgage, execution and acknowledgment of a certificate, or filing of a discharge of mortgage required by this section or section 41 shall be performed within whichever of the following time periods is applicable:

(a) For the first 2 years after the effective date of the amendatory act that added this subsection, 75 days.

(b) Beginning 2 years after the effective date of the amendatory act that added this subsection, 60 days.