Michigan A Corporation With Debt

Description

How to fill out Organizational Minutes For A Michigan Professional Corporation?

Whether you handle documentation frequently or occasionally need to submit a legal report, it is vital to obtain a resource where all the examples are pertinent and current.

The initial step regarding a Michigan A Corporation With Debt is to ensure that it is indeed the latest version, as it determines its eligibility for submission.

If you wish to streamline your search for the most up-to-date document examples, look for them on US Legal Forms.

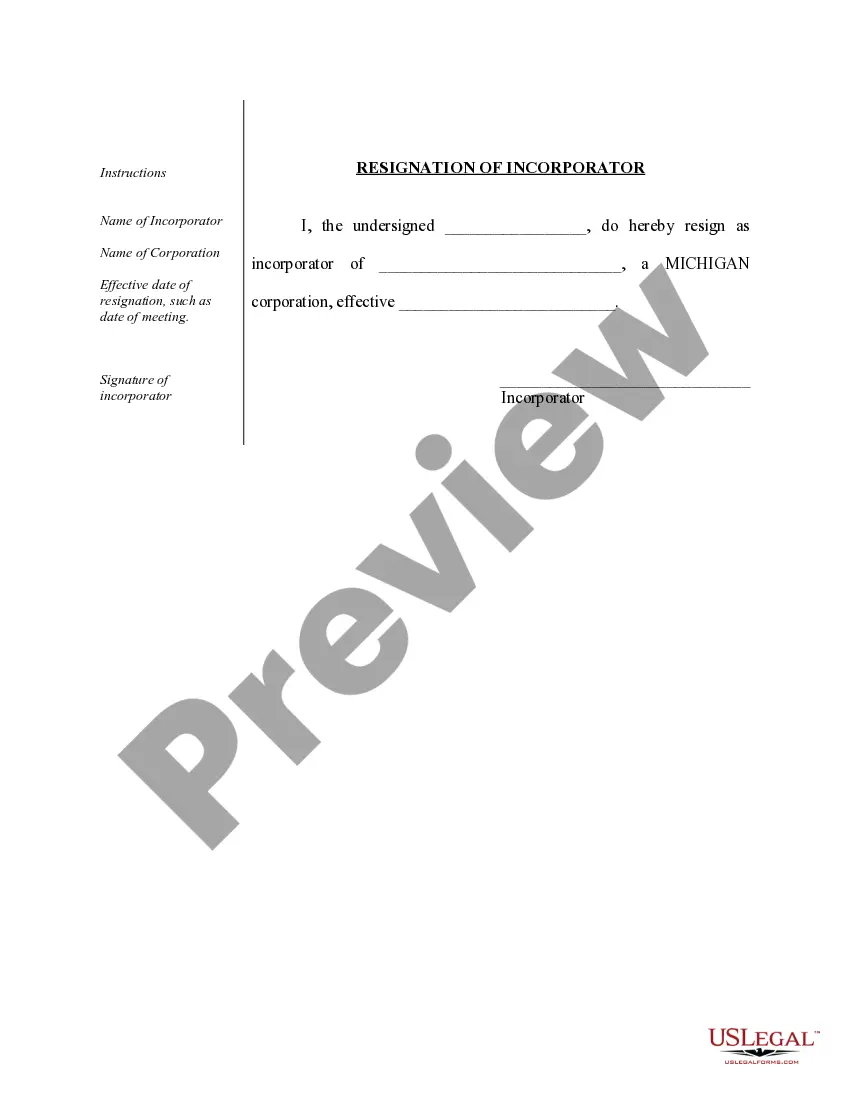

To acquire a form without an account, follow these instructions: Use the search menu to locate the form you need. Review the preview and overview of the Michigan A Corporation With Debt to confirm it is the exact template you are looking for. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card details or PayPal account to finalize the purchase. Choose the document format for download and verify it. Eliminate the confusion associated with legal paperwork. All your templates will be classified and confirmed with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that encompasses nearly every sample you might need.

- Search for the templates you want, verify their pertinence immediately, and discover more about their applications.

- With US Legal Forms, you gain access to over 85,000 form templates across various sectors.

- Acquire the Michigan A Corporation With Debt samples within moments and store them at any time in your profile.

- A US Legal Forms profile will provide you with the ability to access all the samples you require with greater ease and minimal hassle.

- Simply click Log In in the website header and navigate to the My documents section to have all the forms you need at your fingertips.

- You won't need to spend time searching for the correct template or checking its validity.

Form popularity

FAQ

The timeframe to get an LLC approved in Michigan typically ranges from a few days to several weeks, depending on the filing method. Online filings are usually processed faster than paper submissions. Planning ahead can help, especially if you are striving to establish a Michigan corporation with debt promptly. Uslegalforms can also assist in expediting the process, ensuring that you meet all necessary requirements efficiently.

Taxes for an LLC in Michigan can vary based on how the LLC opts to be taxed. Generally, an LLC is treated as pass-through entities, meaning profits and losses pass directly to the owners' personal tax returns. It's essential for a Michigan corporation with debt to understand the implications of these tax structures on personal liability and financial management. Consulting a tax professional can provide tailored guidance for your specific situation.

To fill out Michigan LLC paperwork, start by gathering necessary information such as the LLC's name, registered agent details, and business purpose. You can find the forms online through the Michigan Department of Licensing and Regulatory Affairs' website. Follow the instructions carefully while ensuring all information is accurate and complete. If you feel uncertain, uslegalforms can guide you through the process, making it easier for your Michigan corporation with debt.

Michigan Form 163, also known as the 'Corporate Income Tax Annual Return,' is a tax form that corporations in Michigan must submit. This form reports the corporation's income, resulting in tax liability calculations. For a Michigan corporation with debt, understanding Form 163 is essential to ensure accurate reporting and compliance with tax obligations, which can help prioritize debt repayment.

To close a company in Michigan, you must follow several steps to ensure compliance with state laws. Initially, you need to hold a meeting to obtain approval from shareholders or members to dissolve the corporation. After approval, file the Articles of Dissolution with the Michigan Department of Licensing and Regulatory Affairs, and make sure to settle any outstanding debts. Proper closure helps avoid ongoing financial responsibilities, especially for a Michigan corporation with debt.

Setting up as a corporation in Michigan requires filing your articles of incorporation with the state. Be prepared to appoint a registered agent and outline your corporation's structure and purpose. Utilizing platforms like US Legal Forms can streamline this process, especially for those managing Michigan a corporation with debt, by providing templates and guidance to help you comply with state requirements.

In Michigan, property taxes become delinquent after February 14 of the following year. The county can eventually foreclose on the property if taxes remain unpaid for three years. It’s wise to engage with a knowledgeable professional if your Michigan corporation with debt faces issues related to property taxes, ensuring you take the right steps to protect your assets.

Collecting a debt in Michigan involves several steps. First, it's important to send a demand letter to the debtor outlining the amount owed and your intent to collect. If this is unsuccessful, consider working with a collections agency or filing a claim in small claims court. Understanding Michigan's laws regarding debt collection can help you navigate this process effectively, especially for a Michigan corporation with debt.

Typically, a corporation in Michigan is not liable for your personal debts. The corporate structure creates a legal separation between personal and business liabilities, protecting your personal assets. However, exceptions exist, such as when personal guarantees are signed or if there is fraud involved. If you’re concerned about how Michigan a corporation with debt can affect your personal finances, consider consulting with a legal expert or utilizing platforms like US Legal Forms for guidance.

A Michigan C corporation is a type of business entity that is taxed separately from its owners. This structure provides limited liability protection, meaning personal assets are generally safe from corporate debts. Additionally, C corporations can attract investors by issuing shares. It's beneficial to explore options if you're considering forming a Michigan a corporation with debt, as the structure can influence liability and tax obligations.