Mi Attorney Real Foreclosure

Description

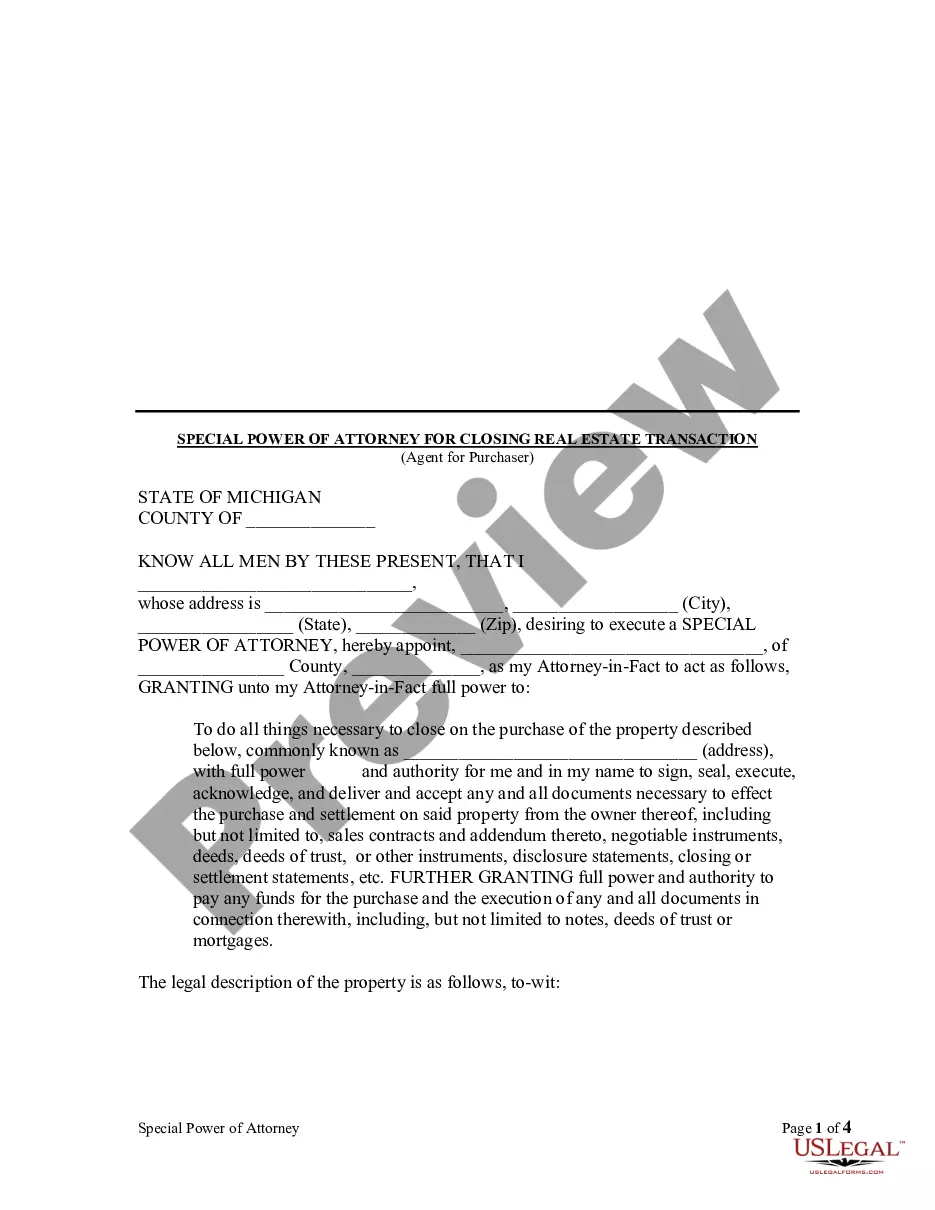

How to fill out Michigan Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may entail hours of investigation and significant financial expenditure.

If you’re seeking a more direct and affordable method for generating Mi Attorney Real Foreclosure or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal matters.

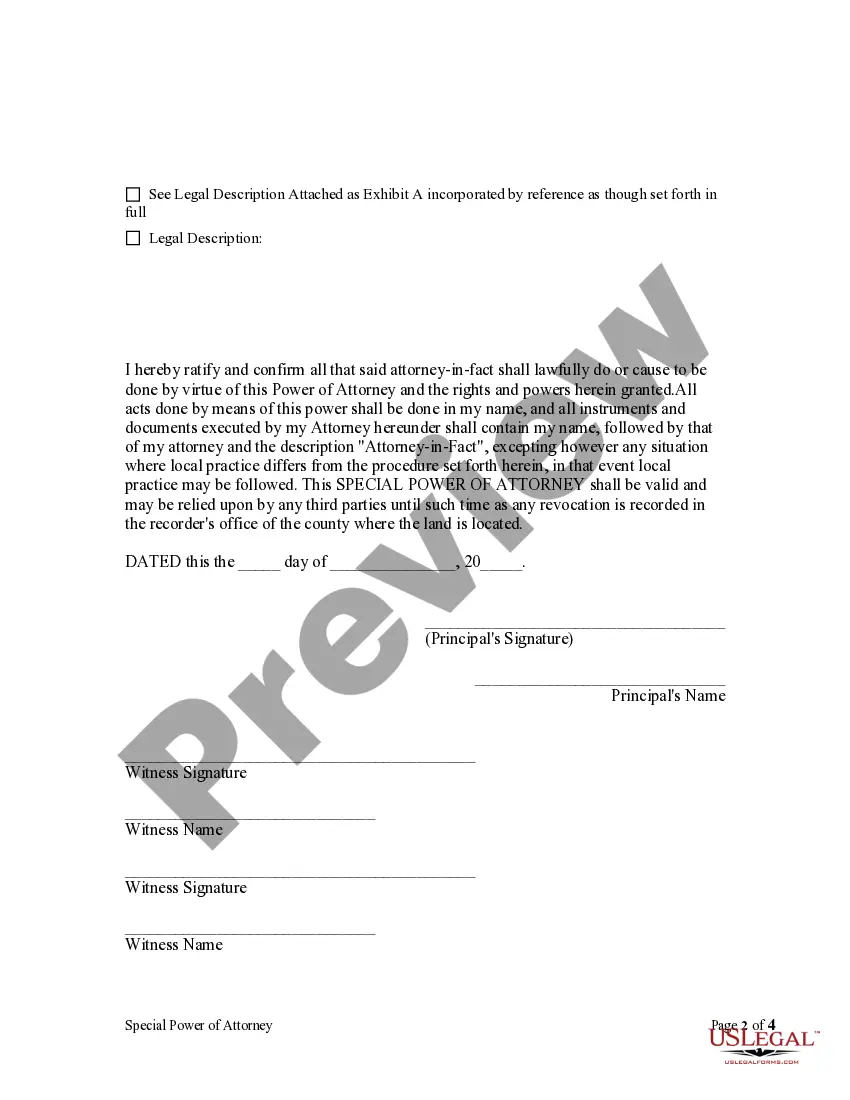

Examine the form preview and descriptions to ensure you are on the correct document, confirm that the template you select complies with the laws and regulations of your state and county, choose the most appropriate subscription plan to purchase the Mi Attorney Real Foreclosure, download the form, and then complete, sign, and print it. US Legal Forms boasts a flawless reputation and over 25 years of expertise. Join us today and make document execution effortless and efficient!

- With just a few clicks, you can quickly access state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service to swiftly locate and download the Mi Attorney Real Foreclosure.

- If you’re familiar with our site and have previously registered an account with us, simply sign in to your account, choose the template, and download it or re-download it anytime from the My documents section.

- Don’t have an account? No problem. It takes just a few minutes to sign up and browse the library.

- But before directly downloading Mi Attorney Real Foreclosure, adhere to these guidelines.

Form popularity

FAQ

Under Michigan's Foreclosure by Advertisement Law, a company must publish a Notice of Sale once a week for four weeks, in a newspaper of general circulation in the county where the property is located. The notice must also be posted on the property at least 15 days after the first Notice of Sale is posted.

Ways to Stop Foreclosure in Michigan Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. It has become difficult to fully pay off the mortgage payments. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Short Sale. ... Deed In Lieu of Foreclosure.

Michigan's Foreclosure Law includes a six-month redemption period (12 months for agricultural property that is larger than three acres) for homeowners whose homes have sold at a foreclosure sale.

Redemption Period ? starts day of Sheriff Sale -Six (6) months is most common. -If the amount claimed to be due on the mortgage at the date of foreclosure is less than 2/3 of the original indebtedness, the redemption period is 12 months. -Farming property can be up to twelve (12) months.

Real Property Tax Forfeiture and Foreclosures Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency. Real property taxes which remain unpaid as of March 31 in the third year of delinquency are foreclosed upon by the Foreclosing Governmental Unit (FGU).