Mi Attorney Real Estate Withholding

Description

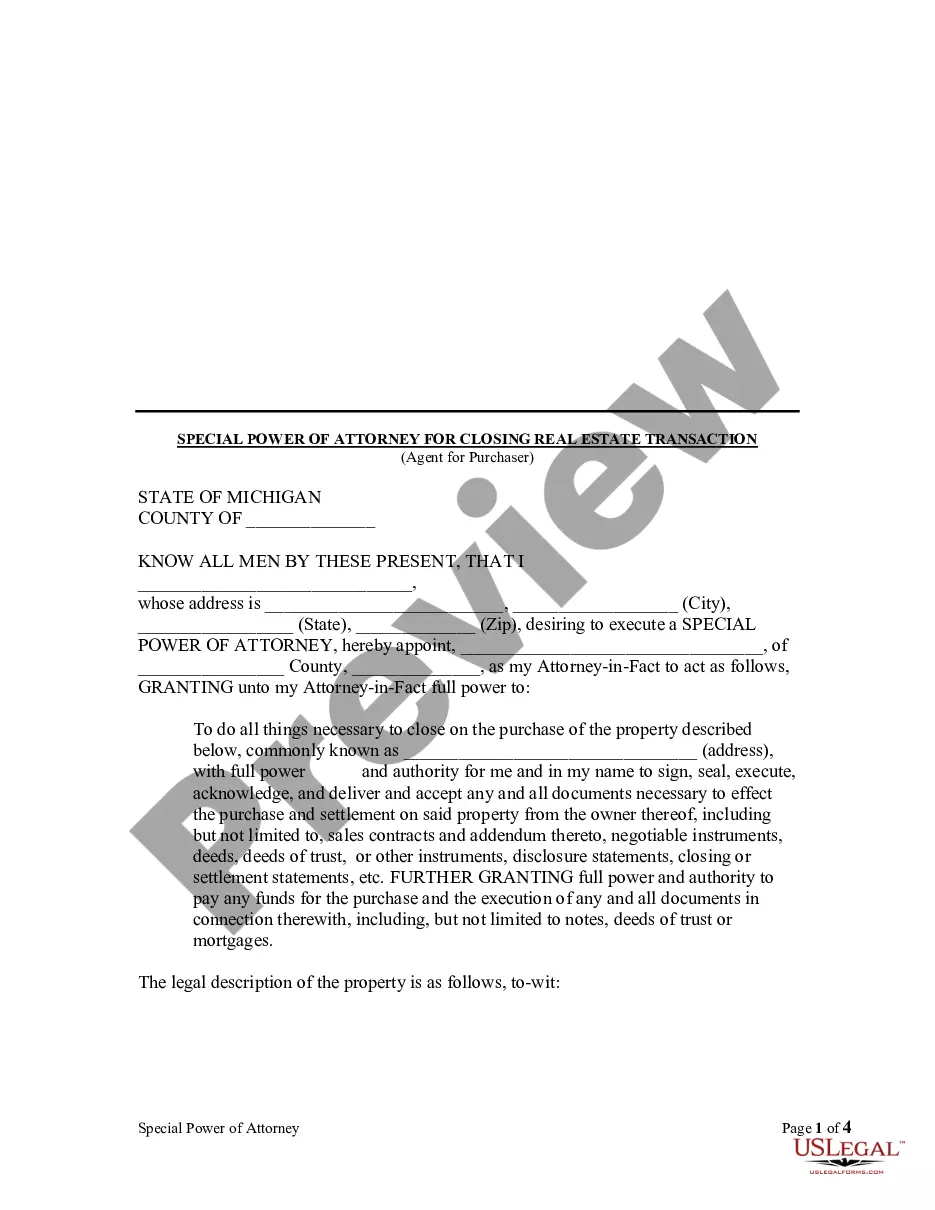

How to fill out Michigan Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Legal managing may be overpowering, even for experienced professionals. When you are searching for a Mi Attorney Real Estate Withholding and don’t have the time to commit searching for the right and up-to-date version, the processes may be stressful. A robust online form catalogue might be a gamechanger for anyone who wants to take care of these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any needs you may have, from personal to enterprise paperwork, all-in-one spot.

- Make use of advanced tools to accomplish and control your Mi Attorney Real Estate Withholding

- Gain access to a resource base of articles, tutorials and handbooks and materials related to your situation and requirements

Save effort and time searching for the paperwork you need, and use US Legal Forms’ advanced search and Preview tool to find Mi Attorney Real Estate Withholding and get it. If you have a monthly subscription, log in for your US Legal Forms profile, search for the form, and get it. Take a look at My Forms tab to find out the paperwork you previously downloaded and to control your folders as you can see fit.

Should it be the first time with US Legal Forms, register an account and obtain unrestricted usage of all benefits of the library. Listed below are the steps to consider after accessing the form you need:

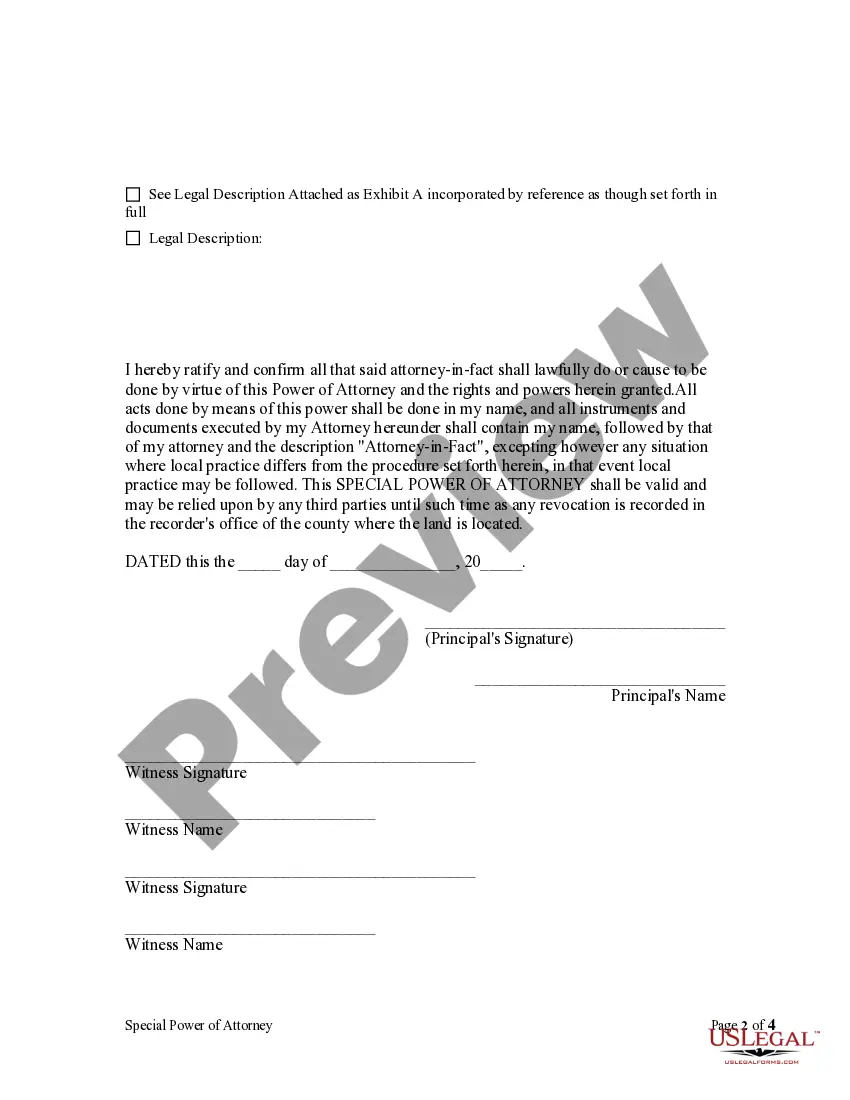

- Verify this is the right form by previewing it and reading its information.

- Be sure that the sample is recognized in your state or county.

- Choose Buy Now when you are ready.

- Select a subscription plan.

- Pick the formatting you need, and Download, complete, eSign, print and deliver your papers.

Enjoy the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Transform your day-to-day papers management into a smooth and easy-to-use process today.

Form popularity

FAQ

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

» California Real Estate Withholding is prepayment of estimated income tax due the State of California on gain from the sale of California real property. If the amount withheld is more than the income tax liability, the state will refund the difference when you file a tax return for the taxable year.

Bonuses and other payments of employee compensation made separately from regular payroll payments are subject to Michigan income tax withholding. The withholding amount equals the payment amount multiplied by 4.25 percent (0.0425). Do not make any adjustment for exemptions.

Any person who withheld on the sale or transfer of California real property during the calendar month must file Form 593 to report, and Form 593-V to remit the amount withheld. Normally, this will be the title company, escrow company, intermediary, or accommodator.

With tax return: Make check payable to the ?State of Michigan?. Carefully write the business tax account number, ?SUW?, and the return period on the memo line of the check. Send with the tax return to the address listed on the return form.