Formswift Promissory Note

Description

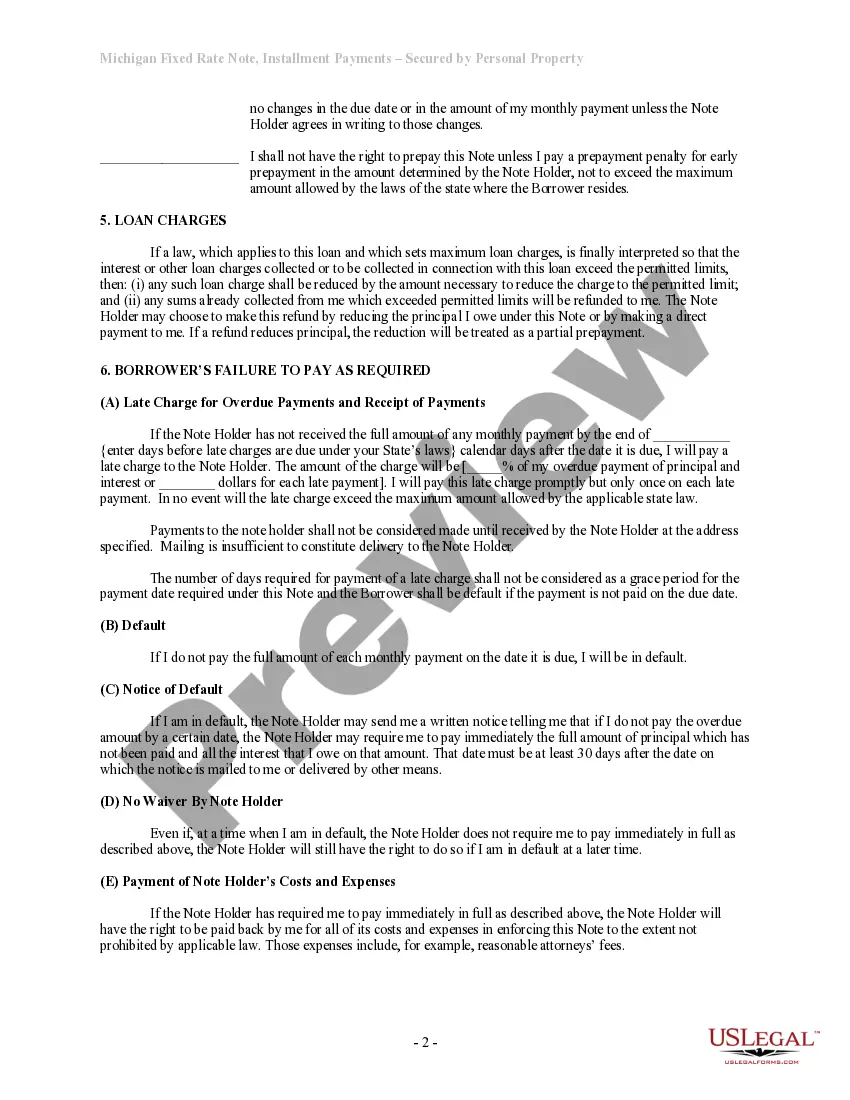

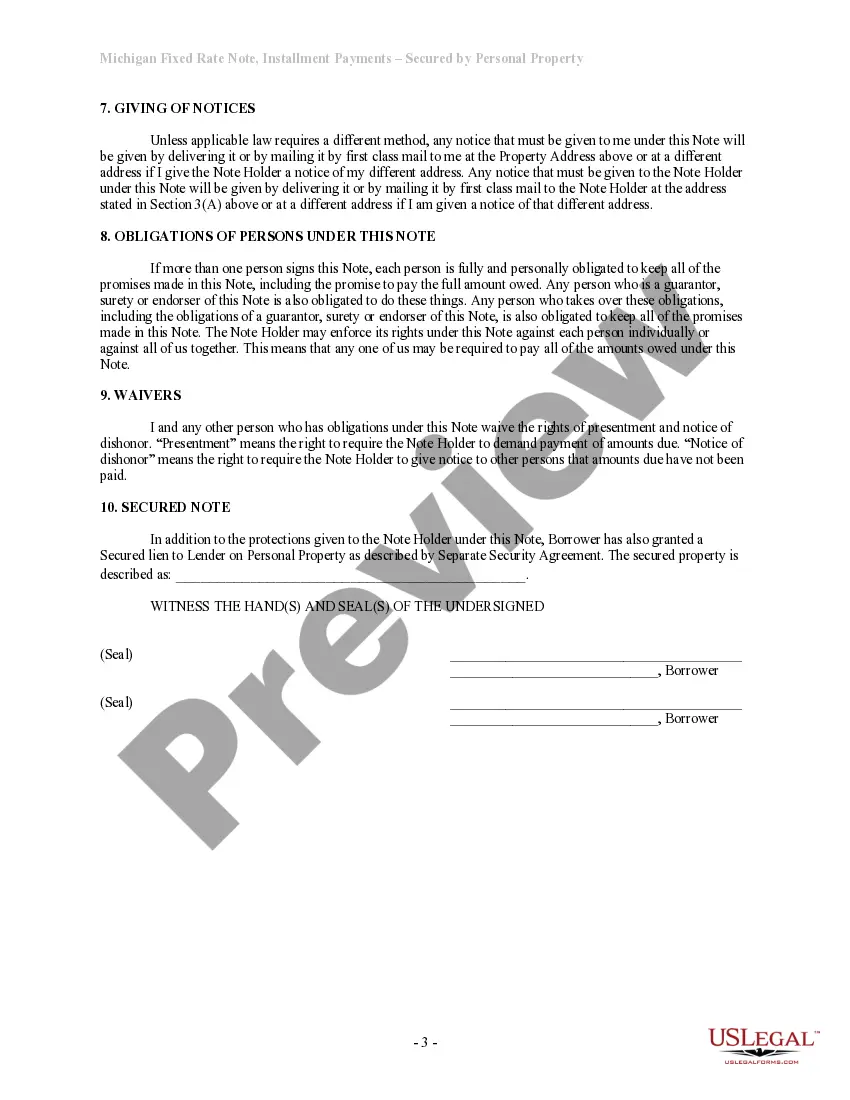

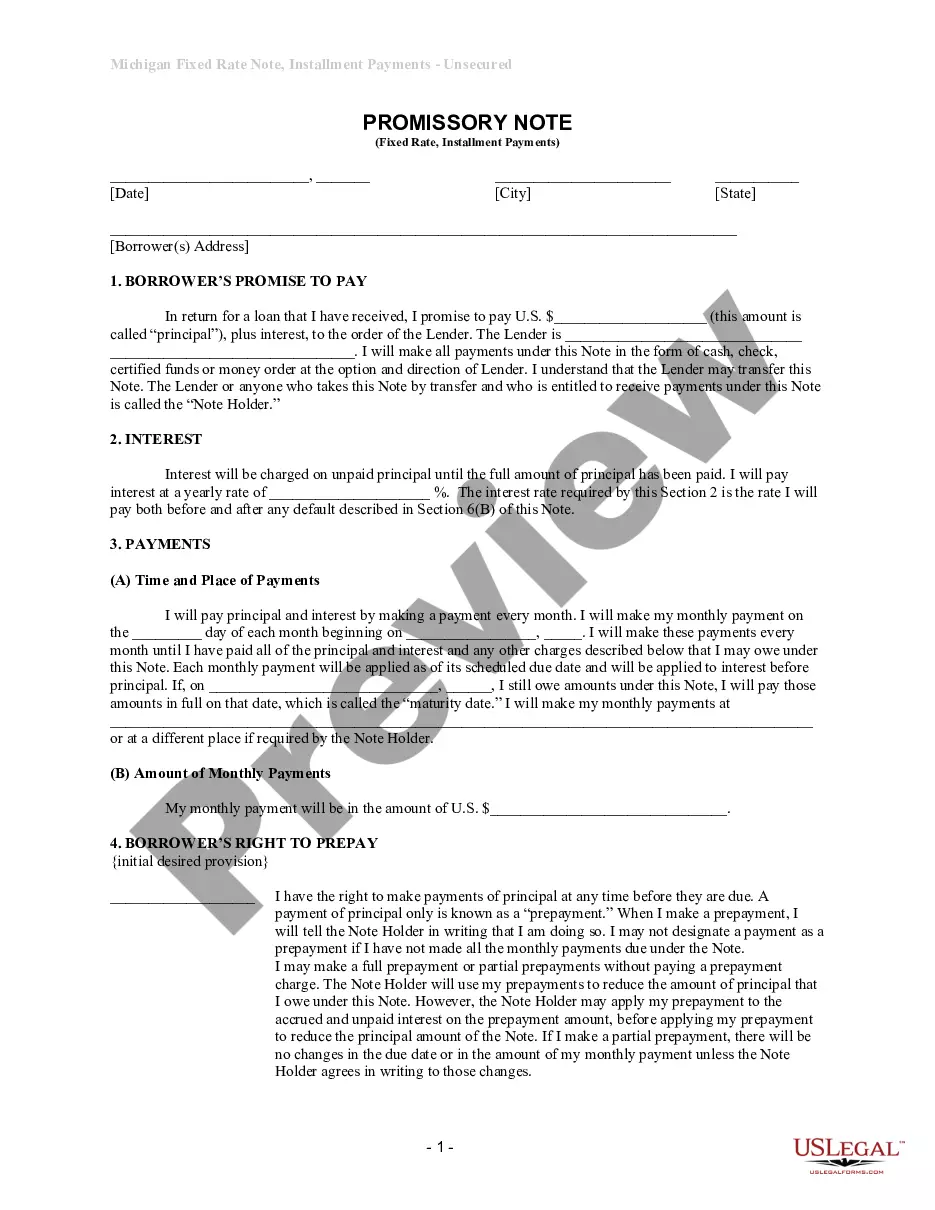

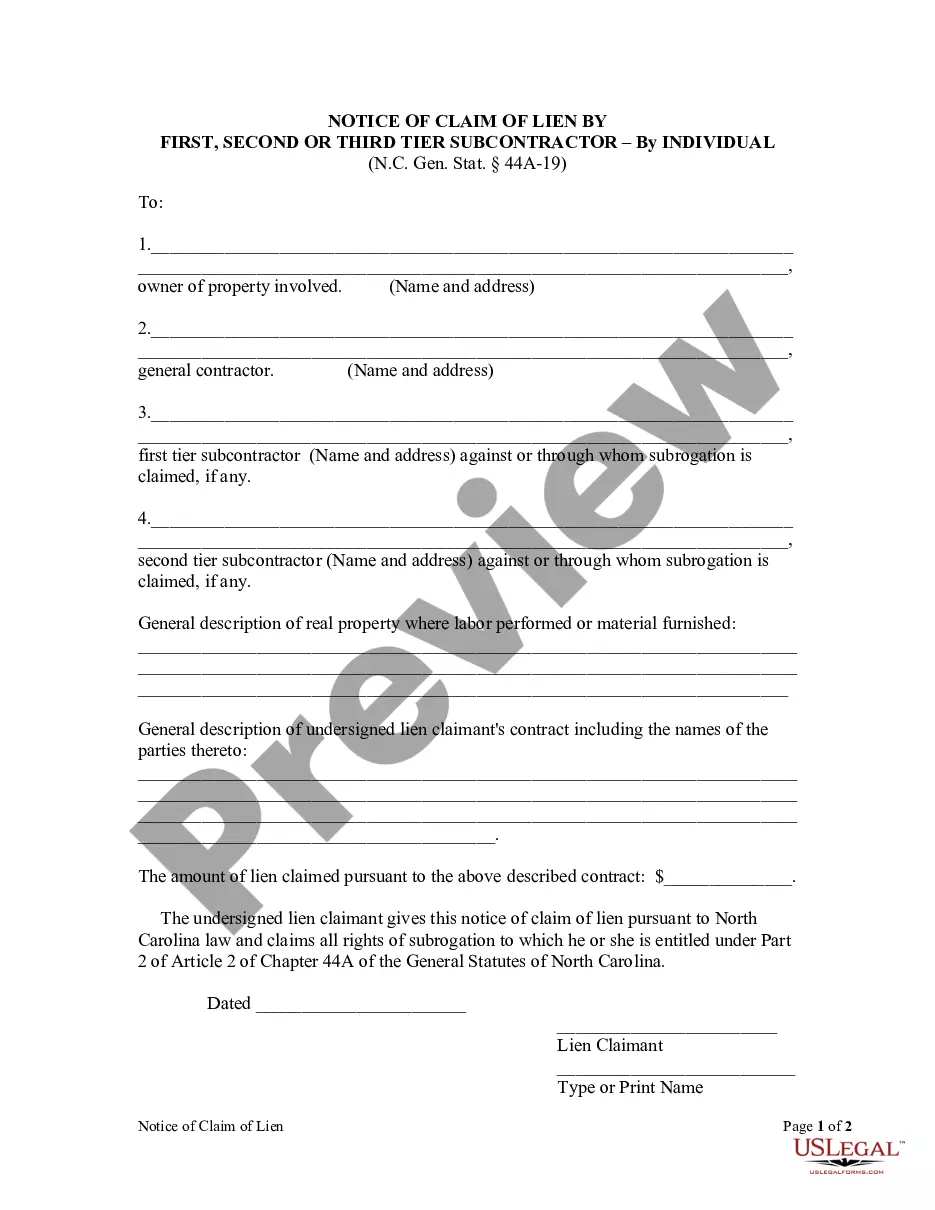

How to fill out Michigan Installments Fixed Rate Promissory Note Secured By Personal Property?

When you are required to complete the Formswift Promissory Note that adheres to your local state's laws and regulations, there may be several options available. If you are a subscriber to US Legal Forms, there is no need to review every document to verify that it fulfills all legal requirements.

It is a reliable resource that can assist you in acquiring a reusable and current template on any topic. US Legal Forms boasts the most comprehensive online library, featuring over 85,000 ready-to-use documents for both business and personal legal matters.

All templates are confirmed to align with the laws and regulations of each state. Consequently, when you download the Formswift Promissory Note from our platform, you can rest assured that you have a legitimate and current document.

Choose the most fitting subscription plan, Log In to your account, or create a new one. Pay for a subscription (PayPal and credit card options are available). Download the sample in your chosen file format (PDF or DOCX). Print the document or fill it out electronically via an online editor. Securing professionally crafted official documents becomes simple with US Legal Forms. Furthermore, Premium users can benefit from the robust integrated solutions for online PDF editing and signing. Try it out today!

- Obtaining the required sample from our platform is remarkably simple.

- If you already possess an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can navigate to the My documents tab in your profile to access the Formswift Promissory Note at any time.

- If it is your first time using our website, kindly follow the instructions below.

- Explore the suggested page and verify it meets your requirements.

- Utilize the Preview mode to review the form description if it is available.

- Search for another sample using the Search field in the header if necessary.

- Click Buy Now once you locate the suitable Formswift Promissory Note.

Form popularity

FAQ

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.