Amendment Tradução

Description

How to fill out Michigan Amendment To Living Trust?

- Log in to your account if you're a returning user. Ensure your subscription is active, or renew it according to your payment plan.

- If you're new to the service, start by checking the Preview mode and the form description to choose the correct document that meets your jurisdiction's requirements.

- If you need to find a different form, utilize the Search tab to locate the appropriate template that fits your needs.

- Once you’ve selected the desired document, click the Buy Now button and choose your subscription plan, which requires account registration.

- Complete your purchase by entering your payment details, either credit card or PayPal, to finalize the transaction.

- Download your form to your device, allowing you access from the My Forms menu whenever you need to edit or complete the document.

In conclusion, US Legal Forms offers an extensive collection of documents that empower users to create legal forms confidently. By following these steps, you can access the resources you need quickly and efficiently.

Start your journey to easy legal document creation – visit US Legal Forms today!

Form popularity

FAQ

To file your own amendment, begin by completing Form 1040-X, which is specifically designed for this purpose. Make sure to include any supporting documents and explanations for the changes you are making. It's advisable to review IRS guidelines thoroughly to ensure you meet all requirements. Platforms like uslegalforms provide step-by-step assistance on completing the amendment tradução effectively.

Filing an amendment does not automatically trigger an audit; however, certain red flags might increase your chances. For instance, claiming an excessively high deduction or changing your income could draw more scrutiny. It's important to be honest and accurate when amending your return. Utilizing resources like uslegalforms can provide you with tips to ensure your amendment tradução does not raise unnecessary alarms.

To amend a document, you typically need to draft a new version that incorporates the changes, clearly marking amendments. Ensure that all parties involved agree to the revised document. It’s essential to retain a copy of the original document alongside the amendment for your records. Uslegalforms can assist you with templates and guidance specifically designed for the amendment tradução process.

Absolutely, you can file an amendment yourself. The IRS provides necessary forms and detailed instructions for individuals who wish to complete this process independently. Though it can be straightforward, using platforms like uslegalforms ensures accuracy and helps simplify the amendment tradução to your document. They provide user-friendly solutions and resources tailored to your needs.

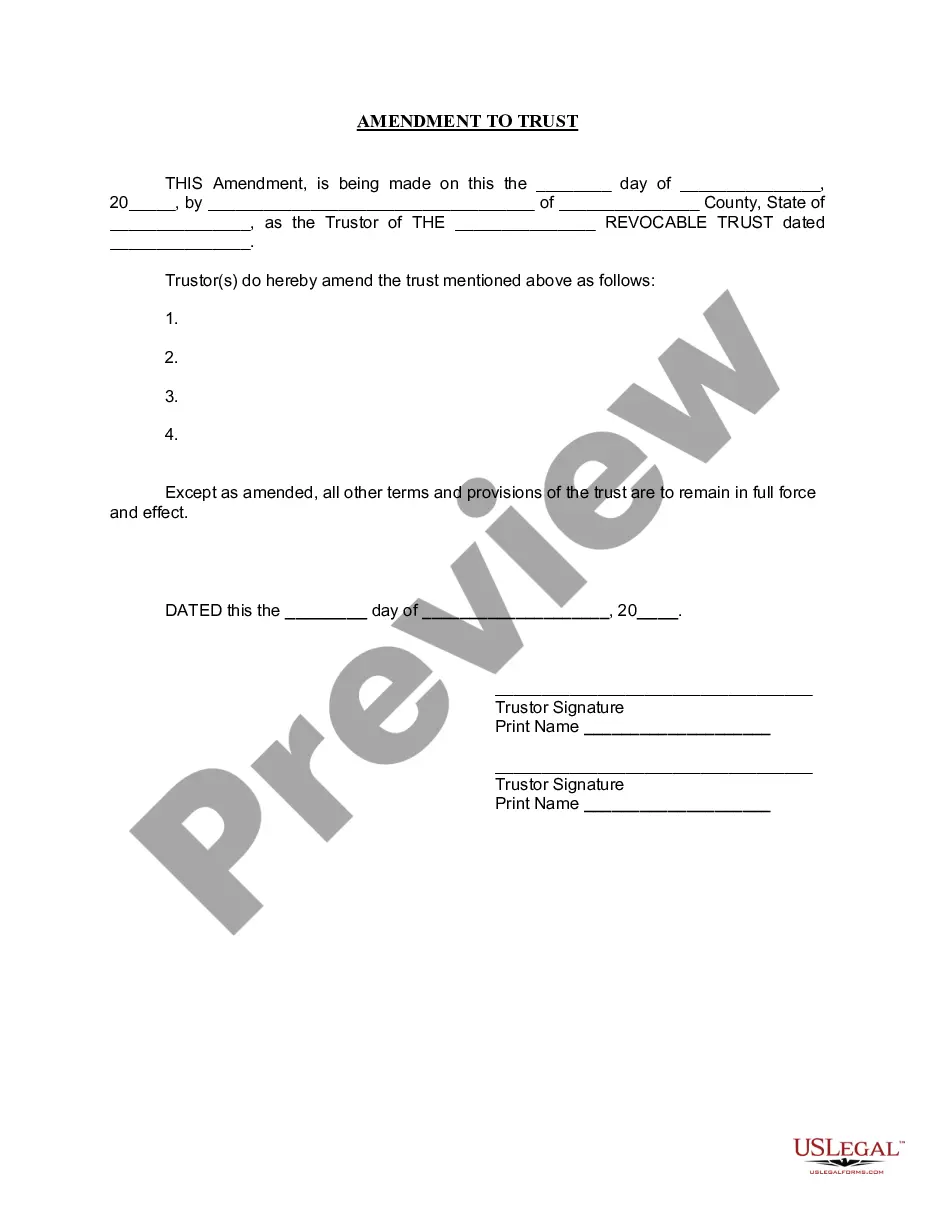

Writing an amendment to a document requires you to clearly state the modifications you want to make. Start with a title that indicates it is an amendment, then specify the sections or clauses being changed. Finally, ensure that all parties involved understand and agree to the amendment, preferably through signatures. For a formal approach, consider using templates from US Legal Forms to ensure accuracy.

The easiest way to amend a tax return is to use tax software that includes the amendment process, like TaxAct. This software will guide you through the necessary steps and calculations. Alternatively, you can consult professionals who specialize in tax amendments to assist you, ensuring the Amendment tradução is correctly applied throughout the process.

To file an amendment to the Tax Act, you need to submit Form 1040X, which is designed for this purpose. Make sure to explain the reasons for the amendments clearly in the form. After completing the form, send it to the address specified for your state. If you are unsure, platforms like US Legal Forms can provide resources and assistance for a successful filing.

Generally, there is no penalty for simply filing an amended tax return if you are correcting your previous mistakes. However, if your amendment results in additional taxes owed, you may incur interest on the unpaid balance. To avoid complications, it is wise to assess your situation carefully and act promptly. Using Amendment tradução can also guide you to ensure all steps are effectively handled.

If TaxAct made a mistake in your tax return, you should first verify the error before making any changes. Once you have confirmed the mistake, you can file an amended tax return to correct it. Utilizing the Amendment tradução process will help you make the necessary adjustments without complications. Always keep copies of any documents and communications related to the correction.

Filling out articles of amendment requires you to provide specific details about your business entity. You need to include the name of your business, the type of legal entity, and the changes you are making. Additionally, ensure you check the state requirements since they can vary. For a streamlined process, you can use platforms like US Legal Forms to access templates that simplify this task.