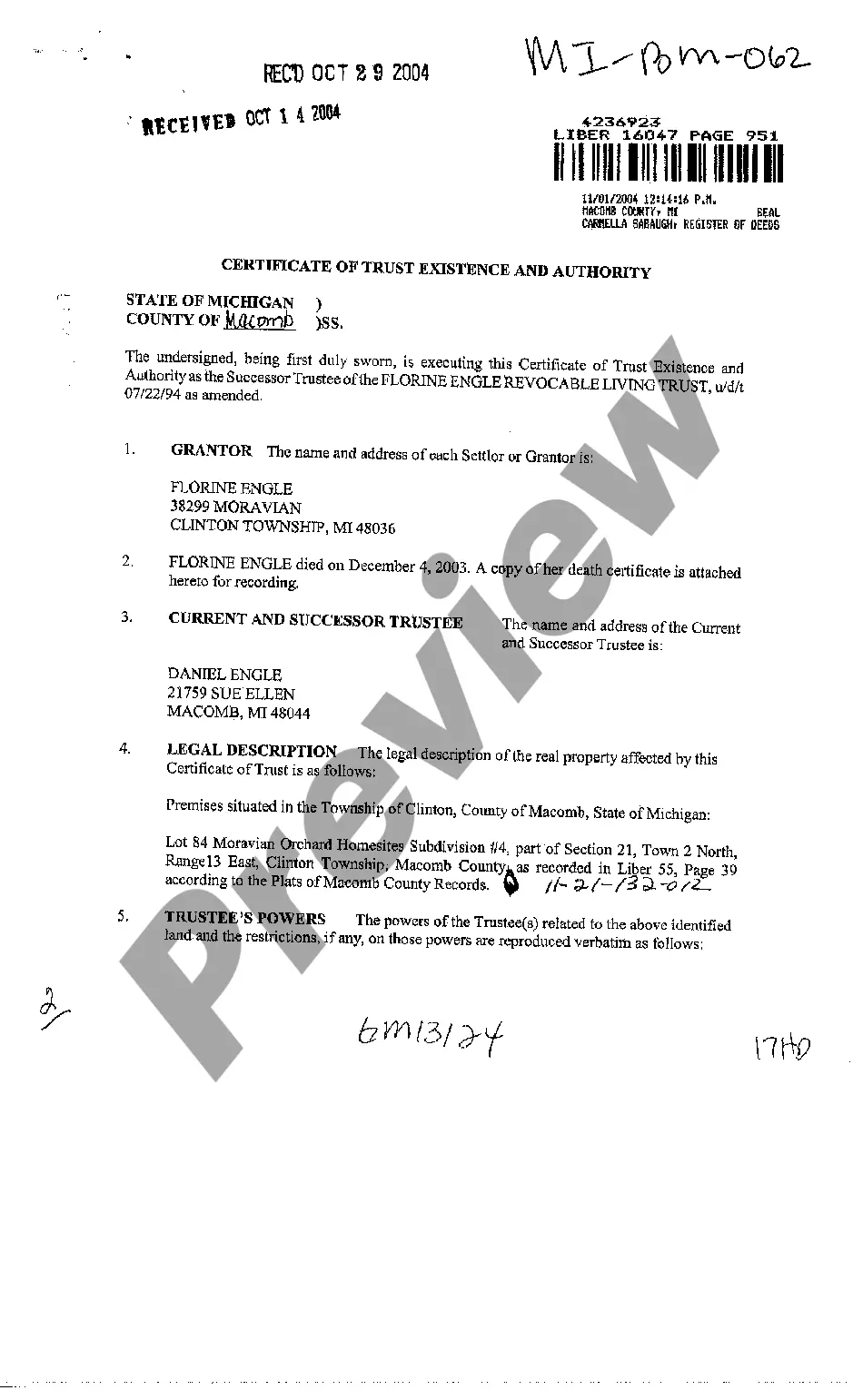

Certificate Of Trust In Michigan

Description

Form popularity

FAQ

One significant mistake parents make when setting up a trust fund is failing to properly fund the trust. It is crucial to transfer assets into the trust to ensure that they are managed according to your wishes. Additionally, using tools available on uslegalforms can help avoid these mistakes and streamline the setup process.

No, a trust does not go through probate in Michigan if it is set up correctly. Assets held in a trust generally transfer directly to beneficiaries without needing probate court involvement. This can save time and reduce costs, making trusts an appealing option for estate planning.

In Michigan, a trust does not typically need to be filed with the court unless it is being probated or if specific legal actions require court oversight. Since many trusts remain private, filing them is usually a personal choice. Using platforms like uslegalforms can help you navigate when and if court filing is necessary.

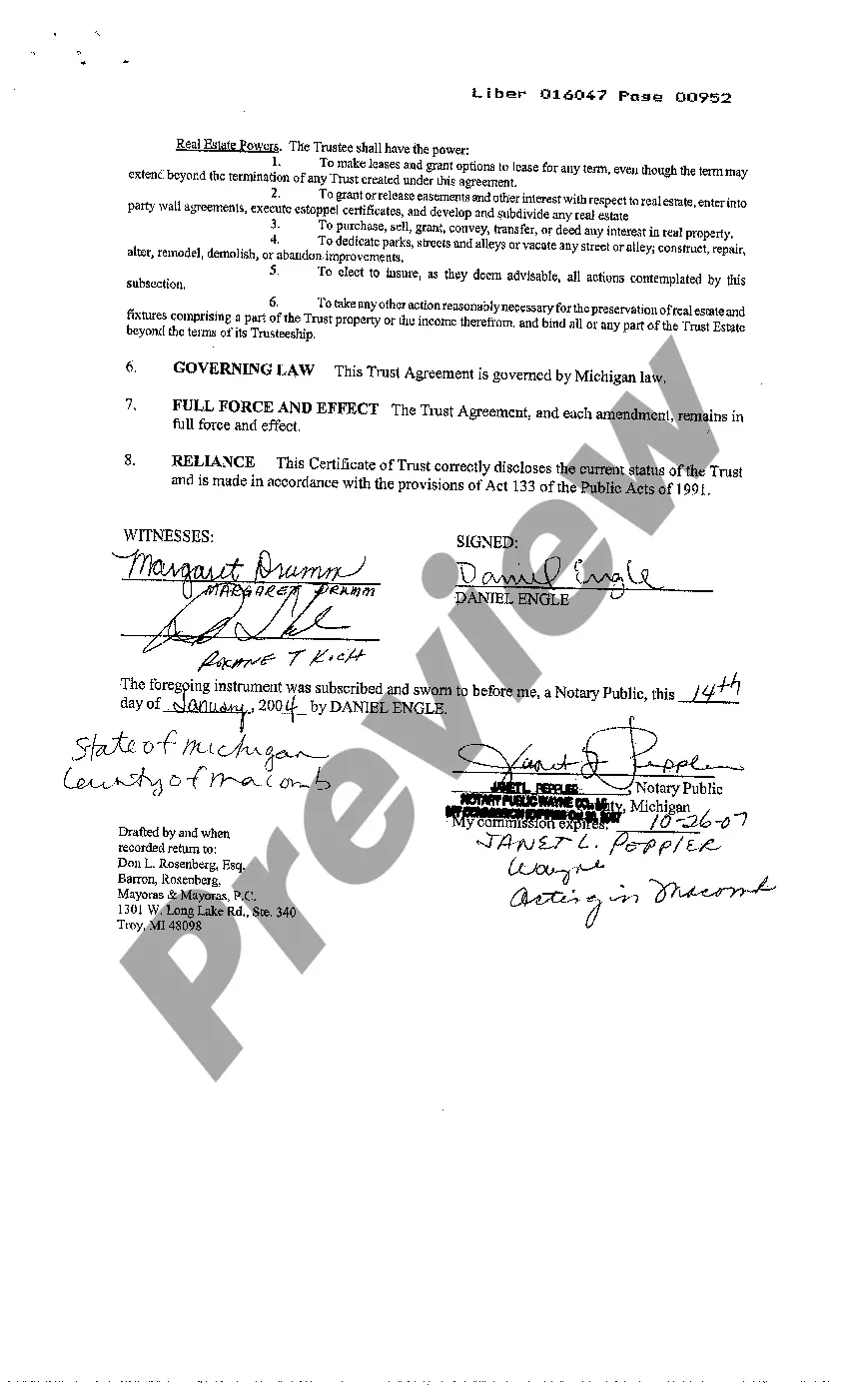

No, a trust does not have to be recorded in Michigan. This is particularly true for revocable living trusts, which typically remain private. However, if the trust involves real property, some documents may need to be filed to protect the interests in those assets.

In Michigan, a certificate of trust does not need to be recorded by law. However, recording it may simplify transactions and provide assurance to third parties dealing with the trust. It is often beneficial to have it on record to establish authority when managing trust assets.

You file a trust in Michigan at the county clerk's office in the county where the trustor resides. If you are dealing with real estate, you may also need to file additional documents at the local register of deeds. Through uslegalforms, you can find the right documentation to ensure your trust is filed correctly and efficiently.

To record a certificate of trust in Michigan, you should prepare the document with the necessary details regarding the trust and its terms. Then, bring it to the local county clerk's office where you will file it. Recording your certificate of trust helps provide public notice of the trust’s existence and its provisions.

You can obtain a certification of trust from the trustee who manages the trust. If needed, you may also consult an attorney to assist in drafting this document. For convenience, using platforms like USLegalForms can simplify the process of obtaining a certification of trust in Michigan, providing you with templates and support for accurate completion.

Usually, the trustee or the attorney who established the trust prepares the certification of trust. This individual understands the trust’s stipulations and can succinctly summarize its essential elements. Engaging a knowledgeable professional ensures your certification of trust meets legal requirements and effectively represents the certificate of trust in Michigan.

To acquire a certificate of trust, you typically need to work with the trustee who can prepare this document. They will provide the necessary details and ensure it aligns with the original trust agreement. Consider leveraging services like USLegalForms, which offer templates and guidance to help you create a valid certificate of trust in Michigan, ensuring compliance with local laws.