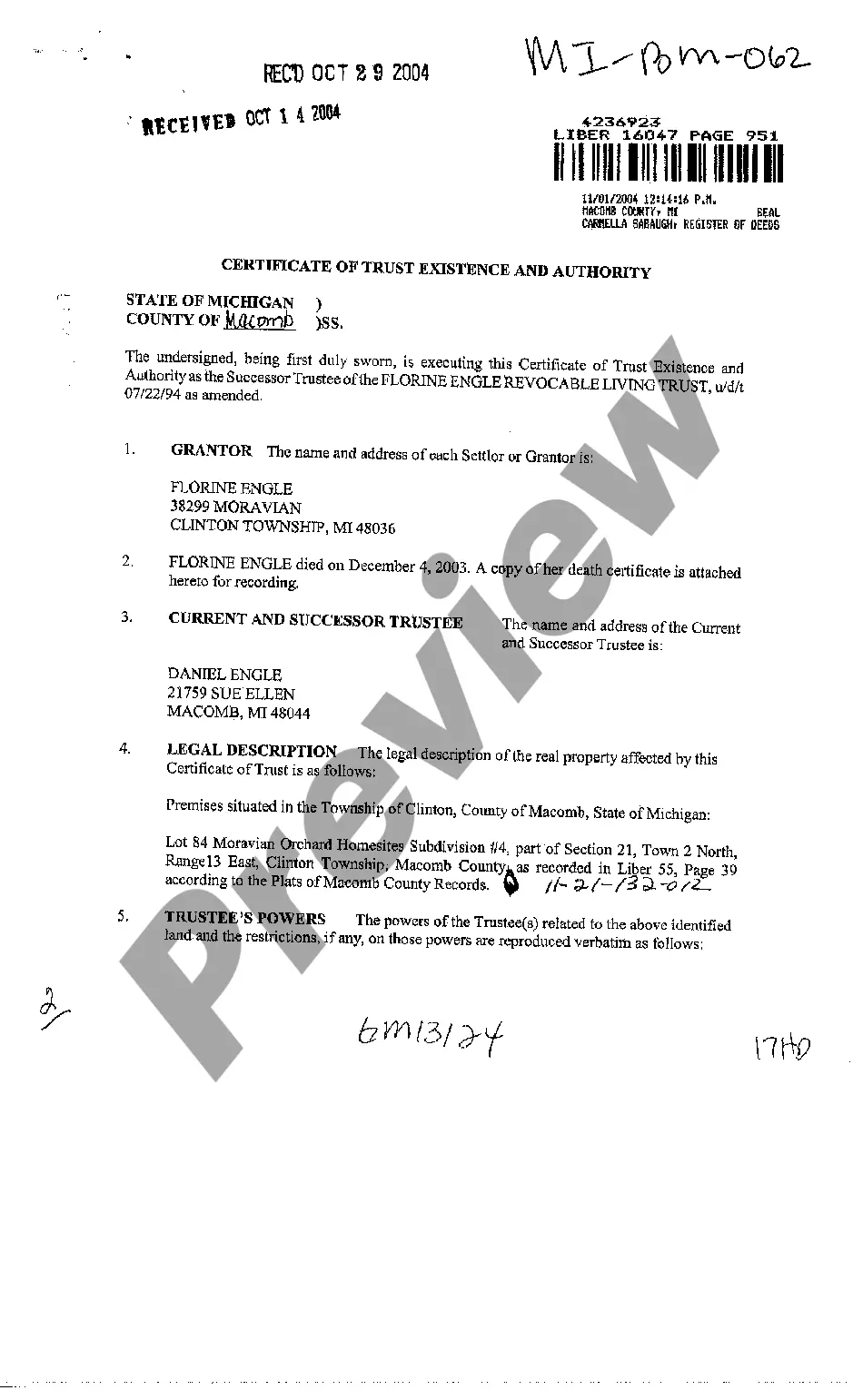

Certificate Of Trust Existence And Authority Michigan Withholding

Description

How to fill out Michigan Certificate Of Trust Existence And Authority?

Acquiring legal templates that comply with federal and local regulations is crucial, and the internet presents numerous choices to select from.

But why squander time searching for the appropriate Certificate Of Trust Existence And Authority Michigan Withholding template online when the US Legal Forms digital library already has such documents gathered in one convenient location.

US Legal Forms is the largest online legal repository with over 85,000 fillable documents drafted by attorneys for any professional and personal scenario.

Review the template using the Preview feature or through the text outline to verify it suits your requirements.

- They are simple to navigate with all files organized by state and intended use.

- Our experts stay current with legislative updates, ensuring your documentation is always up to date and compliant when obtaining a Certificate Of Trust Existence And Authority Michigan Withholding from our platform.

- Acquiring a Certificate Of Trust Existence And Authority Michigan Withholding is straightforward and fast for both existing and new clients.

- If you already possess an account with an active subscription, Log In and download the required document sample in the desired format.

- If you are new to our site, follow the instructions below.

Form popularity

FAQ

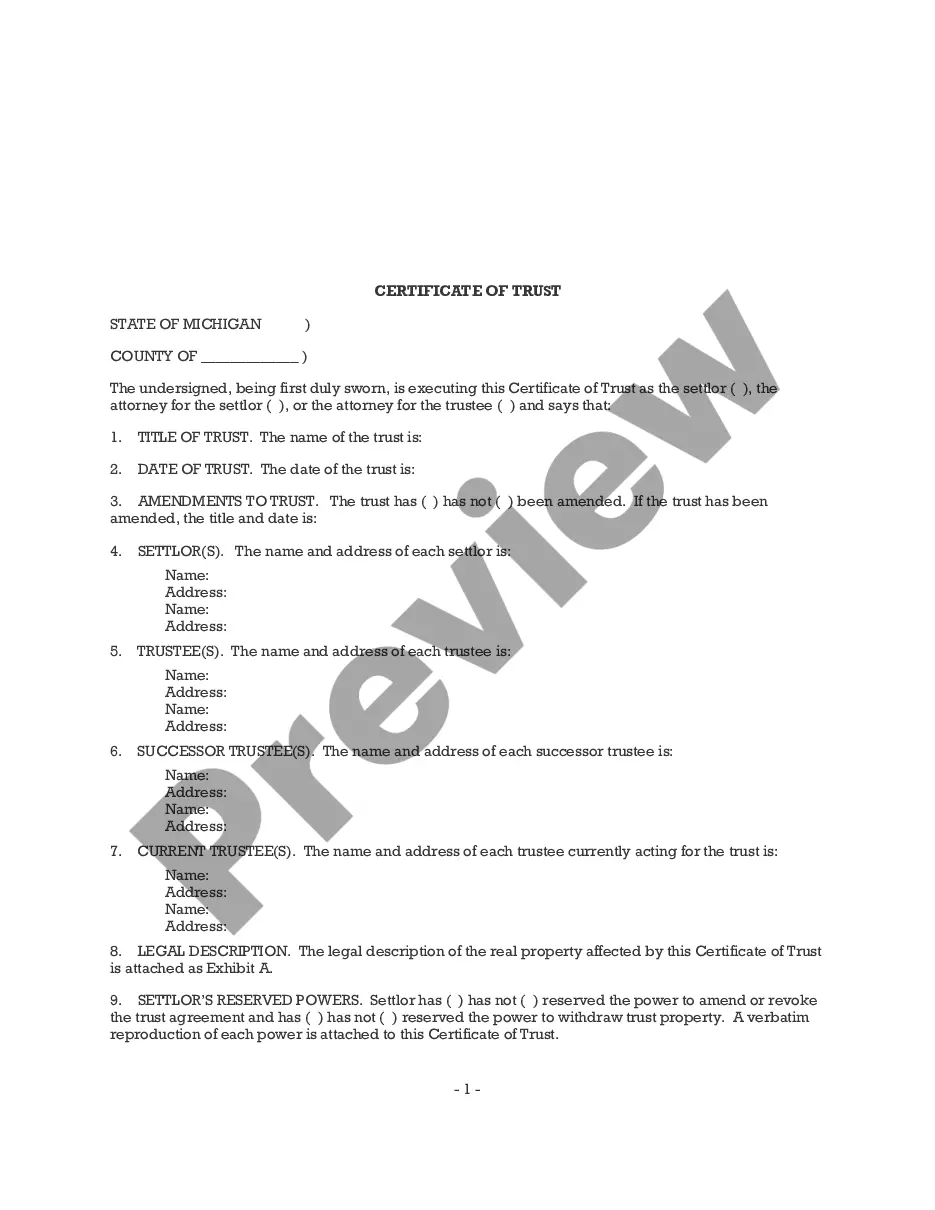

(2) A certificate of trust may be signed or otherwise authenticated by the settlor, any trustee, or an attorney for the settlor or trustee. The certificate must be in the form of an affidavit.

As per federal law, employers have to withhold 4.25% of the gross salary of all the employees working under them in Michigan.

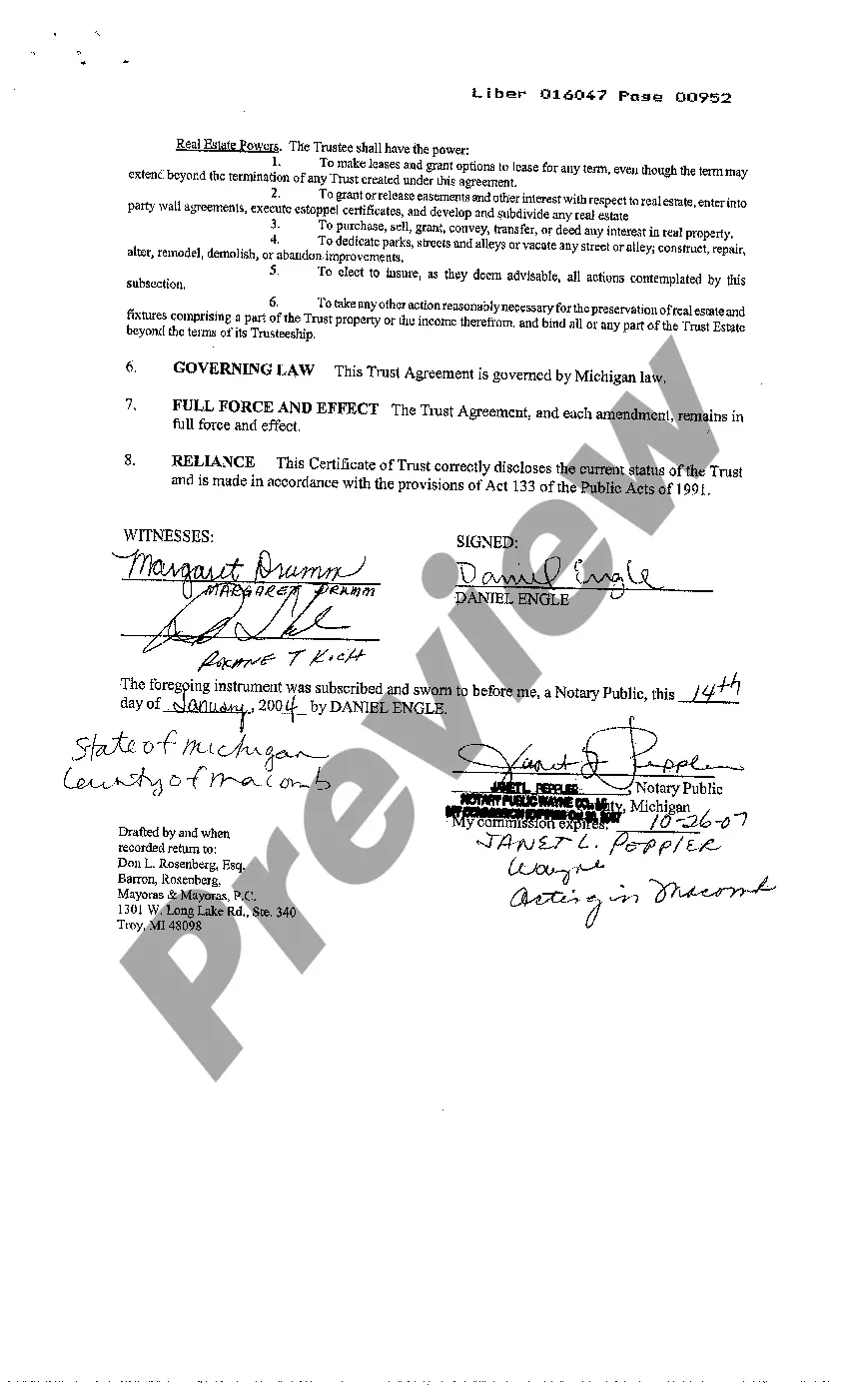

Pursuant to the current law, a certificate of trust must include: The name of the trust, the date of the trust, and the date of each operative trust instrument. The name and address of each current trustee. The powers of the trustee relating to the purposes for which the certificate of trust is offered.

Every employer must obtain a Withholding Exemption Certificate (Form MI-W4) from each employee. The federal W-4 cannot be used in place of the MI-W4. The exemption amount is $4,750 per year times the number of personal and dependency exemptions allowed under Part 1 of the Michigan Income Tax Act.

What is a Certificate of Trust in Michigan? The name of the trust, the date of the trust, and the date of each operative trust instrument. The name and address of each current trustee. The powers of the trustee relating to the purposes for which the certificate of trust is offered.