Release Of Lien Michigan Withholding Tax

Description

How to fill out Michigan Order For Release Of Lien?

Whether for commercial objectives or personal issues, everyone eventually encounters legal situations in their lifetime.

Completing legal documents requires meticulous consideration, beginning with selecting the appropriate form template. For example, if you select an incorrect version of the Release Of Lien Michigan Withholding Tax, it will be rejected upon submission.

With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the ideal template online. Utilize the library’s easy navigation to find the right document for any situation.

- Obtain the necessary template by utilizing the search bar or catalog browsing.

- Review the form’s details to ensure it fits your circumstances, state, and area.

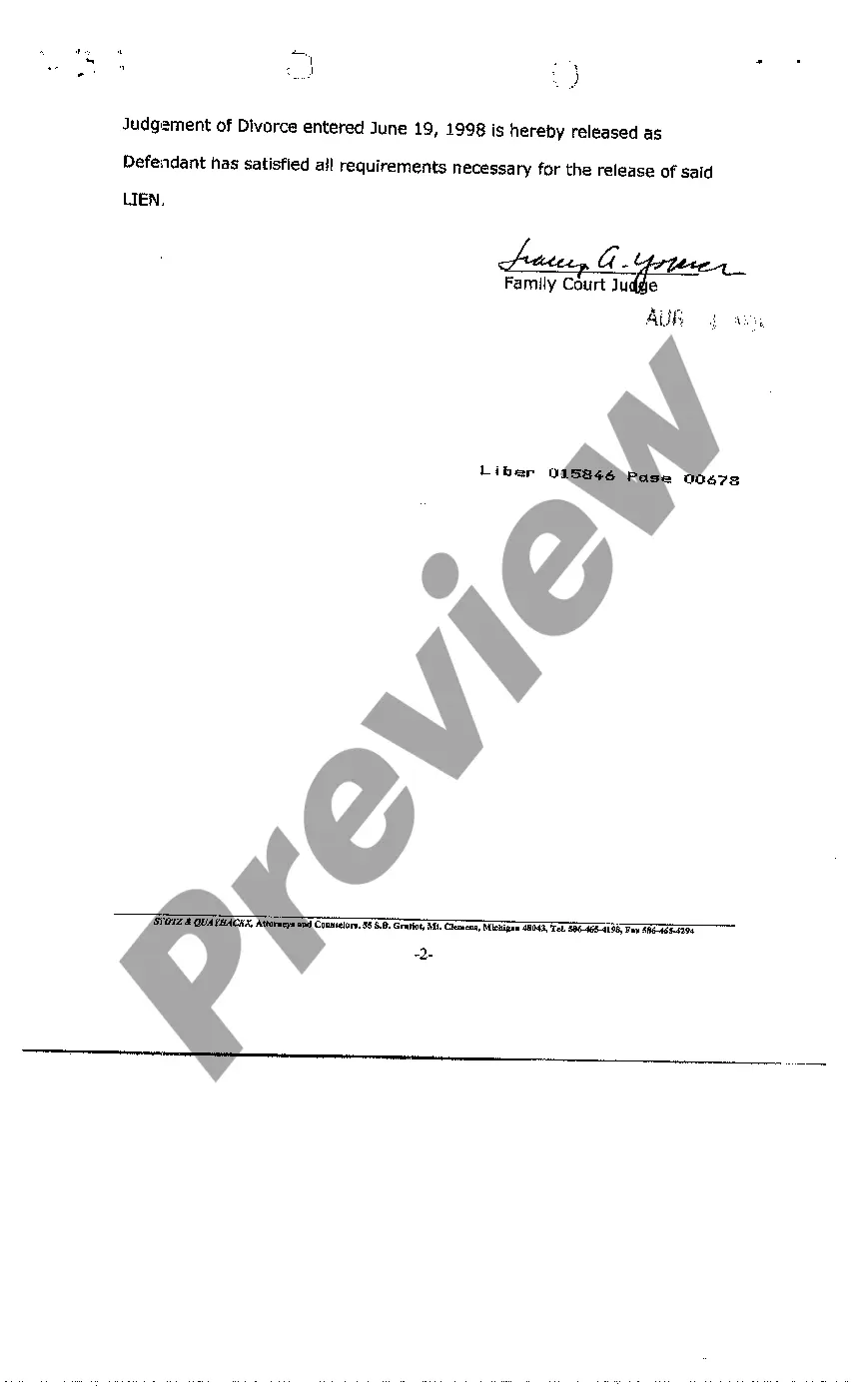

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Release Of Lien Michigan Withholding Tax sample you need.

- Acquire the file when it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you have not created an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the file format you desire and download the Release Of Lien Michigan Withholding Tax.

- After it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Every employer in Michigan who is required to withhold federal income tax under the Internal Revenue Code, must also be registered for and withhold Michigan income tax.

Complete all sections that apply. Changes provided on this form may also be completed electronically at mto.treasury.michigan.gov. If using this form, sign and mail to: Michigan Department of Treasury, Registration Section, PO Box 30778, Lansing MI 48909.

With tax return: Make check payable to the ?State of Michigan?. Carefully write the business tax account number, ?SUW?, and the return period on the memo line of the check. Send with the tax return to the address listed on the return form.

This is the Maine form for keeping your address confidential when filing for a Protection from Abuse order. Use this form if you don't want the abuser to know your address.