Limited/u

Description

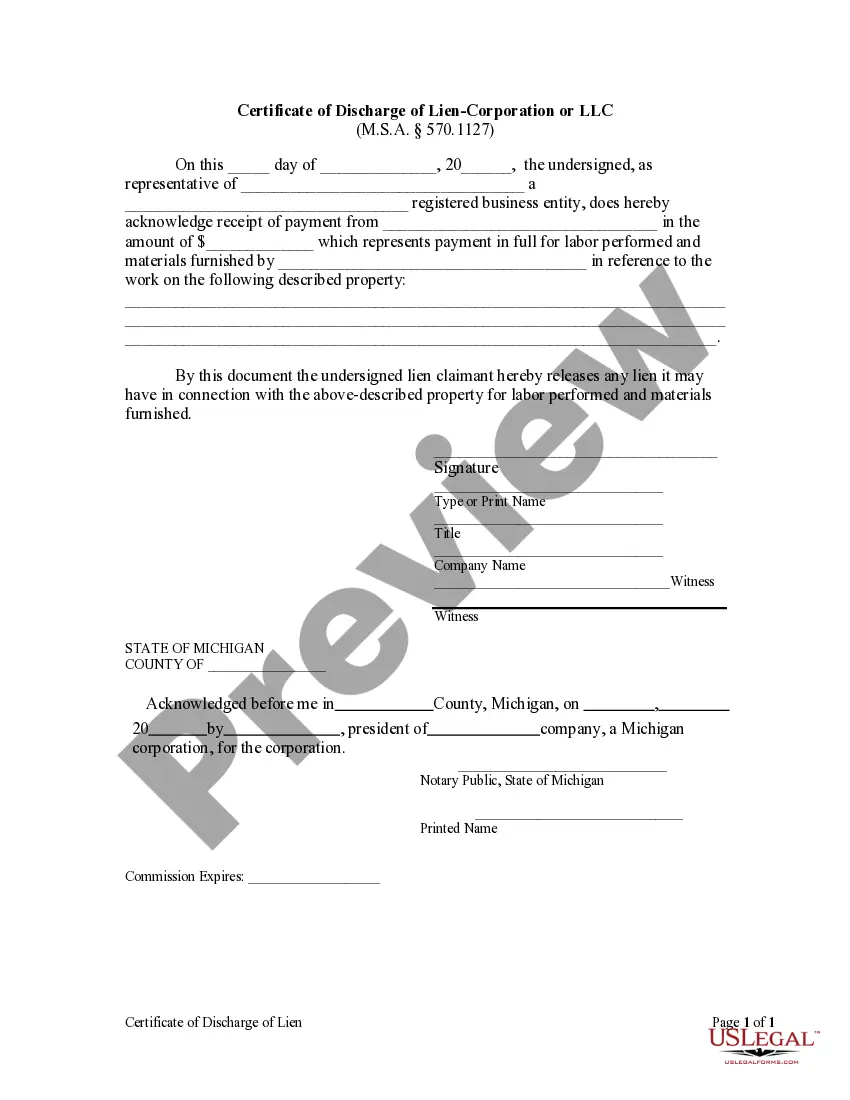

How to fill out Michigan Certificate Of Discharge Of Lien - Corporation Or LLC?

- If you're a returning user, simply log into your account and download the desired form by hitting the Download button. Ensure your subscription is active; if not, update it based on your payment plan.

- For first-time users, start by browsing the Preview mode and reading the description of the forms. Confirm that you select one that fits your needs and complies with local jurisdiction requirements.

- If you encounter any discrepancies, utilize the Search tab to find the correct template. Once you’ve found the right one, continue to the next step.

- Proceed to purchase your document by clicking the Buy Now button. Choose your preferred subscription plan and create an account to unlock access to the complete form library.

- Complete your purchase by providing your payment method—credit card details or your PayPal account.

- Finally, download your form and save it to your device. Access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms offers users a simplified experience with an exceptional selection of legal documents. Enjoy the advantages of prompt access and expert assistance to ensure all your legal needs are seamlessly met.

Start your journey with US Legal Forms today and witness how effortless legal documentation can be!

Form popularity

FAQ

To file a disregarded entity, which is often an LLC with a single owner, you will report your business income and expenses on your personal tax return using Schedule C. This approach keeps the process straightforward since there is no separate federal tax form for the LLC itself. If you're unsure about the process, consider leveraging uslegalforms for clear instructions and support.

You can file your Limited/u separately from other business interests or affiliations. This can help you keep finances distinct and simplify tax preparation. It's important, however, to ensure that you are complying with all filing requirements specific to the LLC. Utilizing platforms like uslegalforms can be a great resource for precise guidance.

member Limited/u files taxes through a process known as passthrough taxation. This means that profits and losses are reported directly on your personal tax return, simplifying the process for you. While this method is straightforward, it’s advisable to consult a tax professional to ensure you are meeting all legal obligations and benefiting from available deductions.

You can file for a Limited/u on your own without needing legal assistance. However, navigating the paperwork can be tricky, and you might miss essential steps. Therefore, using tools like uslegalforms can simplify the filing process, ensuring you fulfill all necessary requirements efficiently and correctly.

Yes, you can form a Limited/u and let it sit inactive. However, it's crucial to remember that you still have to comply with ongoing requirements, such as filing annual reports and paying any associated fees. This means you cannot simply ignore your LLC, as maintaining its good standing requires some effort. Consider using uslegalforms to manage these responsibilities effectively.

If you neglect to file taxes for your Limited/u, you may face penalties from the IRS and state authorities. This can include fines and interest on unpaid taxes, as well as the potential for your LLC to lose its good standing. To prevent these issues, it's important to stay organized and file your taxes on time. Using platforms like uslegalforms can help you remain compliant and informed.

A Limited/u has some drawbacks, including the potential for increased paperwork and compliance requirements. This can make maintenance more complex compared to other business structures. Additionally, LLCs may face self-employment taxes on their profits, which can impact your overall tax burden. It’s essential to weigh these factors when deciding if a Limited/u is right for you.

The best person to be your power of attorney is someone who knows you well and understands your wishes. This might be a trusted family member, friend, or even a financial advisor. It’s crucial that they possess the ability to make decisions that align with your values, particularly when operating under a limited power of attorney which may have specific guidelines.

To fill out a W-9 for a disregarded entity, provide the name of the individual or business that owns the entity on the first line. Next, enter the disregarded entity’s name in the 'Business Name' section, if applicable. You will also need to include the taxpayer identification number of the individual owner, since it is treated as such for tax purposes. Resources like U.S. Legal Forms can guide you through this process efficiently.

Having more than one person as power of attorney can provide added support and shared responsibility. This arrangement can be particularly beneficial in complex situations, as multiple agents can offer diverse perspectives and expertise. Furthermore, if one agent is unavailable or unable to act, the other can step in, ensuring that your interests are consistently represented with a limited power of attorney.