Limited Lliability

Description

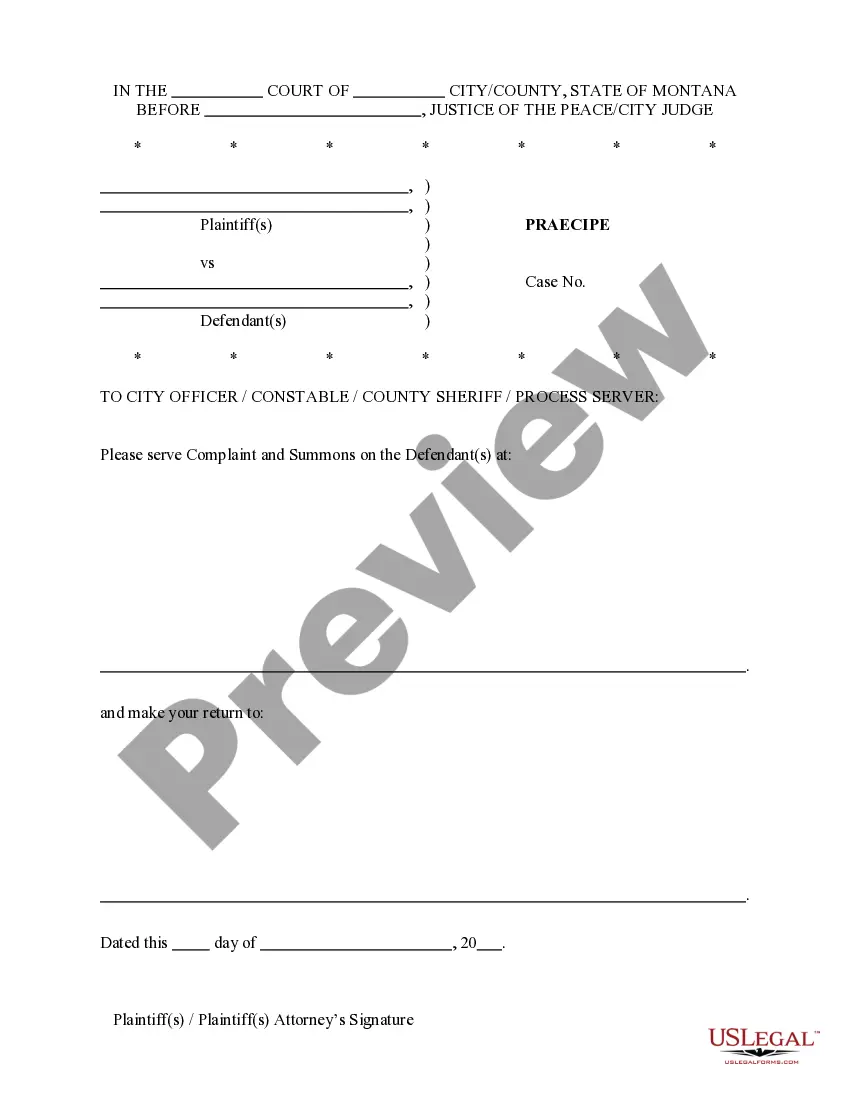

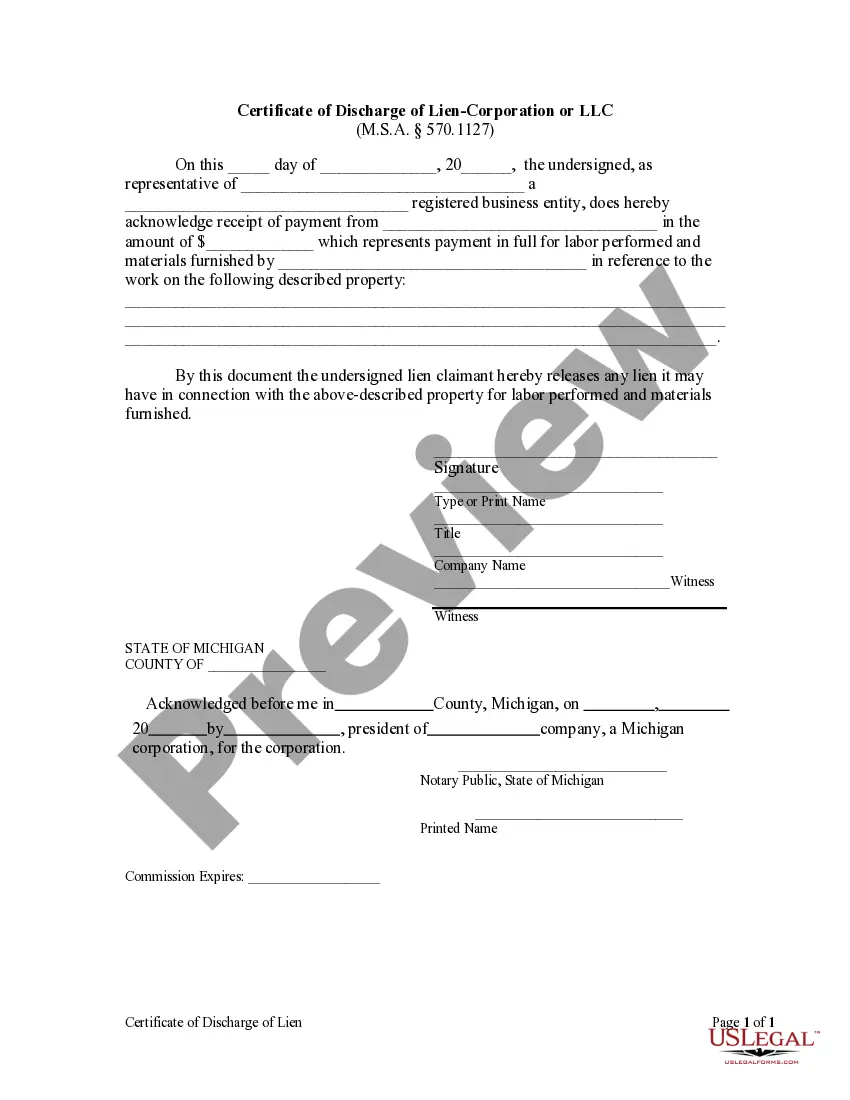

How to fill out Michigan Certificate Of Discharge Of Lien - Corporation Or LLC?

- If you are a returning user, log in to your account and choose the required limited liability template. Ensure your subscription is current; renew if necessary.

- For first-time users, begin by viewing the preview and description of the form. Confirm it meets your needs and adheres to your local legal standards.

- If adjustments are needed, utilize the search bar to find additional templates that might fit your criteria better.

- Proceed to purchase your selected document by clicking the 'Buy Now' button and choosing your preferred subscription plan. You will need to create an account to access more resources.

- Finalize your transaction by entering your payment information via credit card or PayPal.

- Once your purchase is confirmed, download the form directly to your device for easy access. You can revisit it anytime in the My Forms section of your account.

By following these steps, you can efficiently access a vast array of legal forms, including those related to limited liability, from US Legal Forms.

Don’t hesitate to explore our library today and take control of your legal needs!

Form popularity

FAQ

Yes, you can file your LLC separately if it has multiple members. In this case, your limited liability company would file Form 1065 and issue K-1 forms to each member. This allows each member to report their share of the income on their personal tax returns. For single-member LLCs, a separate filing isn't necessary, as income is reported directly on your personal return.

The specific tax form a limited liability company needs to file depends on its structure. For single-member LLCs, Form 1040 with Schedule C is typically used to report income. Multi-member LLCs usually file Form 1065 to report business income and losses, with members receiving a Schedule K-1. Understanding your filing requirements is important for maintaining the limited liability of your business.

A single member LLC generally files taxes as a disregarded entity, meaning it does not file a separate tax return. Instead, you will report business income and expenses directly on your personal tax return using Schedule C. This simplified process allows you to retain the benefits of limited liability while managing your tax obligations efficiently. Engaging with a tax professional can ensure you're taking advantage of any available deductions.

Not filing taxes for your LLC can lead to serious consequences, including the loss of your limited liability protection. The IRS and state authorities may impose penalties and interest on unpaid taxes, which can accumulate quickly. Additionally, your LLC might face administrative dissolution if it fails to comply with state filing requirements. It's essential to stay on top of your tax responsibilities to avoid these issues.

Yes, you can have an LLC and not actively conduct business. However, it is important to maintain your limited liability status by filing annual reports and paying any required fees. Failing to stay compliant with state regulations may dissolve your LLC and jeopardize its protections. Using a platform like US Legal Forms can help you manage necessary filings and keep your LLC in good standing.

A single owner LLC typically files taxes as a sole proprietorship. This means you report your business income and expenses using Schedule C of your personal tax return, which simplifies the process. However, it is crucial to maintain separate financial records for your limited liability to ensure you accurately report all income and deductions. Consulting a tax expert can provide clarity on your tax obligations.

Filing your LLC and personal taxes together can depend on your LLC’s structure. For a limited liability company, if you are a single-member LLC, the IRS allows you to report your business income on your personal tax return. However, if your LLC has multiple members, you may need to file a separate business return. It's wise to consult with a tax professional to understand your specific situation.

While an LLC offers limited liability protection, it also comes with some downsides. You may face higher startup costs and annual fees compared to a sole proprietorship. Additionally, maintaining an LLC requires adherence to state regulations and possible filing of reports, which can be time-consuming. However, the benefits of protecting your personal assets often outweigh these drawbacks, especially when you consider the peace of mind that comes with limited liability.

Yes, you can set up an LLC even if you do not have a fully operational business. Many entrepreneurs create an LLC to safeguard their personal assets before they decide to launch their products or services. This approach provides you with limited liability protection right from the beginning, helping you to position yourself as a legitimate business. Using platforms like USLegalForms can guide you through the process seamlessly.

There's no specific income threshold to form an LLC, but it's smart to consider it when you expect to earn a significant profit. Establishing an LLC before you reach a certain income level can protect your personal finances from business obligations. Typically, if you foresee generating revenue or taking on risks, forming an LLC will enhance your limited liability. It's better to be proactive and protect your assets early in your venture.