... Limited

Description

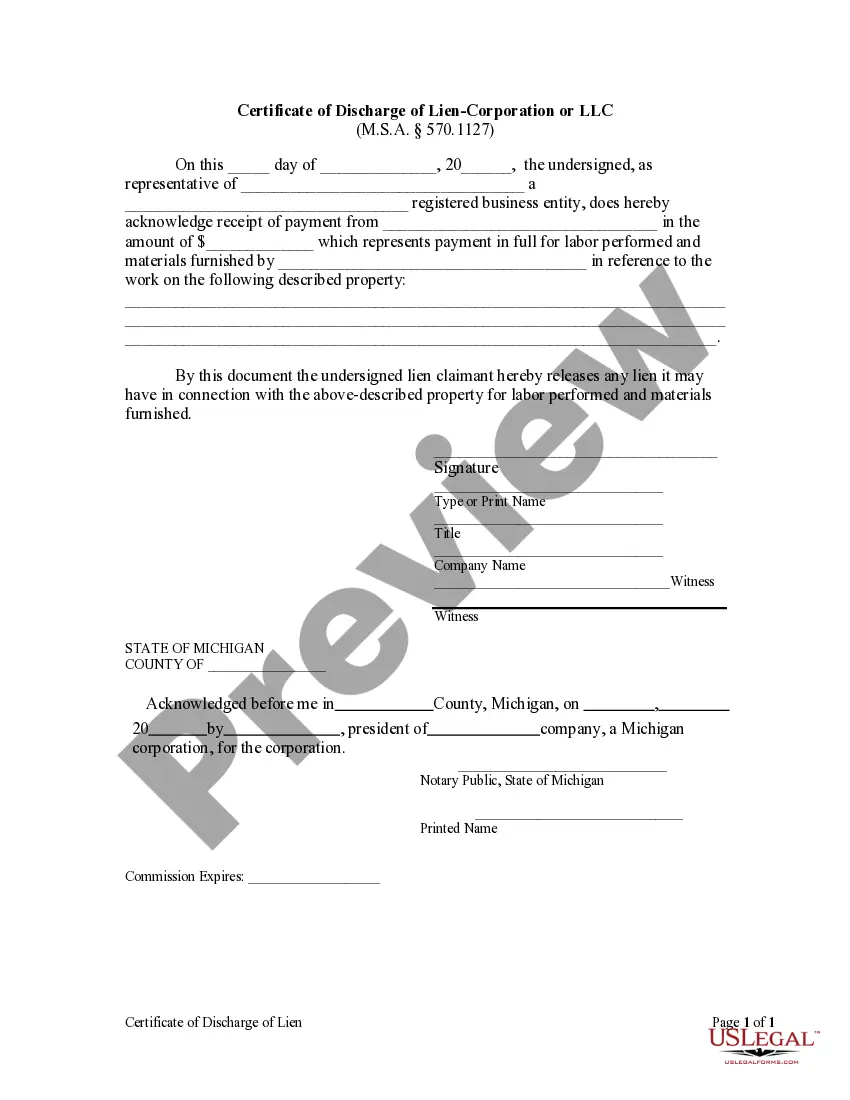

How to fill out Michigan Certificate Of Discharge Of Lien - Corporation Or LLC?

- Log in to your account if you're a returning user. Make sure your subscription is active. If it's not, renew it through your payment plan.

- Preview the available forms to confirm they meet your legal requirements. This step ensures accuracy for your local jurisdiction.

- If necessary, utilize the search feature to find additional templates that fit your specific needs.

- Purchase the desired document by clicking the Buy Now button. Choose your preferred subscription plan and register an account for full library access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download your selected form to your device for easy access. You can also revisit it anytime through the My Forms section in your profile.

By following these steps, you can quickly obtain the legal forms you need to ensure your documents are both precise and compliant with legal standards.

Don't hesitate—start your journey with US Legal Forms today and empower yourself to handle your legal needs with confidence!

Form popularity

FAQ

Limited U items in Roblox are indeed tradable, allowing players to exchange these unique items with others. This trading system enhances social interaction among users, as you can negotiate and make deals to acquire new limited U items. Engaging in trades adds an exciting dynamic to collecting and enhances your gameplay on Roblox.

Yes, you can sell your limited items on Roblox, provided they meet certain criteria. Make sure the item is either a limited or limited U type, and navigate to your inventory to initiate the sale. Selling your limited items can help you thin out your collection while potentially earning a profit.

Roblox continues to release limited items, enriching the gaming community and offering players new opportunities to enhance their collections. These limited releases often occur during events or updates, generating excitement and engagement among users. Keeping an eye on Roblox announcements can help you stay updated on new limited offerings.

Limited U items are a specific category of limited items that can only be owned by one player, making them truly unique. Once purchased or acquired, these items cannot be replicated or restocked, increasing their rarity. This scarcity can significantly drive their market value, making them highly sought after by Roblox players.

In Roblox, limited refers to items that have a restricted quantity and can be bought, sold, or traded among players. These items typically appreciate in value over time, attracting collectors and gamers alike. Understanding what makes items limited can enhance your gameplay and investment strategy within the platform.

Yes, you can file your LLC separately from other business entities you may have. This can help to maintain clear records for different ventures and facilitate easier tax filing. Utilizing services like US Legal Forms can simplify this process, allowing you to manage filings efficiently and stay organized in managing your limited liability company.

While you might consider using 'limited' as part of your business name, it is important to adhere to your state's naming conventions that govern LLCs. Typically, an LLC must include 'Limited Liability Company' or the abbreviations 'LLC' or 'L.L.C.' Using 'limited' alone could create confusion and may not be legally acceptable. Always verify your state’s regulations to ensure compliance.

Yes, you can file your LLC independently without needing professional help if you feel confident in your understanding of the process. Many individuals choose to use online resources and platforms like US Legal Forms to guide them through the necessary steps. Ultimately, it's essential to ensure accuracy in your filings to maintain your limited liability status.

If you fail to file taxes for your LLC, you may face penalties and interest on any unpaid tax liability. This situation can result in legal issues, including the potential loss of limited liability protection if the state considers your entity inactive. Therefore, it is crucial to meet your tax obligations to protect your business and personal assets.

A single owner LLC typically files taxes as a disregarded entity, meaning you include business income and expenses on your personal tax return. This streamlined approach is beneficial for many, as it simplifies the tax process. You will report your LLC's earnings on Schedule C of your Form 1040, ensuring you comply with IRS guidelines for limited liability companies.