Michigan Lady Bird Sample Withdrawal

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

Whether for professional objectives or personal issues, everyone must handle legal matters at some point in their life.

Completing legal forms demands meticulous focus, starting from selecting the appropriate template sample.

With a vast US Legal Forms catalog available, you don't need to waste time searching for the correct template across the web. Utilize the library's user-friendly navigation to find the proper template for any circumstance.

- For instance, if you choose an incorrect version of the Michigan Lady Bird Sample Withdrawal, it will be rejected upon submission.

- Thus, it is essential to obtain a reliable source of legal documents such as US Legal Forms.

- If you need to acquire a Michigan Lady Bird Sample Withdrawal template, adhere to these simple steps.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form's description to ensure it aligns with your situation, state, and locality.

- Click on the form's preview to examine it.

- If it is not the correct form, return to the search feature to find the Michigan Lady Bird Sample Withdrawal template you need.

- Download the template if it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you desire and download the Michigan Lady Bird Sample Withdrawal.

- After saving it, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Yes, you can write your own ladybird deed in Michigan. It's crucial to ensure that the language is clear and meets legal standards. To assist you, consider using a Michigan lady bird sample withdrawal available on platforms like US Legal Forms, which can provide a solid foundation for your deed.

A ladybird deed can be a good idea in Michigan, especially for individuals looking to avoid probate. It allows you to retain control over your property during your lifetime while smoothly transferring it to your beneficiaries after death. Evaluating your unique situation and reviewing a Michigan lady bird sample withdrawal can help you make an informed decision.

One disadvantage of a ladybird deed in Michigan is that it might not protect your property from creditors after your death. Additionally, the deed does not provide the same level of control as a trust. Understanding these downsides is essential, and reviewing a Michigan lady bird sample withdrawal can help clarify these concerns.

You can prepare your own ladybird deed in Michigan. The process involves filling out the necessary forms and ensuring they comply with state laws. Utilizing a Michigan lady bird sample withdrawal from US Legal Forms can simplify the process and help you avoid common mistakes.

Yes, you can create a ladybird deed without a lawyer in Michigan. However, it is important to understand the legal implications and ensure that all requirements are met. Using a reliable resource, such as US Legal Forms, can provide you with a Michigan lady bird sample withdrawal to guide you through the process accurately.

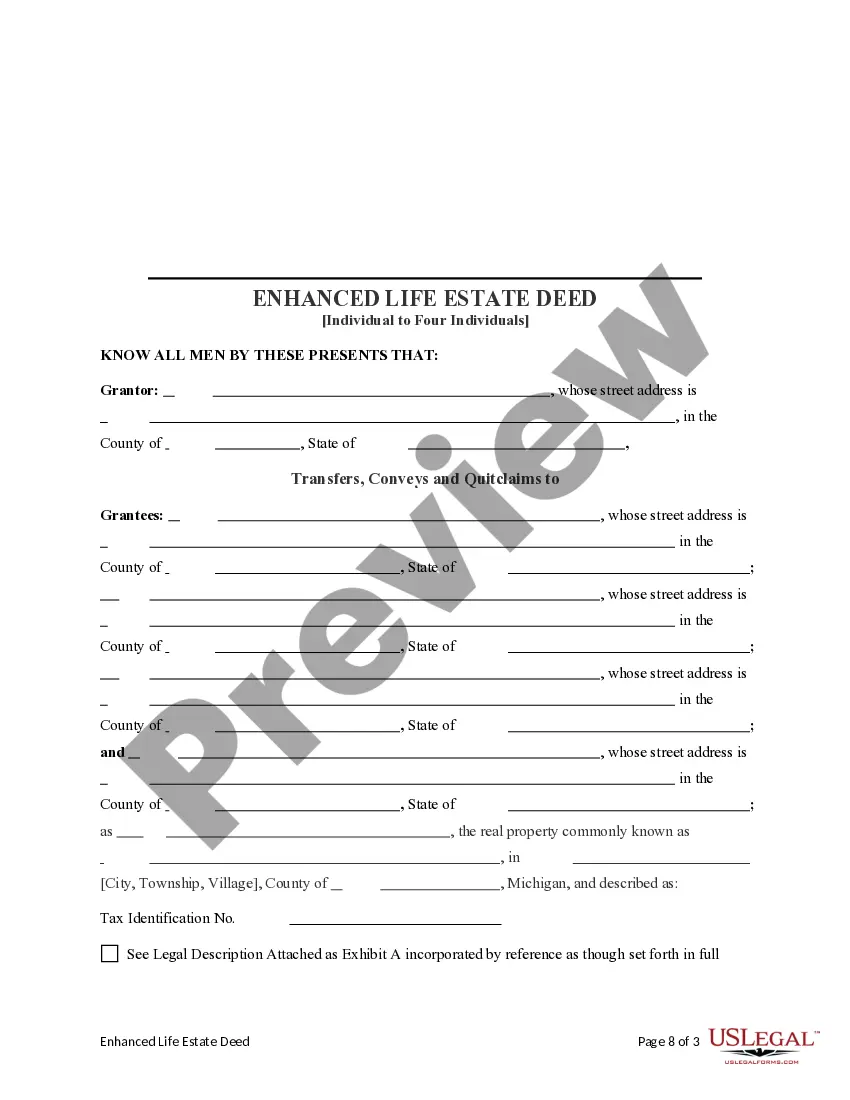

A Michigan ladybird deed is a type of Quit Claim Deed commonly used in Michigan. This estate planning instrument allows a property owner to maintain control over their property while alive and transfer it to heirs upon their death.

Disadvantages of a Lady Bird deed There is a fairly large mortgage balance on the property. You want more flexibility, such as being able to name an alternative beneficiary in the event the grantee dies before you do, in which case a trust may be better.

Each county's form requires the same basic information, including the names and addresses of the grantee and grantor, the property description (which you can get from a prior deed to the property or from the County Register of Deeds Office), and the amount of money being exchanged for the property.

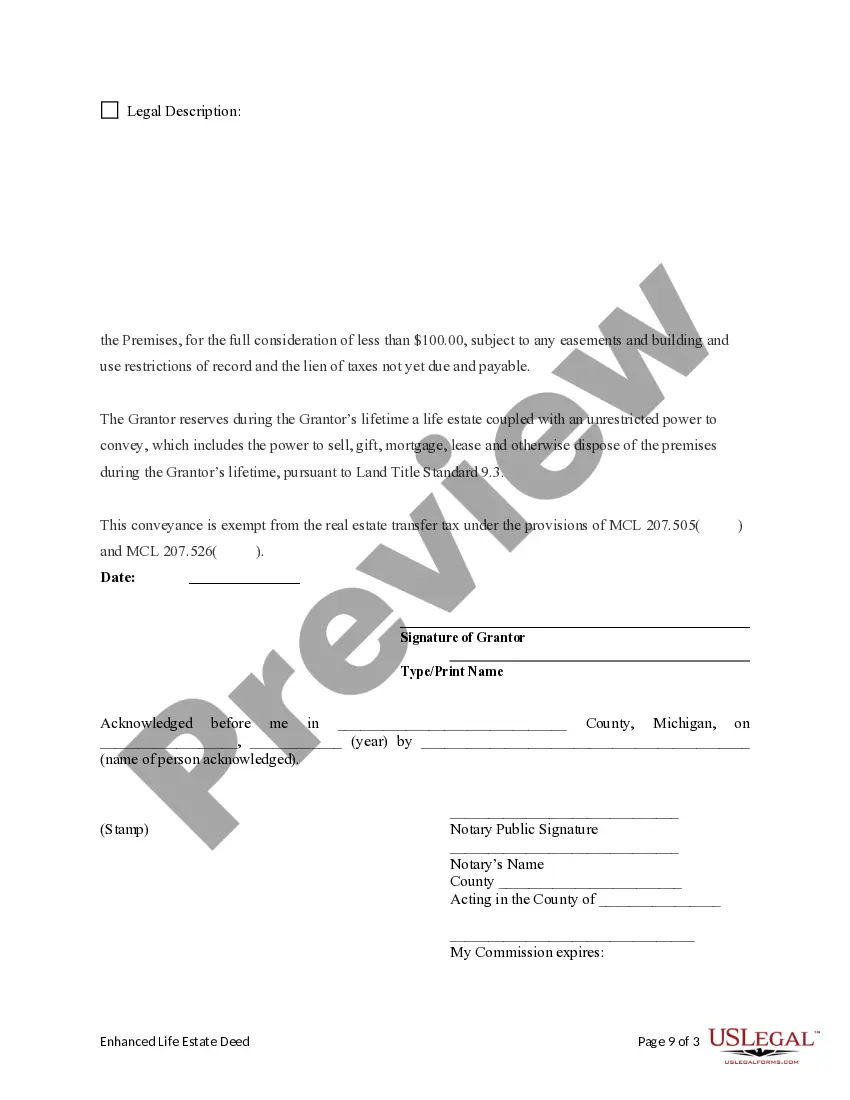

A Lady Bird did will not uncap or affect your property tax and does not increase your property's taxable value. The Lady Bird deed does not transfer until the owner's death and therefore, since there is no transfer until death, the property tax is not uncapped.

When compared with a traditional Quitclaim Deed or Life Estate Deed, a Lady Bird Deed is a much more flexible option. Using a Lady Bird Deed in Michigan allows you to retain control of your property during your lifetime, meaning that you can still sell or mortgage your property at any time if you want.