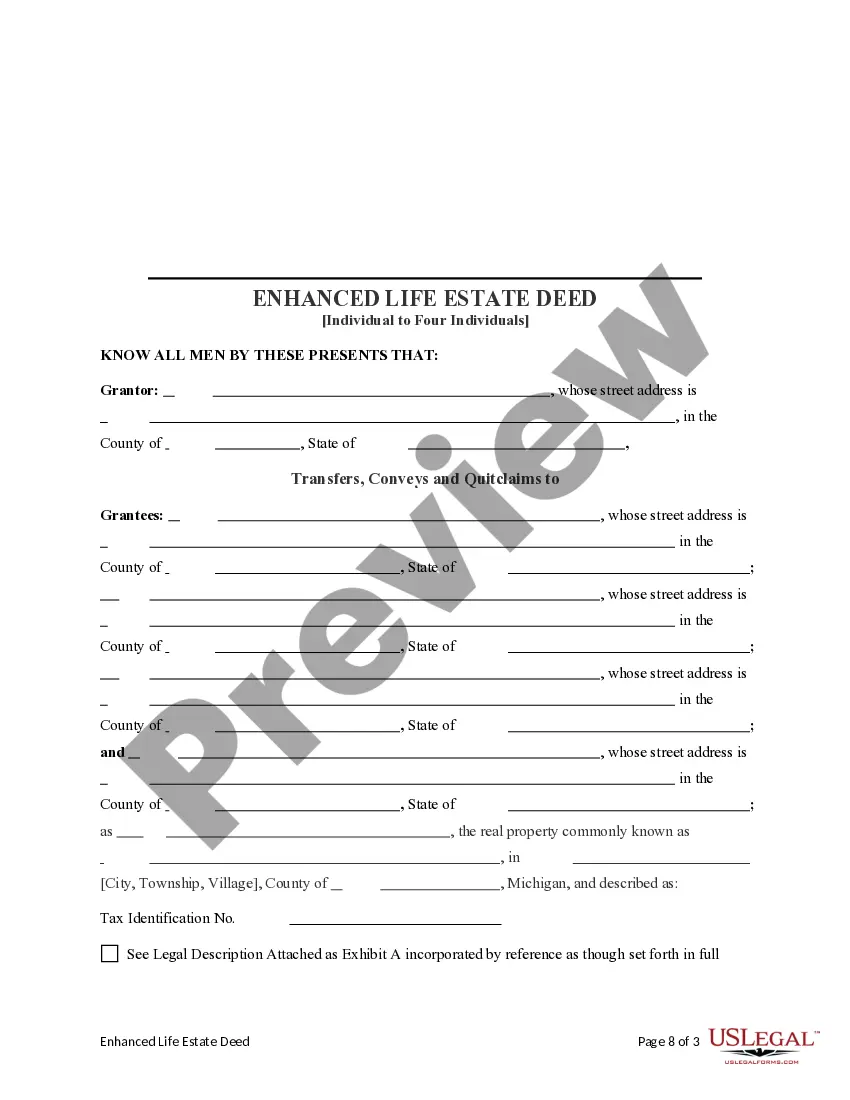

Enhanced Life Estate Deed

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

- If you're a returning user, log in to your account to download the necessary form by selecting the Download button. Ensure that your subscription is active; if not, renew it as per your payment plan.

- For first-time users, begin by checking the Preview mode and description of the enhanced life estate deed to confirm that it meets your needs and adheres to your local jurisdiction's regulations.

- If needed, explore other templates. Use the Search feature to find the correct documents if any discrepancies arise.

- Purchase the document by clicking the Buy Now button, choosing your desired subscription plan, and creating an account to access the forms library.

- Complete the purchase by entering your payment details or opting for PayPal to finalize your subscription.

- Download the form to your device, allowing you to complete it with ease. You can find it anytime through the My Forms section of your account.

US Legal Forms empowers both individuals and attorneys to expediate legal document execution with its extensive library of over 85,000 fillable forms.

With a wide selection at competitive prices and access to legal experts for personalized assistance, ensure your enhanced life estate deed is accurate and legally sound. Start today to make your legal process straightforward!

Form popularity

FAQ

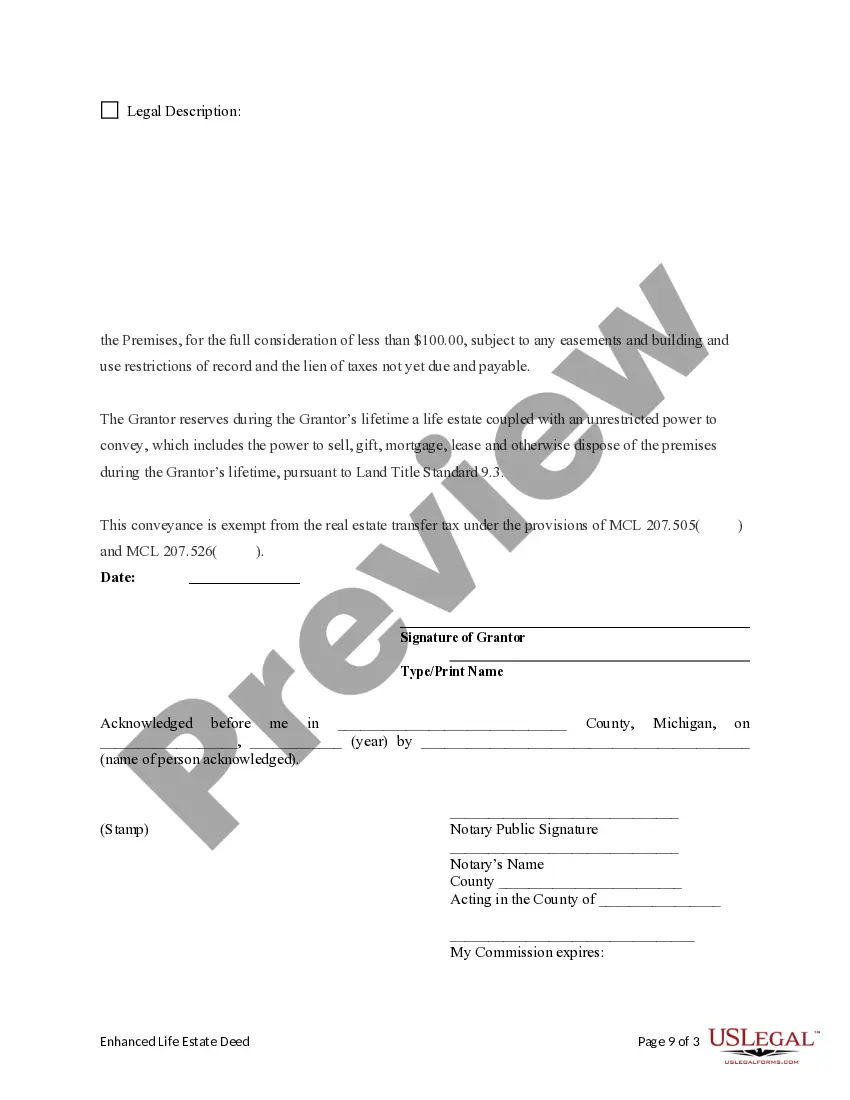

The primary difference between a life estate deed and an enhanced life estate deed lies in the retained rights. With a life estate deed, you cannot sell or modify the property without consent from remainder beneficiaries. However, an enhanced life estate deed allows you to sell, gift, or mortgage the property while still providing a clear path for asset transfer upon death. For more detailed comparisons and templates, visit US Legal Forms.

Ladybird deeds, similar to enhanced life estate deeds, are available in states like Florida, Texas, and Michigan. These specialized deeds allow property owners to retain full control over their property during their lifetime while enabling direct transfer to beneficiaries upon death. If you’re looking for clarity and actionable steps, US Legal Forms provides comprehensive forms and guidance to help you navigate this option.

An example of an enhanced life estate deed is when a homeowner in Florida designates their children as beneficiaries while maintaining the right to live in the home for life. This arrangement enables the homeowner to enjoy their property without sacrificing future inheritance rights for their heirs. To illustrate this process and ensure proper documentation, US Legal Forms can help you draft a suitable deed tailored to your situation.

Enhanced life estate deeds are acknowledged in various states, including Florida, Texas, and New Mexico. This type of deed allows property owners to retain certain rights while smoothly transferring assets upon death. For specific guidelines based on your location, the US Legal Forms platform provides valuable templates and resources. Always check local regulations to ensure compatibility.

Getting around a life estate deed can be complex, but there are some options available. One approach is to negotiate with the remaindermen to buy their interest, which would allow for full control of the property. Alternatively, involving legal assistance to draft certain documents may provide clarity on current rights and potential options for future changes. Using platforms like USLegalForms can help you navigate these legalities effectively.

While an enhanced life estate deed offers several benefits, it also comes with potential downsides. One significant drawback is the loss of the full ownership rights, meaning the life tenant cannot sell, encumber, or will the property without the consent of the remaindermen. Additionally, property taxes and maintenance costs continue to fall on the life tenant, which can become burdensome over time. It is crucial to weigh these factors carefully during estate planning.

Many individuals create enhanced life estate deeds to ensure that their property transfers smoothly to their heirs while still allowing them to retain control during their lifetime. This type of deed provides the owner with the right to live on the property, use it, and even benefit from it. It simplifies the estate planning process and can help avoid probate. Hence, people find it a practical solution for wealth distribution among family members.

While a life estate deed, including the enhanced version, provides significant benefits, it does have some drawbacks. For instance, once you execute an enhanced life estate deed, you cannot easily change the beneficiaries without altering the deed itself. Additionally, potential creditors may still pursue claims against the property during your lifetime, which could impact your estate planning goals.

An enhanced life estate allows you to enjoy full rights to your property during your lifetime, while ensuring it will pass directly to your chosen beneficiaries upon your death. Unlike traditional life estates, this deed offers more flexibility and controls over the property, along with potential tax advantages. Utilizing an enhanced life estate deed helps protect your assets for future generations.

An enhanced life estate deed is often considered the best option to avoid probate. This type of deed allows you to maintain your rights to the property, while facilitating a smooth transfer of ownership without going through the probate process. By designating beneficiaries directly in the deed, you can effectively streamline the transition of your assets.