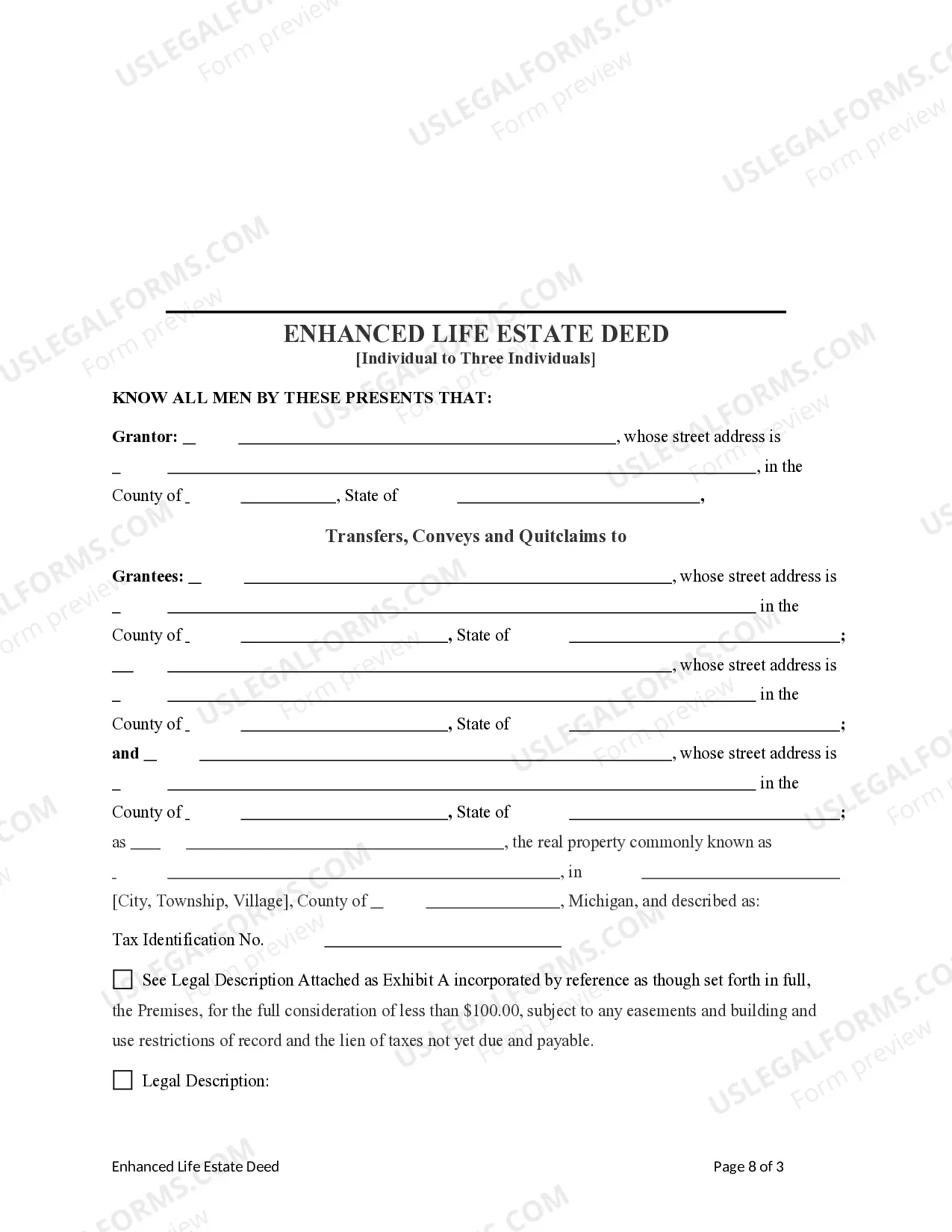

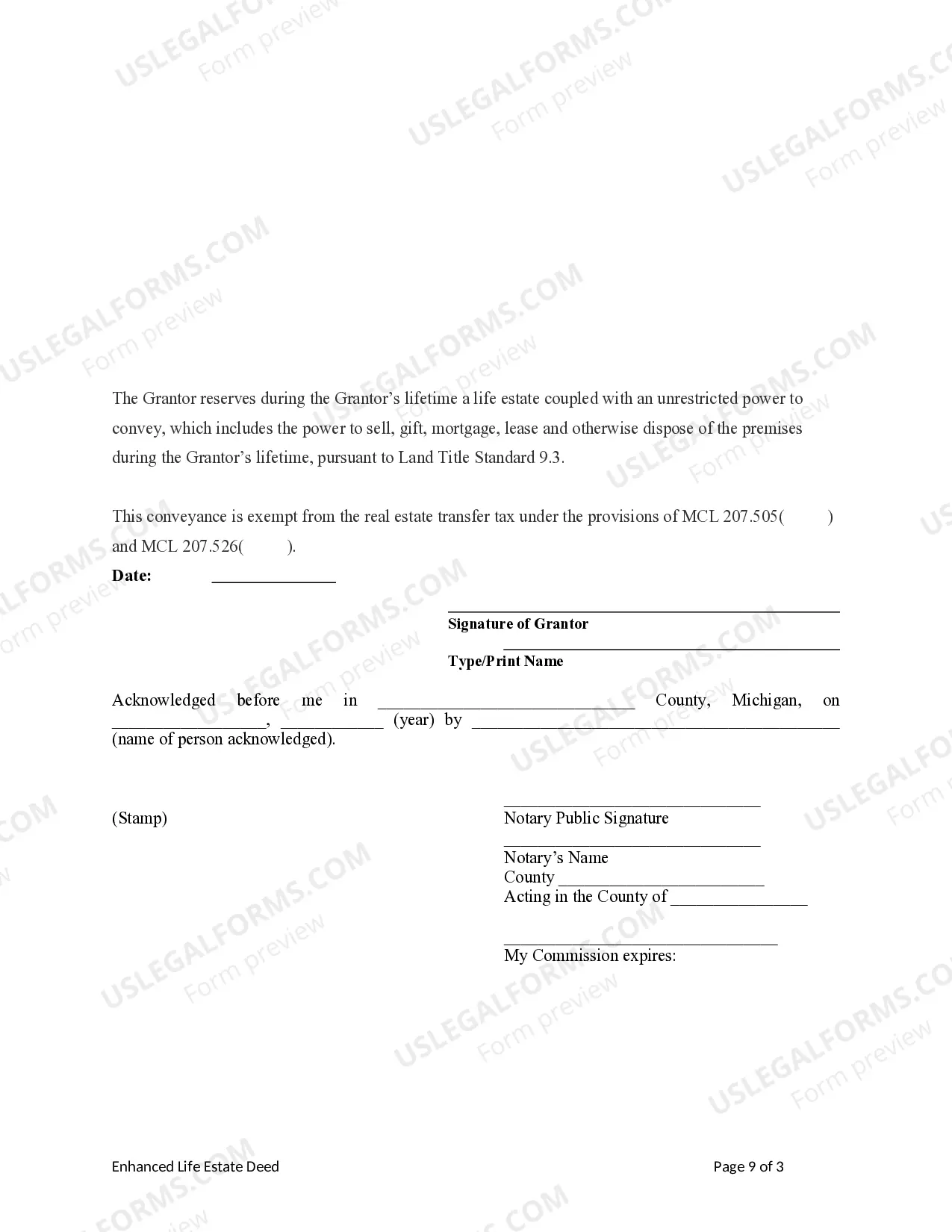

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are three individuals. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Transfer On Death Deed In Michigan

Description

How to fill out Transfer On Death Deed In Michigan?

Properly composed formal documents are one of the essential assurances for circumventing complications and legal disputes, but obtaining them without the help of an attorney may consume time.

Whether you seek to promptly locate an updated Transfer On Death Deed in Michigan or any other forms for employment, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only have to Log In to your account and click the Download button next to the desired file. Additionally, you can access the Transfer On Death Deed in Michigan at any time in the future, as all documents ever acquired on the platform are accessible within the My documents section of your account. Save time and money on preparing formal paperwork. Explore US Legal Forms today!

- Verify that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar located in the page header.

- Hit Buy Now once you identify the suitable template.

- Choose the pricing option, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Transfer On Death Deed in Michigan.

- Press Download, then print the form to complete it or upload it to an online editor.

Form popularity

FAQ

The best way to transfer property title between family members can be achieved through a transfer on death deed in Michigan, which allows for a straightforward transition of ownership. This method caters to family dynamics and keeps the process simple by avoiding probate. Alternatively, a traditional deed transfer can be utilized, but it may involve more steps and potential complications.

To transfer property title to a family member in Michigan, prepare a new deed that reflects the new ownership. A transfer on death deed in Michigan is an ideal option for this purpose, allowing you to retain ownership during your lifetime while ensuring a smooth transfer upon death. After completing the deed, sign it in front of a notary, and file it at your local county clerk’s office to make the transfer official.

When one person on a deed dies in Michigan, the property typically transfers to the surviving owner, if applicable. If the deceased owner is the sole title holder, the property may enter probate unless a transfer on death deed in Michigan has been executed. With a transfer on death deed in place, the property transfers directly to the designated beneficiary without the need for probate, simplifying the process.

To transfer a deed to a family member in Michigan, you must first prepare a new deed that clearly identifies the current owner and the new owner. You can use a transfer on death deed in Michigan to specify that the property should go to your family member upon your death without going through probate. Once you complete the deed, it must be signed and notarized, then filed with the county clerk's office where the property is located.

To create a transfer on death deed in Michigan, you first need to ensure you meet the eligibility requirements; typically, you must be the owner of real property. Next, you will need to fill out the appropriate deed form, which clearly states your intentions regarding the transfer of asset ownership upon your death. It is essential to sign the deed in front of a notary public and then record it with your local county register of deeds. For more guidance, consider using platforms like US Legal Forms, which provide resources and templates to simplify the process.

After a death, the lady bird deed automatically transfers property to the designated beneficiary according to the terms outlined in the deed. The beneficiary should ensure the deed is recorded with the county register of deeds to formalize the transfer. If you need help with this process or want to explore other options, USLegalForms can provide valuable resources and assistance.

While a lady bird deed offers advantages in avoiding probate, it does have potential disadvantages. One concern is that it may not provide the same level of control as a traditional will or trust. Additionally, creditors may still access the property upon your death. Considering these factors carefully is essential before choosing this option for your estate planning.

To transfer property after a death in Michigan, you typically execute a transfer on death deed if one exists. This deed allows for a seamless transfer of the property directly to the designated beneficiary. If no such deed is present, probate may be necessary to initiate the transfer process. You can consult USLegalForms for assistance with the necessary documentation.

Yes, Michigan does allow the use of a transfer on death deed. This legal instrument enables property owners to designate someone to inherit their property upon their death without the need for probate. It is a straightforward process that can simplify estate planning. If you are considering this option, it is wise to consult a legal professional for guidance.

The transfer on death deed in Michigan is often considered one of the best options for avoiding probate. This deed allows you to designate a beneficiary who will automatically receive the property upon your passing, without the need for probate proceedings. It simplifies the transfer process and provides clarity regarding your assets. Always consult with a professional to ensure it meets your needs.