Michigan Quitclaim Deed from Individual to LLC

Description

How to fill out Michigan Quitclaim Deed From Individual To LLC?

Obtain any template from 85,000 legal documents including the Michigan Quitclaim Deed from Individual to LLC online using US Legal Forms.

Each template is prepared and revised by state-licensed attorneys.

If you already possess a subscription, Log In. Once on the form’s page, click on the Download button and navigate to My documents for access.

With US Legal Forms, you will consistently have immediate access to the correct downloadable template. The service organizes documents by categories to simplify your search. Utilize US Legal Forms to acquire your Michigan Quitclaim Deed from Individual to LLC quickly and efficiently.

- Verify the state-specific criteria for the Michigan Quitclaim Deed from Individual to LLC you wish to utilize.

- Browse the description and preview the template.

- Once you confirm the template meets your needs, click on Buy Now.

- Choose a subscription plan that suits your financial situation.

- Establish a personal account.

- Make a payment using one of two suitable methods: credit card or PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is saved, print it or store it on your device.

Form popularity

FAQ

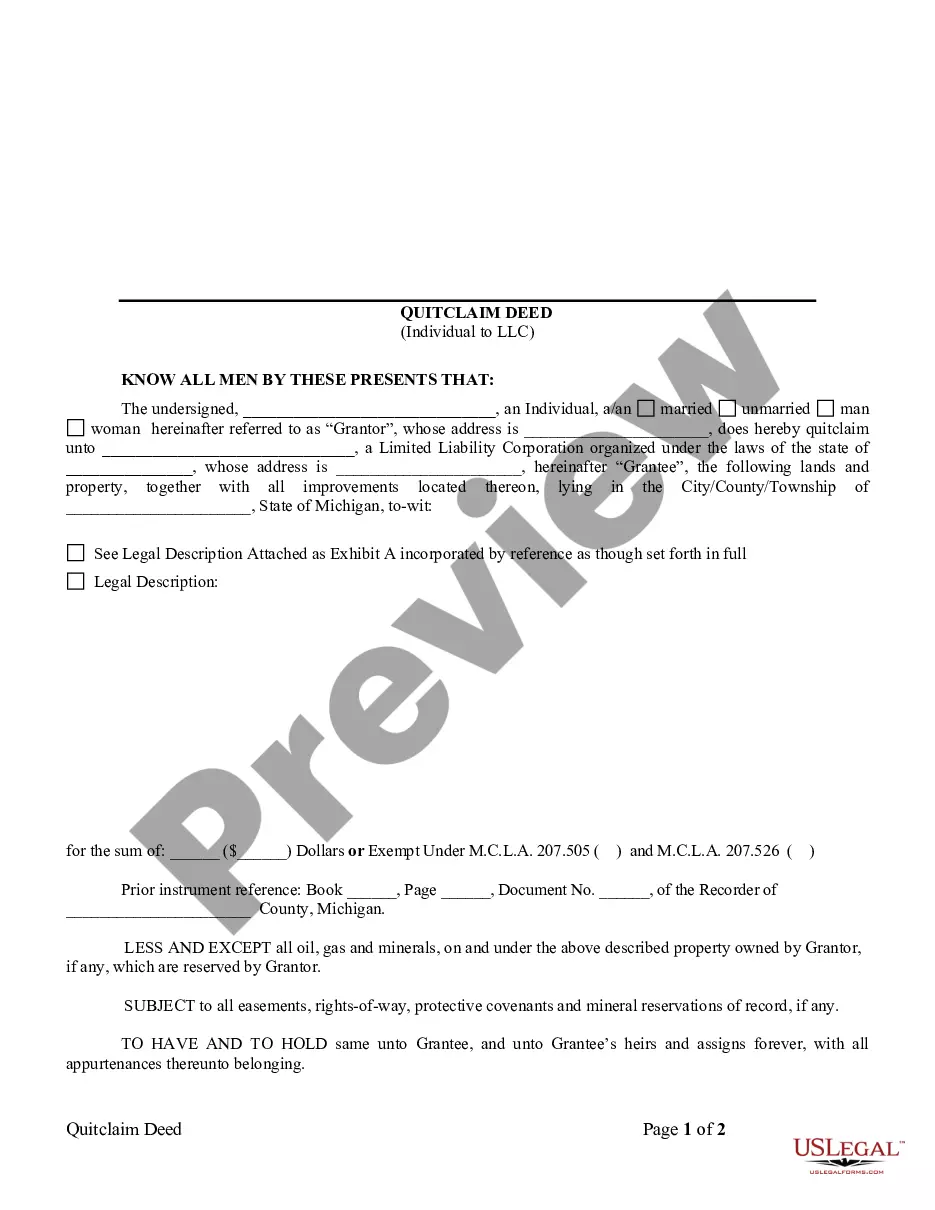

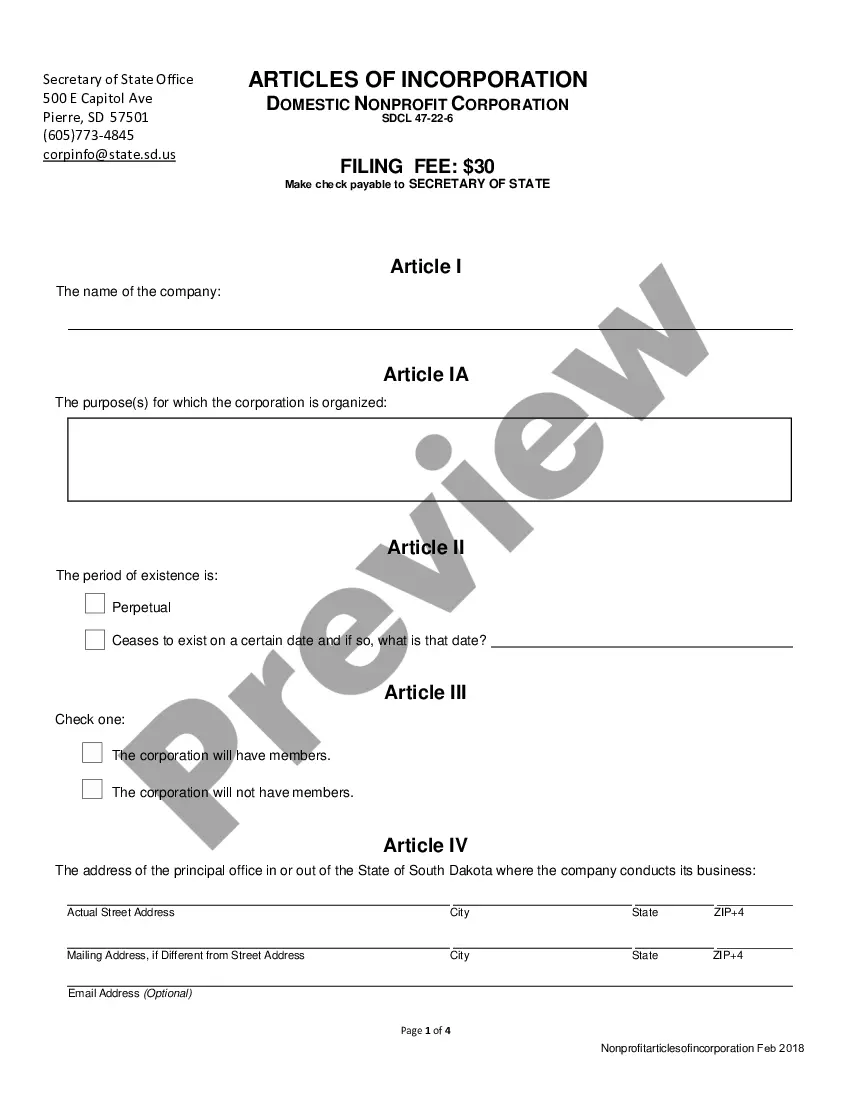

To create a valid quitclaim deed in Michigan, you need to include key information about the grantor, grantee, and property description. Additionally, both parties must sign the document before a notary public. For a smoother process, especially when transferring ownership through a Michigan Quitclaim Deed from Individual to LLC, using a platform like uslegalforms can provide you with the necessary templates and guidance tailored for Michigan laws.

In Michigan, the statute concerning quitclaim deeds is outlined in the Michigan Compiled Laws. A quitclaim deed must meet specific statutory requirements, including proper execution and recording. It’s essential to adhere to these legal guidelines to ensure that your Michigan Quitclaim Deed from Individual to LLC is valid and enforceable, so consider consulting uslegalforms for comprehensive legal support.

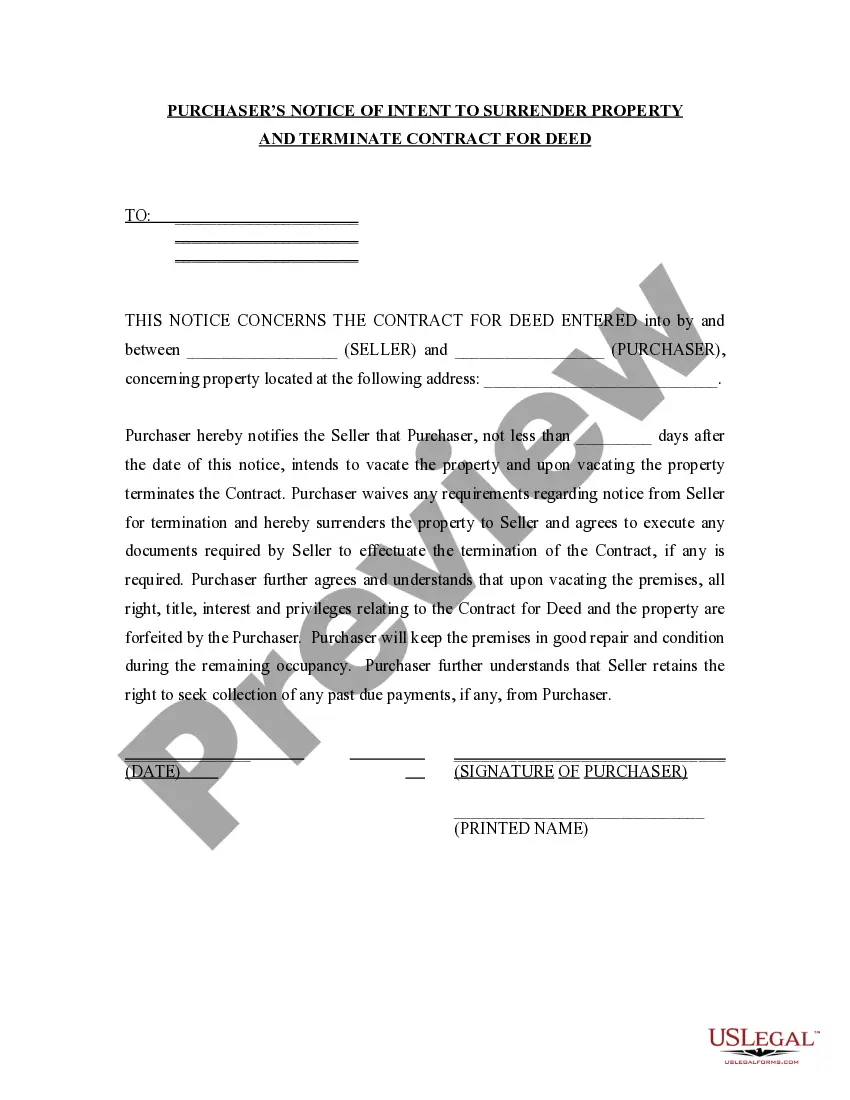

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

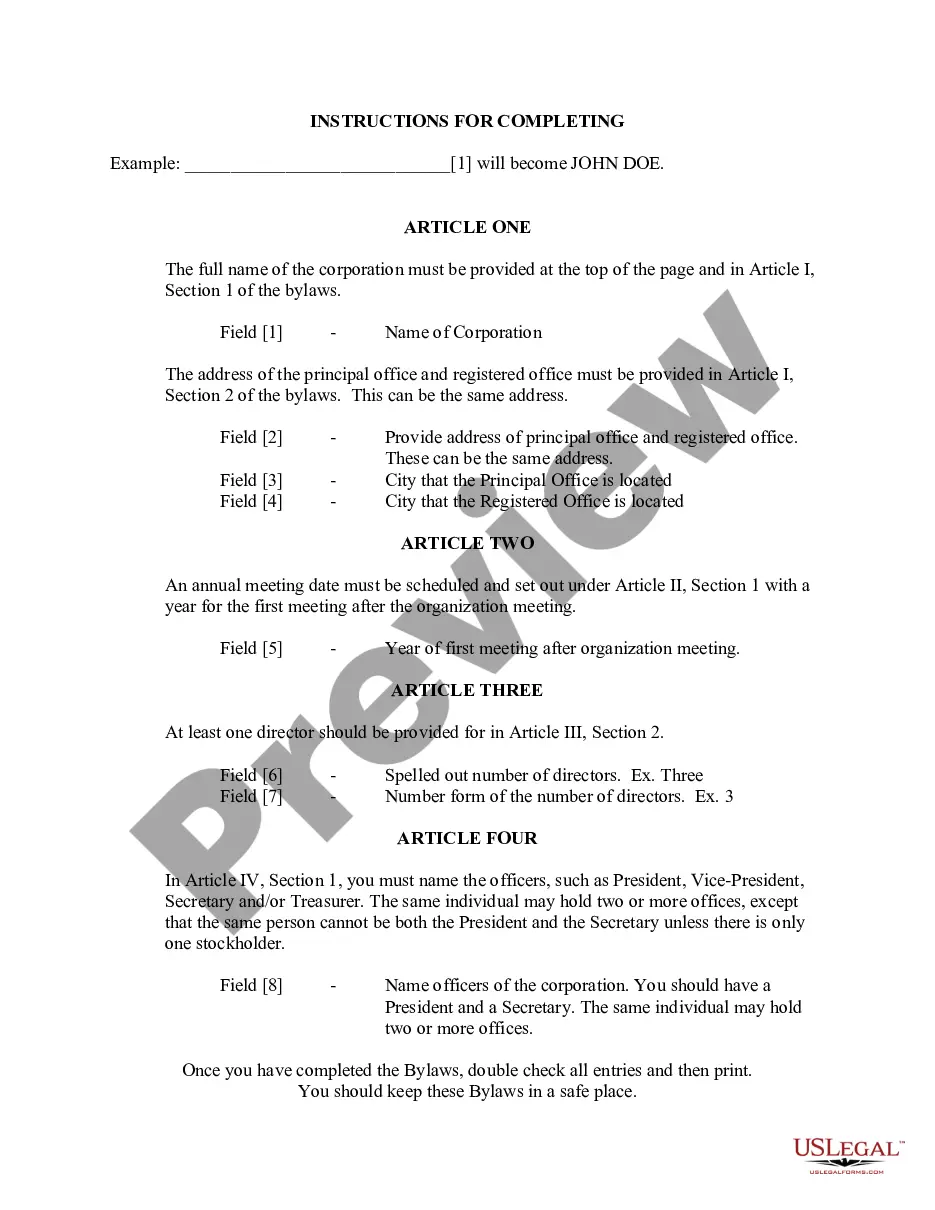

Step 1: Download the MI quitclaim deed form. Step 2: Add the name and address of the preparer under Prepared By on the first line of the document. Step 3: Add the return address under After Recording Return To. This is typically the name and address of the grantee, but it could be a different party.

In Michigan, a quit claim deed must be signed by a witness, in addition to the notary, to make it legal.After all required signatures are collected and notarized, file the document with your local register of deeds to complete the transaction.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

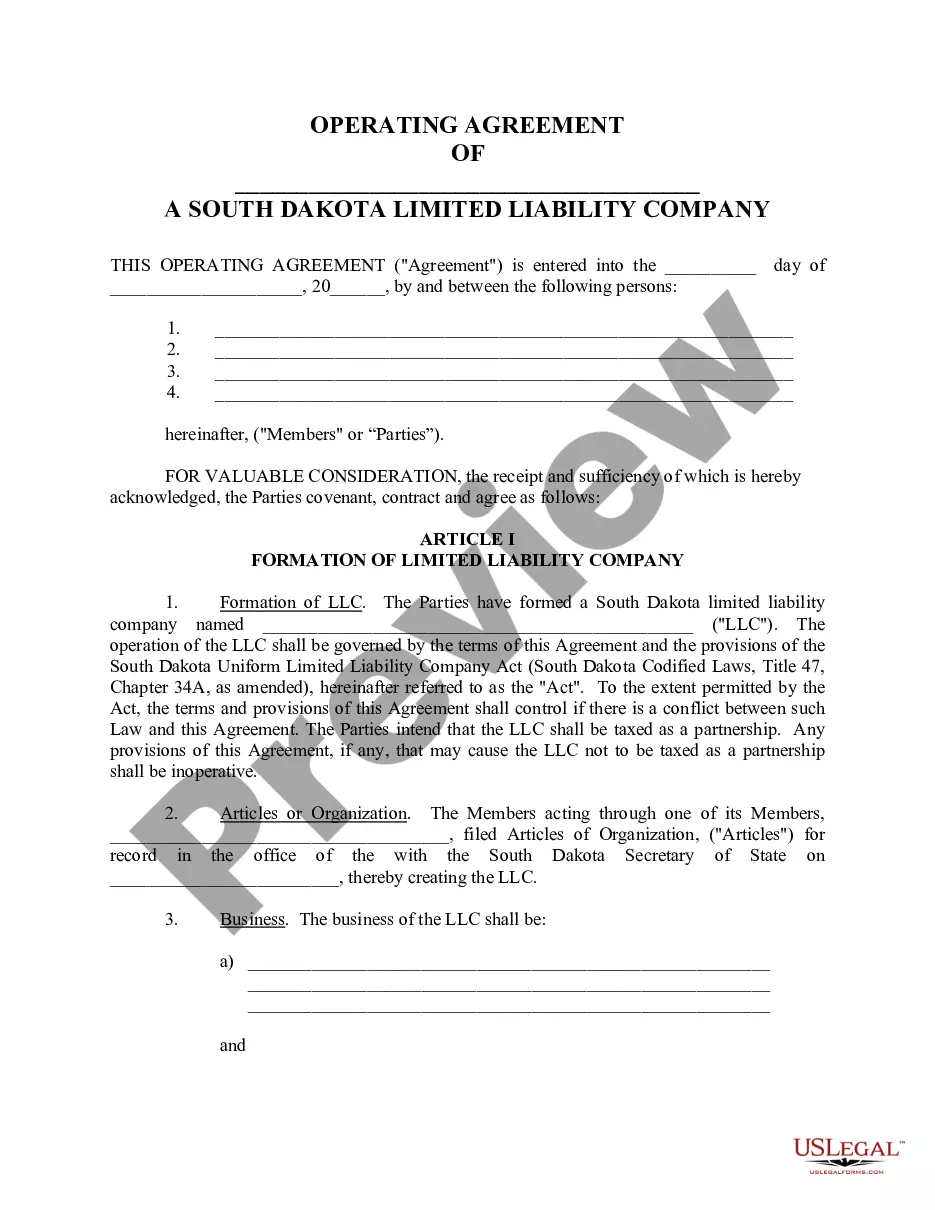

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

There will be a $30 recording fee. If you prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed (after Divorce) tool, detailed instructions on what to do next will print out along with the deed.