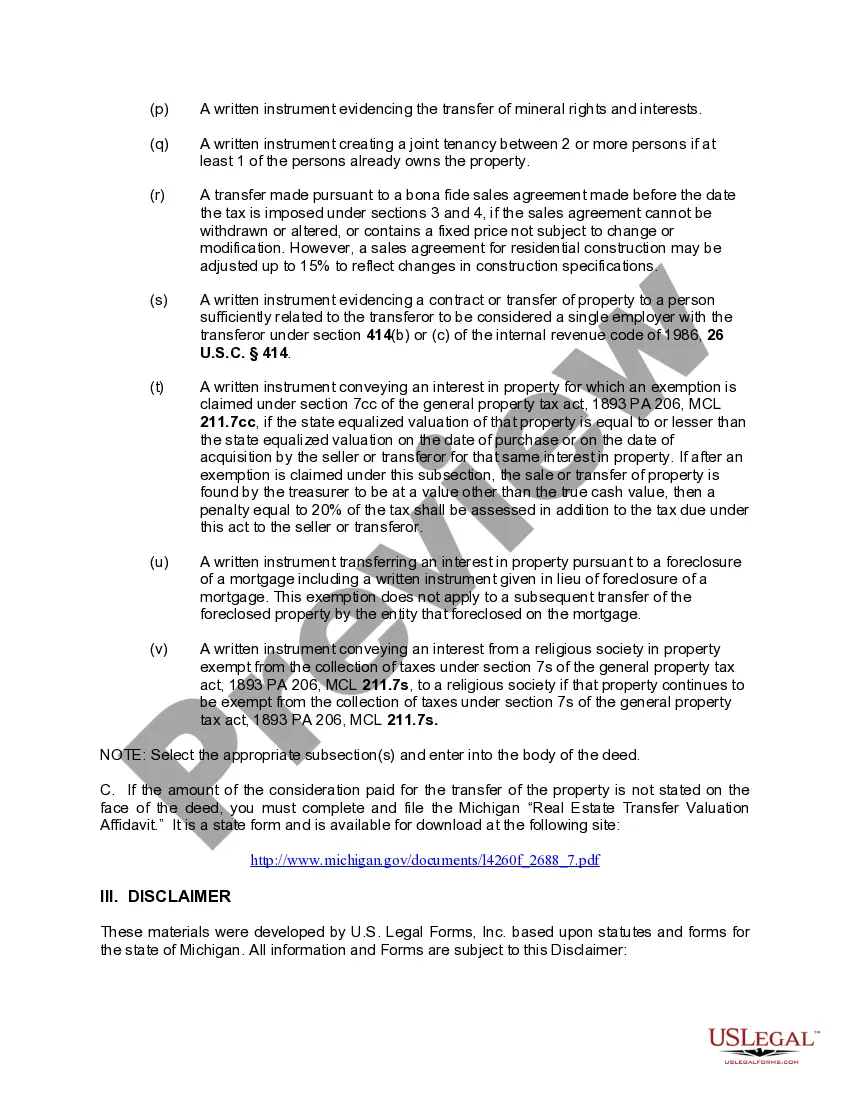

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantors conveys the property to Grantee subject to a retained enhanced life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Enhanced Bird Husband For Sale

Description

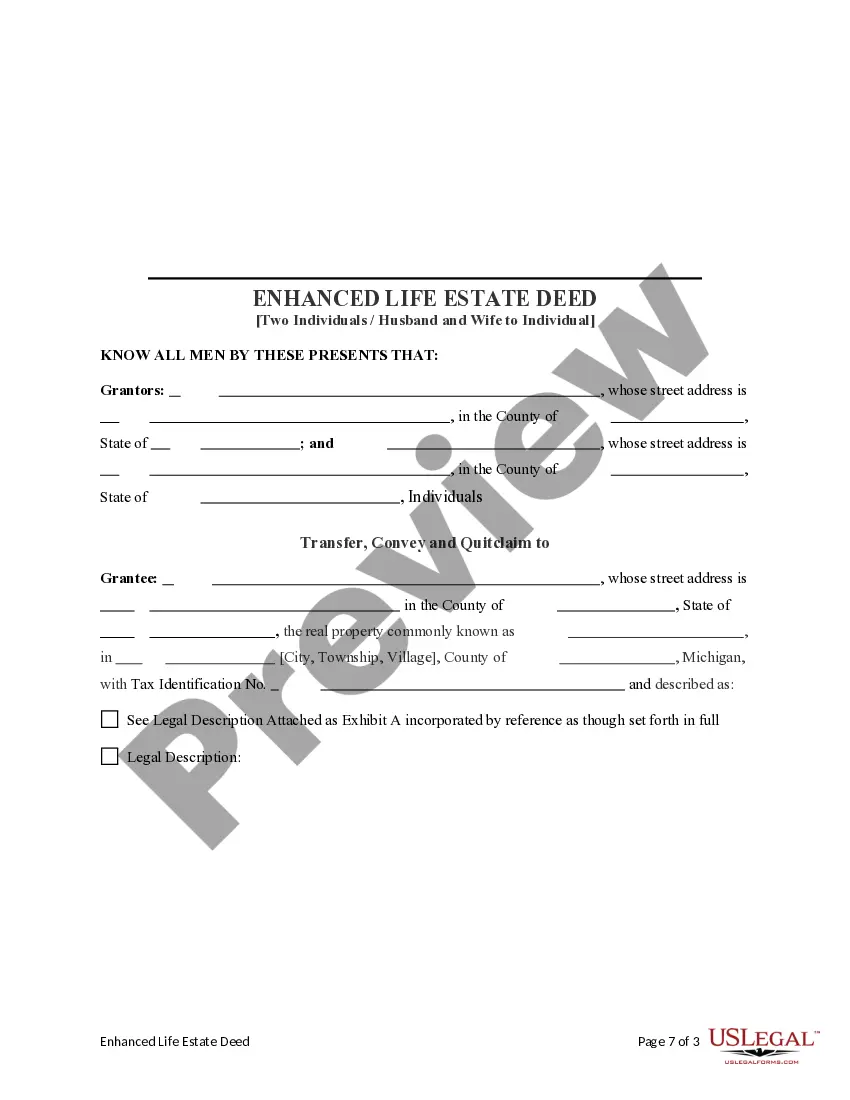

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Two Individuals / Husband And Wife To An Individual?

- If you’re a returning user, log in to your account and ensure your subscription remains active. Then, click on the Download button for the form you need.

- For new users, start by browsing the available templates. Check the Preview mode and ensure the form matches your local jurisdiction requirements.

- If the current template doesn't suit your needs, utilize the Search tab to find a more appropriate document.

- Once you find the right form, click the Buy Now button. Choose from various subscription plans and create your account to access all resources.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After payment, download your form and save it to your device. You can always access it in the My Forms section of your account.

By using US Legal Forms, you gain access to a rich library of over 85,000 easily editable legal documents and packages, far exceeding the offerings of competitors.

Take charge of your legal needs today and experience the benefits that come with a premium subscription. Visit US Legal Forms now and make your legal documentation seamless!

Form popularity

FAQ

In Florida, a lady bird deed must explicitly state the intentions of the property owner, ensuring it is executed properly to avoid legal complications. The property owner must be competent, and the deed must be signed, witnessed, and notarized for validity. Additionally, it should adhere to Florida-specific legal standards to ensure that property transfers smoothly upon the owner's passing. Explore solutions like enhanced bird husband for sale to understand how they fit into your overall estate planning.

A lady bird deed does not inherently avoid inheritance tax; however, it can simplify the transfer of property, potentially minimizing tax implications. When property passes directly to beneficiaries via this deed, it may reduce the estate’s taxable value. It's important to consult with a tax professional to understand how this deed interacts with tax regulations. Viewing options like enhanced bird husband for sale may also enlighten your estate planning strategies.

The lady bird deed is widely regarded as one of the best options to avoid probate. By using this deed, property owners can transfer real estate to beneficiaries while retaining control during their lifetime. This method not only helps to bypass probate but also reduces administrative complexities associated with estate management. For those interested in estate planning, learning about enhanced bird husband for sale could provide additional benefits.

A lady bird deed is not considered inheritance because it allows property to transfer outside of probate after the owner's death. This type of deed gives the current owner full control over the property during their lifetime. It also provides a straightforward way to pass property to heirs without the burdens of the probate process. Considering enhanced bird husband for sale can simplify these estate planning concerns.

Filling out a lady bird deed requires specific information about the property and the grantor’s intentions. You typically need to provide the property details, names of beneficiaries, and terms of the deed. If you're unsure how to navigate the process, consider using tools from USLegalForms to guide you through the enhanced bird husband for sale. Clear instructions and templates can simplify the experience.

A lady bird deed does not override a will; instead, it works alongside it. The property designated in the lady bird deed will transfer directly to the named beneficiaries, bypassing the probate process. Therefore, if you are considering the enhanced bird husband for sale, it’s vital to review how it aligns with the provisions in your will. A comprehensive plan is key to securing your wishes.

Yes, Medicaid may still have a claim to the property even if you have a lady bird deed. The property might be considered an asset for recovery purposes after your passing. Utilizing the enhanced bird husband for sale can help protect your property, but it's important to navigate these regulations carefully. Legal guidance can help ensure that your estate remains secure from such claims.

A key downside of a lady bird deed is that it does not provide complete protection from Medicaid recovery claims. If the property is needed for Medicaid eligibility, it could potentially be targeted for costs after the owner's death. Therefore, understanding the nuances of the enhanced bird husband for sale is essential to ensure it meets your estate planning goals. Always consider speaking with a qualified attorney on these issues.

While lady bird deeds offer benefits, they also come with some disadvantages. One major concern is that if the grantor needs to sell the property, they may face challenges or legal complications. Additionally, the enhanced bird husband for sale might not completely protect assets from creditors, which could be a concern for some individuals. It is crucial to weigh these factors before making a decision.

A lady bird deed does have the potential to avoid capital gains tax under certain circumstances. When the property passes to beneficiaries at the owner's death, it may receive a step-up in basis. This can significantly reduce capital gains taxes, making the enhanced bird husband for sale a beneficial option for many homeowners. Consulting with a tax advisor can provide clarity specific to your situation.