Michigan Heirship For Identify

Description

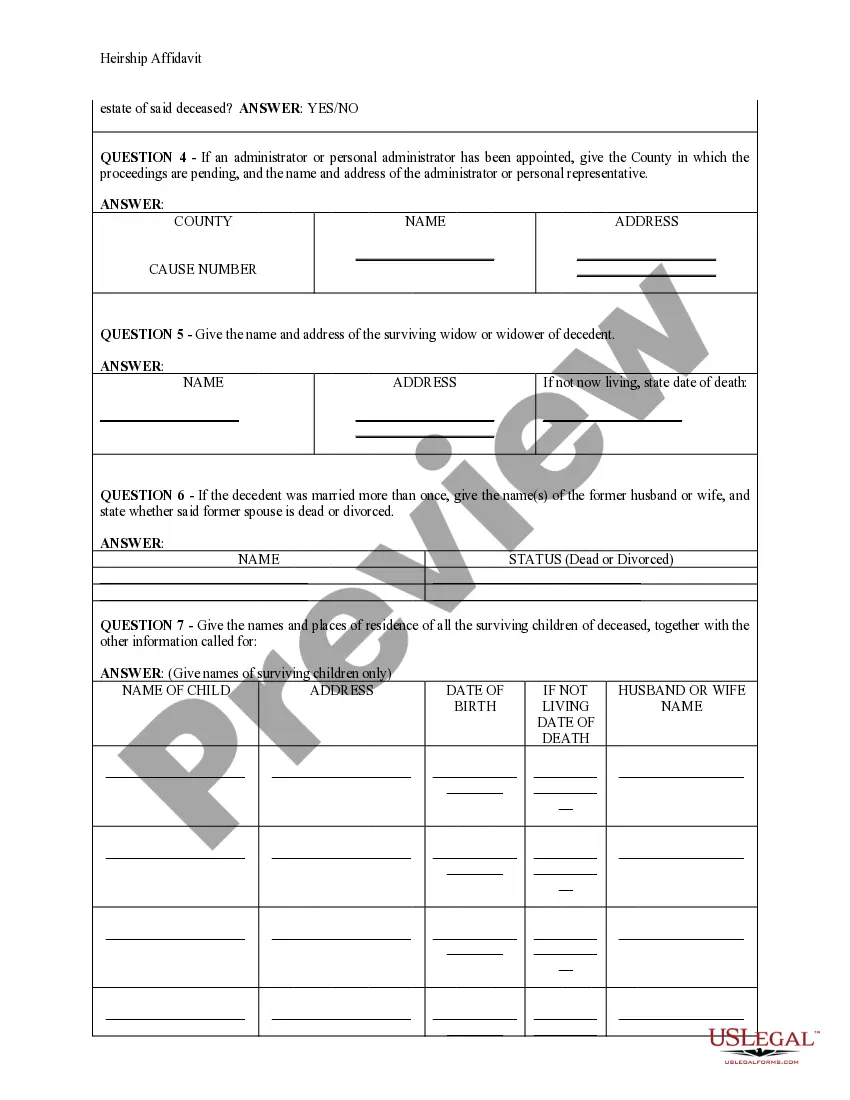

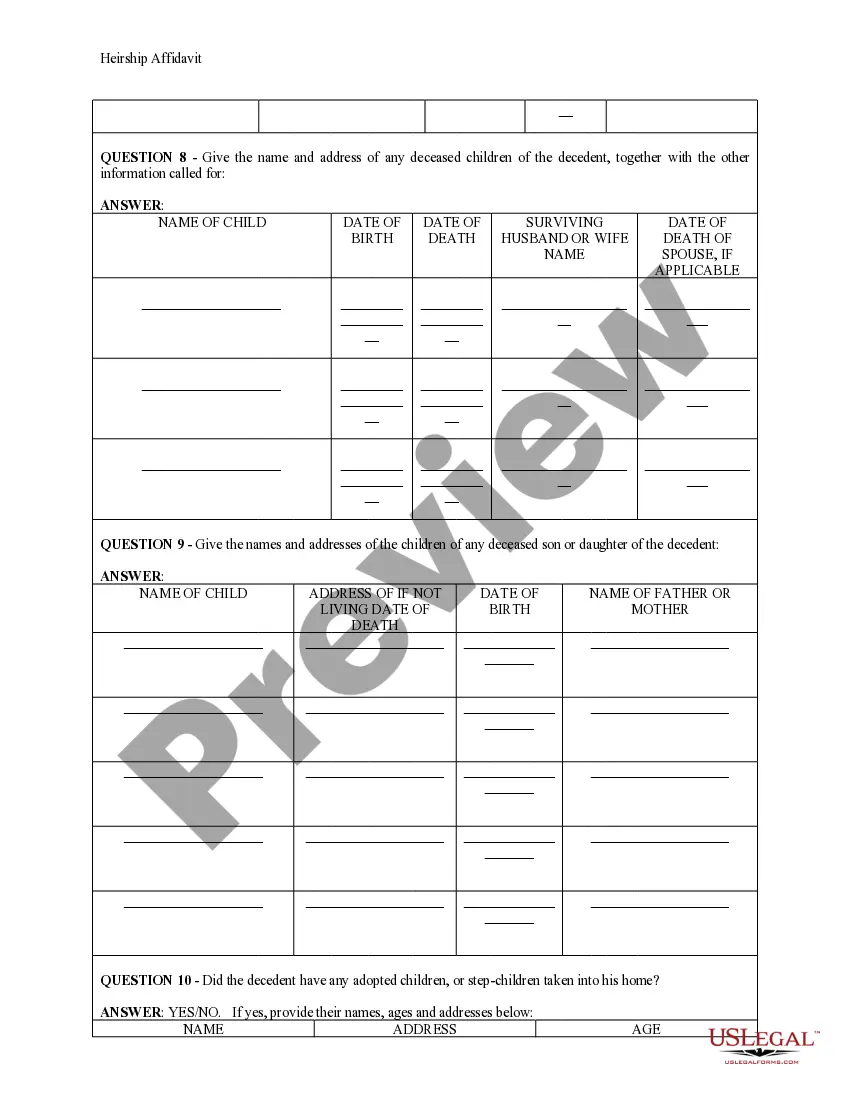

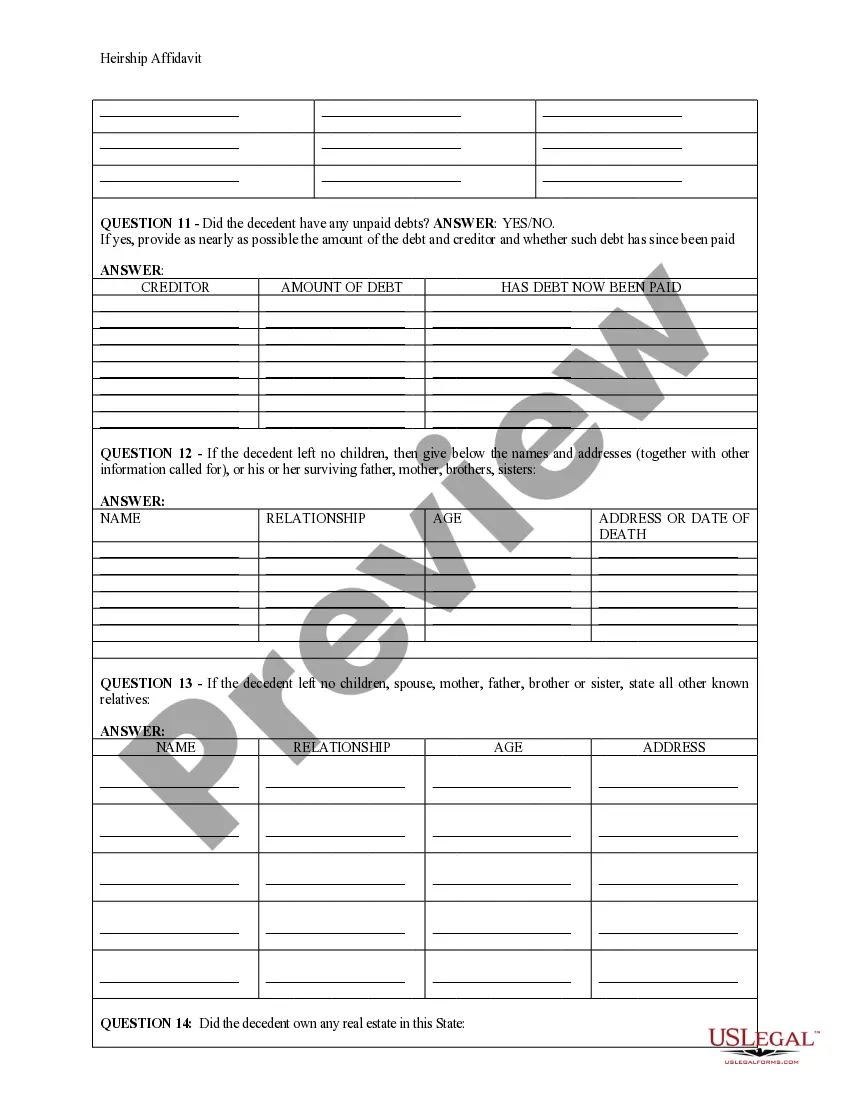

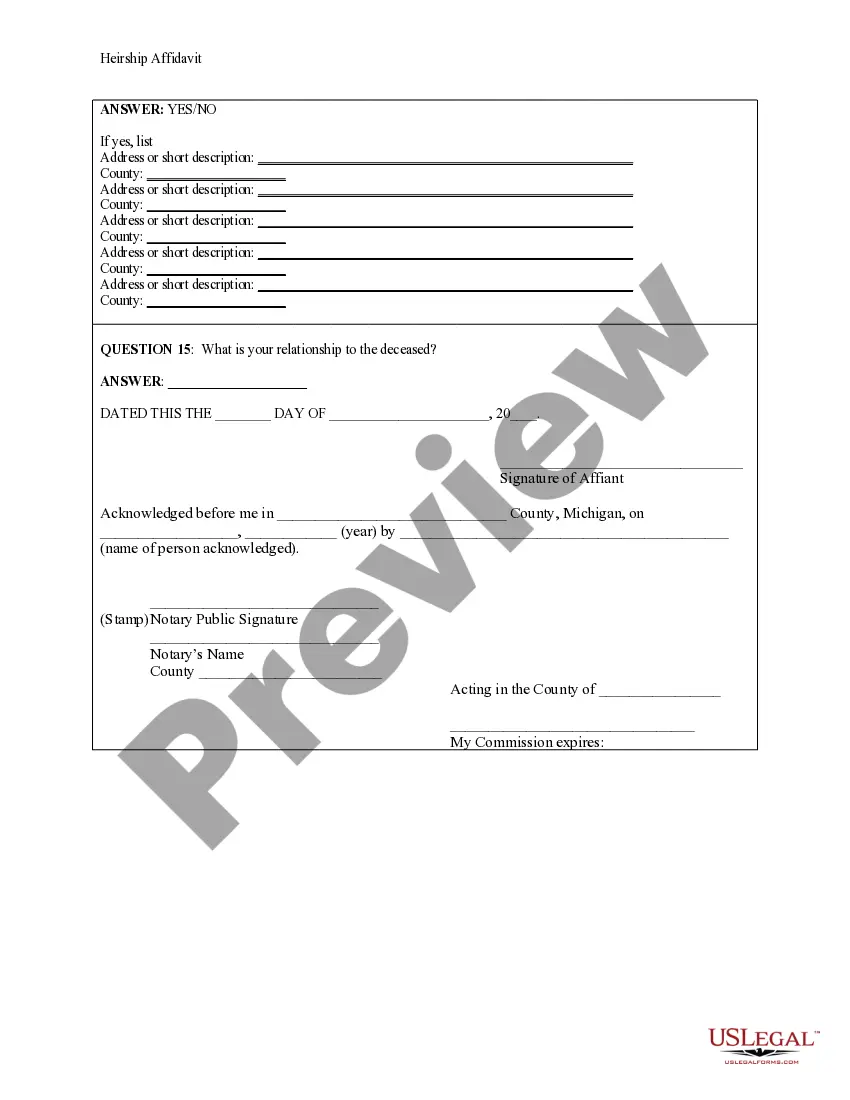

How to fill out Michigan Heirship Affidavit - Descent?

The Michigan Heirship For Identify you observe on this page is a versatile legal template crafted by expert attorneys in compliance with federal and state statutes.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with more than 85,000 authenticated, state-specific documents for any corporate and personal circumstance. It’s the fastest, most direct, and most dependable method to acquire the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Register for US Legal Forms to have authenticated legal templates for all of life's scenarios readily available.

- Search for the document you require and review it.

- Browse the example you sought and preview it or peruse the form description to confirm it suits your requirements. If it falls short, utilize the search bar to discover the suitable one. Click Buy Now once you’ve found the template you desire.

- Choose and access your account.

- Select the pricing option that best fits you and register for an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and examine your subscription to proceed.

- Acquire the editable template.

- Pick the format you prefer for your Michigan Heirship For Identify (PDF, DOCX, RTF) and download the document onto your device.

- Complete and endorse the documentation.

- Print out the template to finish it manually. Alternatively, employ an online multifunction PDF editor to quickly and accurately fill out and endorse your form with a valid.

- Re-download your documentation again.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

To declare heirship in Michigan, you typically need to file a petition with the probate court. This process involves gathering necessary documentation, such as birth certificates and marriage licenses, to establish your relationship to the deceased. Understanding the nuances of Michigan heirship for identify can simplify this procedure. Additionally, USLegalForms provides templates and tools that guide you through the declaration process, making it more manageable.

Priority heirs are those individuals who have the first legal right to inherit from a deceased person under Michigan law. Generally, the spouse and children are considered priority heirs, followed by parents and siblings if there are no surviving children. Grasping the concept of Michigan heirship for identify helps clarify these relationships and rights. For help identifying priority heirs, USLegalForms offers comprehensive resources to ensure you understand your position.

In Michigan, the heirs of a deceased person are determined by the state's intestate succession laws. These laws specify that heirs typically include the deceased's spouse, children, and, if none are present, parents and siblings. Understanding Michigan heirship for identify is essential, as it establishes who has a legal claim to the deceased’s assets. If you need assistance navigating this process, consider using USLegalForms for clear guidance.

Yes, you can file an affidavit of heirship on your own in Texas, as long as you ensure it meets state requirements. However, understanding the nuances of the law can enhance your filing's effectiveness. If you need assistance, platforms like USLegalForms can provide the necessary guidance for both Michigan heirship for identity and Texas regulations.

Yes, you can write your own affidavit of heirship, provided you include the necessary information and structure it correctly. However, it's crucial to ensure that the affidavit complies with Michigan laws. Using a service like USLegalForms can simplify the process and help you focus on Michigan heirship for identity.

To write a self-declaration for a legal heir certificate, start by clearly stating your relationship to the deceased. Include your personal details and any relevant information about the estate. Resources from USLegalForms can guide you in crafting a declaration that accurately reflects your claim under Michigan heirship for identity.

Form PC 598 is the Michigan Affidavit of Heirship, which establishes the identity of heirs when a person passes away without a will. This form plays a crucial role in clarifying the heirship status and can be essential for Michigan heirship for identity matters. Completing this form correctly can facilitate smoother estate resolution.

In Michigan, you do not necessarily need a lawyer to file an affidavit of heirship. However, having legal guidance can help ensure that the document is properly formatted and contains all required details. If you are unsure, consider consulting with a professional or using resources from USLegalForms focusing on Michigan heirship for identity.

Yes, you can create an affidavit without a lawyer, but it is important to ensure it meets legal requirements. Self-prepared affidavits must be clear and include all necessary information. Utilizing platforms like USLegalForms can help you draft an affidavit that aligns with Michigan heirship for identity.

To avoid probate in Michigan, consider establishing a living trust or designating beneficiaries on your accounts. This strategy allows assets to transfer directly to heirs without going through the probate process. Effective planning regarding Michigan heirship for identity can significantly simplify estate management.