Firpta Form In Maine Withholding Certificate

Description

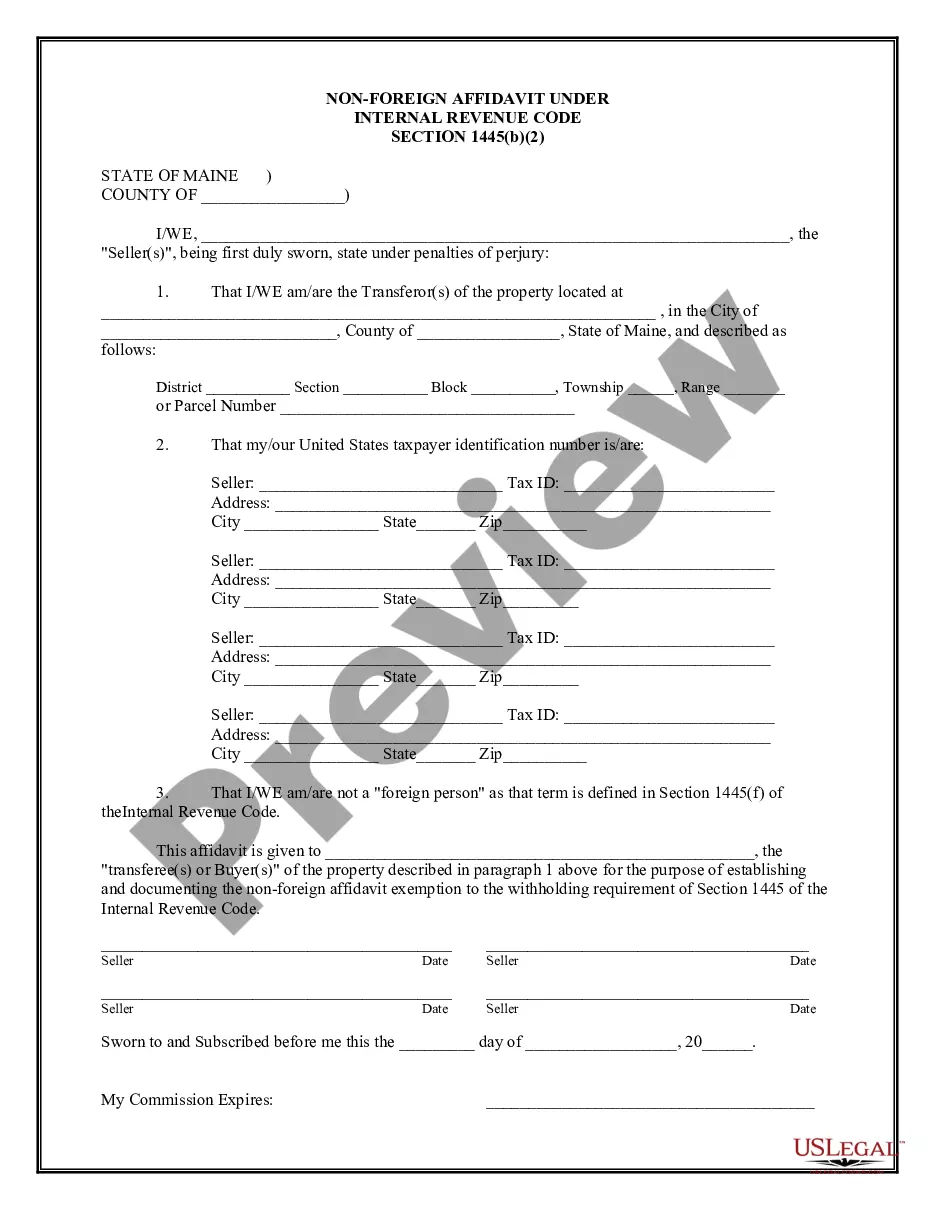

How to fill out Maine Non-Foreign Affidavit Under IRC 1445?

Traversing the red tape of official documents and formats can be daunting, particularly if one is not engaged in that professionally.

Even selecting the correct format for a Firpta Form In Maine Withholding Certificate will be labor-intensive, as it must be accurate and precise to the last detail.

However, you will need to spend significantly less time locating a suitable template from a trustworthy source.

Obtain the correct form in a few simple steps: Enter the document name in the search field. Find the appropriate Firpta Form In Maine Withholding Certificate among the results. Review the description of the sample or open its preview. If the template satisfies your needs, click Buy Now. Choose your subscription plan. Use your email to create a secure password to register an account at US Legal Forms. Select a credit card or PayPal payment option. Save the template file on your device in your preferred format. US Legal Forms will conserve your time and energy investigating whether the form you encountered online is suitable for your purposes. Create an account and gain unrestricted access to all the templates you require.

- US Legal Forms is a resource that streamlines the process of finding the appropriate documents online.

- US Legal Forms serves as a single platform to acquire the most current samples of forms, consult their applicability, and download these specimens for completion.

- This is a repository with over 85K forms applicable in diverse fields.

- When searching for a Firpta Form In Maine Withholding Certificate, you won't have to doubt its authenticity as all forms are validated.

- Having an account at US Legal Forms will ensure you have all necessary samples at your fingertips.

- You can save them in your history or add them to the My documents collection.

- You can retrieve your saved forms from any device by clicking Log In on the library site.

- If you do not yet have an account, you can still search for the template you need.

Form popularity

FAQ

Typically, any foreign seller of U.S. real estate must file for FIRPTA. This includes individuals, corporations, partnerships, and other entities selling property. Buyers should also consider their role when completing documentation related to FIRPTA. Having the Firpta form in maine withholding certificate is important to ensure that all parties fulfill their obligations under IRS regulations.

To obtain a FIRPTA withholding certificate, you must file Form 8288-B with the IRS. This form requests the withholding certificate and requires you to provide information about the transaction, including the property details and involved parties. It’s advisable to consult with a tax professional or use platforms like uslegalforms to assist you in efficiently completing the necessary forms and ensuring compliance. This can make obtaining the Firpta form in maine withholding certificate much easier.

A FIRPTA form is a document required by the U.S. government to report the sale of U.S. real estate by foreign sellers. This form helps ensure that the appropriate taxes are collected on the transaction. Completing the Firpta form in maine withholding certificate is essential for maintaining compliance with tax regulations. Having this form ready can simplify the process and protect both buyers and sellers.

The withholding agent for FIRPTA is typically the buyer of the property. This means that as a buyer, you are responsible for ensuring the proper tax is withheld when purchasing property from a foreign seller. It is crucial to understand this role to avoid any complications during the transaction. By obtaining the Firpta form in maine withholding certificate, you can manage your responsibilities effectively.

The purpose of the withholding certificate is to officially document and verify the amount that needs to be withheld during a real estate transaction involving a foreign seller. This certificate helps streamline the tax reporting process and protects both parties from potential legal issues. With the right FIRPTA form in Maine withholding certificate, you can simplify compliance and ensure accurate tax filings.

Yes, Maine has specific forms for state tax withholding which may apply to real estate transactions. It's important to check state-specific regulations, as they can vary. Incorporating the FIRPTA form in Maine withholding certificate alongside any state forms will help ensure thorough compliance with both federal and state tax laws.

A FIRPTA withholding certificate is a document that requests a reduction of the FIRPTA withholding amount. This certificate can be submitted to the IRS for approval if the seller qualifies for a lower withholding rate. Completing the FIRPTA form in Maine withholding certificate correctly can help facilitate this process and reduce potential financial burdens.

The FIRPTA certificate serves as proof of the amount withheld from the sale proceeds by the buyer. This certificate indicates compliance with FIRPTA regulations and is crucial for the seller to claim a tax refund when applicable. With a proper FIRPTA form in Maine withholding certificate, both buyers and sellers can navigate this process more efficiently.

The FIRPTA affidavit is typically provided by the seller of the property. This document affirms the seller's foreign status and is necessary for the buyer to determine the appropriate FIRPTA withholding. If you need assistance with the FIRPTA form in Maine withholding certificate, consider utilizing uslegalforms, which can guide you through the process.

To submit FIRPTA withholding to the IRS, you must complete Form 8288 and ensure the funds are sent along with the form. The withheld amount must typically be submitted within 20 days of the sale. By using the FIRPTA form in Maine withholding certificate, you can ensure that all necessary information is included and submitted correctly.