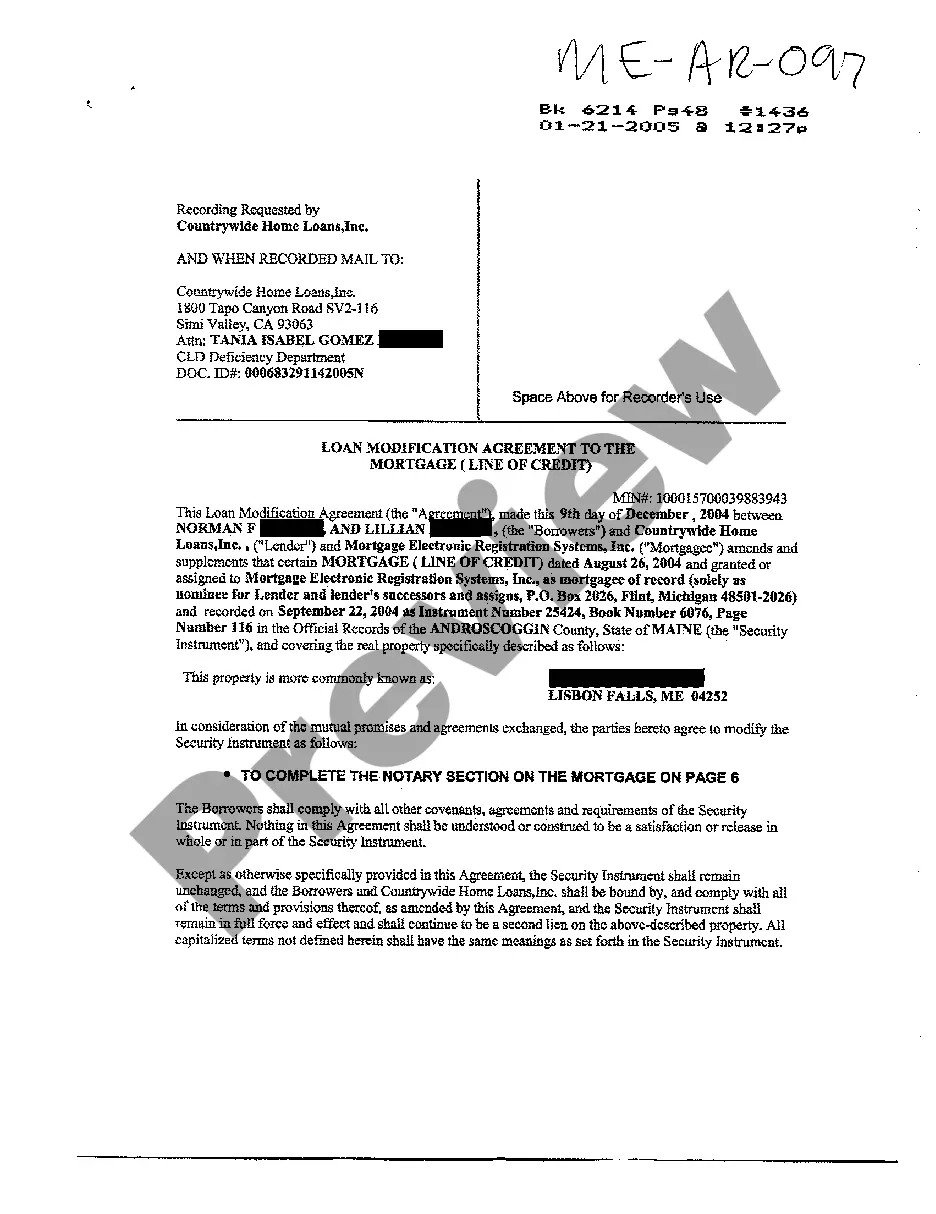

Mortgage Modification Agreement Maine Withholding

Description

How to fill out Maine Loan Modification Agreement To The Mortgage?

Regardless of whether you frequently handle documents or only occasionally need to submit a legal report, it is essential to find a resource where all the samples are pertinent and current.

The initial step you should take when utilizing a Mortgage Modification Agreement Maine Withholding is to confirm that it is the latest version, as it determines its eligibility for submission.

If you wish to streamline your quest for the latest document examples, search for them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search menu to locate the necessary form. Review the preview and description of the Mortgage Modification Agreement Maine Withholding to ensure it’s the exact one you need. After verifying the form, just click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your current one. Provide your bank card information or PayPal account to complete the transaction. Choose the file format for download and confirm your selection. Eliminate confusion when dealing with legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms serves as a compendium of legal templates that features virtually every document sample you might seek.

- Browse the templates you require, check their relevance immediately, and learn more about their applicability.

- With US Legal Forms, you gain access to over 85,000 document formats across various sectors.

- In just a few clicks, locate the Mortgage Modification Agreement Maine Withholding examples and save them to your profile at any time.

- A profile on US Legal Forms will enable you to access all the samples you need with ease and minimal hassle.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need will be readily available.

- You won't need to spend time searching for the perfect template or verifying its validity.

Form popularity

FAQ

Change Your Withholding Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

You are required to withhold Maine income tax if: 1) You maintain an office in Maine or transact business in Maine; 2) You make payments to individuals (resident or nonresident) who are taxable to Maine; and 3) You are required to withhold federal income tax from those payments.

Individual Income Tax The 2021 Maine personal exemption amount is $4,300 and the Maine basic standard deduction amounts are $12,550 for single and $25,100 for married individuals filing joint returns.

If the form is incorrect, and you had state taxes withheld, you would need to have the employer issue a corrected W-2. Unfortunately, if they did not withhold state taxes (even if you did not indicate this), you have to report it as such because nothing was paid in.