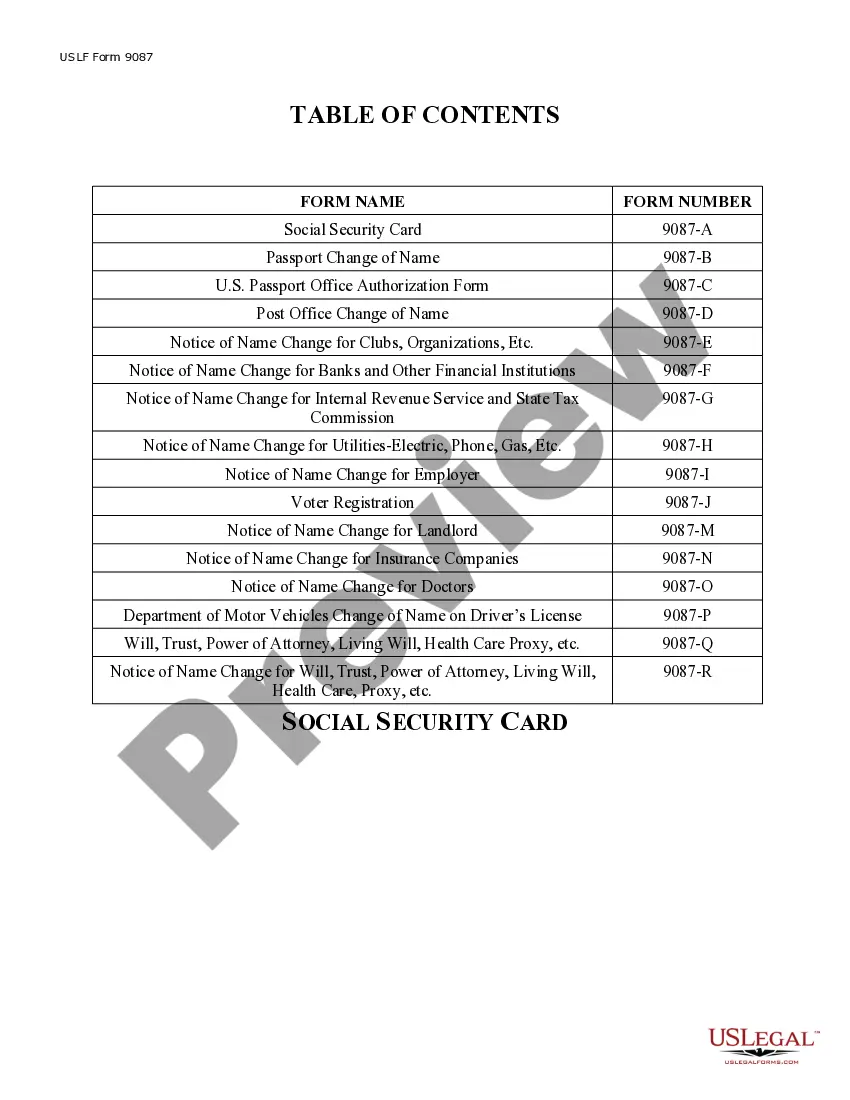

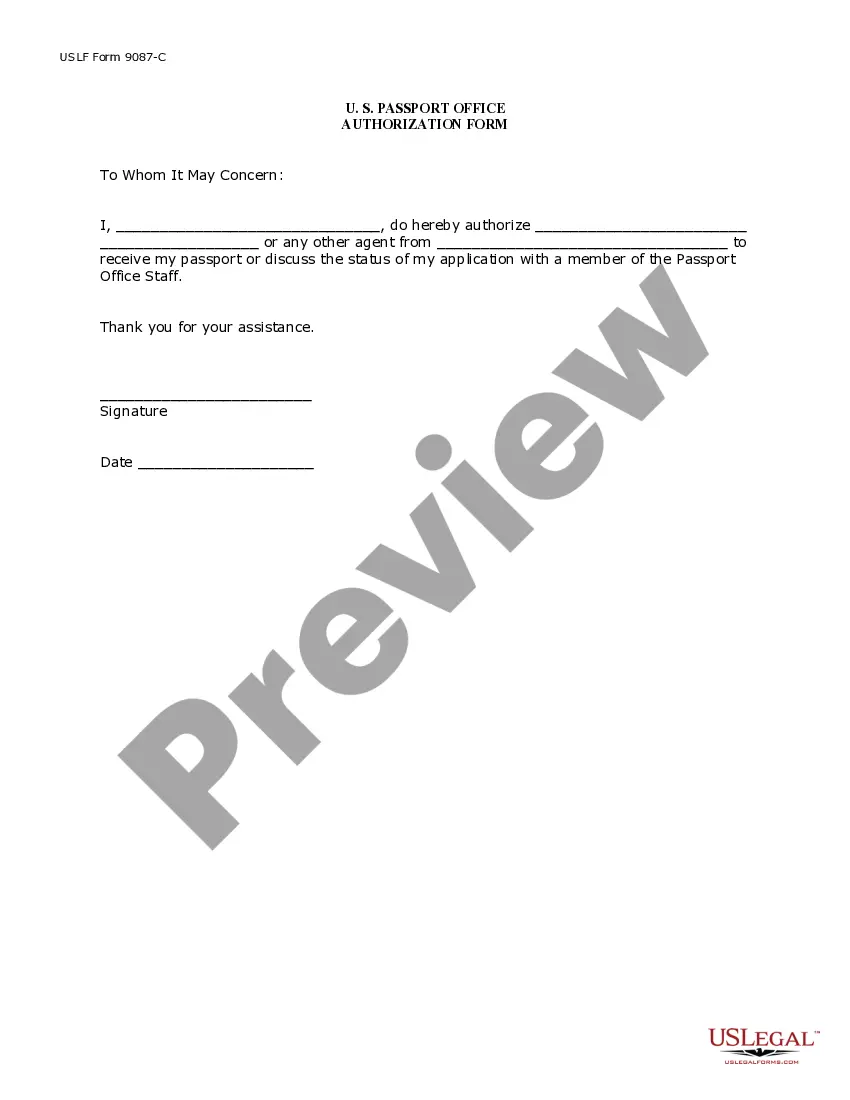

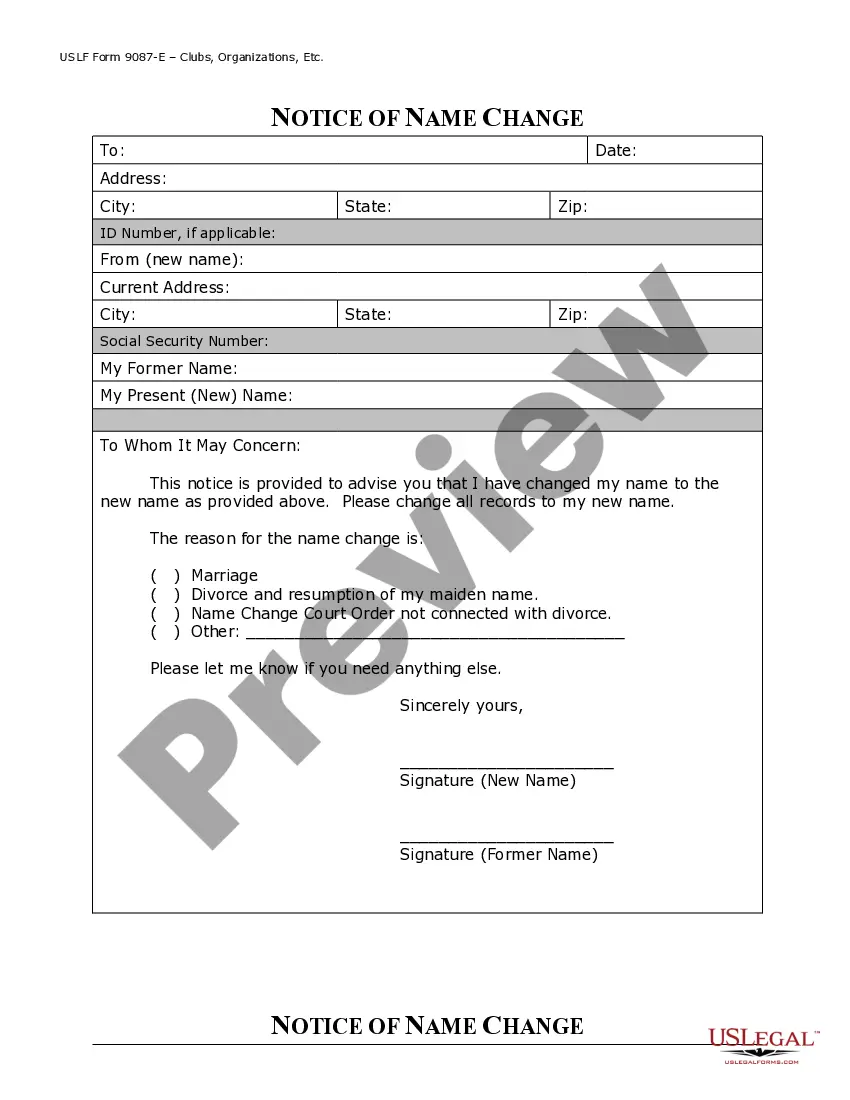

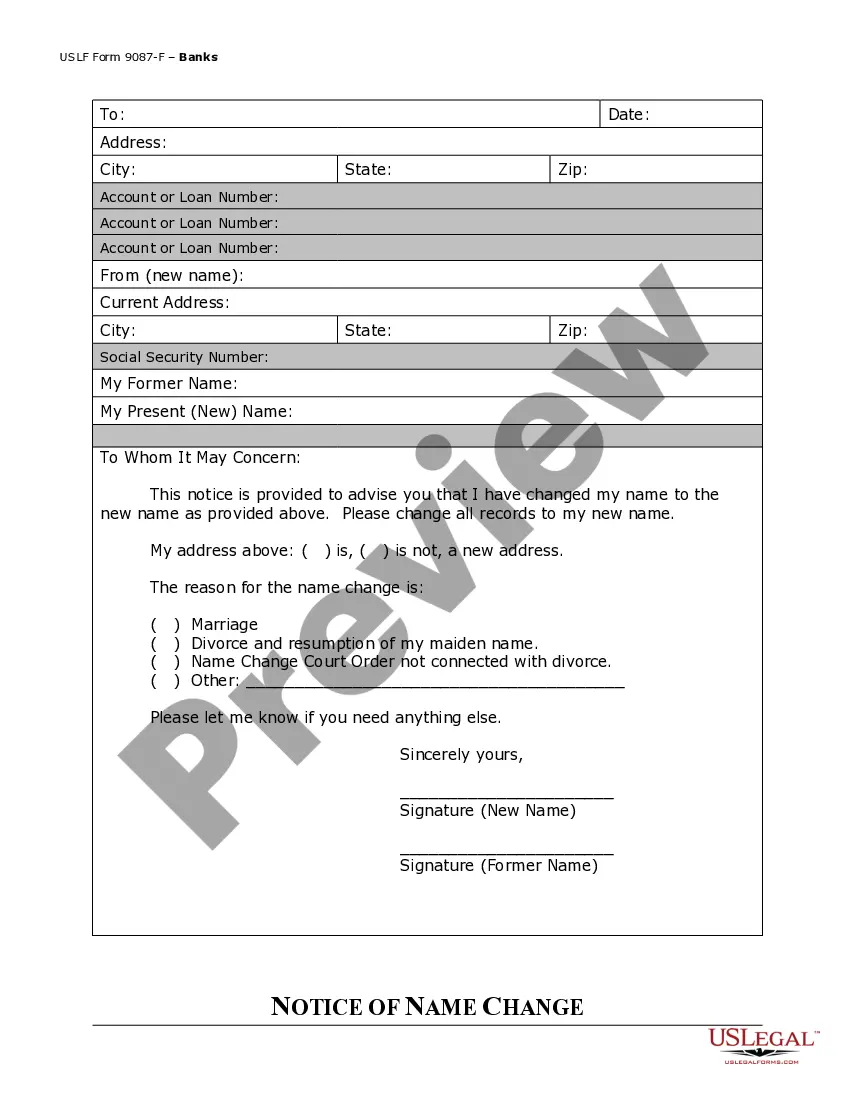

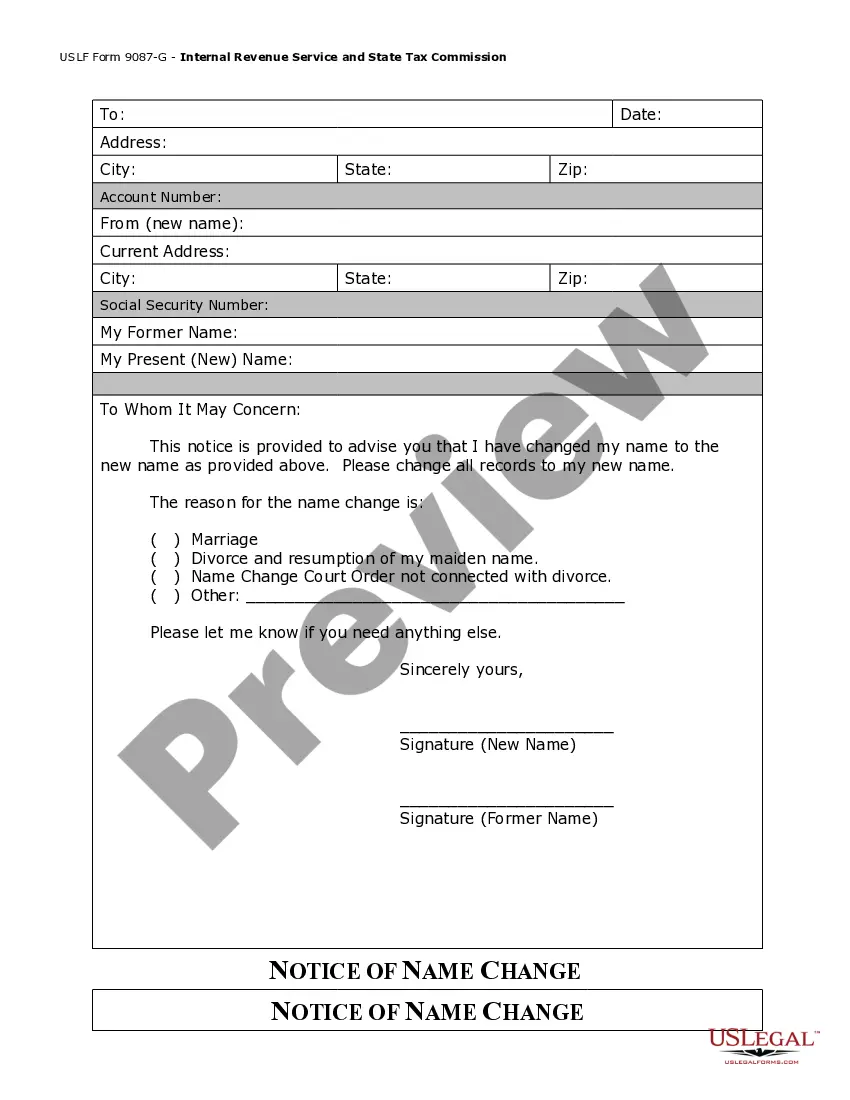

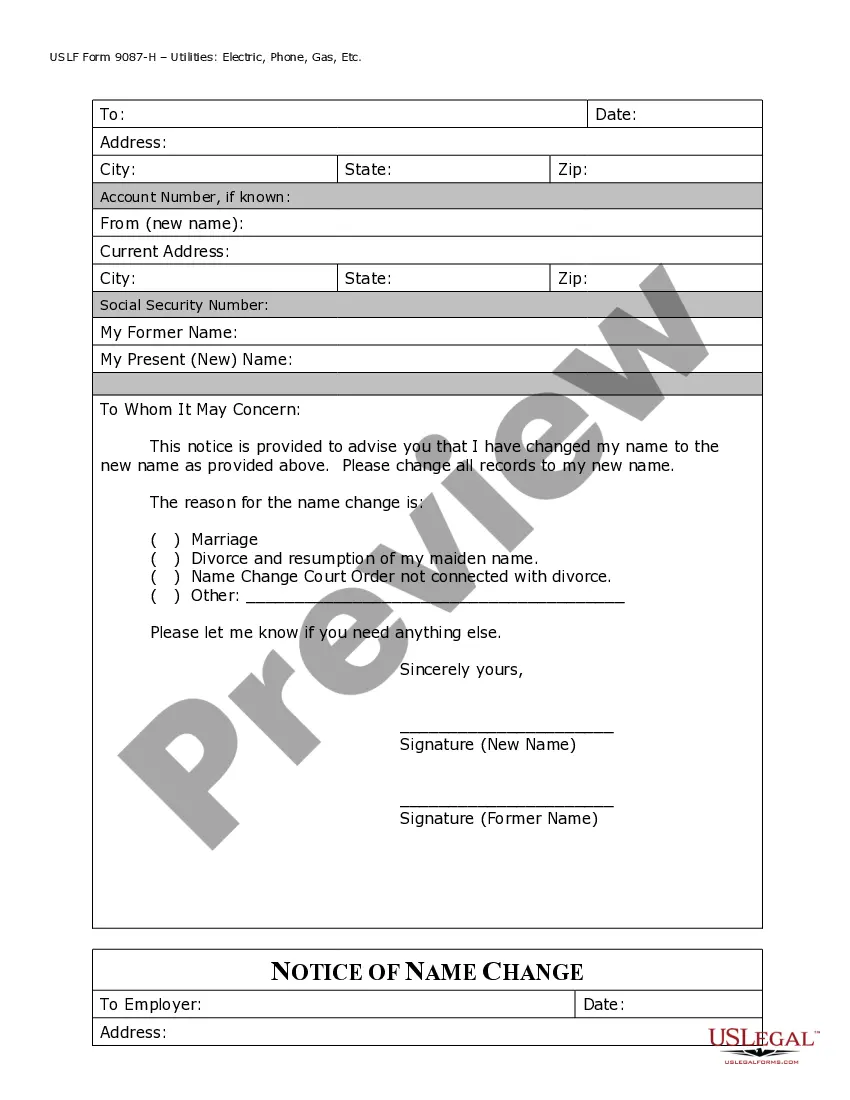

This Name Change Notification Package - Brides, Court Order Name Change, Divorced, Marriage form is an extensive package containing forms and instructions for notifying government agencies and others of a name change. Forms and instructions included for Passport, Social Security Card, Voter Registration, Employer, Banks and other Financial Institutions, Clubs and Organizations, Drivers License, Post Office, Insurance Companies, IRS, State Tax Commission, etc. It also contains forms for changing contracts, wills and other legal documents

Maine Name Change Withholding

Description

Form popularity

FAQ

The amount you should withhold for Maine taxes depends on your income level and filing status. It's crucial to calculate this correctly, especially after a name change in Maine, to avoid under or over withholding. The Maine Revenue Services provides guidelines that can help you determine the right amount. If you find the process overwhelming, USLegalForms offers resources to ensure you meet your withholding obligations efficiently.

Yes, you can reclaim your withholding tax if you qualify for a refund based on your tax situation. After a name change in Maine, make sure to file your tax return accurately to facilitate the reclaim process. This might also include the option to amend previous filings if necessary. If you want to navigate the complexities involved, USLegalForms can provide the necessary forms and guidance.

Yes, you can change your withholding at any time by submitting a new Form W-4 to your employer. When you make a name change in Maine, it's essential to update your withholding information to reflect your new identity. This change can help ensure that your tax withholdings match your updated filing status. If you need assistance with this process, consider using USLegalForms to simplify the paperwork.

Many people find that certain states have streamlined processes for legally changing your name. States like California and New York are often cited for their user-friendly approaches. However, Maine also offers a straightforward procedure, especially when you consider factors like Maine name change withholding. If you need assistance, uslegalforms can provide you with the necessary tools to facilitate your name change journey.

In Maine, withholding refers to the portion of your wages retained by your employer to cover state income taxes. As of 2025, the rates may vary based on your income level and filing status. It's important to stay informed about these changes, especially if you are considering a Maine name change and how that may affect your tax situation. Understanding Maine name change withholding can help you better manage your finances during this transition.

Non-residents in Maine typically face a withholding tax rate based on their income and specific circumstances. It's important to check current rates with Maine Revenue Services, as they may change. If you are a non-resident impacted by a name change, you should also look into how the Maine name change withholding affects your tax situation to avoid surprises.

You can reach the Maine withholding department at 1-207-624-9784. This number is essential for answering your questions about withholding regulations and policies. When you call, have your personal tax information ready. It will help you receive the most accurate advice, especially regarding Maine name change withholding.

To change your withholding, complete the appropriate form, such as the W-4ME, and submit it to your employer. This form allows you to specify the amount to withhold or to adjust your filing status. If you’ve undergone a name change, make sure to indicate this on the form to ensure proper Maine name change withholding updates. Keeping your information current is essential.

Yes, Maine does have a state withholding tax. Employers are required to withhold state income taxes from employee wages, following the guidelines provided by Maine Revenue Services. If you experience a name change, you should notify your employer to adjust the Maine name change withholding accordingly.

Yes, you can file your Maine taxes online through the Maine Revenue Services website. Online filing is convenient, allowing for quicker processing of your return. It is also beneficial for tracking any potential Maine name change withholding implications on your file. Ensure you have all necessary documents for a smooth filing experience.