Minutes A Corporation With Debt

Description

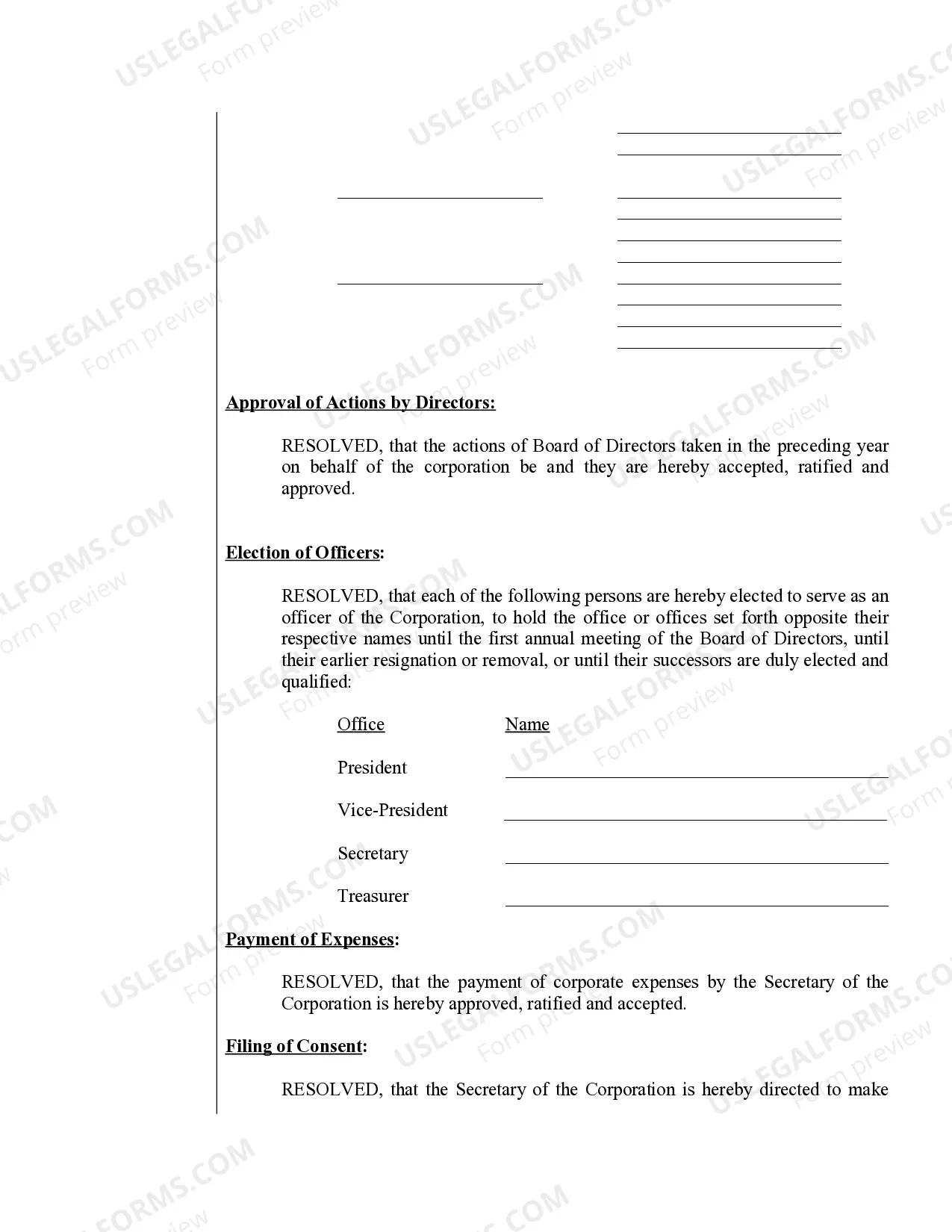

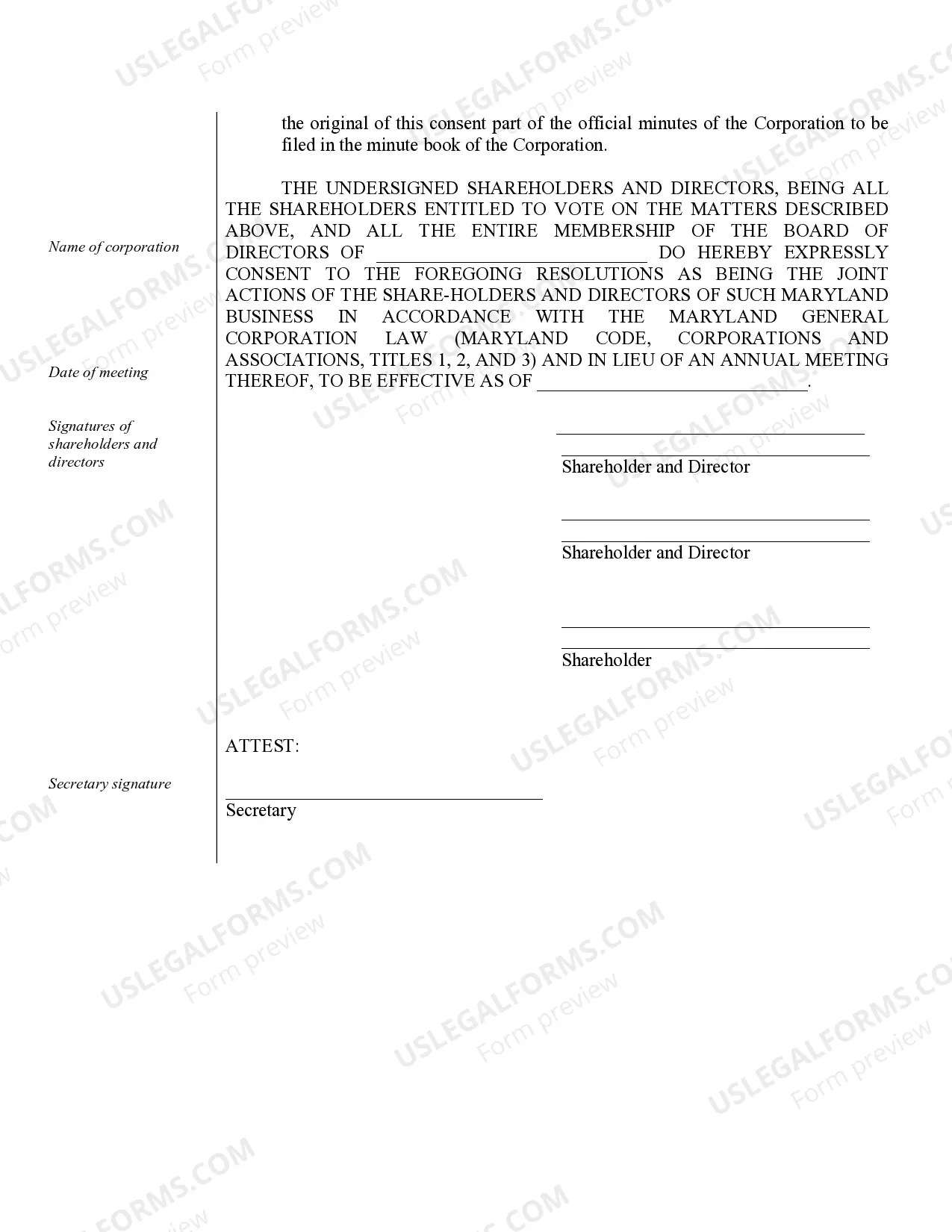

How to fill out Sample Annual Minutes For A Maryland Professional Corporation?

Legal papers managing may be frustrating, even for the most knowledgeable experts. When you are looking for a Minutes A Corporation With Debt and do not get the a chance to devote in search of the correct and up-to-date version, the processes may be demanding. A strong online form library might be a gamechanger for everyone who wants to manage these situations successfully. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms covers any requirements you might have, from personal to business documents, all-in-one place.

- Use advanced resources to accomplish and handle your Minutes A Corporation With Debt

- Access a resource base of articles, instructions and handbooks and materials connected to your situation and requirements

Save effort and time in search of the documents you will need, and utilize US Legal Forms’ advanced search and Preview feature to find Minutes A Corporation With Debt and get it. For those who have a membership, log in to the US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to find out the documents you previously saved and to handle your folders as you can see fit.

If it is your first time with US Legal Forms, make a free account and have limitless usage of all advantages of the platform. Here are the steps for taking after accessing the form you want:

- Verify this is the proper form by previewing it and reading its information.

- Ensure that the sample is approved in your state or county.

- Choose Buy Now when you are ready.

- Choose a monthly subscription plan.

- Pick the formatting you want, and Download, complete, sign, print and send your papers.

Enjoy the US Legal Forms online library, backed with 25 years of experience and trustworthiness. Change your daily papers administration into a smooth and easy-to-use process right now.

Form popularity

FAQ

Because you accrue this debt for personal reasons and not for your company, this type is considered to be consumer debt. Business debt: Business debt, or nonconsumer debt, is any debt you take on for your business, such as a limited liability company. Sometimes, there can be a gray area.

Common types of reportable liabilities include: boat loans, capital commitments, credit card debt, exercised lines of credit, margin accounts, mortgage debt, student loans, loans from non-commercial sources (e.g., loan from a friend), and liabilities for which you co-signed and have a current legal obligation to repay.

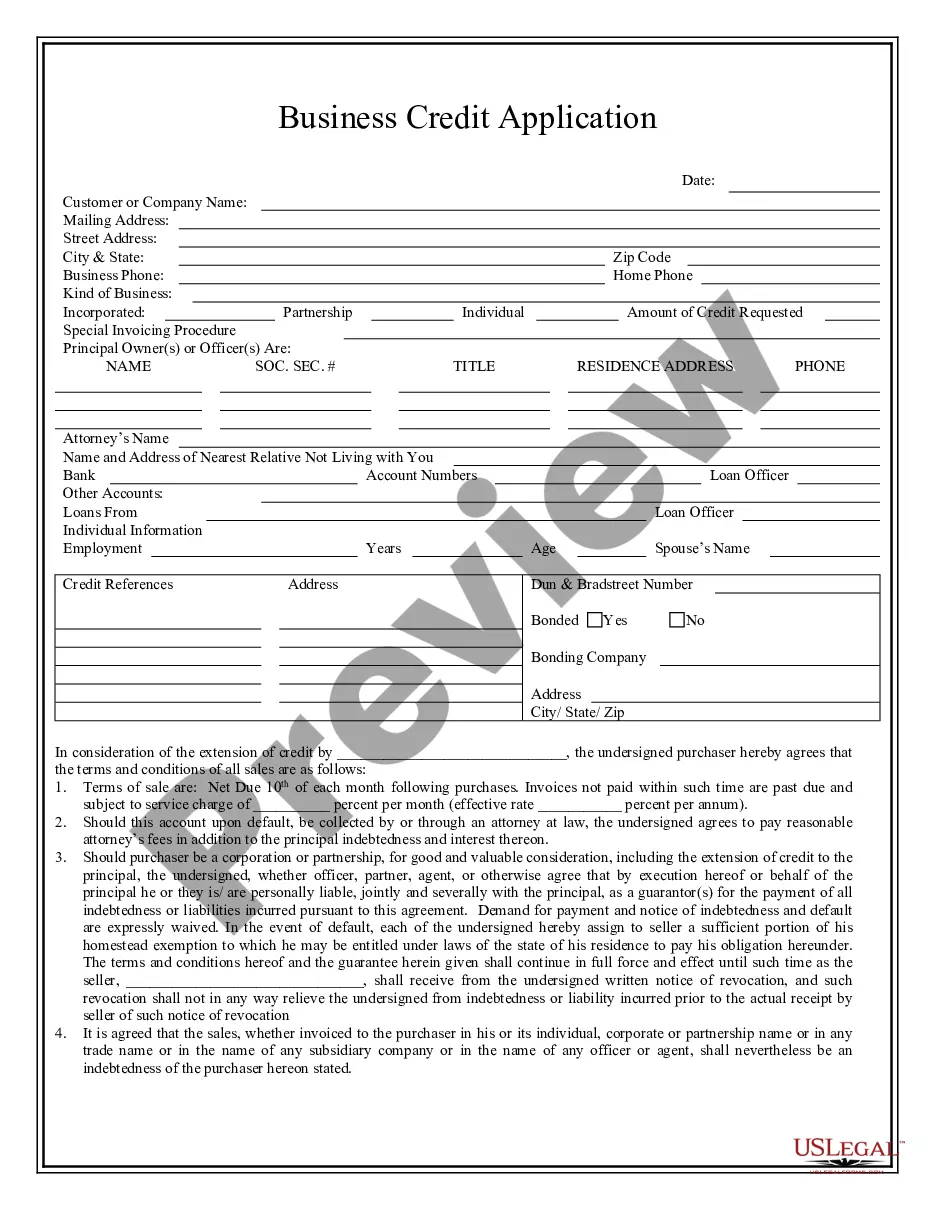

How to make a business debt schedule Name of creditor/lender. Type of debt. Original amount of debt. Origination date of debt. Interest rate. Current balance. Monthly payment amount. Maturity date.

When you begin to make a debt schedule, list out all the relevant details of the debt, including: Creditor or lender name. Origination date of the debt. Original debt amount. Current balance. Interest rate. Monthly payment. Security or collateral pledged. Maturity date.

Details of each debt should be included in the debt schedule. These details include the creditor or lender, the current balance and the original total debt amount, the interest rate, monthly payment, maturity date, due date, and any collateral pledged.