Minutes A Corporation For Tax Purposes

Description

How to fill out Sample Annual Minutes For A Maryland Professional Corporation?

Legal management can be frustrating, even for knowledgeable experts. When you are looking for a Minutes A Corporation For Tax Purposes and don’t have the a chance to commit searching for the appropriate and updated version, the processes could be stressful. A strong online form library can be a gamechanger for anybody who wants to manage these situations effectively. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from personal to organization papers, all in one location.

- Utilize innovative resources to finish and control your Minutes A Corporation For Tax Purposes

- Gain access to a useful resource base of articles, instructions and handbooks and materials related to your situation and needs

Help save effort and time searching for the papers you will need, and use US Legal Forms’ advanced search and Preview tool to locate Minutes A Corporation For Tax Purposes and get it. For those who have a monthly subscription, log in for your US Legal Forms account, search for the form, and get it. Take a look at My Forms tab to view the papers you previously downloaded as well as to control your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and acquire limitless access to all advantages of the library. Listed below are the steps for taking after accessing the form you want:

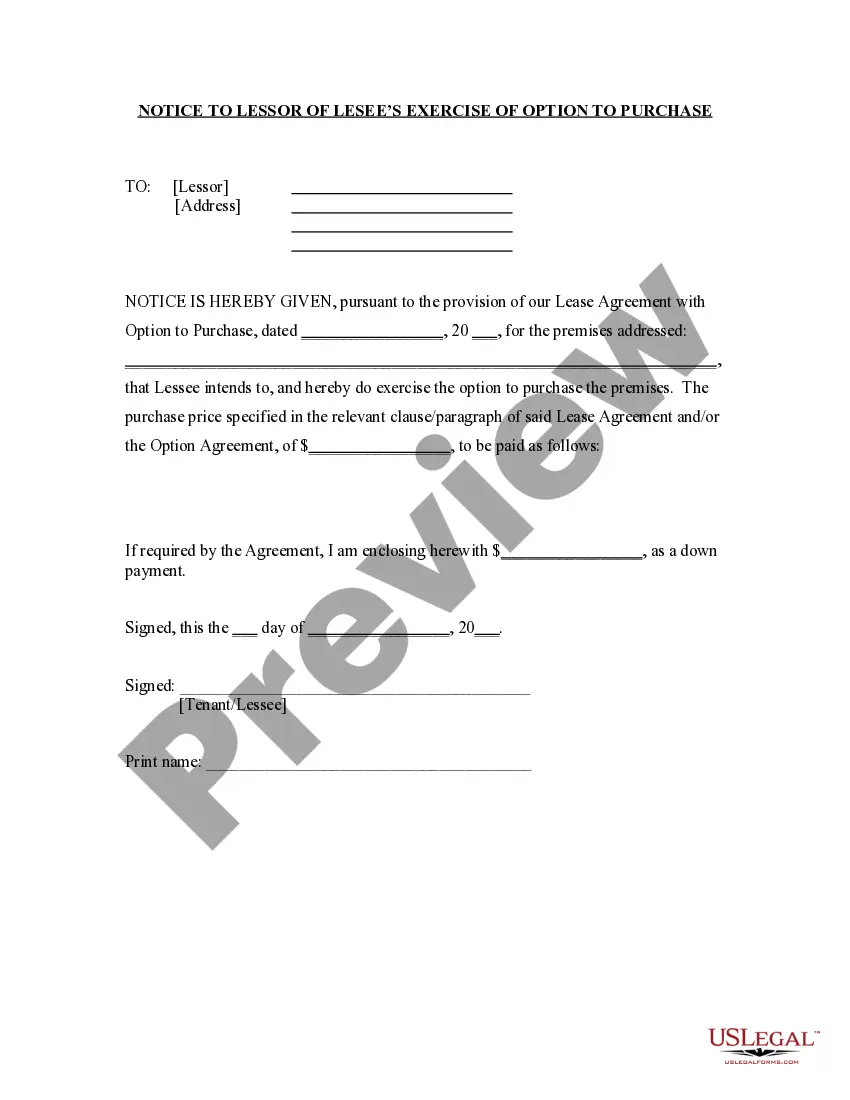

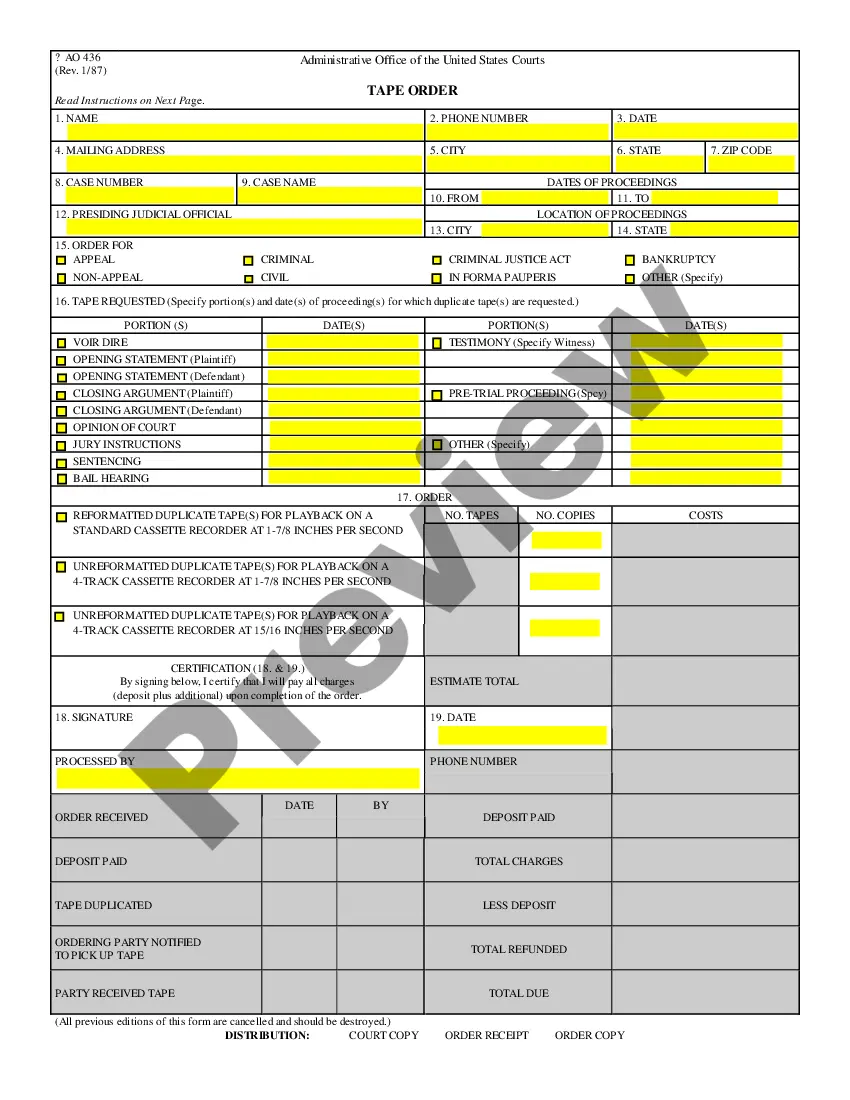

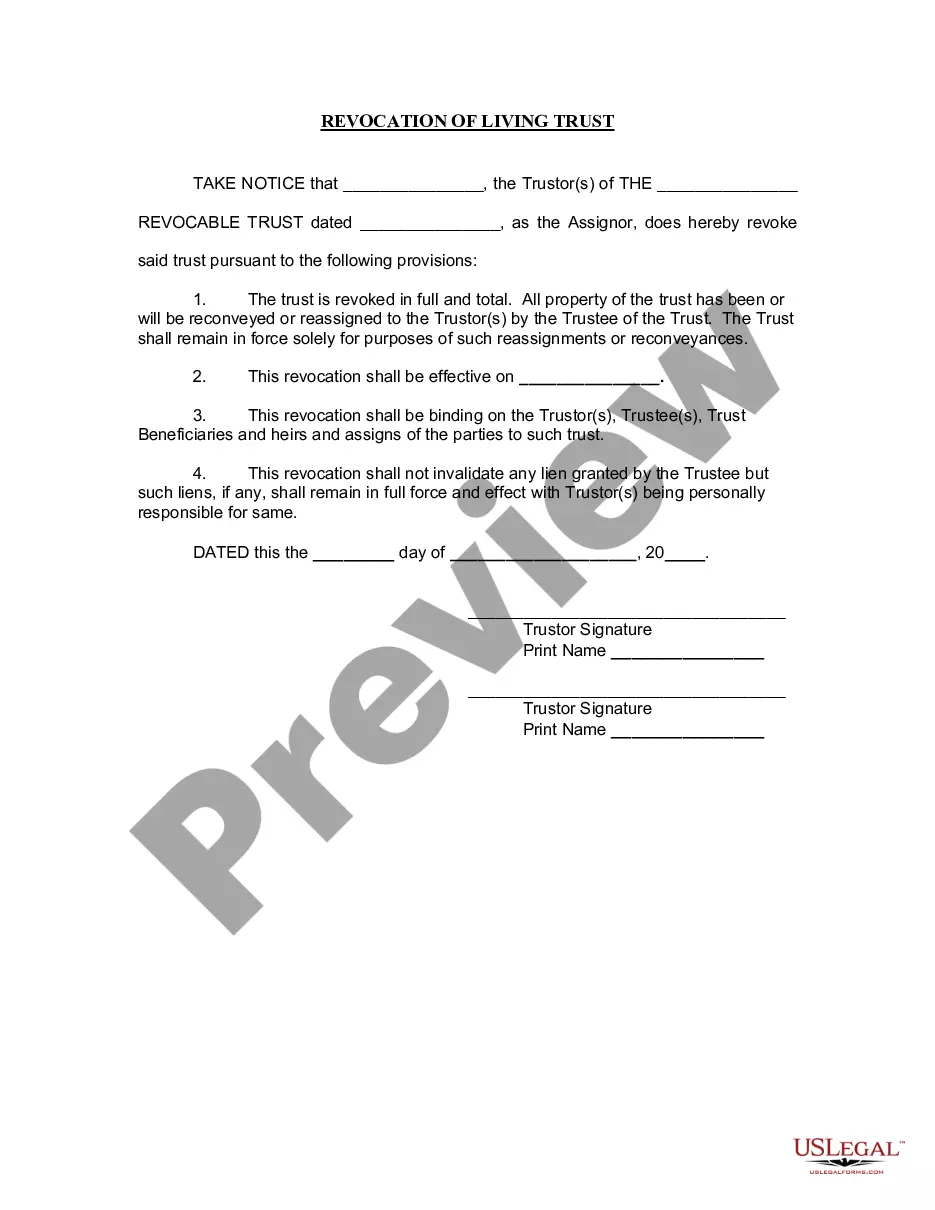

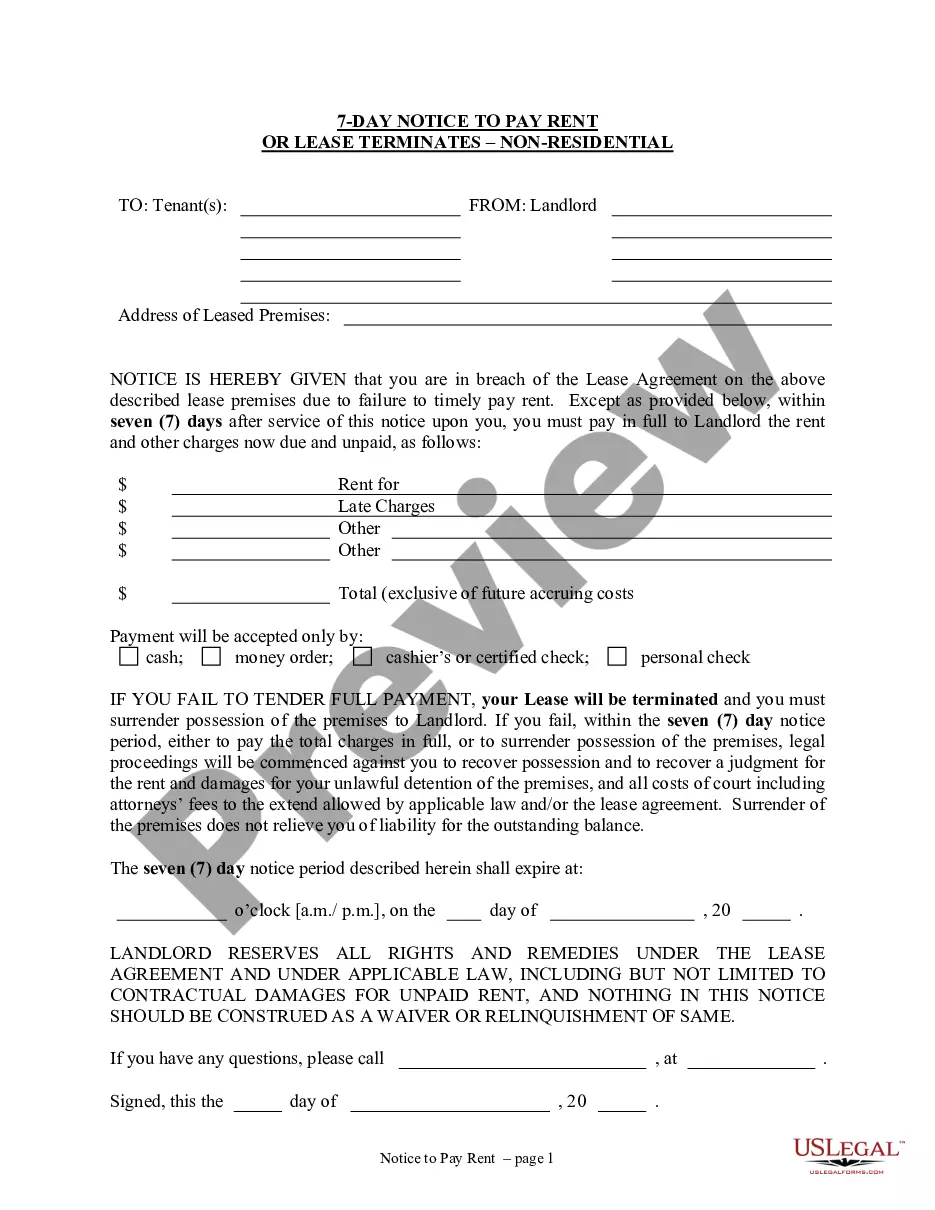

- Validate this is the correct form by previewing it and reading through its description.

- Ensure that the sample is approved in your state or county.

- Pick Buy Now when you are ready.

- Select a subscription plan.

- Pick the format you want, and Download, complete, sign, print out and deliver your document.

Benefit from the US Legal Forms online library, supported with 25 years of experience and trustworthiness. Change your daily document management into a smooth and intuitive process today.

Form popularity

FAQ

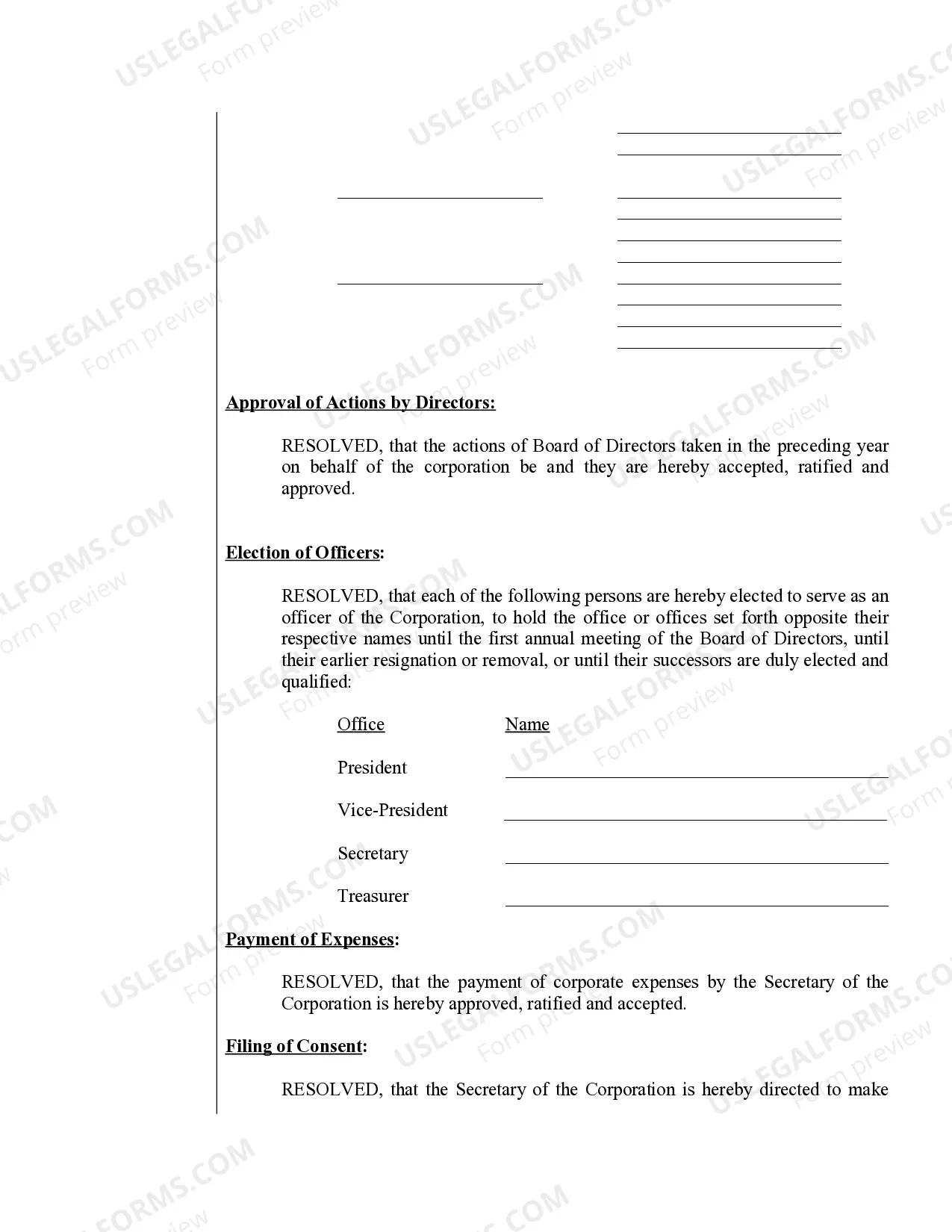

The minutes should not be a verbatim transcript, any more than they should be a bare-bones outline. It is best to say that minutes should be an accurate and truthful summary of what occurred. The length of any specific item in the minutes should reflect the relative importance of that item to the meeting agenda.

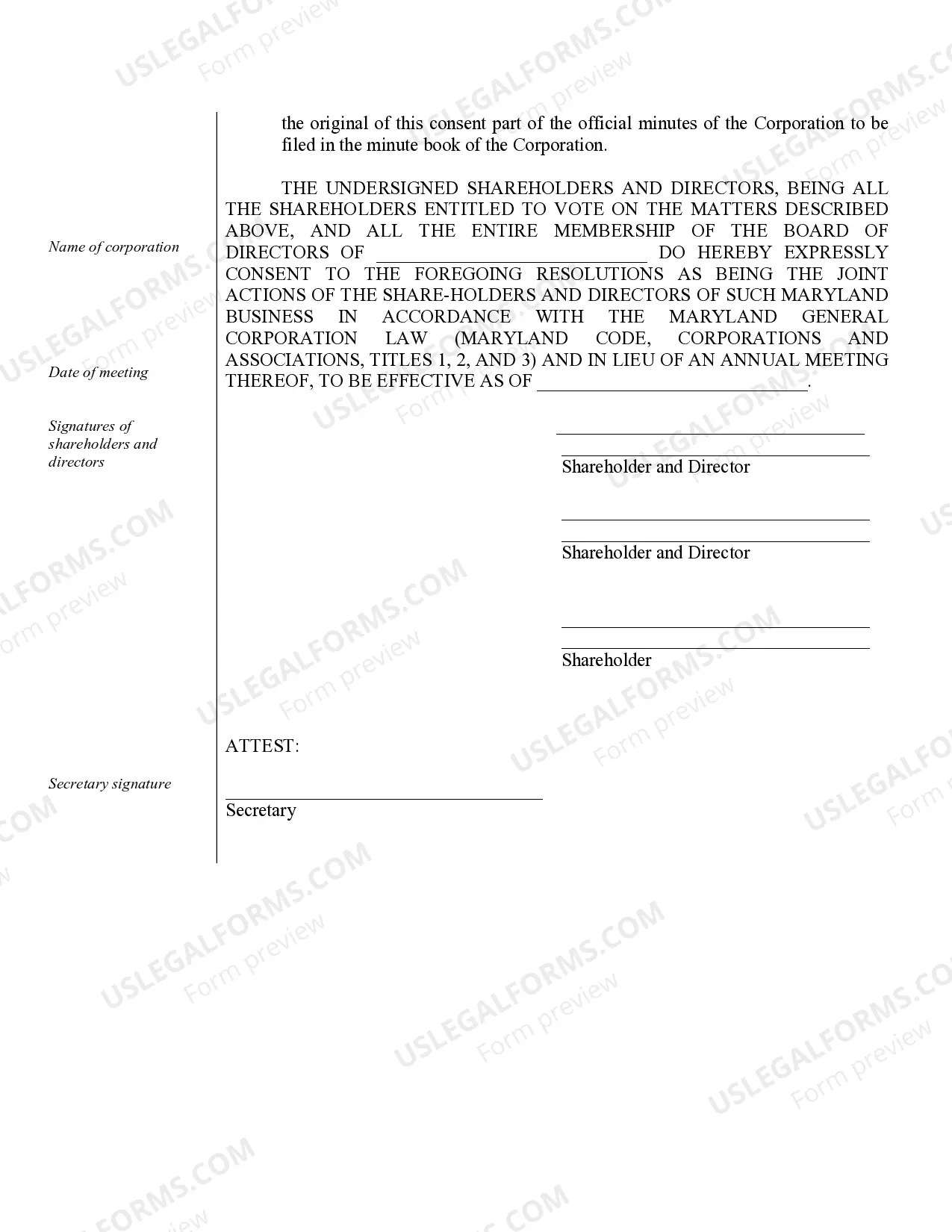

As for content, in general, your S corporation's meeting minutes should contain the following information: date and place of the meeting. who was present and who was absent from the meeting. details about the matters discussed at the meeting. results of votes taken, if any.

Though these minutes do not need to be filed with the state and can instead be kept with your corporate records, they are important documents for protecting your limited liability status and keeping track of the votes and decisions made by your business.

How to Write Corporate Minutes Date and Time of the Meeting. Start by documenting the date and time of the meeting. ... Names of Meeting Participants. Next, list the names of the attendees. ... Purpose of the Meeting. Include a statement defining the reason for the corporate meeting. ... Meeting Notes. ... Action Items.

What should be recorded in meeting minutes? Any actions taken (or agreed to be taken) during the meeting. Voting outcomes on proposals brought forward to the board. The outcome of motions (taken or rejected) Items to be held over to a meeting at a later date.