Power Attorney Poa Form For Business

Description

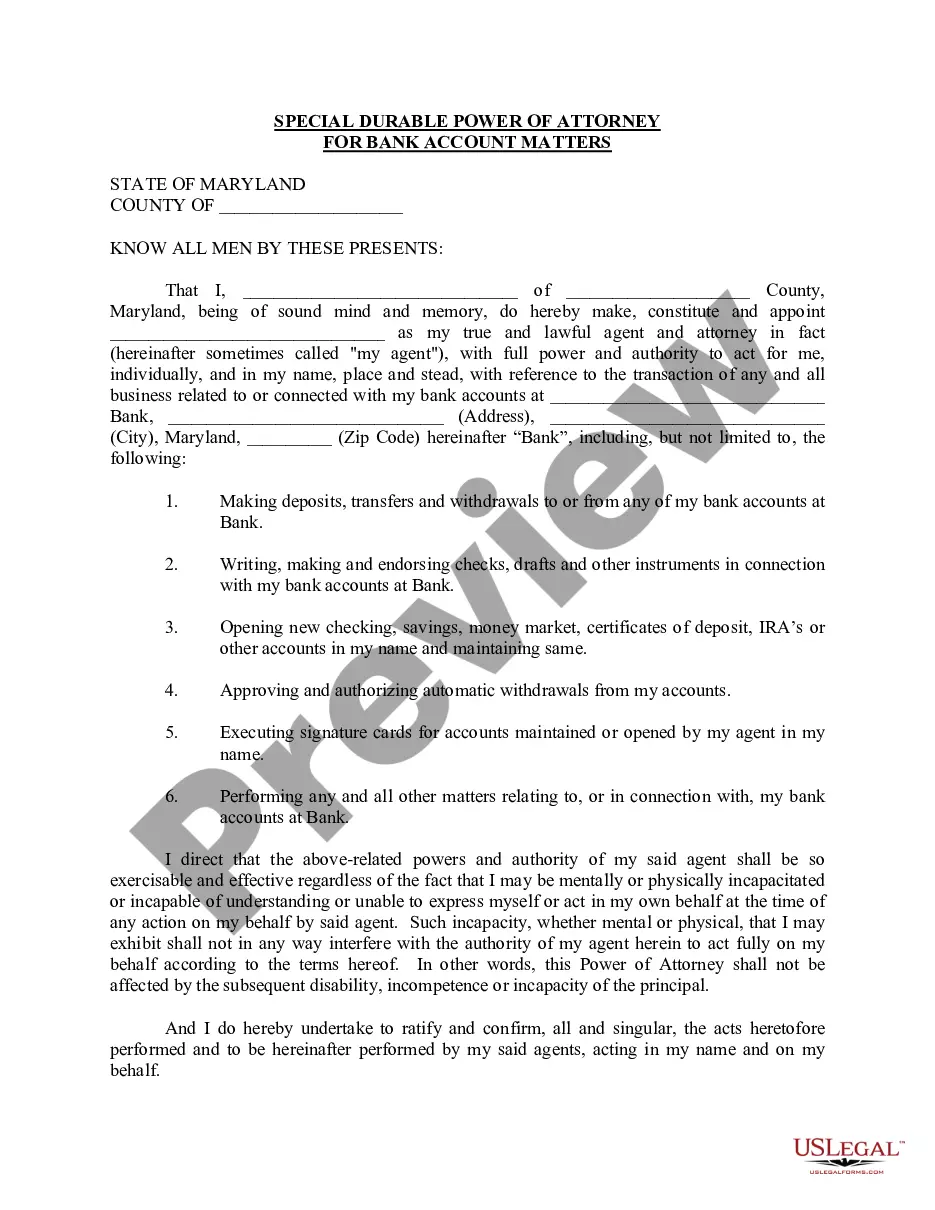

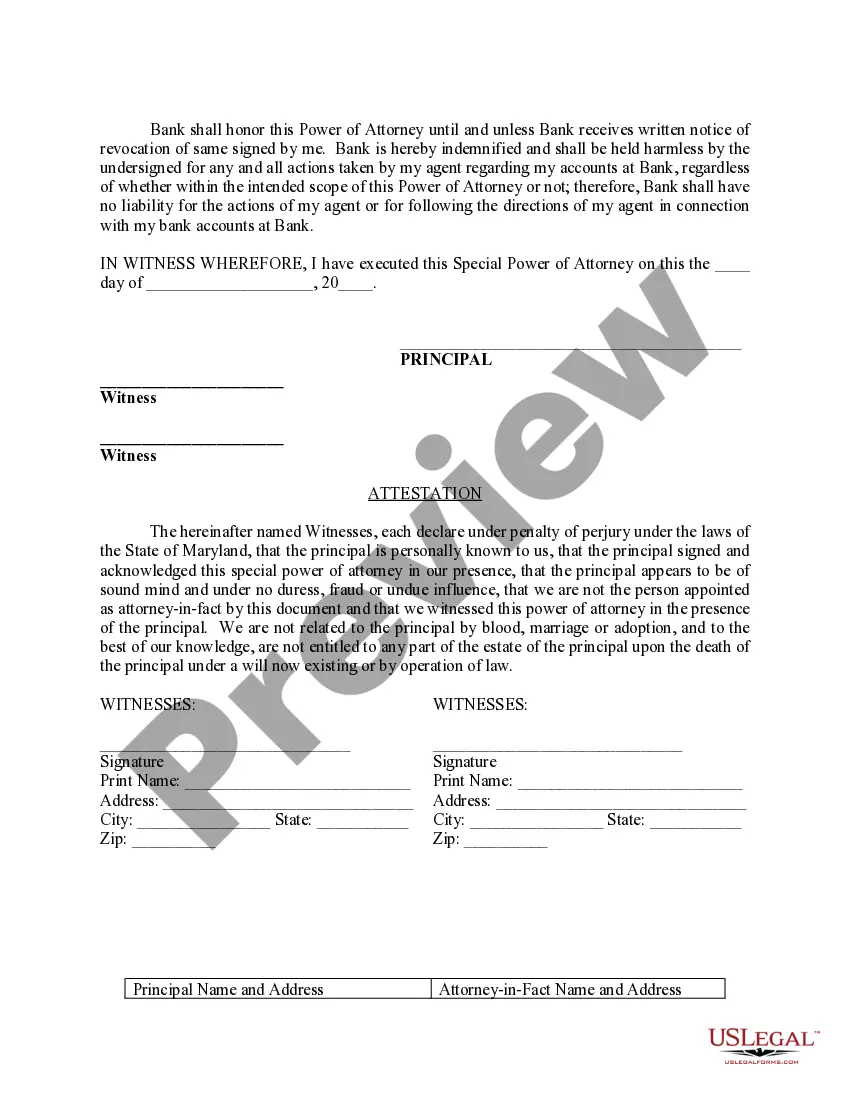

How to fill out Maryland Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your existing US Legal Forms account. Ensure your subscription remains valid to access the required document.

- If you’re new to the service, start by checking the Preview mode and read the form description carefully to find the appropriate Power Attorney POA form that aligns with your needs.

- In case you find discrepancies, utilize the Search feature to explore alternative templates that may better suit your business requirements.

- Once you've identified the correct form, proceed by clicking the Buy Now button and select your ideal subscription plan. Registration is necessary to unlock full access to the resource library.

- Finalize your purchase by entering your payment details, either via credit card or PayPal, to secure your subscription.

- After payment, download the form onto your device. You can revisit and access it anytime from the My Documents section of your profile.

With US Legal Forms, you gain access to a massive library of over 85,000 legal forms, empowering individuals and attorneys to execute documents swiftly and accurately. This platform offers more forms than competitors at comparable prices, ensuring your experience is seamless and efficient.

Don't delay in securing your Power Attorney POA form for business today. Visit US Legal Forms and take the first step towards your legal documentation needs!

Form popularity

FAQ

To obtain a power of attorney in New Mexico, you need to complete a power of attorney POA form for business. This form allows you to designate someone to make decisions on your behalf. You can find the necessary forms on legal websites like US Legal Forms, which provide easy access to valid templates. After completing the form, ensure that both you and the agent sign it, and consider notarization for added security.

Filling out power of attorney paperwork involves gathering necessary information about the principal and the agent. Use the Power attorney POA form for business, ensuring that all sections are completed accurately. It’s advisable to review the document thoroughly or consult a legal professional to confirm that you have provided all required details.

Yes, the IRS allows for electronic signatures on certain Power attorney POA forms, including the Power attorney POA form for business. This feature simplifies the process, allowing you to submit forms quickly and efficiently. Make sure to follow the IRS guidelines for electronic signing to ensure compliance.

Typically, the IRS takes about 4 to 6 weeks to process and approve the Power attorney POA form for business. However, the processing time can vary depending on their workload and the completeness of your submitted form. While waiting, you can check the status by contacting the IRS directly.

You can submit your Power attorney POA form for business to the IRS by using Form 2848, which is specifically designed for this purpose. Fill out the form completely and ensure it is signed by both the taxpayer and the designated Power of Attorney. Once completed, send it to the appropriate IRS address as stated in the instructions.

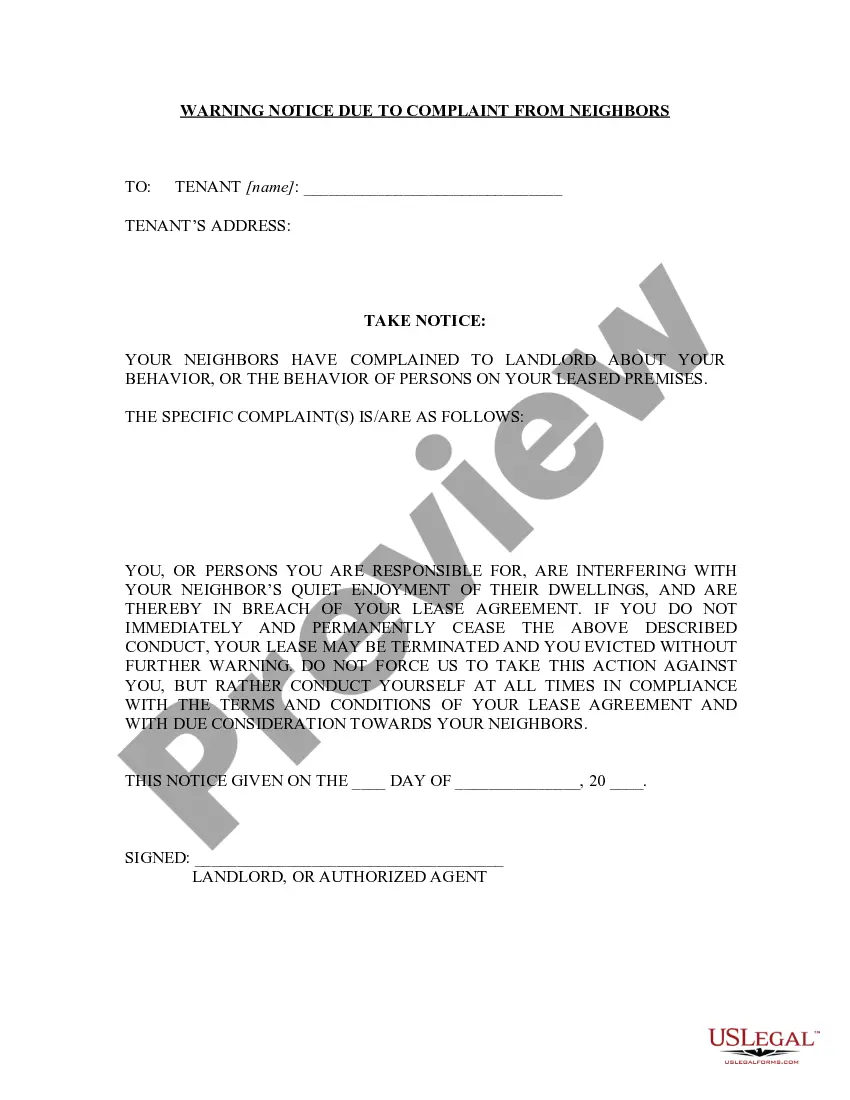

Yes, a power of attorney can be added to a business account. To do this, you must provide the bank with the relevant Power attorney POA form for business, demonstrating your legal authority to access and manage the account. This can streamline account operations and ensure that business matters are handled efficiently.

Filing taxes as a Power of Attorney requires you to complete the appropriate IRS forms using the Power attorney POA form for business. First, ensure you have been granted authority to act on behalf of the individual or entity. You will need to submit your signature alongside the taxpayer's name to file correctly, ensuring compliance with IRS regulations.

A power of attorney can often be added to a business account, allowing someone to manage financial transactions on behalf of the business. This can simplify business banking and ensure that essential tasks are completed smoothly in the absence of the primary decision-maker. Using a power attorney POA form for business facilitates this process and ensures that the authority is clearly defined.

Yes, you can add a power of attorney to an LLC to empower someone to make decisions or act on behalf of the company. This step can be particularly beneficial in ensuring ongoing operation and management. Be sure to utilize a power attorney POA form for business to make this authorization legally binding.

To submit a power of attorney (POA) to the IRS, you should complete Form 2848, which designates someone to represent you before the IRS. Once filled out, send it to the specified address provided on the form. Using a power attorney POA form for business here ensures that your chosen representative can handle your tax matters efficiently.