Md Attorney Property Format

Description

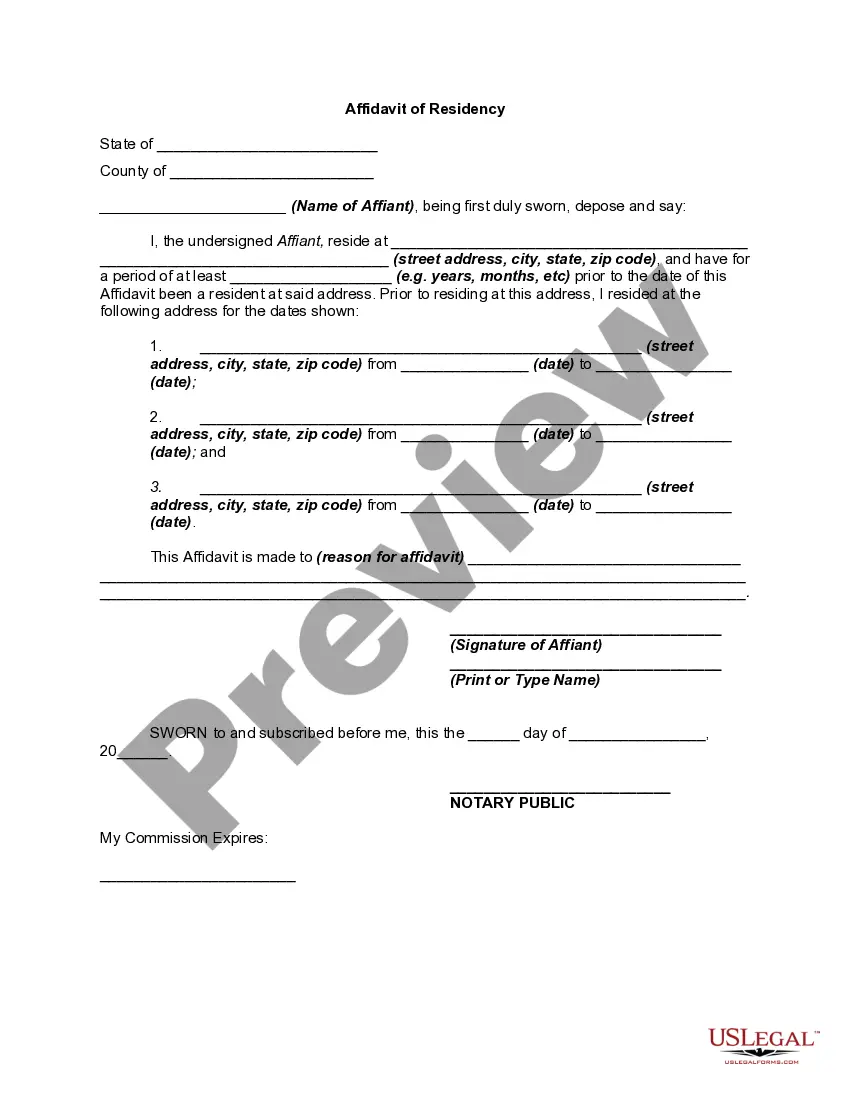

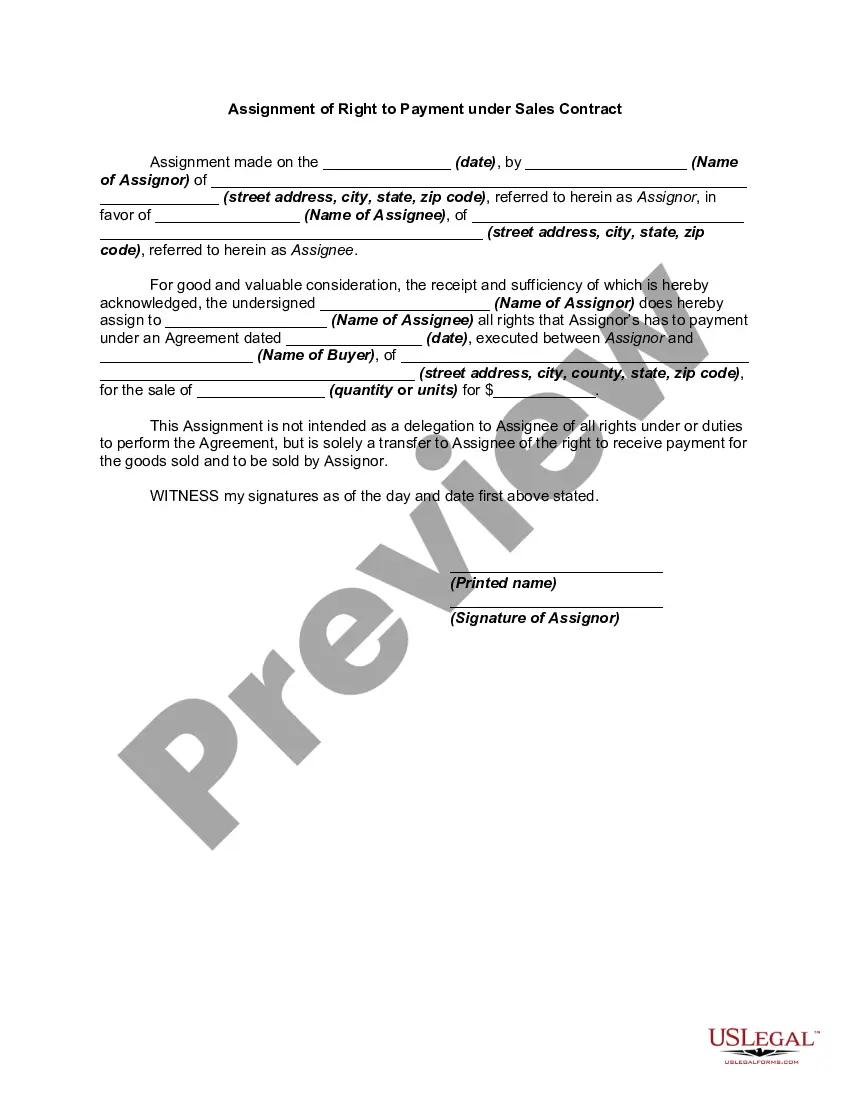

How to fill out Maryland General Durable Power Of Attorney For Property And Finances Or Financial Effective Upon Disability?

Creating legal documents from the ground up can frequently be daunting.

Some situations may necessitate extensive research and significant financial expenditure.

If you seek a simpler and more economical approach to preparing Md Attorney Property Format or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-approved templates meticulously prepared by our legal professionals.

Ensure that the template you select complies with the standards of your state and county. Select the appropriate subscription plan to obtain the Md Attorney Property Format. Download the document, then complete, sign, and print it. US Legal Forms prides itself on a flawless reputation and over 25 years of experience. Join us today and make document execution a straightforward and efficient process!

- Utilize our website whenever you require dependable and trustworthy services to quickly find and download the Md Attorney Property Format.

- If you're a returning user with an existing account, simply Log In, find the form, and download it or re-download it any time through the My documents section.

- Not yet registered? No worries. Registering takes minimal time, and navigating the library is easy.

- Before proceeding to download the Md Attorney Property Format, heed these suggestions.

- Review the document preview and descriptions to confirm that you have located the correct form.

Form popularity

FAQ

Access Your Form 1099G Form 1099G tax information is available for up to five years through UI Online. Note: If an adjustment was made to your Form 1099G, it will not be available online. Call 1-866-401-2849, Monday through Friday, from 8 a.m. to 5 p.m. (Pacific time), except on state holidays.

Taxpayers should first contact the employer, payer or issuing agency directly for copies. Taxpayers who haven't received a W-2 or Form 1099 should contact the employer, payer or issuing agency and request a copy of the missing document or a corrected document.

If you forget to report the income documented on a 1099 form, the IRS will catch this error. When the IRS thinks that you owe additional tax on your unreported 1099 income, it'll usually notify you and retroactively charge you penalties and interest beginning on the first day they think that you owed additional tax.

To get a copy of the Form W-2 or Form 1099 already filed with your return, you must use Form 4506 and request a copy of your return, which includes all attachments. This requires a fee of $50. It may take up to 75 calendar days for the IRS to process your request.

If you are looking for 1099s from earlier years, you can contact the IRS and order a ?wage and income transcript?. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

Access Your Form 1099G Form 1099G tax information is available for up to five years through UI Online. Note: If an adjustment was made to your Form 1099G, it will not be available online. Call 1-866-401-2849, Monday through Friday, from 8 a.m. to 5 p.m. (Pacific time), except on state holidays.

You can use our Get Transcript tool to request your wage and income transcript. It shows the data reported to us on information returns such as Forms W-2, Form 1099 series, Form 1098 series, and Form 5498 series; however, state or local information isn't included with the Form W-2 information.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit .IRS.gov/orderforms.