Selling An Unsecured Promissory Note Forgivable

Description

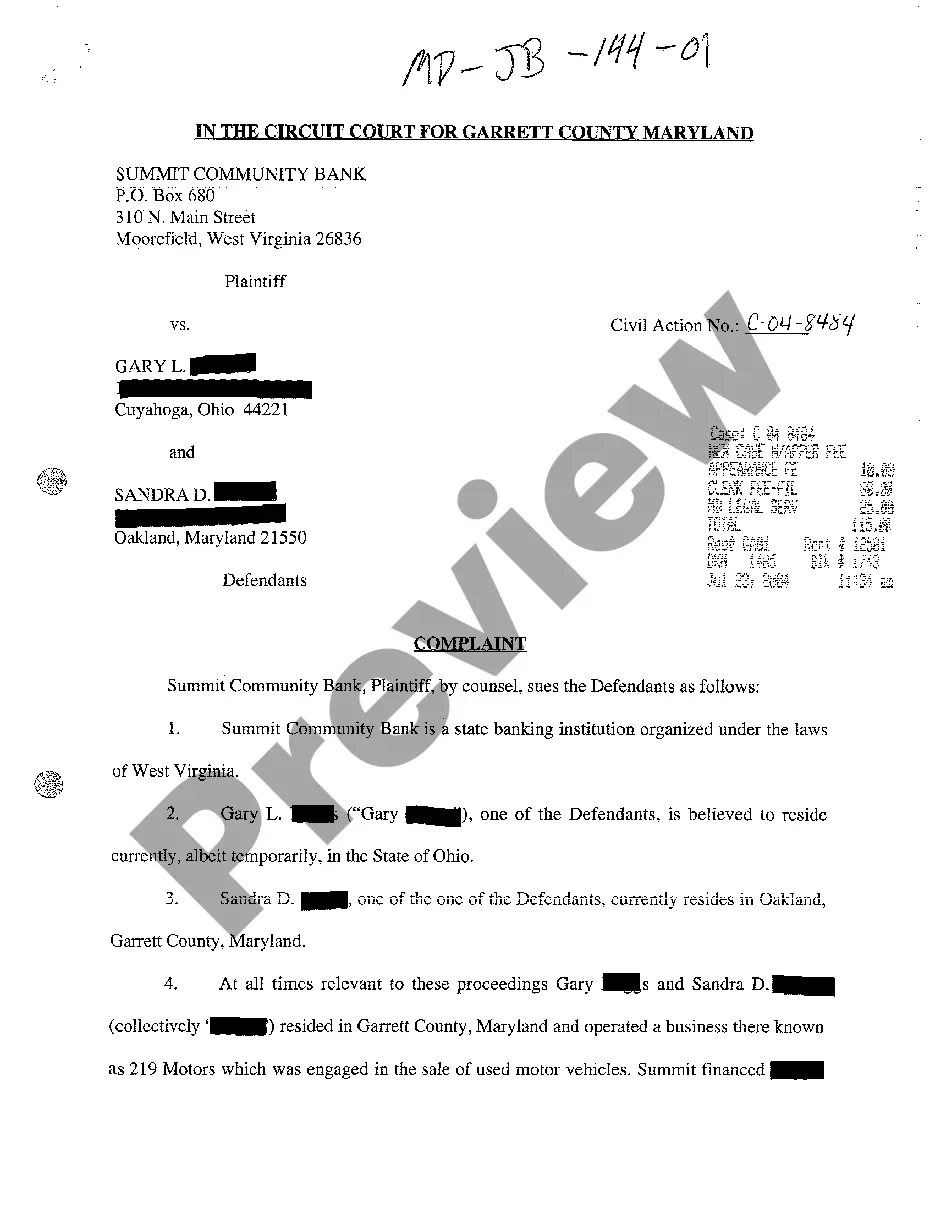

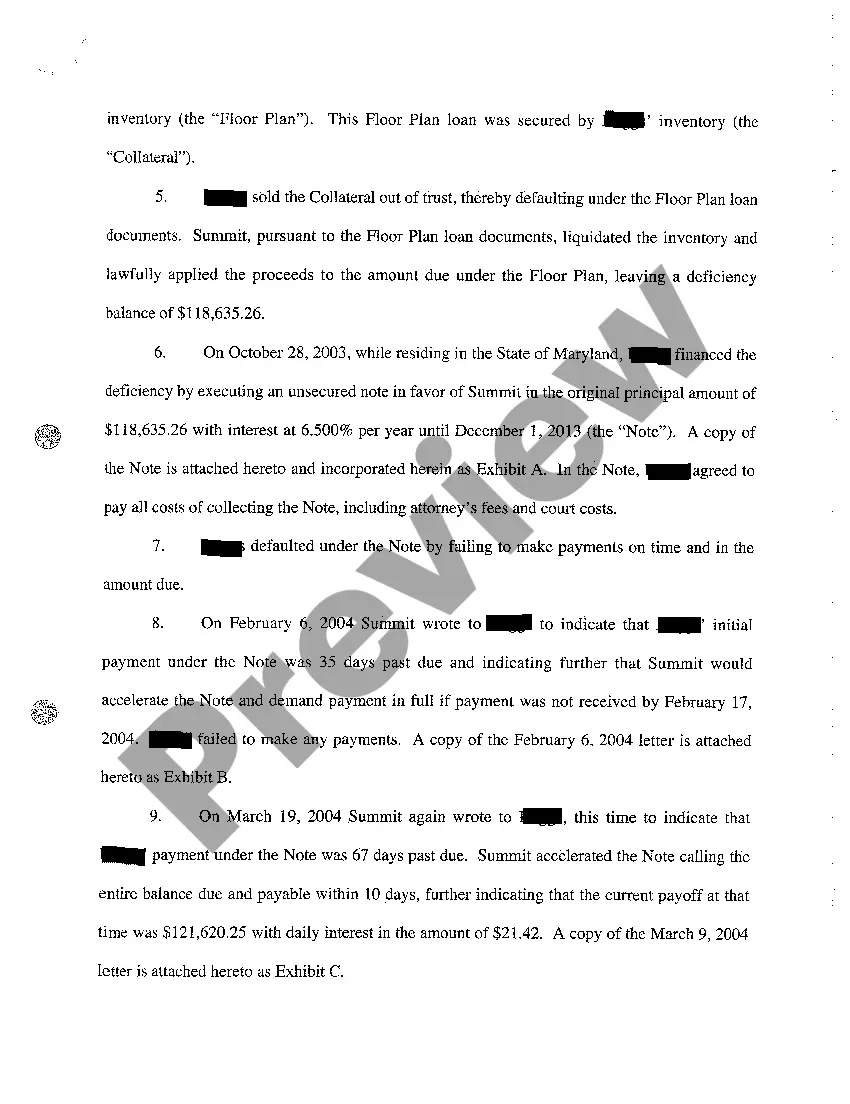

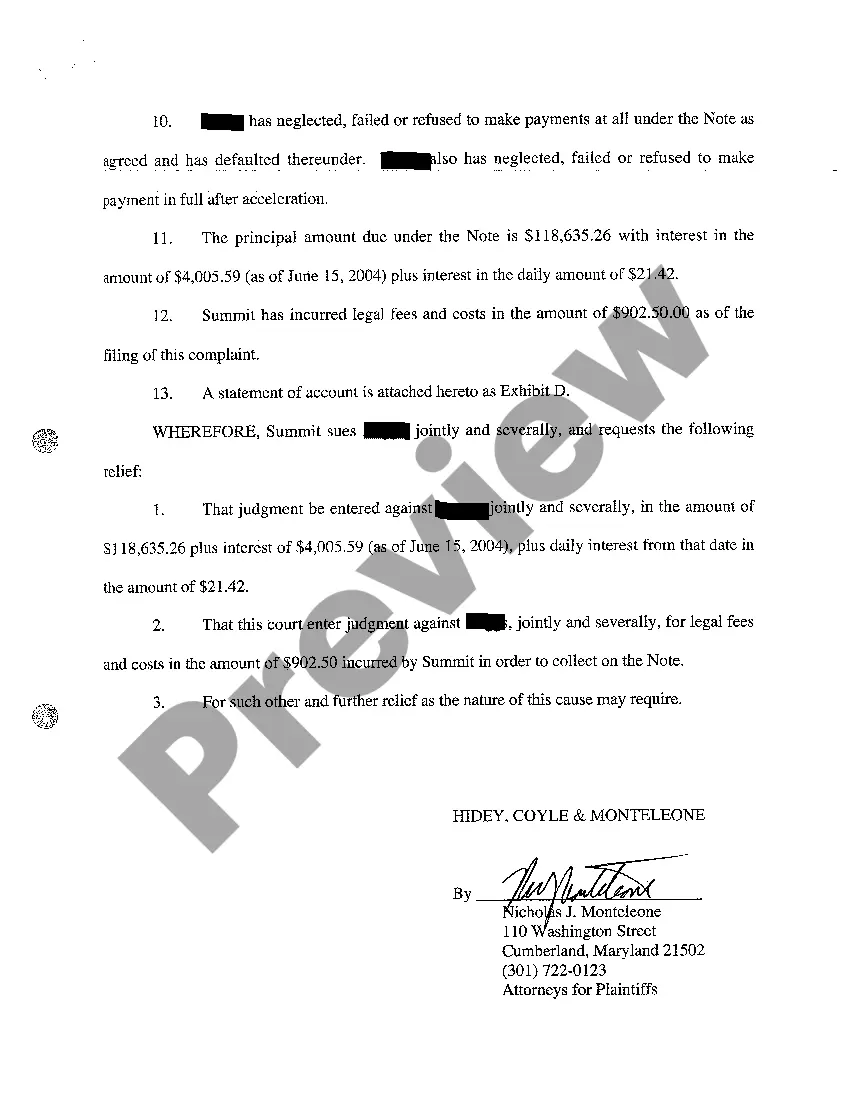

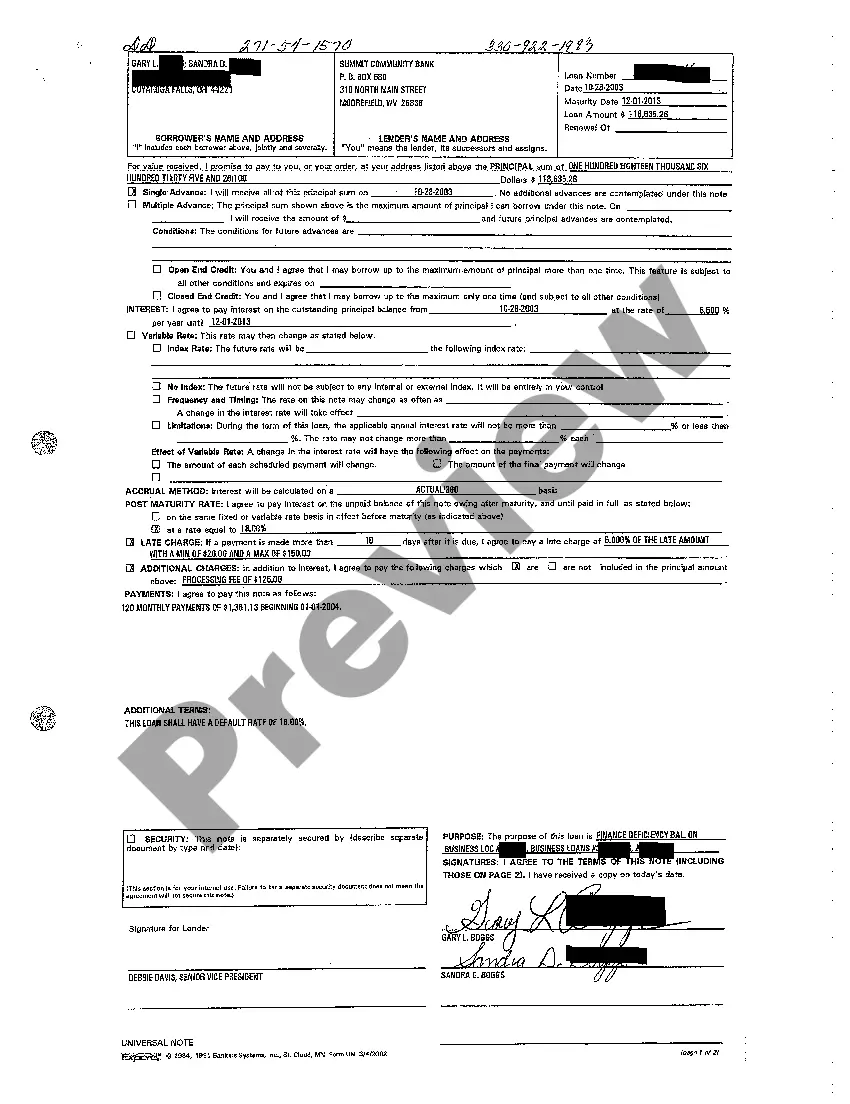

How to fill out Maryland Complaint For Breach Of Promissory Note By Selling Collateral Security?

Bureaucracy requires exactness and correctness.

Unless you engage in completing forms like Selling An Unsecured Promissory Note Forgivable on a daily basis, it can lead to certain misconceptions.

Selecting the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avert any troubles with re-submitting a document or repeating the same task from the beginning.

If you are not a subscribed user, finding the required template will involve a few additional steps: Find the template using the search feature. Ensure the Selling An Unsecured Promissory Note Forgivable you’ve discovered is suitable for your state or county. View the preview or read the description that includes the details regarding the use of the template. If the result matches your search, click the Buy Now button. Choose the appropriate option from the available subscription plans. Log In to your account or register a new one. Finalize the transaction using a credit card or PayPal account. Receive the document in the file format of your preference. Obtaining the correct and updated templates for your documentation takes only a few moments with an account at US Legal Forms. Eliminate the bureaucratic worries and enhance your efficiency with paperwork.

- You can always find the suitable template for your paperwork in US Legal Forms.

- US Legal Forms is the largest online forms repository, housing over 85 thousand templates across various topics.

- You can discover the most current and pertinent version of the Selling An Unsecured Promissory Note Forgivable simply by searching on the platform.

- Locate, store, and preserve templates in your profile or consult the description to verify you possess the correct one at your disposal.

- With an account at US Legal Forms, it's straightforward to acquire, consolidate in one location, and navigate the templates you bookmark for quick access.

- When on the site, select the Log In button to authenticate.

- Next, go to the My documents page, where the record of your documents is maintained.

- Review the description of the forms and bookmark those you require at any moment.

Form popularity

FAQ

The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash. The buyer of the note assumes the responsibility of collecting the money.

If you are the holder of a promissory note, you may be able to sell the note for cash. However, you will be selling the note for less than the face value. Generally, a note buyer will discount the note by 10 to 35 percent.

Forgiving a promissory note is as straightforward as destroying the document or returning it to the debtor. In court, a promissory note is a legal document that proves a debt, and without that document, there is generally no proof of the agreement.

The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash. The buyer of the note assumes the responsibility of collecting the money.

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.