Maryland Child Support Worksheet Withholding

Description

How to fill out Maryland Child Support Worksheet Withholding?

Whether you handle documentation frequently or you occasionally need to file a legal report, it is crucial to acquire a source of information where all samples are relevant and up-to-date.

One essential action you must take with a Maryland Child Support Worksheet Withholding is to ensure that you possess its most current version, as it determines whether it can be submitted.

If you wish to make your search for the most recent document examples easier, look for them on US Legal Forms.

Utilize the search feature to locate the form you need. View the Maryland Child Support Worksheet Withholding preview and description to ensure it is exactly what you require. After verifying the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or sign in to your existing one. Use your credit card information or PayPal account to complete the transaction. Choose the document format for download and confirm it. Eliminate any confusion when handling legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that offers nearly every type of document sample you might need.

- Search for the templates you need, check their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Locate the Maryland Child Support Worksheet Withholding examples in just a few clicks and store them in your account at any time.

- A US Legal Forms account enables you to access all required samples with added convenience and minimal effort.

- Simply click Log In in the header of the website and navigate to the My documents section where all your necessary forms are readily available, eliminating the need to spend time searching for the best template or assessing its validity.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

The new child support guidelines in Maryland consider various factors, including the child's needs, parent income, and more. These guidelines aim to create a fair and equitable distribution of support required for raising children. By using the Maryland child support worksheet withholding, both parents can easily navigate these changes and ensure compliance with the latest legal standards, providing peace of mind for everyone involved.

In Maryland, the courts take into consideration various factors to determine the appropriate child support percentage. Typically, the guidelines suggest that between 16% and 24% of the non-custodial parent's income may be allocated towards child support for one child, depending on the combined parental income. Utilizing the Maryland child support worksheet withholding can help clarify these percentages and provide a more accurate breakdown for both parents.

In Maryland, the maximum percentage that can be withheld for child support is generally set at 50% of disposable earnings for an employee. This amount can vary based on your specific situation, including whether you owe arrears. The Maryland child support worksheet withholding ensures that all calculations comply with state laws, making it essential for both custodial and non-custodial parents to understand.

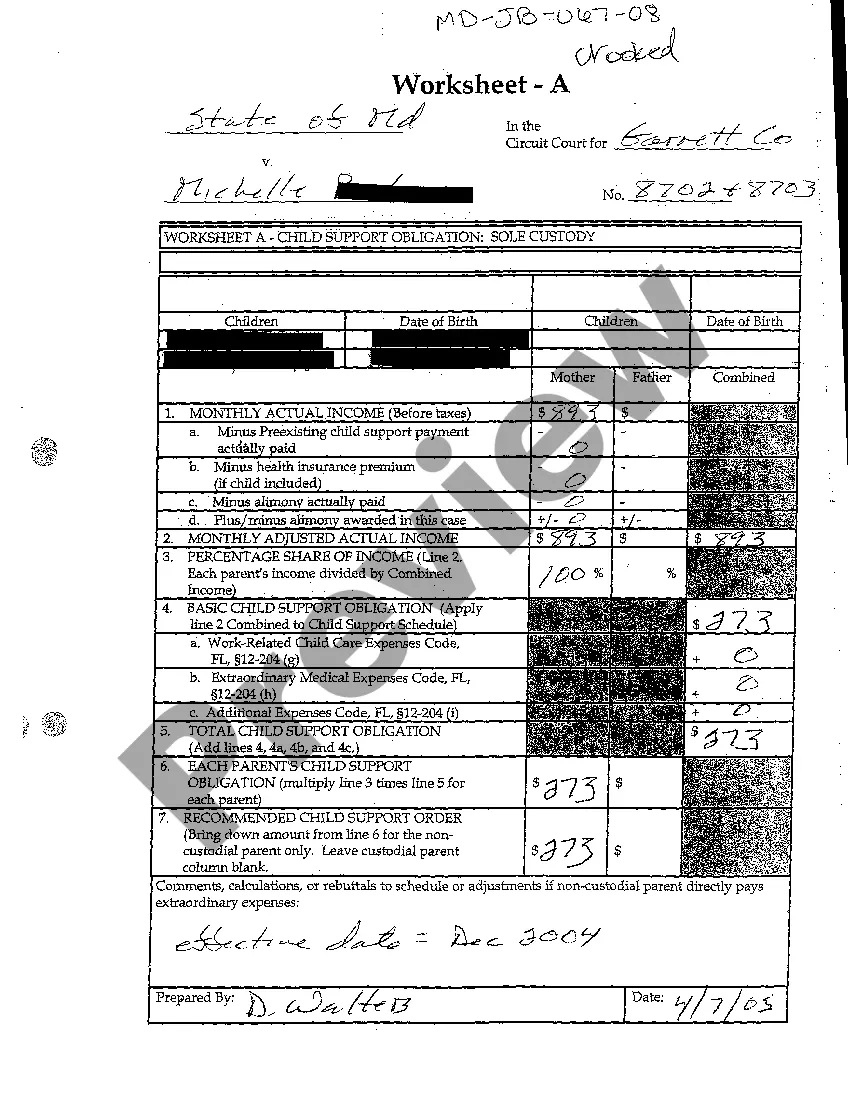

The child support worksheet is a crucial tool used to calculate the financial support obligations of parents. It takes into account various factors like income, expenses, and custody arrangements. For Maryland child support worksheet withholding, this document accurately determines the required payments to ensure children receive proper financial support. If you need assistance, consider exploring uslegalforms for templates and guidance.

Filing for child support in Maryland involves completing specific forms and submitting them to your local child support office. You will need to gather essential documents, including income information, to support your case. Utilizing the Maryland child support worksheet withholding can help clarify the amount owed. For a step-by-step guide, platforms like uslegalforms provide valuable resources.

An income withholding order for child support typically takes about two to four weeks to process. This timeline can vary based on the employer's response and state protocols. When dealing with Maryland child support worksheet withholding, timely processing ensures that payments are made regularly and consistently. To simplify the process, you might find helpful templates and forms on uslegalforms.

In North Carolina, Worksheet A and Worksheet B serve specific purposes in calculating child support. Worksheet A is used for parents with joint custody, while Worksheet B is for cases with sole custody. Understanding this distinction is essential for accurate calculations related to Maryland child support worksheet withholding. If you need guidance, consider using resources available on platforms like uslegalforms.

The biggest factor in calculating child support in Maryland is typically the income of both parents. The Maryland child support worksheet withholding plays a vital role in determining support amounts based on income levels and custody arrangements. It's crucial for parents to understand this process to ensure just and fair support for their children.

Income for child support in Maryland encompasses various sources, such as wages, bonuses, commissions, and even some forms of public assistance. Each source is evaluated to determine the total income for child support purposes. Utilizing the Maryland child support worksheet withholding ensures that all relevant income is accounted for in the calculations.

In Maryland, the actual income for child support calculations generally includes wages, salaries, and other forms of compensation. This income figure is crucial for completing the Maryland child support worksheet withholding accurately. If you have questions about what counts as income, consulting an expert can clarify your situation.